Nasdaq 100 Index Commentary - December 2025

About the index

The NASDAQ-100 is one of the world’s preeminent large cap growth indexes.

The companies in the NASDAQ-100 include the largest non-financial companies listed on the NASDAQ Stock Market based on market capitalization.

Overview

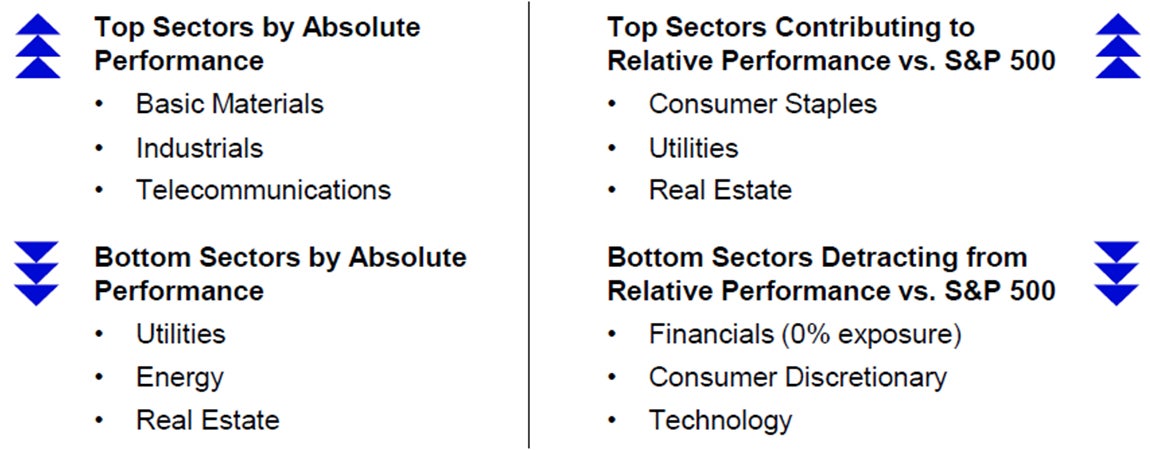

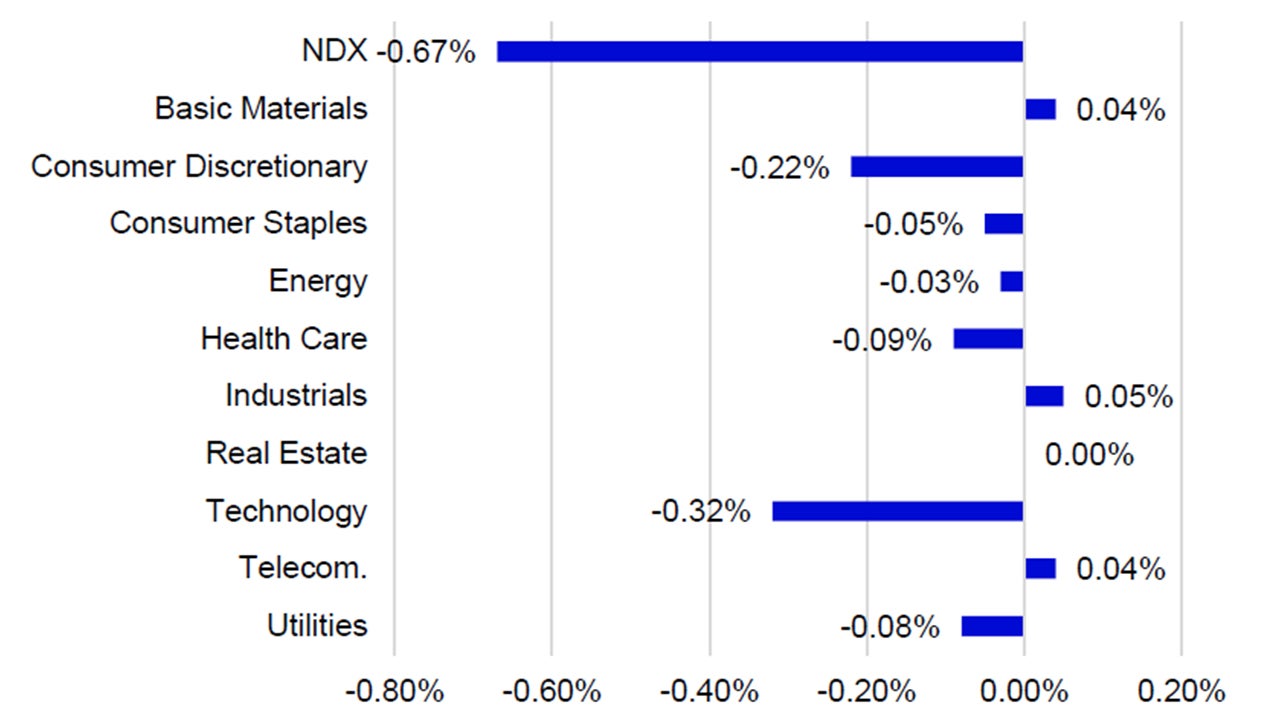

- In December, the NASDAQ-100 Index (NDX) returned -0.67% vs. 0.06% of the S&P 500.

- NDX’s underperformance was driven by its lack of exposure to the Financials sector and its overweight exposure and differentiated holdings in Consumer Discretionary.

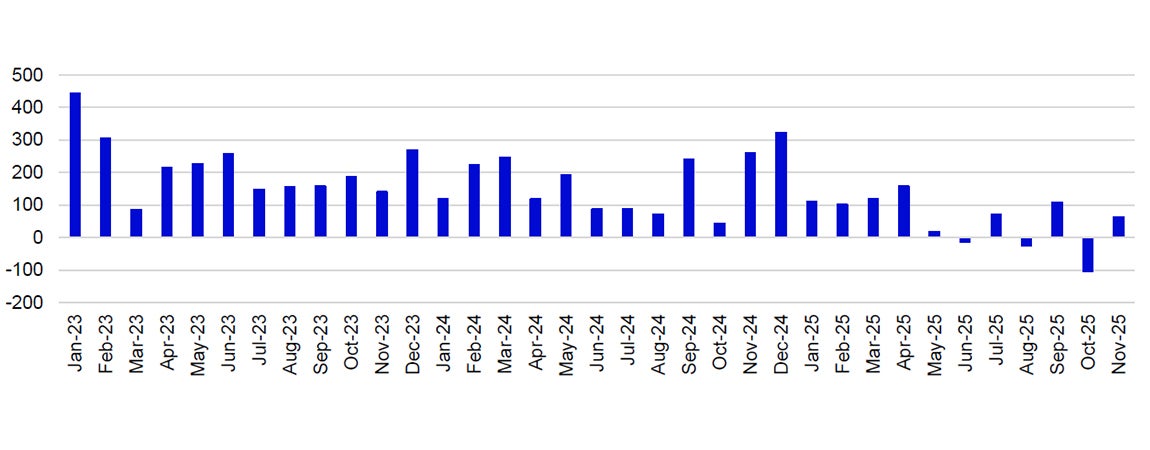

- The Federal Open Market Committee (FOMC) held their final meeting for the year and cut the Fed Target Rate by 0.25% and placed the target range between 3.50% - 3.75%. The dovish but cautious tone from the meeting had a slightly positive effect on equities with NDX finishing up 0.42% the day of the meeting, December 10th.

