Monthly commodities update - January 2024

Key drivers of commodity returns

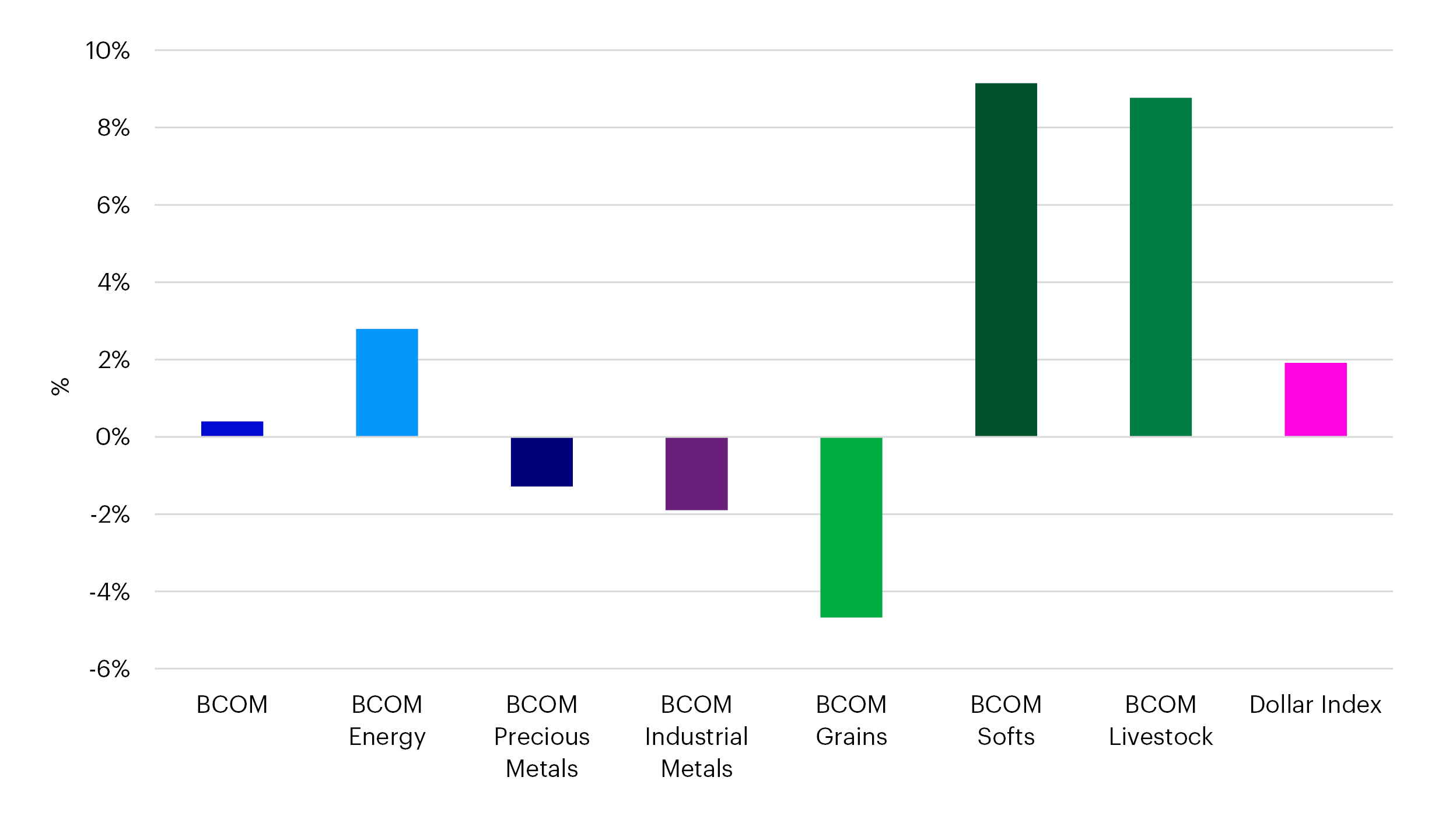

Returns on broad commodity exposures were flat in January, after fading early in the month and then rallying into month-end. Having been rangebound in the first half of January, oil prices rallied as geopolitical tensions increased in the Middle East with the US and UK launching targeted air strikes against Houthi rebel targets across Yemen, with energy being a positive contributor to performance over the month. Meanwhile, the gold price fell slightly as the Dollar strengthened and real yields rose (please see our monthly gold update for a deeper dive into factors affecting the gold price in January). Softs and livestock were the strongest performing commodity sectors over the month while grains was the worst performing sector.

