Nasdaq 100 Index – Commentary - April 2025

Key Highlights

Equities finished April in positive territory amid elevated volatility.

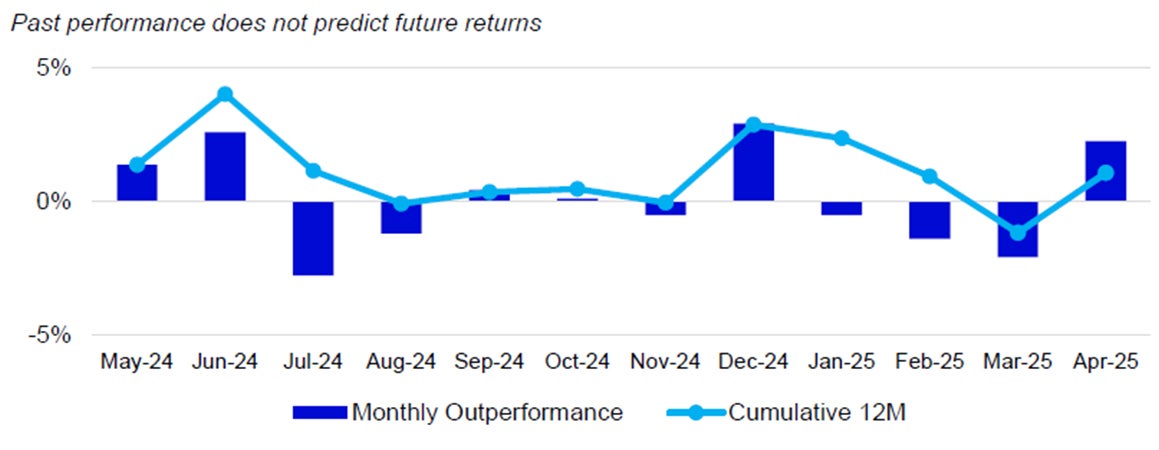

For the month of April, the Nasdaq-100 Index (NDX) returned 1.5%, outperforming the S&P 500 Index, which returned -0.7%.

US Market Recap

April provided market participants with no shortage of substantial developments with significant repercussions for equity and fixed-income markets alike. Market optimism following the November general election gave way to an air of consternation presented in the form of violent intraday price swings and significantly increased volatility. Equity markets posted mixed results in the month of April as represented by the S&P 500 declining incrementally month over month with a decrease of -0.68%. Meanwhile, the Nasdaq-100 Index increased modestly month over month, posting an increase of 1.54%.

April's headline returns for the Nasdaq 100 and S&P 500 seemed unremarkable, but the market action was notable. Despite tariff-related concerns, equity markets posted marginal gains in the first two trading sessions. On April 2nd, President Trump announced a wide-scale tariffs policy, including a 10% minimum rate on all imports and higher tariffs targeting significant trading partners, notably a 34% increase on Chinese imports.

April saw significant volatility in the markets, as reflected by the VIX Index, which closed the month at 24.78, marking the third consecutive month of increased volatility. The VIX spiked to a high closing price of 52.33 on April 8th, the highest since March 2020, and reached an intraday peak of 60.13 on April 7th.

Despite heightened concerns over potential inflationary pressures from US tariffs, April's inflation data provided positive news for the market. The Consumer Price Index (CPI) came in at 2.4%, slightly cooler than the consensus estimate by 0.1%. The year-over-year Core CPI, which excludes volatile food and energy prices, was reported at 2.8%, 0.2% lower than expected. Additionally, the Core Personal Consumption Expenditures (PCE), the Federal Open Market Committee’s preferred inflation gauge, matched estimates at 2.6% year-over-year. These figures suggest that inflationary pressures might be easing, offering a more optimistic outlook for the market.ity remained elevated through April 11th before gradually diminishing towards the end of the month.

