Monthly gold update - March 2024

Gold: Spotlight on March’s performance

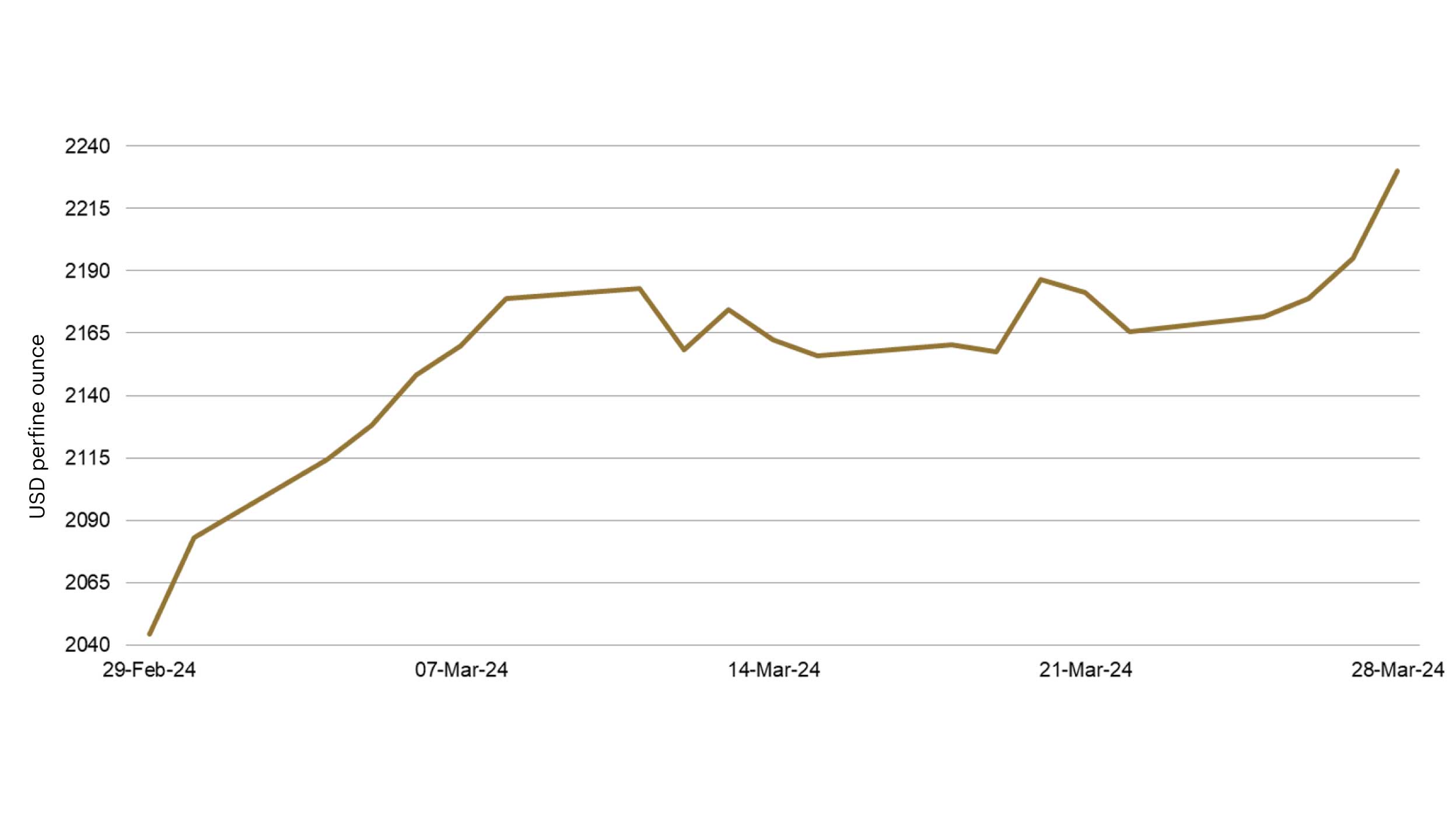

Gold added 9.1% in March ending the month at $2,230. Gold made fresh all-time highs at several points during the month without there being a specific catalyst; real yields were essentially unchanged as the USD was stronger and there was no significant increase in geopolitical tensions. The record price levels were also made despite continued net outflows in gold-backed ETFs.

Source: Bloomberg, as at 1 April 2024. Past performance does not predict future returns.

The gold price ended March at another all-time high, $2,230, adding $186 in the month. Gold reset the record price seven times through March when counting close-of-day levels. The current trend of increasing gold prices began towards the end of February. Rising prices did take a pause mid-March as inflation data came in higher than expected and markets reassessed their positioning ahead of the updated Fed projections.

Records were reset even though there were again net outflows from gold-backed ETFs and the premium in the Shanghai market closed indicating a drop in retail Chinese demand. There has been an increase in the volume of net long non-commercial gold futures, something which could be a consequence of momentum trading strategies with higher prices bringing in more buyers. ETF investors may have to get comfortable with buying at record levels to capture further upside.