Source: Bloomberg, Invesco as at 31 Jan 2024

Longer term histories for oil and gold

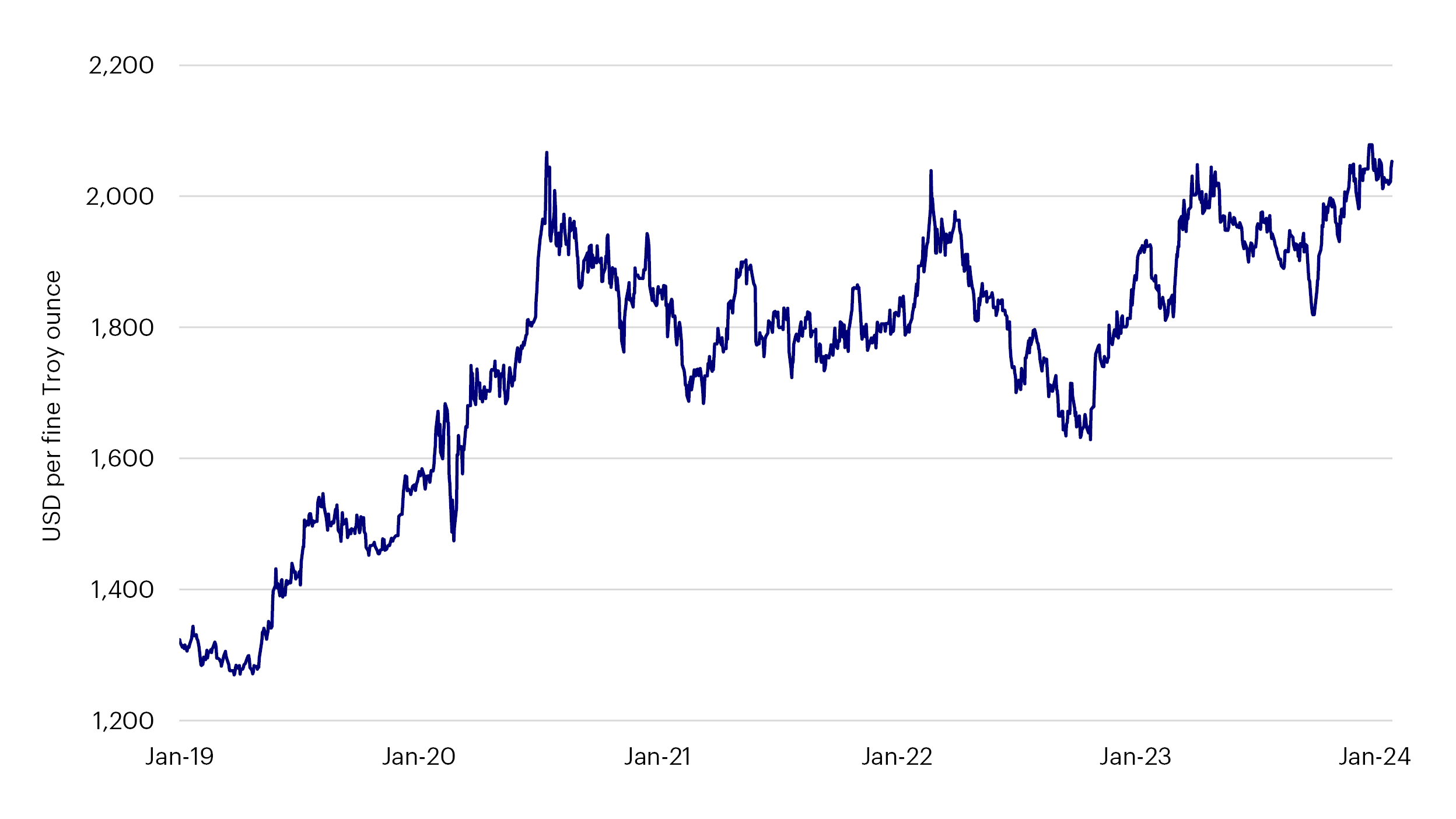

Although the gold price fell slightly in January, it remains close to the all-time high and comfortably above the $2,000 level which has previously been a level at which ETC investors have trimmed positions.

