Monthly gold update - January 2024

Gold: Spotlight on January’s performance

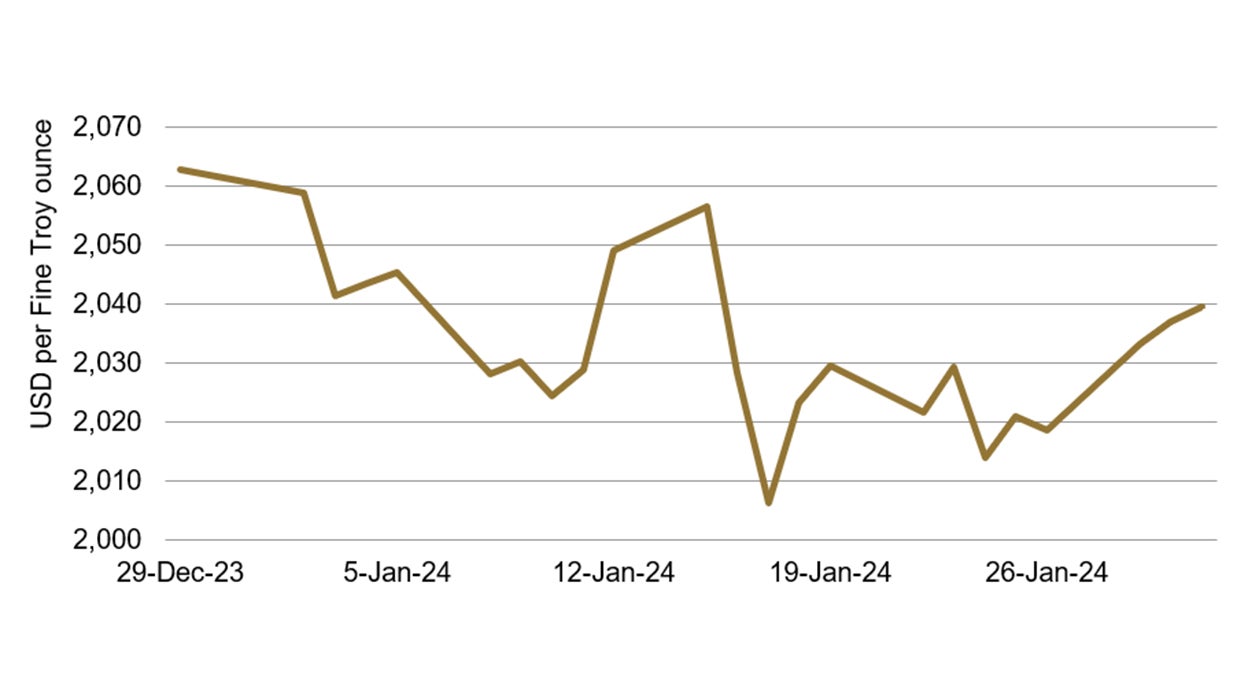

Gold lost 1.1% in the month of January as expectations of the Fed beginning to cut rates in Q1 2024 were pushed back to Q2 2024 with US real rates ending the month higher and the US dollar stronger. Although the general trend of the gold price was lower through the month, tensions in the Middle East did cause gold to rally mid-month before the influence of monetary policy re-asserted itself.

Source: Bloomberg, as at 1 February 2024. Past performance does not predict future returns.

Gold ended January at $2,0401, $23 lower than where it started the month as markets unwound their expectation for a Fed rate cut in March. The gold price appreciated mid-month following US and UK airstrikes in Yemen, increasing concerns of wider conflict in the Middle East. As these concerns eased, gold continued its downward trend towards $2,000 before recovering some of the mid-month losses.

Unusually for January, gold delivered a negative return, only the seventh time in the past 20 years, although this did follow unprecedented demand for the metal in 2023. An exception to this was the ETF segment; as the gold price increased 13.1% in 2023, gold-backed ETFs saw outflows and sold 8.7% of their physical holdings. In January, ETF flows have continued to be negative, as they have shown greater sensitivity to monetary factors compared to recent central bank activity for example. These factors are expected to have a positive influence over gold in 2024.

Keep an eye on … US positioning on Middle East tensions.