- Volatility ticked up slightly on the 16th with the release of the delayed October Non-Farm Payrolls number which showed a larger than expected decrease in jobs, -105k vs. the expectation of -25k.

- However, equities welcomed the most recent Consumer Price Index (CPI) release on the 18th which showed inflation rising 2.7% vs. the expectation of 3.1%.

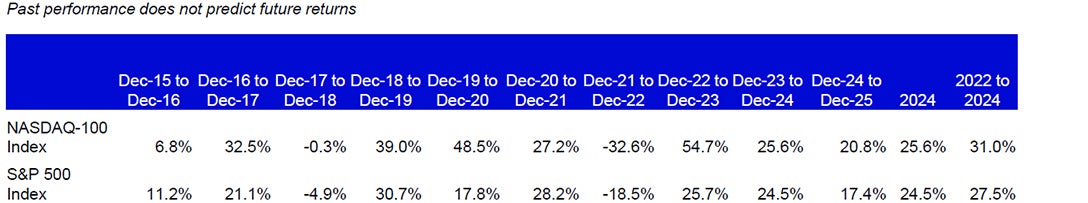

Data: Bloomberg, L.P., as of 31/12/2025. An investor cannot invest directly in an index. Past performance does not predict future results. All data is in USD unless indicated otherwise.

The Index uses the Industry Classification Benchmark (“ICB”) classification system which is composed of 11 economic industries: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities.