Source: Bloomberg, Invesco as at 31 Jan 2024

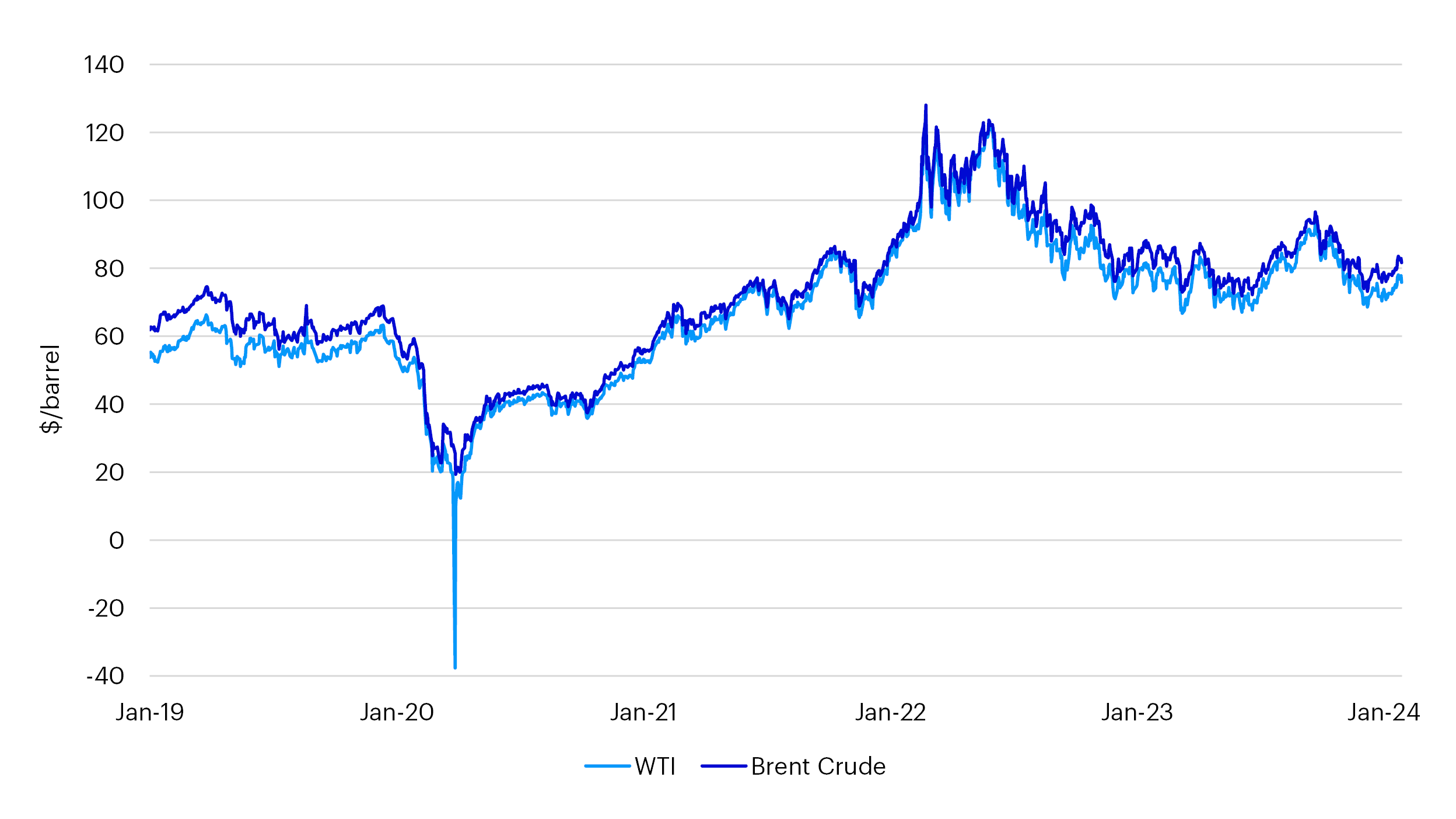

Meanwhile, the rally in oil took prices for West Texas towards $80/barrel and Brent Crude into the mid-$80s, energy prices remain below levels seen at the end of Q3 2023 and considerably lower than the levels seen when Russia invaded Ukraine.

