Monthly gold update - April 2025

Key takeaways

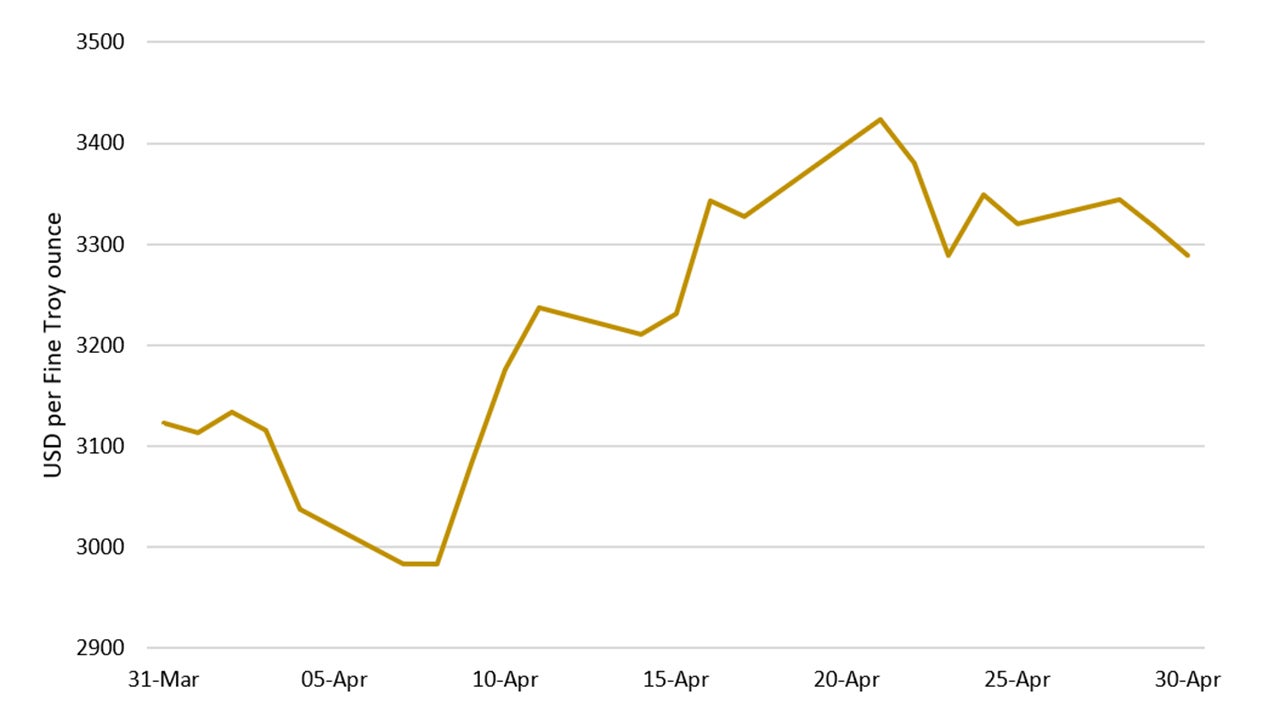

Gold had another strong month, gaining 5.3% in April and setting yet another record high before profit-taking saw the month close at US$3,289.

The tariff announcement shook financial markets at the start of the month, but the 90-day pause eased inflation fears and sent both gold and equities higher.

Flows into gold exchange-traded products globally were positive for the fifth-consecutive month, although European demand weakened in April after a strong start to the year.

Gold: Spotlight on April’s performance

The gold price followed up its incredibly strong performance in March by gaining a further 5.3% in April. The yellow metal touched US$3,500 intraday on 22 April but would eventually end the month at US$3,289 following profit-taking. There was also general market relief after the US Administration called a 90-day pause to the tariffs announced earlier in the month. Interestingly, it was the pause that sent the gold price higher, rather than the equity market correction and general volatility caused by the “Liberation Day” announcement. The reaction suggests the market was more concerned by the possibility that high tariffs would stoke inflation, with those fears at least partially relieved by reports that negotiations were taking place to reduce tariffs. China was the big exception to the pause, with the two sides engaging in what appeared to be a high-stakes game of bluff.

Source: Bloomberg, as at 1 May 2025. Past performance does not predict future returns.

We highlighted in last month’s gold update the importance of keeping an eye on the reaction of governments and individual companies and, indeed, with the obvious exception of China, around 75 countries have sought to negotiate their trade terms, according to the US Administration.

In key economic news, US inflation was lower than expected, with CPI for March falling to an annualised rate of 2.4%, down from the 2.8% for February and better than the 2.6% predicted by the market. Stripping out food and energy, core inflation was at a four-year low.

There was also positive employment news. The 228,000 jobs created in March was almost double the number of jobs added in February and smashed the 140,000 consensus expectation. The market’s reaction to the report was fairly muted given its release came shortly after the tariff announcement.