This means gold has increased 8.1% in Q1 2024, the strongest start to a year since 20161.

Keep an eye on … momentum trading and ETF inflows looking to capture the upswing.

Source: Bloomberg, as at 1 April 2024. Generic Inflation Index US 10-year government bond or real yield on generic 10-year TIPS (TIPS = Treasury Inflation Protected Security).

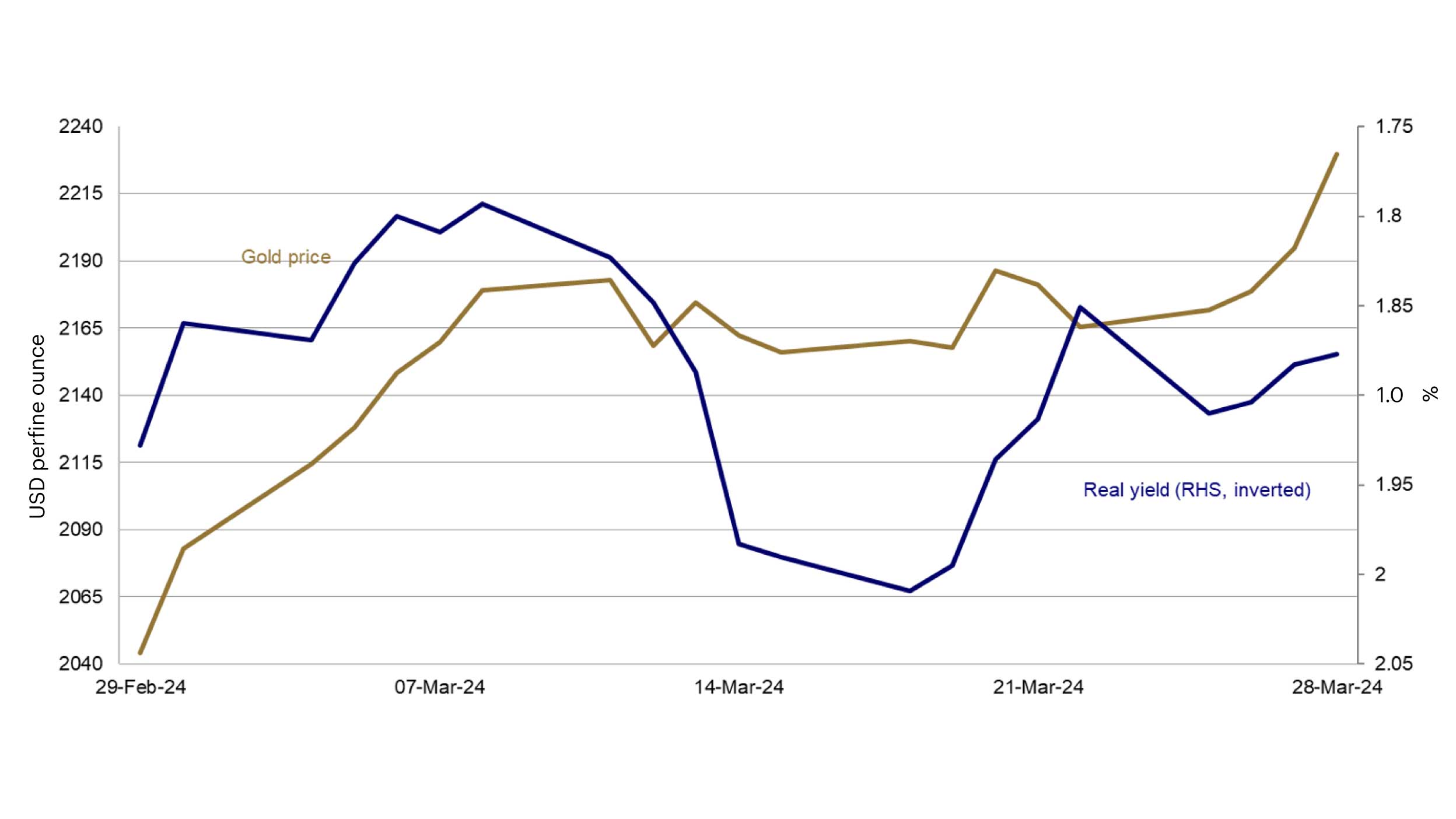

Slightly lower real rates do not explain the monthly increase in the gold price. US real rates ended March 5 basis points lower than where they started the month, 1.88% versus 1.93%; however, the intra-month range was significantly wider. Real yields fell to 1.79% at the start of the month, reacting to the downward revision of the January payroll data and increase in the unemployment rate to 3.9% from 3.7%. Treasury yields then climbed as US CPI data came in relatively hot, giving rise to speculation the Fed would be in no hurry to cut rates. Ultimately the Fed dot plot showed the members of the FOMC maintained their year-end pricing of the Fed funds rate as per their previous judgement in December.

At month-end, the Fed’s forecasted measure of inflation, the personal consumption expenditures (PCE) measure, showed price pressures cooled somewhat in February, contradicting other inflation measures. It is likely that the Fed will be looking for broader evidence of a cooling of price pressures before committing to a rate cut.