Source: Bloomberg, Invesco as at 31 Jan 2024

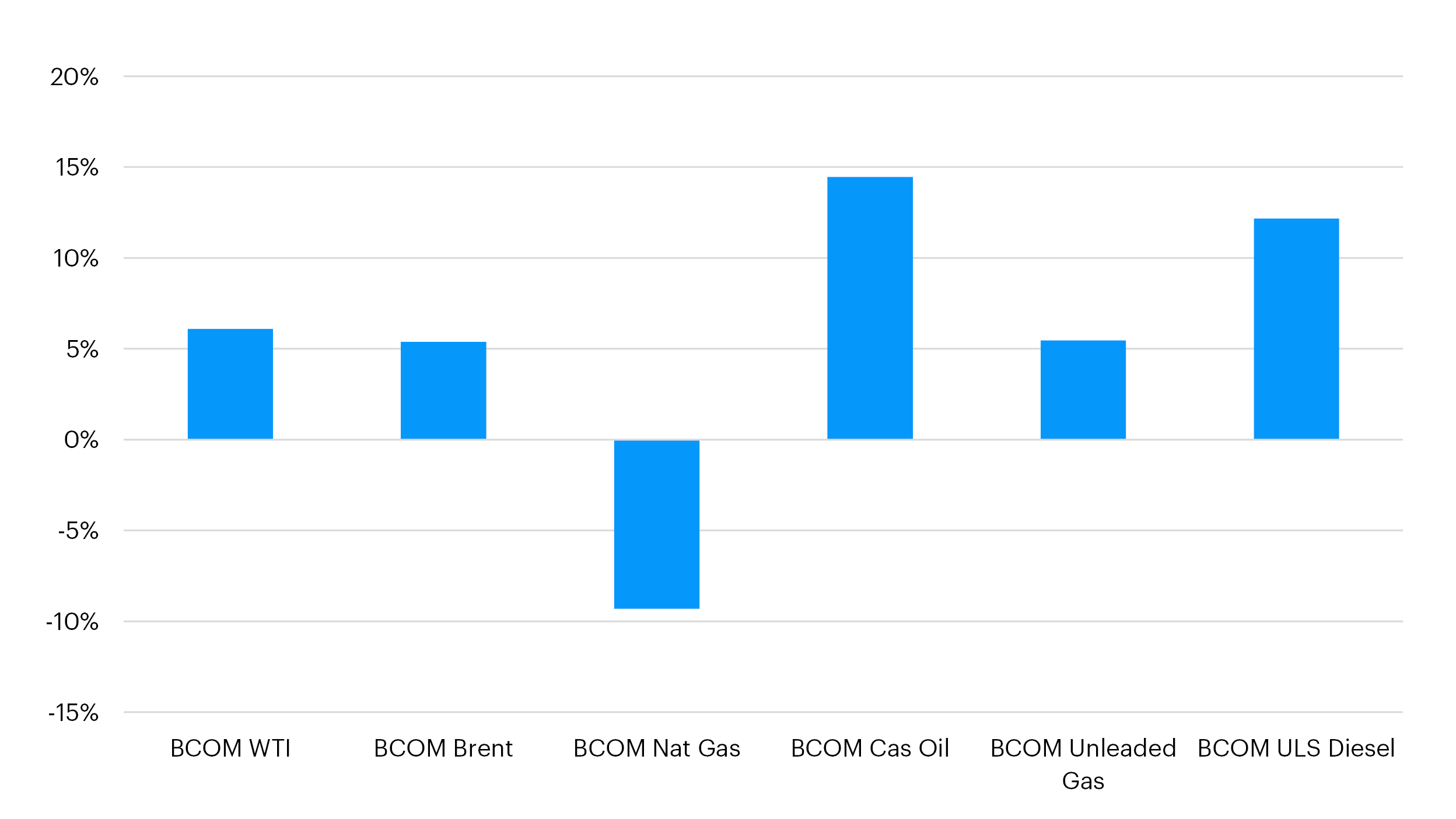

Energy returns

Energy was a positive contributor to broad commodity performance over the month. Following an increase in attacks on commercial shipping in the Red Sea, which drove many container ships to use the much longer and more costly route around southern Africa, the UK and US launched a series of targeted air strike on Houthi rebel targets in Yemen. Natural gas was the outlier in the energy complex with a negative return for the month. Although the price had risen earlier in the month, partly impacted by cold weather and supply disruptions, it faded in the second half of January following forecasts for warmer weather and anticipated lower demand.