Innovator Spotlight

Intuitive Surgical is revolutionizing the field of surgery with its da Vinci Surgical System, a robotic platform that enhances a surgeon’s precision, vision, and control. This innovation is driving a shift towards minimally invasive techniques, resulting in smaller incisions, shorter recovery times, and potentially better outcomes for patients. The company is expanding its platform and global presence, making robotic-assisted surgery more accessible across various hospitals and specialties. As the demand for advanced surgical tools grows, Intuitive Surgical is well-positioned at the intersection of healthcare and robotics.

Additionally, Intuitive Surgical is investing heavily in research and development to continuously improve its technology. The company is also focusing on training and education programs to ensure surgeons are proficient in using their systems, thereby maximizing the benefits of robotic-assisted surgery. Furthermore, Intuitive Surgical is exploring partnerships and collaborations with other healthcare innovators to integrate artificial intelligence and machine learning into their systems, potentially enhancing surgical outcomes even further. With a strong commitment to innovation and accessibility, Intuitive Surgical is poised to lead the future of surgical technology.

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

1.5% | -6.7% | 12.8% | 16.8% |

| S&P 500 | -0.7% | -5.0% | 11.6% | 11.7% |

Relative |

2.3% | -1.8% | 1.1% | 4.6% |

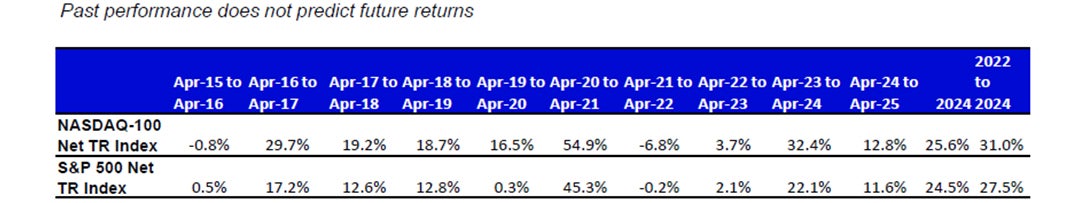

Performance as of 30 Apr 2025. Past performance does not predict future results. Innovator spotlight source: Intuitive Newsroom; intuitive.com/en-us/about-us/newroom. Holding are subject to change and are not buy/sell recommendations.

Source: Bloomberg as of 30 Apr 2025.

An investment cannot be made directly into an index.