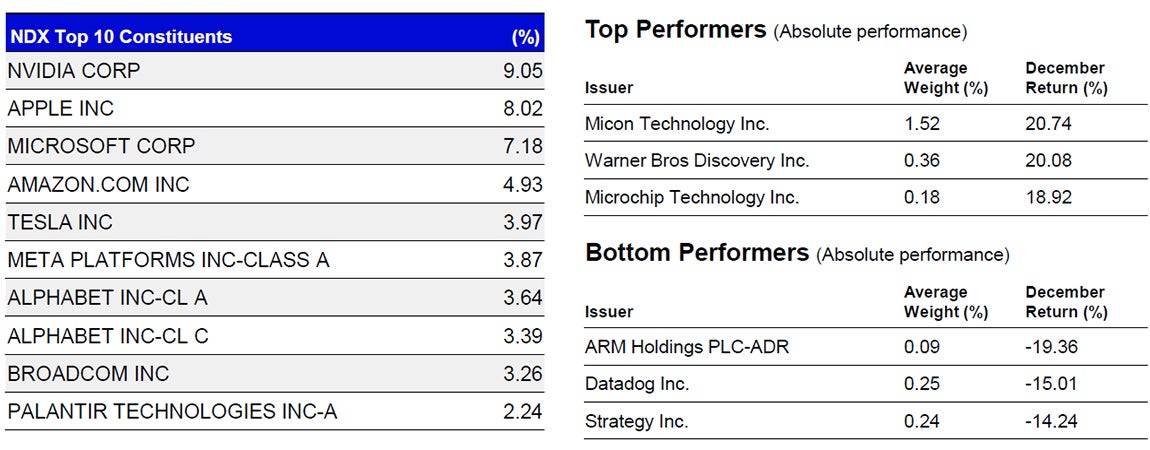

Individual Company Highlights

- The NASDAQ-100 Index went through their annual reconstitution which occurred after the close on December 19th. The reconstitution led to six companies being added and six companies being removed. The additions were Alnylam Pharmaceuticals, Ferrovial SE, Insmed Inc., Monolithic Power Systems Inc., Seagate Technology Holdings and Western Digital Corp. The six companies removed were Biogen, Lululemon, ON Semiconductor, GlobalFoundries, the Trade Desk and CDW.

- Five of the six companies were graduates from the NASDAQ Next Gen 100 Index.

- Broadcom fell over 11% on December 12th, which is the day they announced quarterly earnings. Many investors were concerned over a flat year-over-year revenue forecast in their non-AI semiconductor segment for the first quarter of 2026 along with the potential for operating margins as a percentage of revenue to fall going forward. Broadcom finished December down 13.95%.

Source: Bloomberg, L.P., as of 31/12/2025. Past performance is not a guarantee of future results. Holdings are subject to change and are not buy/sell recommendations. Top and bottom performers for the month by absolute performance.

Outlook

- The along with the rate cut, the FOMC released an updated dot plot that shows the Committee’s outlook on where the Fed Fund’s target rate may be in the future. The dot plot showed that the median did stay the same at 3.38% for the end of 2026, implying potential for one to two 0.25% rate cuts next year. However, the newest member of the Committee, has called for several more stating that the lower rate would increase productivity while not increasing inflation.

- Fed Chairman Jerome Powell’s four-year term ends in May of 2026 with a nomination for his replacement expected to be announced by President Trump sometime in January. The new chairman will have a large influence on future monetary policy.

- The health of the U.S. labor market will continue to be watched by many investors as signs of weakness have started shown by slowing Non-Farm Payrolls releases and a tick up in unemployment. There were three negative Non-Farm Payrolls releases during 2025, the most since 2020.

Source: Bloomberg, L.P., as of 31/12/2025. Data in USD.

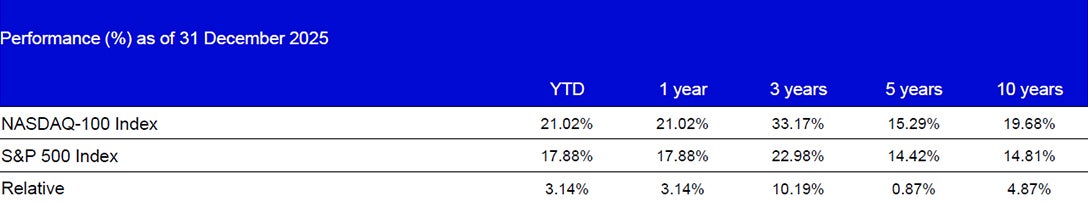

Data: Invesco, Bloomberg as of 31 December 2025. Data in USD.

Data: Bloomberg, L.P., as of 31 December 2025. An investor cannot invest directly in an index. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.