Source: Bloomberg, Invesco as at 31 Jan 2024

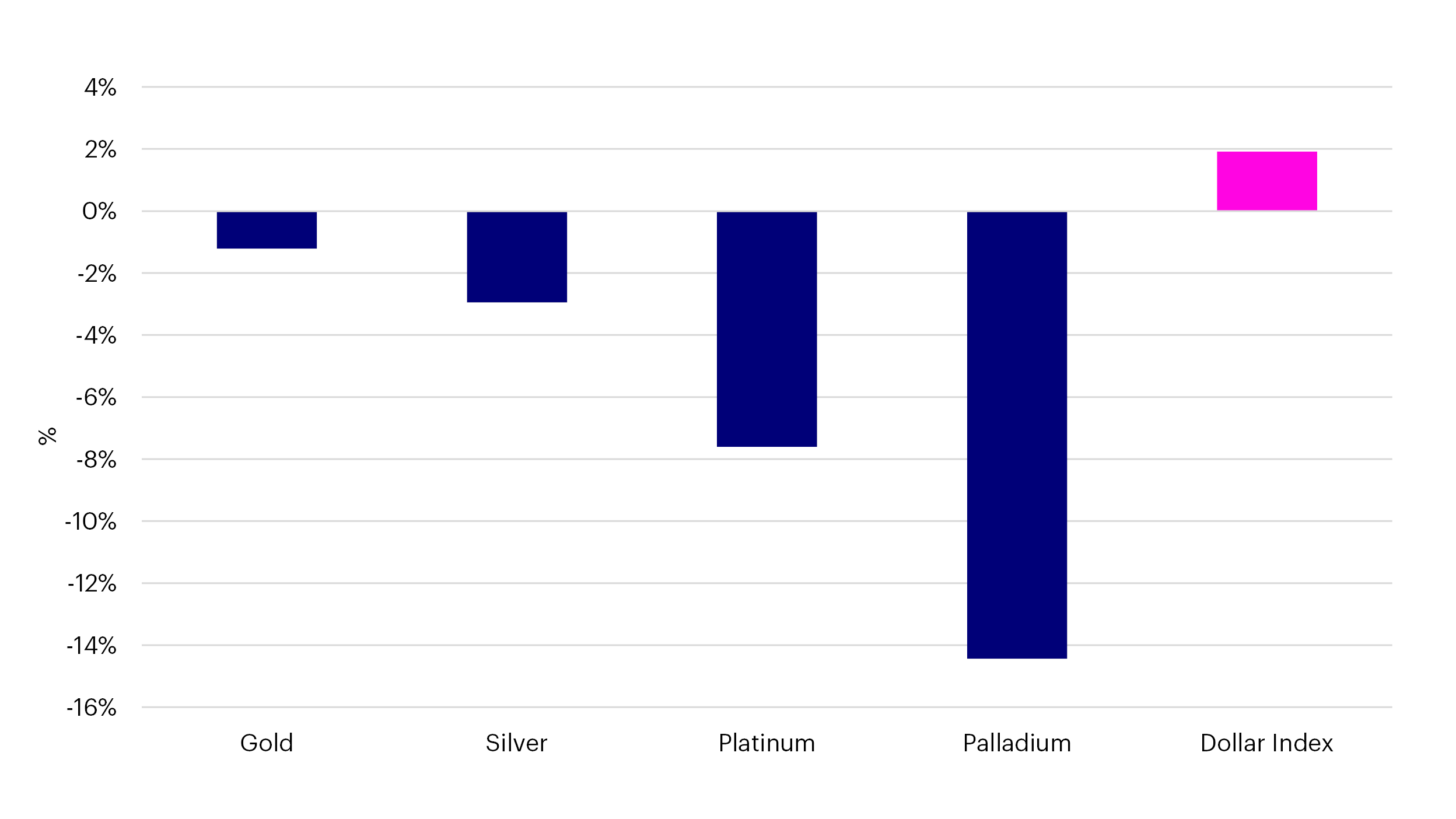

Precious metals

Precious metals performed poorly over the month. Although gold was slightly down on the month, it held up better than silver, platinum, and palladium, with its safe-haven status contributing to its relative outperformance. Additionally, platinum and palladium remain under pressure given their use in catalytic converters during a period of transition from combustion engines to electric vehicles.