Keep an eye on … a convergence in direction of inflation measures.

Source: Bloomberg, as at 1 April 2024.

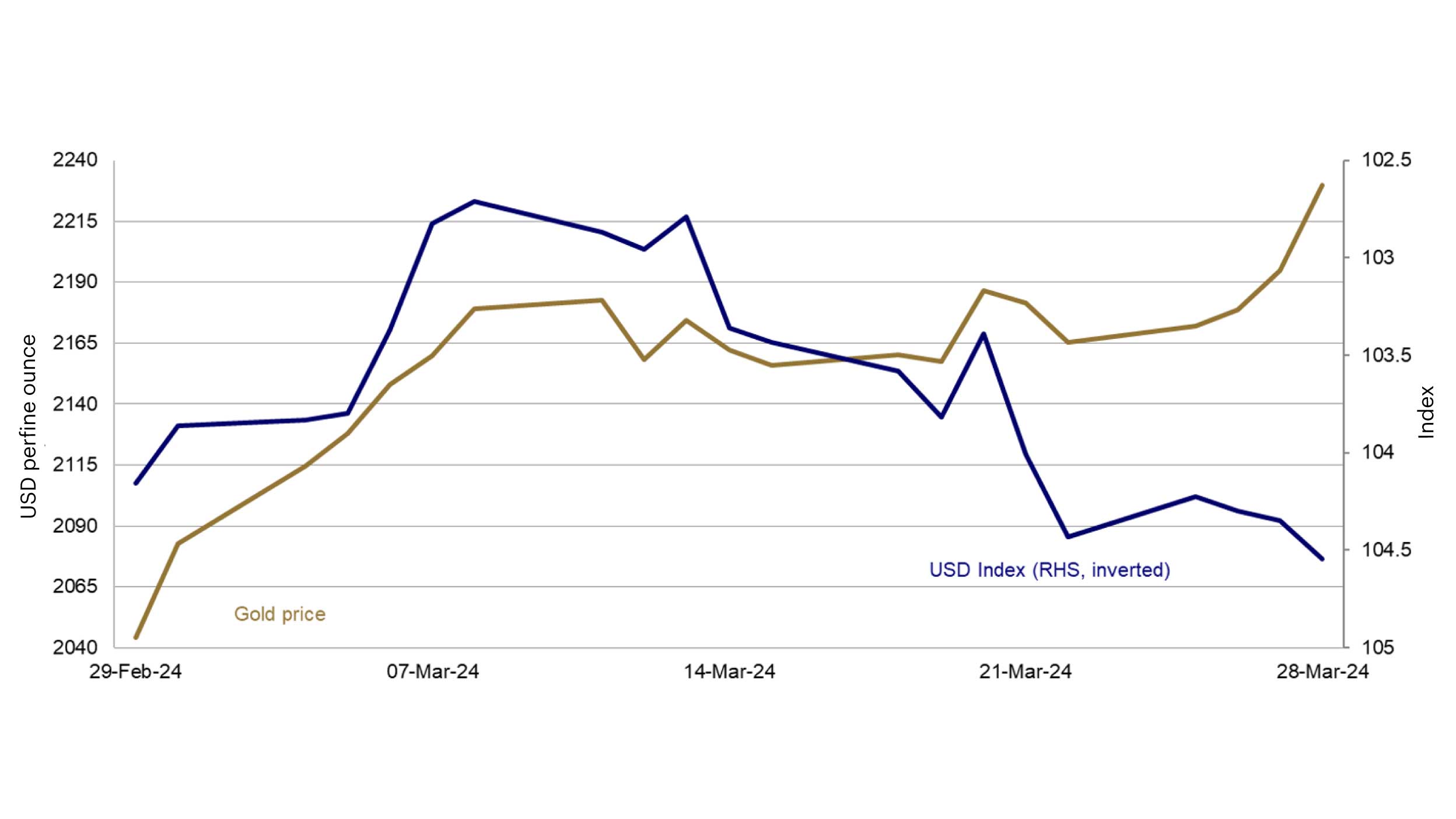

The USD appreciated 0.4% in March according to the DXY index. This was as markets pushed back their expectation for the number of FOMC rate cuts this year to be in-line with the Fed; markets are pricing the Fed Funds rate to reach 4.66% by December whereas the Fed maintained its year-end target of 4.625% in the March dot plot. Despite markets seeing the year-end Fed funds rate slightly higher than what they had previously anticipated and a consequential rise in the USD, gold was also higher. It may be that the USD and gold are flexing their “safe-haven” attributes.

Relative to other influencing currencies in the DXY basket, the USD had the largest month-on-month repricing of year-end policy rates; the Euro represents 57.6% of the DXY index and in March markets increased their expectations for the year-end ECB deposit rate by 2 basis points whereas the year-end estimation for the Fed funds rate increased 17 basis points.

Keep an eye on … markets pricing becoming more hawkish than the Fed.