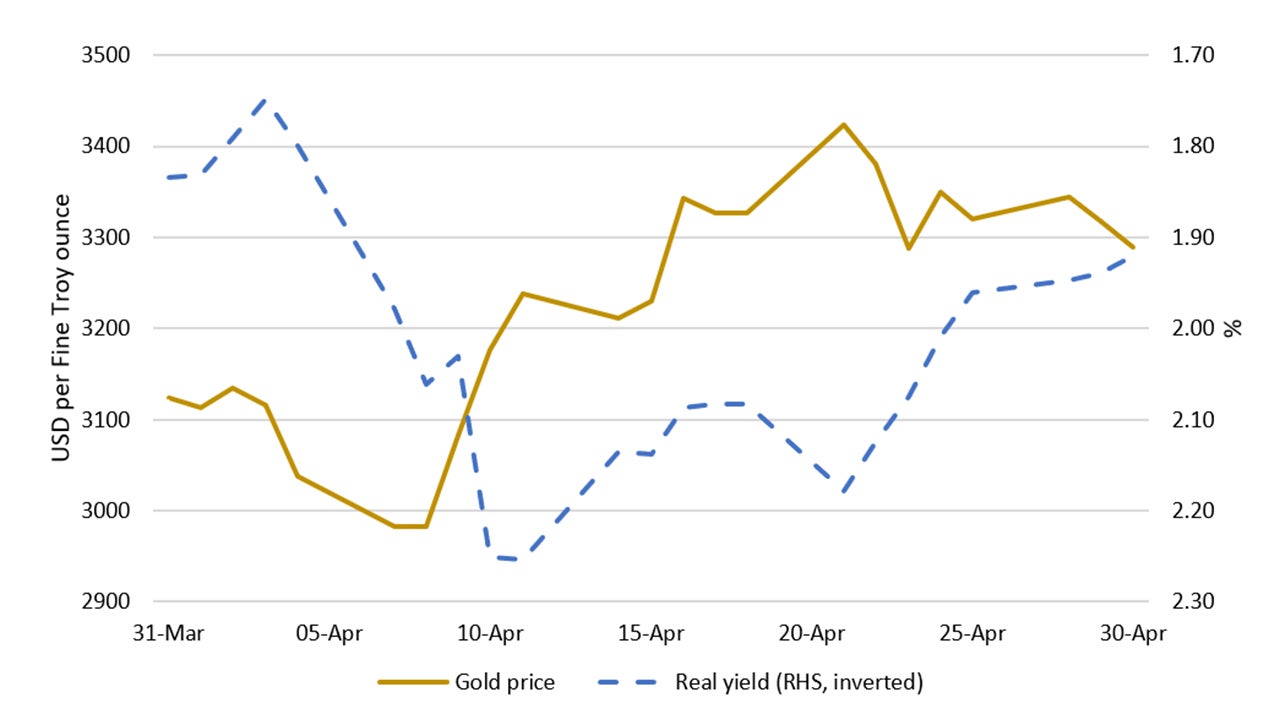

Source: Bloomberg, as at 1 May 2025. Generic Inflation Index US 10-year government bond or real yield on generic 10-year TIPS (TIPS = Treasury Inflation Protected Security).

US Treasury yields spiked higher after the Liberation Day announcement but returned almost to where they were when the month began. The US Dollar meanwhile weakened further in April, with the fall accelerating after the tariff pause. The DXY index fell below 100 to an intra-month low of 98.3, its lowest level for more than three years. For reference the index started this year above 109.

Initial fears that massive tariffs would negatively impact US economic growth and potentially cause higher inflation began to wane as news emerged that the US Administration would pause tariffs and enter negotiations with many of the countries involved. The surprise fall in the US CPI in March helped to alleviate some of those inflation fears and, while the Fed’s preferred gauge of inflation (PCE) would come out at the end of the month, investors were already dreaming of rate cuts. The odds of a 25-basis-point cut at the Fed’s June meeting were 55% by the end of April (with a 42% chance the Fed leaves rates unchanged). The market is pricing in three to four cuts by year-end.

Source: Bloomberg, as at 1 May 2025.

Q1 supply and demand

Data released by the World Gold Council late in April confirmed what we were seeing during the first three months of the year. Investment demand for gold in Q1 was not merely strong but exceeded demand from the jewellery sector, which tends to account for around a half of total gold demand. Of the 1,206 tonnes consumed in the quarter, 551.9 tonnes were from total investment (coins and small bars as well as gold exchange-traded products), while a further 243.7 tonnes came from central bank purchases. By comparison, the jewellery sector fabricated 434 tonnes of gold, with demand limited by high gold prices.

At a regional level, Q1 investment in Europe-domiciled physical gold ETPs was the highest in any quarter since the beginning of the pandemic in 2020. China was another notable market, with strong demand in Q1 from retail (coins and small bars) and institutions (gold ETPs).

Keep an eye on …

Just as we highlighted last month, it will be important to watch how trade negotiations play out in the coming weeks. Will it be the case where those countries most willing to participate will receive the most favourable terms, thereby incentivising others to do the same? If deals can be agreed swiftly with some of the more significant trading partners, such as Japan but more crucially China, market concerns may dissipate, and the Fed could be in a better position to reduce interest rates. That scenario could see a more benign inflation picture, lower bond yields, lower interest rates, further weakness in the USD and a pick-up in economic growth. The combination of those factors could be positive for gold, although we must point out there are plenty of question-marks in that scenario.

Speaking of the Fed, investors should pay attention to comments from both Chair Powell and the US President over the next couple months, particularly if data and/or news on tariff negotiations suggest a shift (in either direction) in economic growth, the employment market, consumer spending or inflation projections. As is often the case, the market is currently more dovish than the Fed appears to be.