Source: Bloomberg, Invesco as at 31 Jan 2024

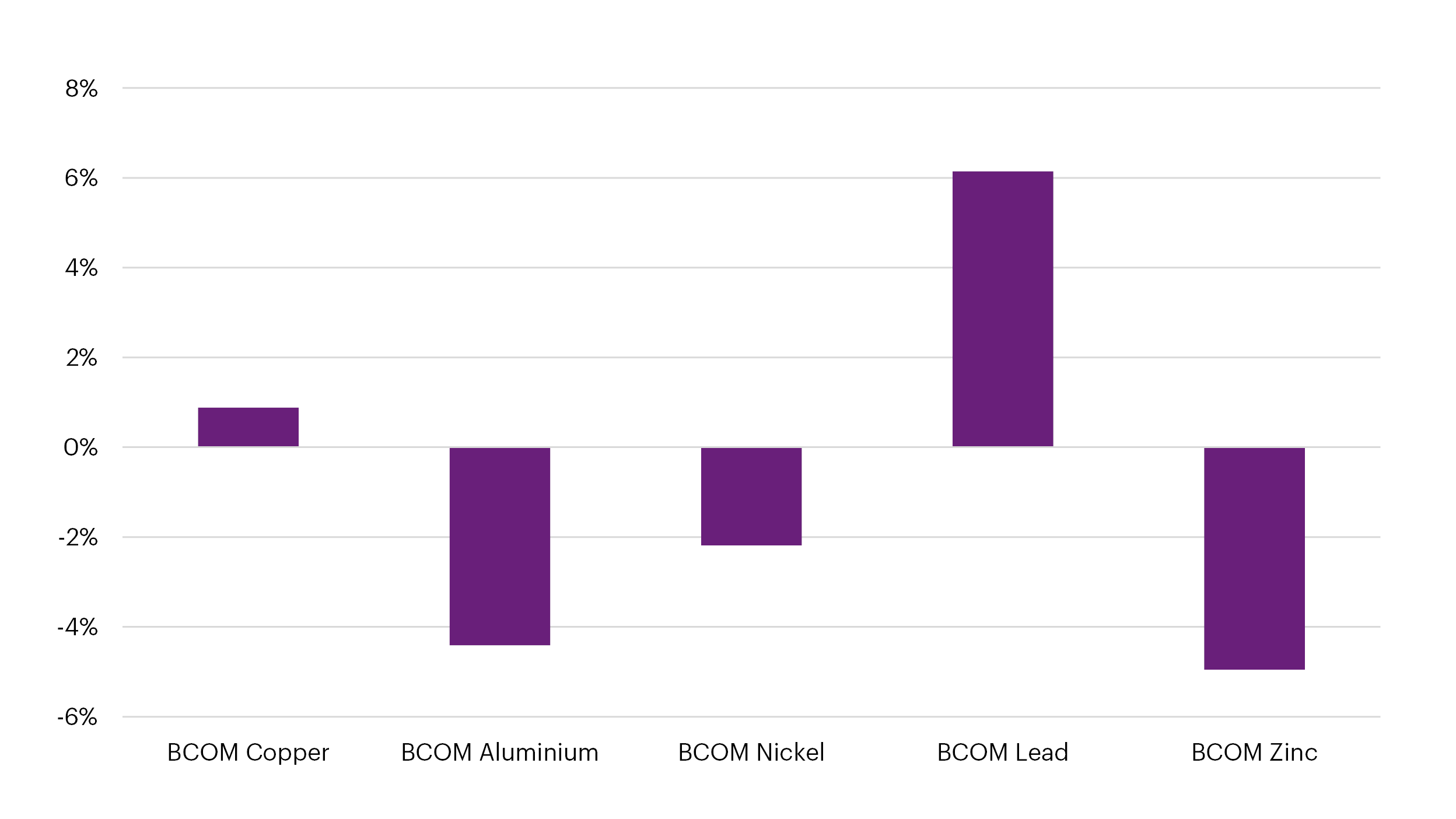

Industrial metals

Industrial metals had mixed fortunes over the month with copper and lead in positive territory while aluminium, nickel and zinc had negative returns. However, the broad path was similar over the month for all industrial metals. Early in the month, prices were generally weaker on concerns about softer demand from China, both from a broader macroeconomic perspective and ahead of the slowdown heading into Chinese New Year. Metal prices then rebounded following headlines of a Chinese stimulus package and rallied further following the 50bp cut to the Reserve Requirement Ratio from the PBoC. Overall, however, this was not enough to drive all metals back into positive territory as the market awaits further measures to boost demand.