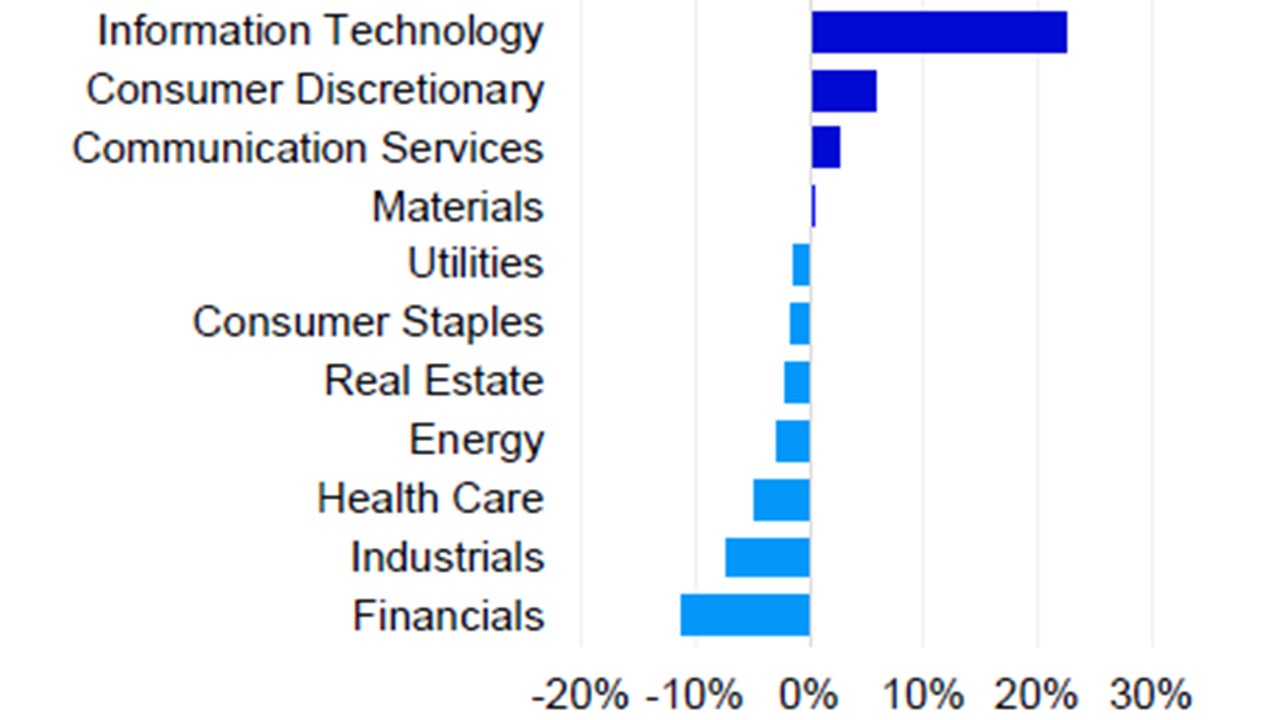

While the Nasdaq-100 specifically excludes Financials, it also currently offers very little exposure to Basic Materials, Energy, and Real Estate

Source: Invesco, FactSet as of 30 Apr 2025. Data in USD. The Index uses the Industry Classification Benchmark (“ICB”) classification system which is composed of 11 economic industries: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities.

