Nasdaq 100 Index Commentary - August 2025

About the index

The Nasdaq 100 is one of the world’s preeminent large cap growth indexes.

The companies in the Nasdaq-100 include the largest non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Overview

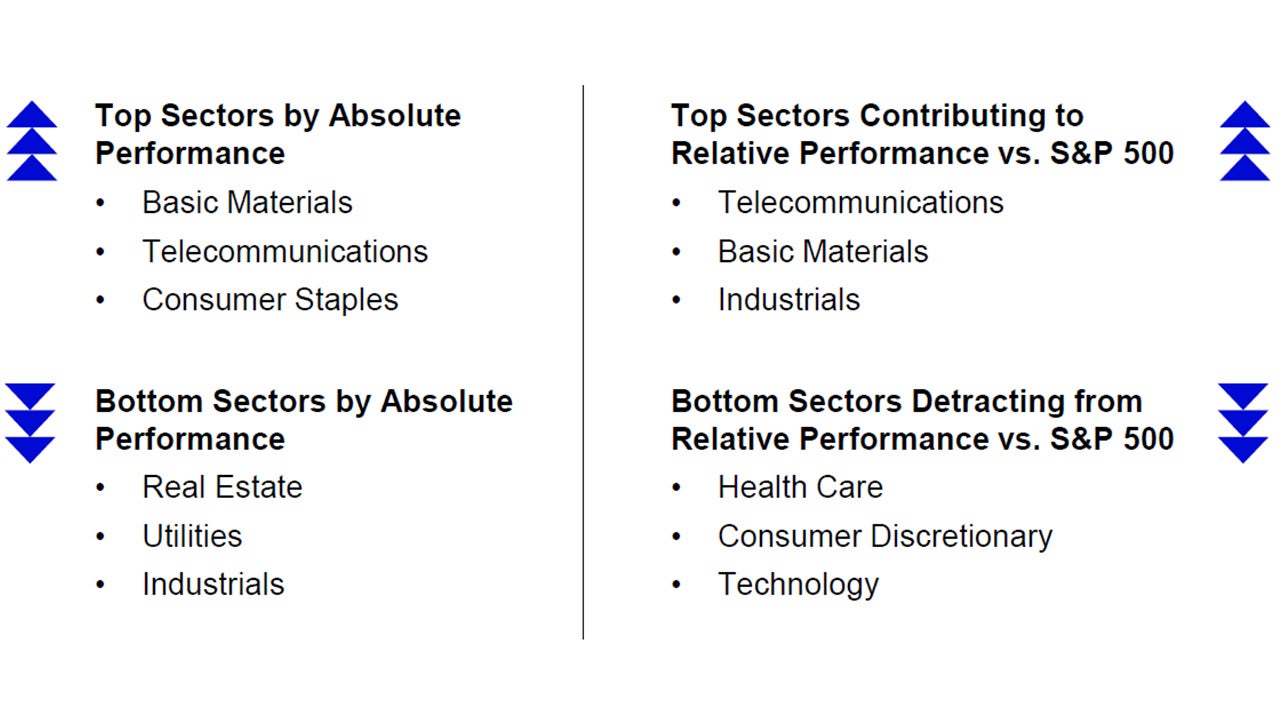

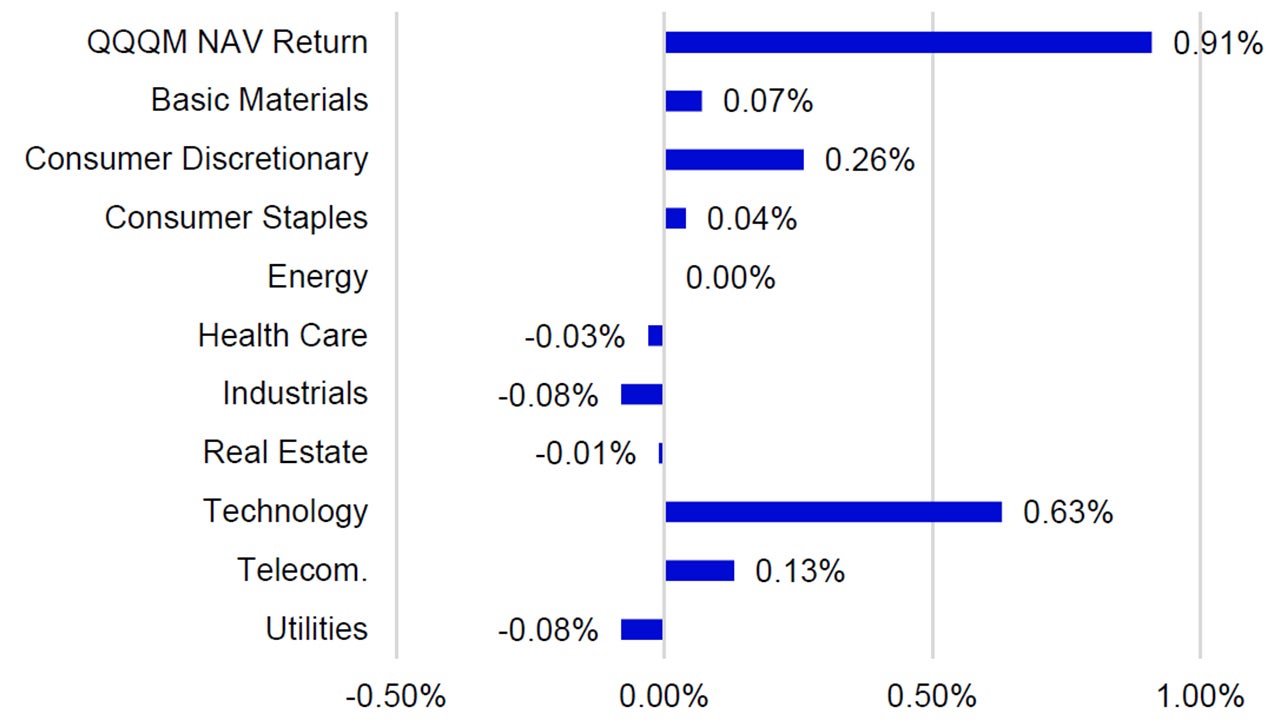

- In August, the NASDAQ-100 Index (NDX) returned 0.92% vs. 2.03% of the S&P 500.

- NDX’s underperformance was driven by its underweight exposure and differentiated holdings in Health Care and its differentiated holdings in Consumer Discretionary.

- August at a rough start with many equities trading negatively on August 1st after a disappointing Non-farm Payrolls report was announced well below expectations

- The Federal Open Market Committee’s (FOMC) annual Jackson Hole Economic Symposium was a key driver of market performance for the end of the month with Fed Chair Jerom Powell delivering his speech on August 22nd.