Source: Bloomberg, Invesco as at 31 Jan 2024

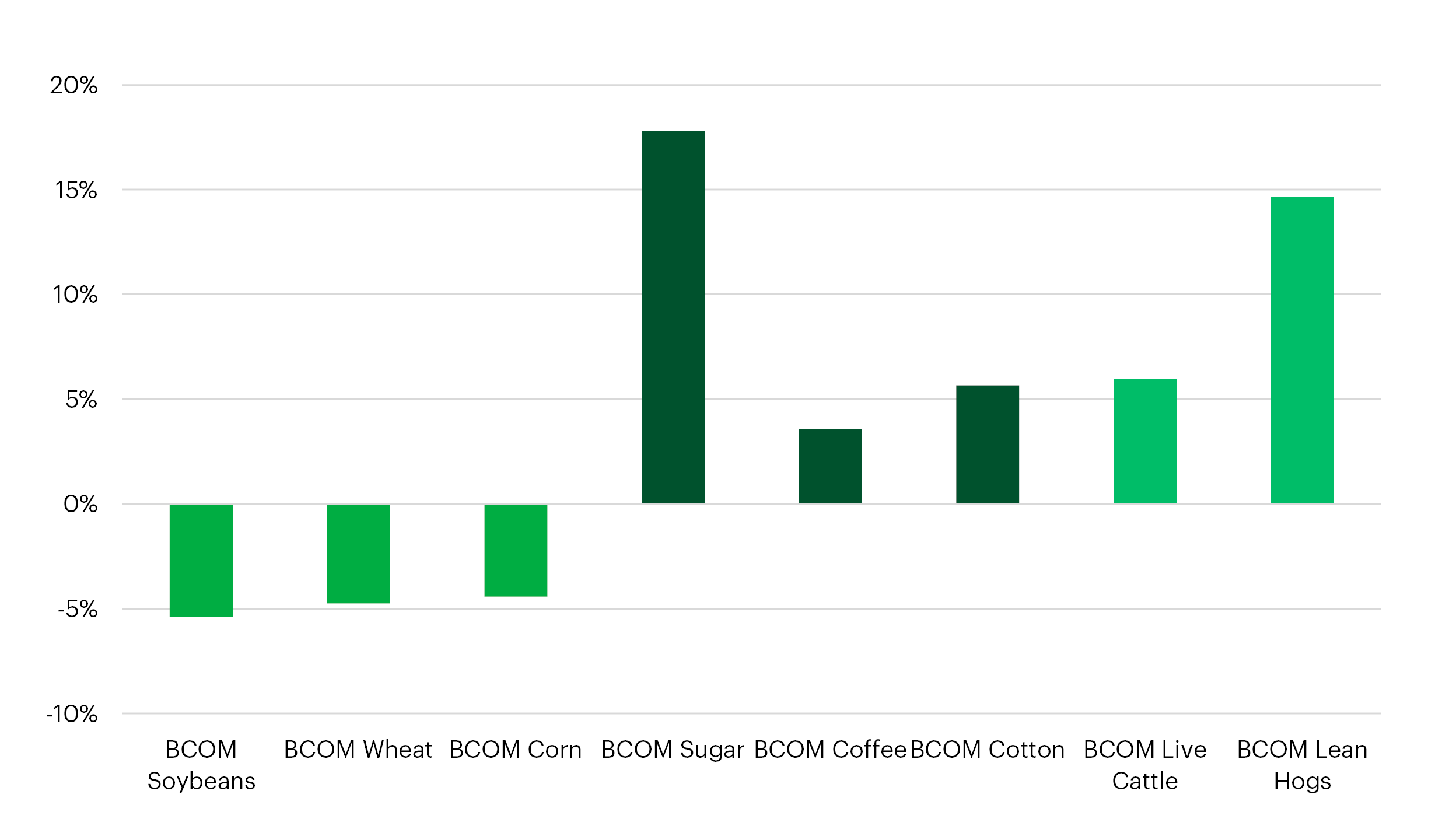

Grains, softs & livestock

Grains performed poorly last month, mainly in anticipation of higher production going forward. For example, Argentine soybean production, along with corn and wheat, is expected to strongly rebound this year as El Nino brought abundant rainfall following the drought last year. Similarly, China’s corn production is also expected to improve this year. On the other hand, softs benefitted from tight supplies and shipping disruptions in the Red Sea. Sugar performed particularly strongly on concerns about Brazilian production with one of its main sugar regions experiencing below average rainfall.