Nasdaq-100 Performance Drivers

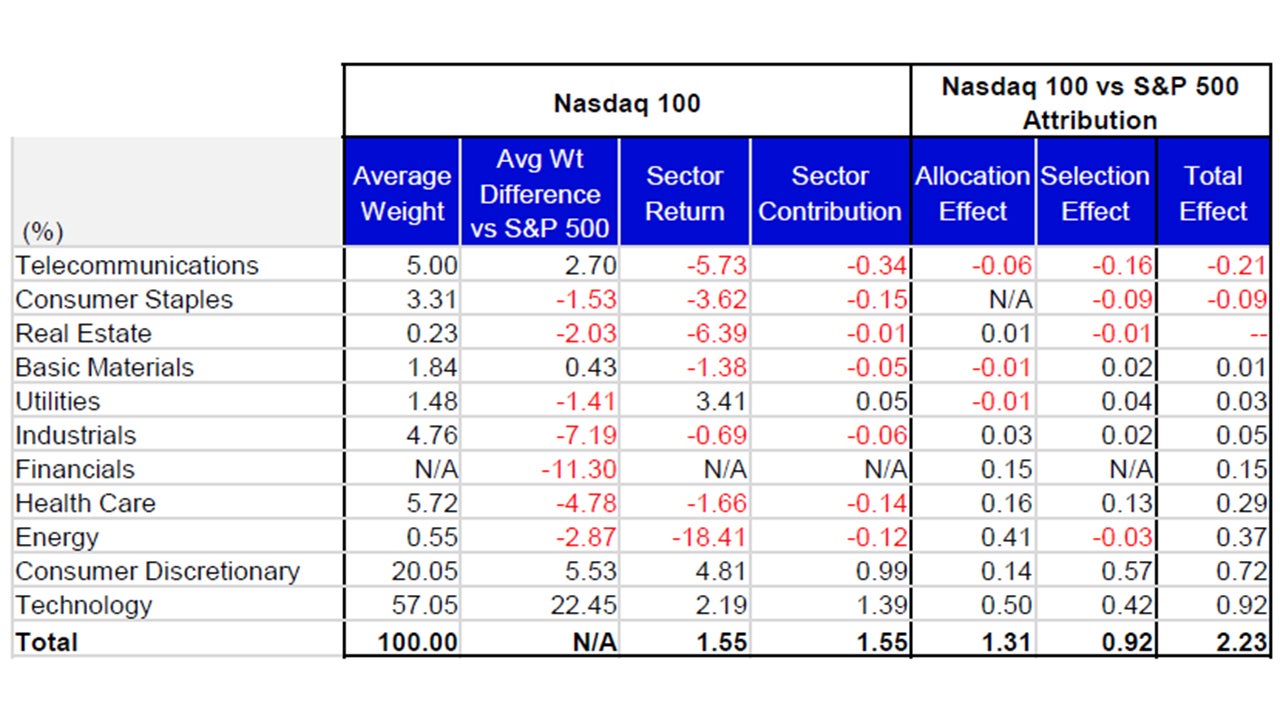

April’s performance attribution of the Nasdaq-100 (NDX) vs the S&P 500 Index

From a sector perspective, seven of the ten sectors that NDX has exposure to finished in negative territory for April. Energy was the worst performing, declining by 18.41% for the month. Relative NDX outperformance versus the S&P 500 was driven by its overweight exposures and differentiated holdings within the Technology and Consumer Discretionary sectors. The Technology sector averaged a 57.05% weighting for the month and saw a total return of 2.19%, compared to the sector’s average weight of 34.58% in the S&P 500 and a total return of 1.47%. Within NDX, the Consumer Discretionary sector averaged a 20.05% weighting for the month and saw a total return of 4.81%, compared to the sector’s average weight of 14.52% in the S&P 500 and a total return of 1.87%.

Energy and Real Estate were the worst-performing sectors in NDX, down 18.41% and 6.39%, respectively. Energy averaged a 0.55% weight in NDX for April, while Real Estate averaged a 0.23% weight over the course of the month.

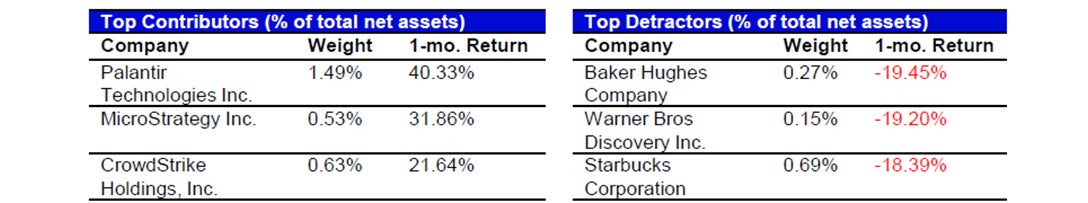

NDX Contributor/Detractor Spotlight- Netflix: Netflix was one of the first companies held by NDX to report, announcing their quarterly results on April 17th. Netflix reported very strong results with diluted earnings per share of $6.61, considerably above the consensus analyst estimate of $5.68 per share. Reported earnings were ~16.3% above consensus analyst estimates. On the top line, Netflix reported revenue of $10.542 billion which was slightly above consensus analyst estimates of ~$10.50 billion for a marginal positive surprise of 0.44%. In addition, Netflix also reported operating income and free cash flow that were significantly higher estimates. Operating income for the quarter totaled ~$3.35 billion, ~11.7% above the consensus estimate of $2.99 billion. Further, the positive surprise was even more considerable in free cash flow which was reported ~30.7% above the consensus estimate. Results were driven by a combination of membership growth and price increases. Investors also seemed encouraged after Netflix provided revenue guidance of ~15% year over year growth for the second quarter, better than analyst forecasts. Shares rose 4.5% after hours on the announced results and finished the month up 21.36% with an average weight of 2.98% for the month. Netflix’s monthly return was the 4th highest for stocks held within NDX.

Holdings are subject to change and are not buy/sell reccomendations.

Data: Invesco, FactSet, as of 30 Apr 2025. Data in USD. Sectors: ICB Classification. All figures in percentage terms. Market allocation effect shows the excess contribution due to sector/market allocation. A positive allocation effect implies that the choice of sector weights in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Selection effect shows the excess contribution due to security selection. A positive selection effect implies that the choice of stocks in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Total effect is the difference in contribution between the benchmark and portfolio.

Source: Bloomberg, as of 30 Apr 2025. Past performance does not predict future returns. Top and bottom performers for the month by relative performance. Holdings are subject to change and are not buy/sell recommendations

Data: Invesco, Bloomberg, as of 30 Apr 2025. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.