- Many investors interpreted Powell’s speech as dovish which led many investors to believe that cuts to the Fed’s target rate may arrive sooner than initially believed prior to Jackson Hole and contributed to major indices’ positive performance.

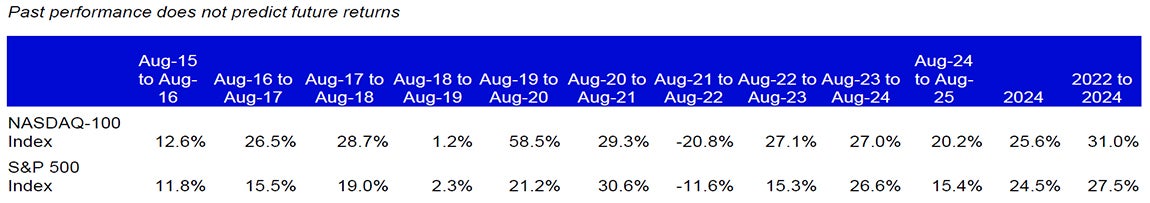

Data: Bloomberg, L.P., as of 31/08/2025. An investor cannot invest directly in an index. Past performance does not predict future results. All data is in USD unless indicated otherwise.

The Index uses the Industry Classification Benchmark (“ICB”) classification system which is composed of 11 economic industries: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities.

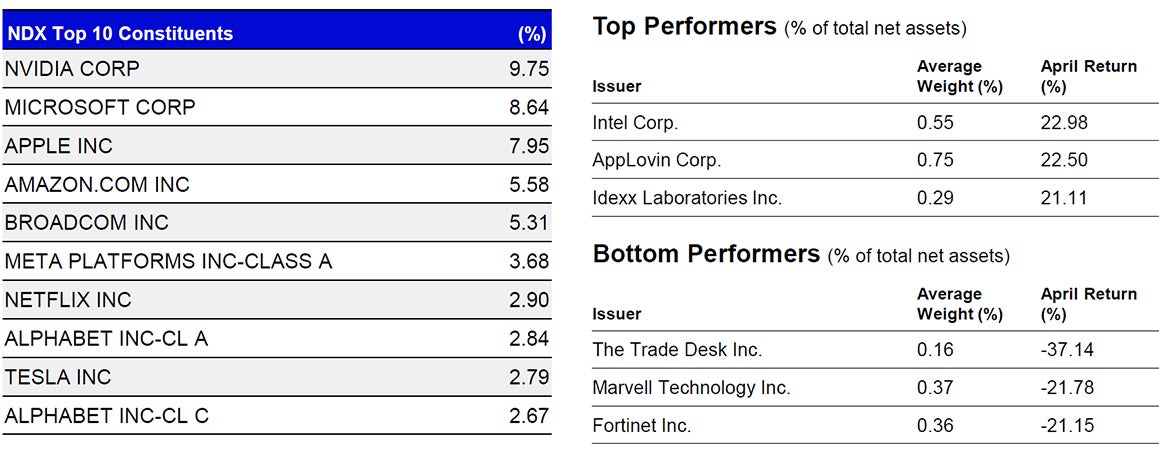

Individual Company Highlights

- After a gap down on August 1st due to a poor jobs report, NDX moved higher and set a new all time high closing level on the 13th, at 23,849. Markets did retrace some of this move up during the 2nd half of the month but ultimately finished with positive month-over-month performance.