Source: Bloomberg, Invesco as at 31 Jan 2024

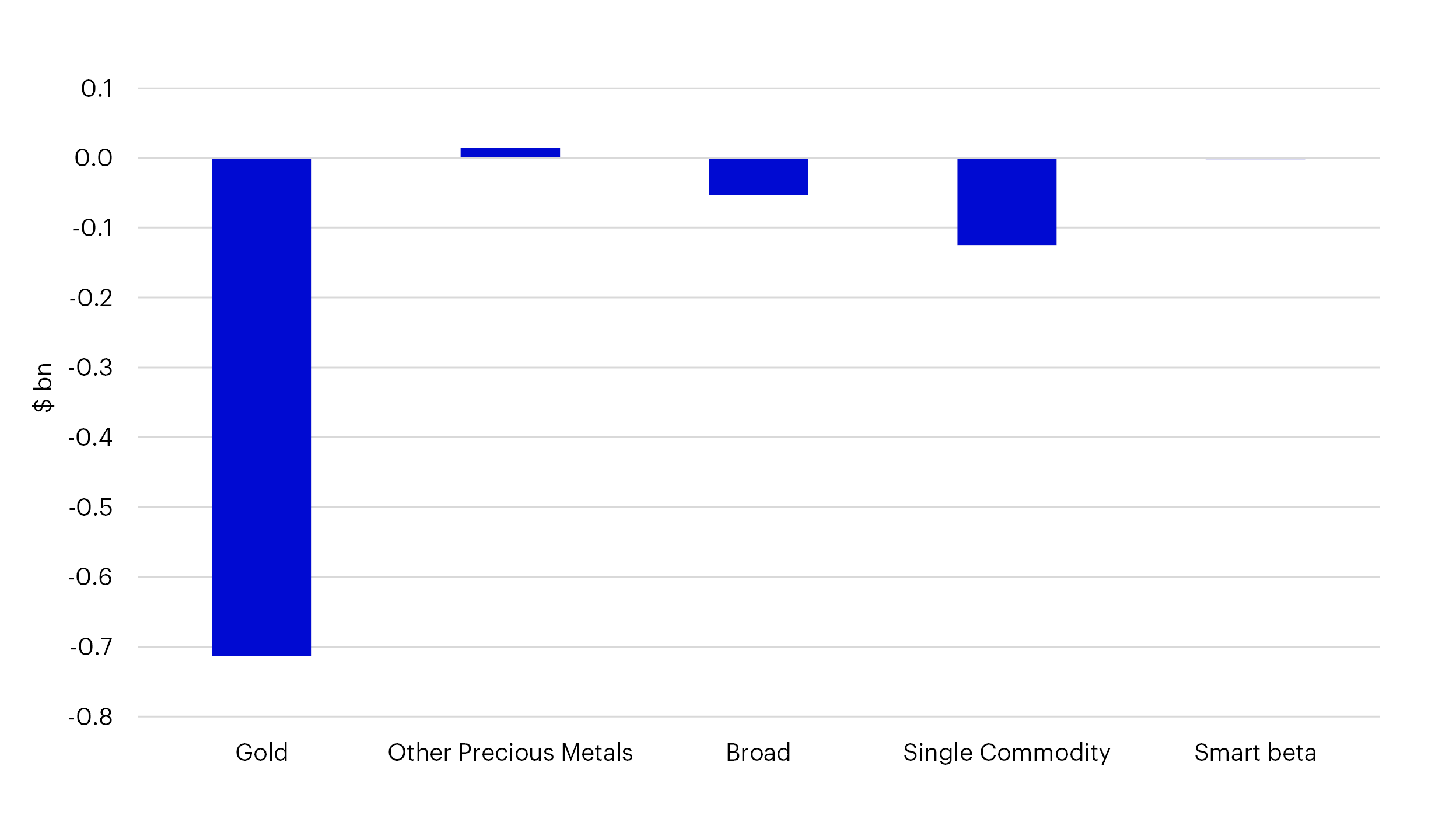

Commodity ETP Flows

Commodities ETPs suffered net outflows in January led by selling of gold as its price remained above $2,000/oz during January. However, while this is close to the all-time high, the gold price has remained above $2,000/oz for most of the last two months and, with the outlook for lower rates and a potentially weaker Dollar, may not fall by much in coming months. Oil prices have risen in response to Middle East tensions but remain well below the levels seen last September. However, it will be worth keeping an eye on energy prices with commodities potentially being a useful allocation for investors worried about price spikes.

Source: Bloomberg, Invesco as at 31 Jan 2024