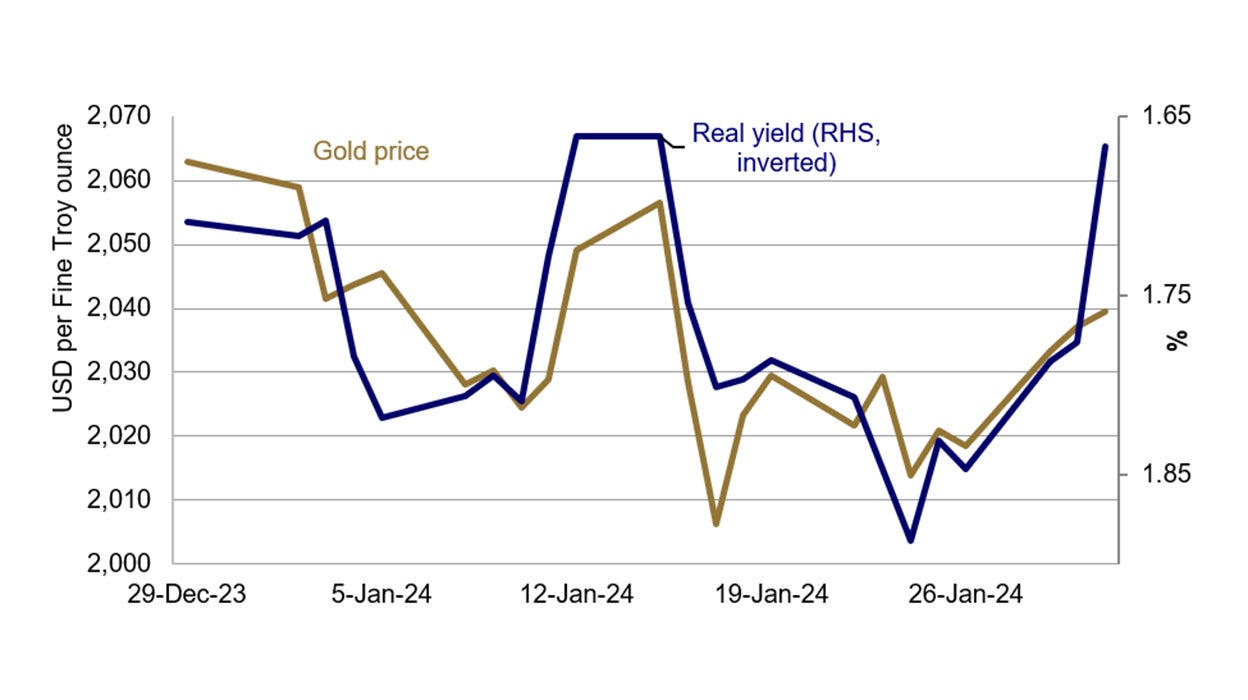

Source: Bloomberg, as at 1 February 2024. Generic Inflation Index US 10-year government bond or real yield on generic 10-year TIPS (TIPS = Treasury Inflation Protected Security).

The sharp fall on the last day of the month ultimately saw US real yields end January lower than where they started at 1.67% versus 1.71%. The month-end slump came following softer US labour-market data – slowing in US hiring in the ADP data2 as well as a lower print from the employment cost index. In addition, a regional US bank reported a Q4 2023 loss and slashed its dividend on the last day of January, also causing real yields to fall.

The fall in real yields was despite the hawkish tone struck by Fed Chair Powell after the Fed’s meeting, confirming the Fed Funds rate at 5.5% but also pushing back against market expectations of rate cuts in March. That US economic growth continues to show resilience also undermines confidence the US is moving to its inflation target, supporting the Fed’s stance of higher rates for longer.

Keep an eye on … further softness in the US labour market.

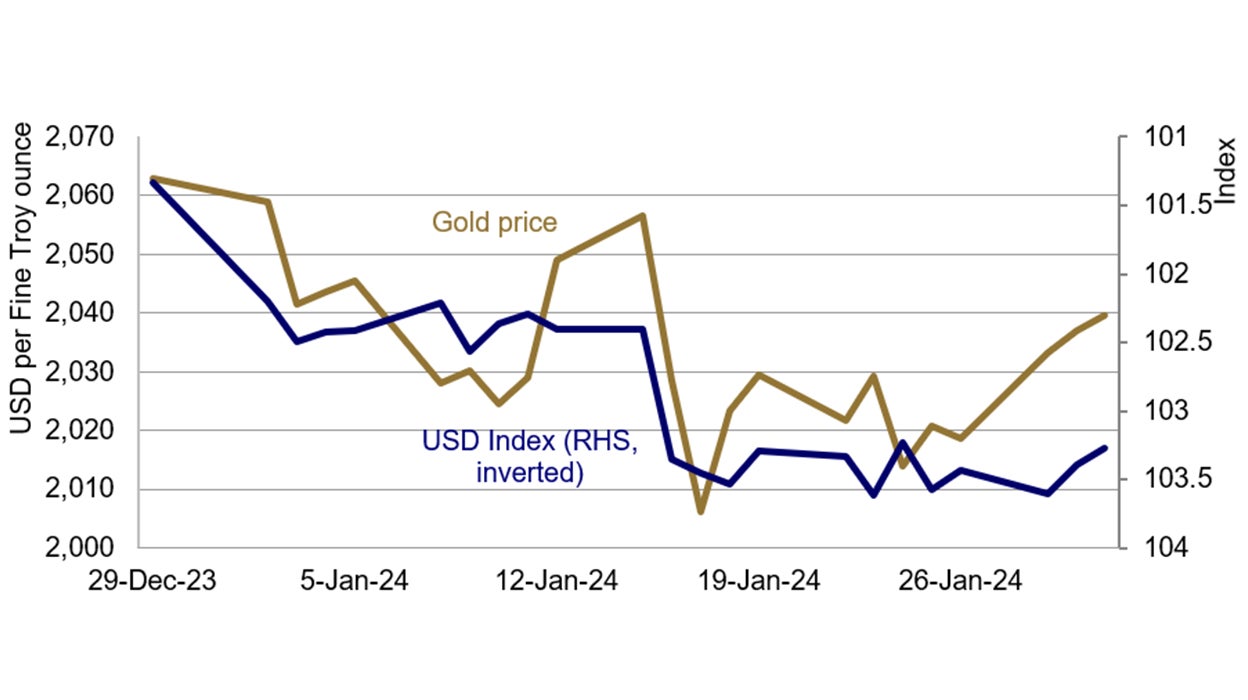

Source: Bloomberg, as at 1 February 2024.

As the market pushed back its view of when the Fed will start cutting rates, there was tandem strengthening in the dollar. The USD strengthening by 1.9% (as per the DXY index) over the course of the month was a key determinant in gold delivering a negative return. Although the market’s view of where the Fed Funds rate will settle come year-end was little changed month-on-month, it was that the timing of the initial rate cut was pushed out that caused the USD to gain.

In general, all major developed central banks are now expected to have higher policy rates at year-end compared to forecasts at the start of the year. Conviction remains that the Fed will be the first to cut and, although interest rate differentials with the US narrowed, the dollar gained as previous weakness was overdone.

Keep an eye on … relative economic strength influencing interest rate paths.