- Nvidia announced quarterly results on August 27th and beat consensus estimates for both revenue and adjusted earnings-per-share. Data center revenue came in slightly lower than expected but did see a year-over-year growth rate of 56.4%. Concerns were raised as no H20 chips were sold in China, a chip made specifically for their market. The companies stock fell 0.8% the following trading day, the 28th.

- Intel was the best performing stock in NDX for the month due to an announcement stating that the U.S. government would be investing $8.9 billion for 9.9% equity in the chipmaker. SoftBank also announced a $2 billion investment into the chipmaker during the month, contributing to the strong performance.

Source: Bloomberg, L.P., as of 31/08/2025. Past performance is not a guarantee of future results. Holdings are subject to change and are not buy/sell recommendations. Top and bottom performers for the month by absolute performance.

Outlook

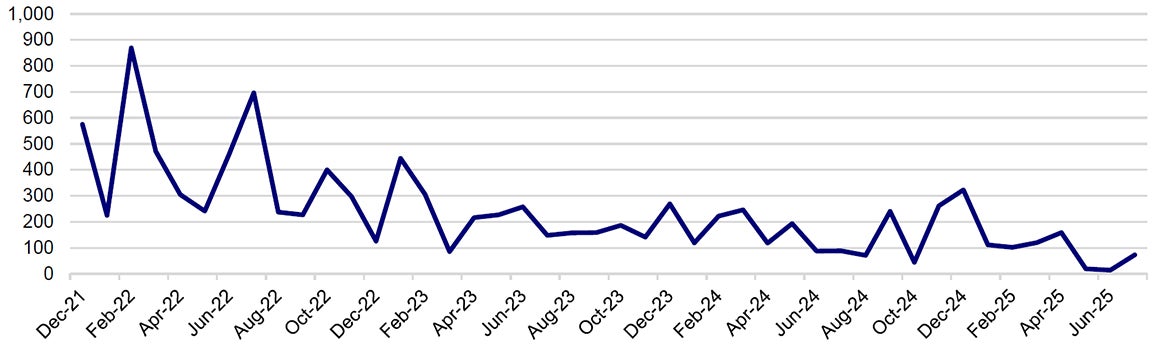

- After the keynote speech from Fed Chairman Jerome Powell, many investors will be closely following future U.S. job and employment data releases as it would appear that the FOMC will be focusing more on this part of the committee’s mandate.

- Some investors have raised concerns around the current state of the U.S. job market. The July Non-farm Payroll numbers announced in August may cause more investors to watch this and U.S. Initial Jobless Claims data more closely.

- The potential for a rate cute at the next FOMC meeting on September 17th rose dramatically after the Jackson Hole Economic Symposium with Fed Futures rising from 72% on August 21st to 88% on the last trading day of August.

- After Nvidia’s earnings announcement, many investors will likely watch the progress the chipmaker can make in generating revenue from sales in China.

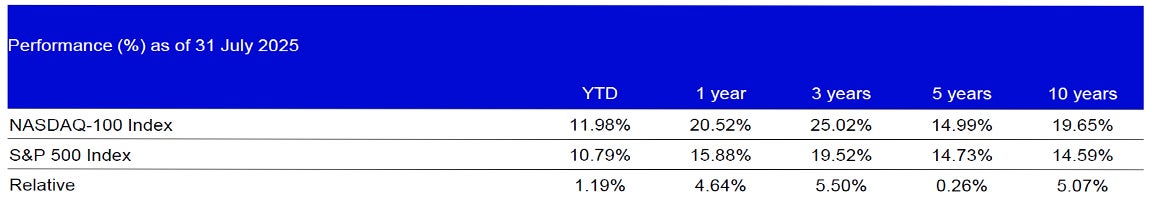

Source: Bloomberg, L.P., as of 31/08/2025. Performance data quoted represents past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than performance quoted. See Important Information for competitor ETFs’ investment objectives. Data in USD.

Data: Invesco, Bloomberg as of 31 August 2025. Data in USD.

Data: Bloomberg, L.P., as of 31 August 2025. An investor cannot invest directly in an index. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.