Nasdaq 100 Index Commentary - January 2026

About the index

The Nasdaq-100 is one of the world’s preeminent large cap growth indexes.

The companies in the Nasdaq-100 include the largest non-financial companies listed on the NASDAQ Stock Market based on market capitalization.

Overview

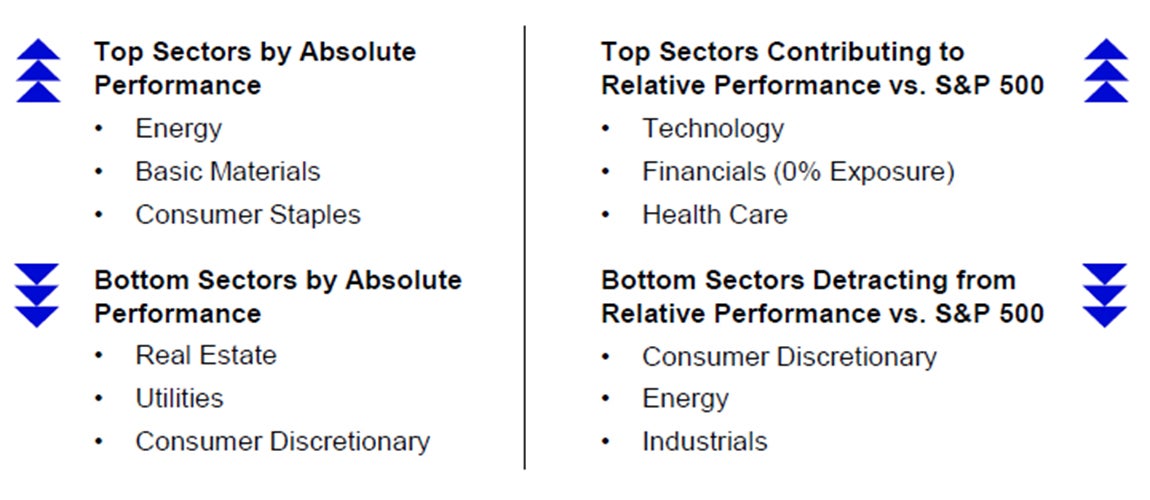

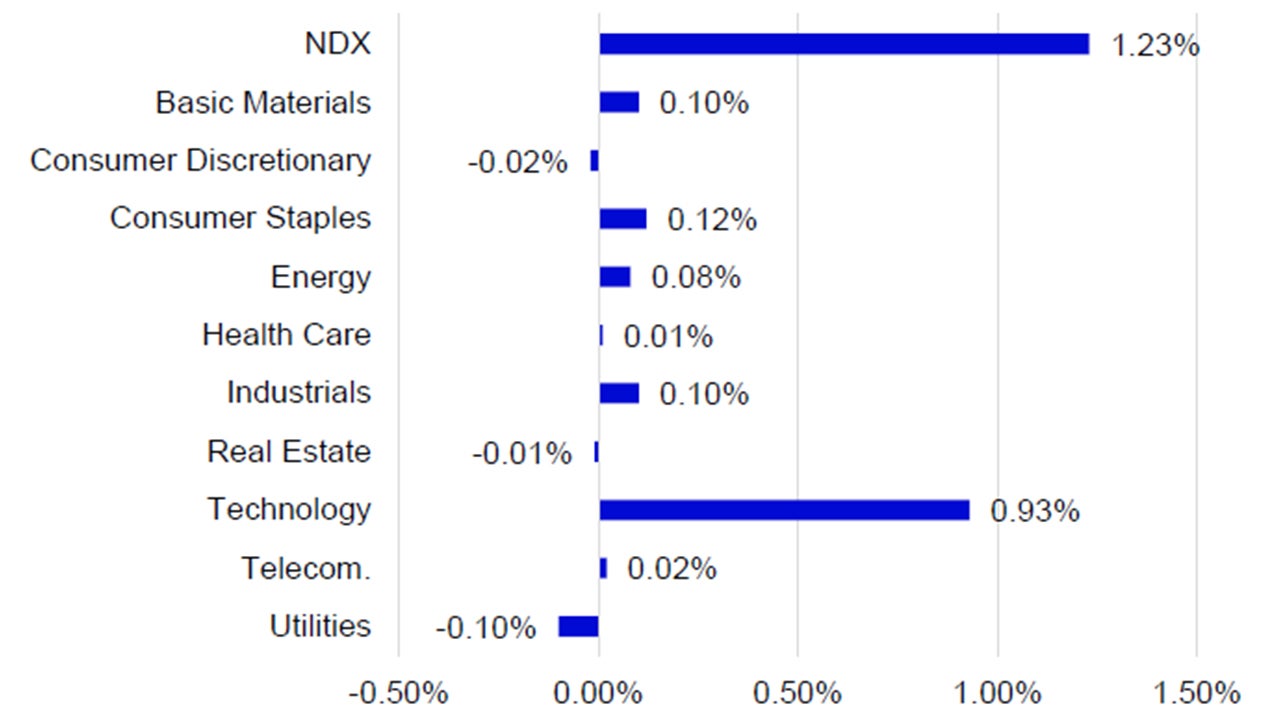

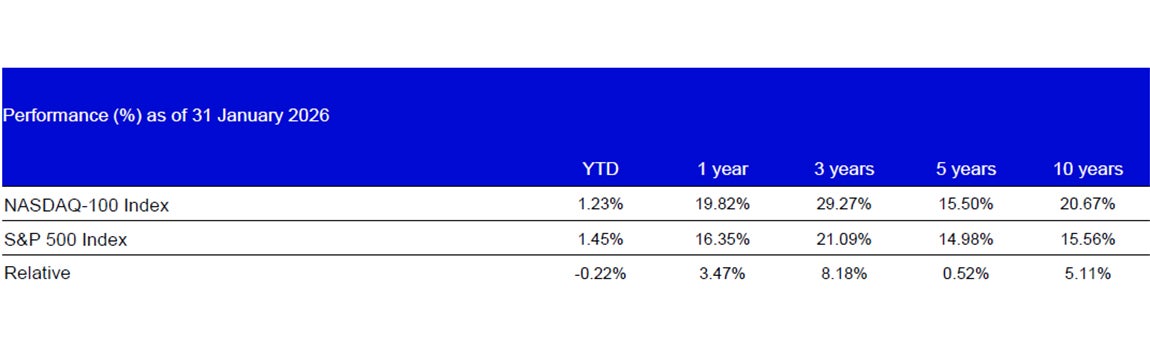

- In January, the Nasdaq-100 Index (NDX) returned 1.23% vs. 1.45% of the S&P 500.

- NDX’s underperformance was driven by its overweight position and differentiated holdings in the Consumer Discretionary sector along with its underweight position in the Energy sector.

- U.S. President Donald Trump threatened to increase tariffs on several European countries that would start on 1 February if a deal was not made for U.S. access to Greenland. While a deal was not officially made, enough progress was made to de-escalate the situation and avoid increased tariffs by the U.S.

- The Federal Open Market Committee (FOMC) met for the first time in 2026 and did not change the target rate, as expected by many analysts.

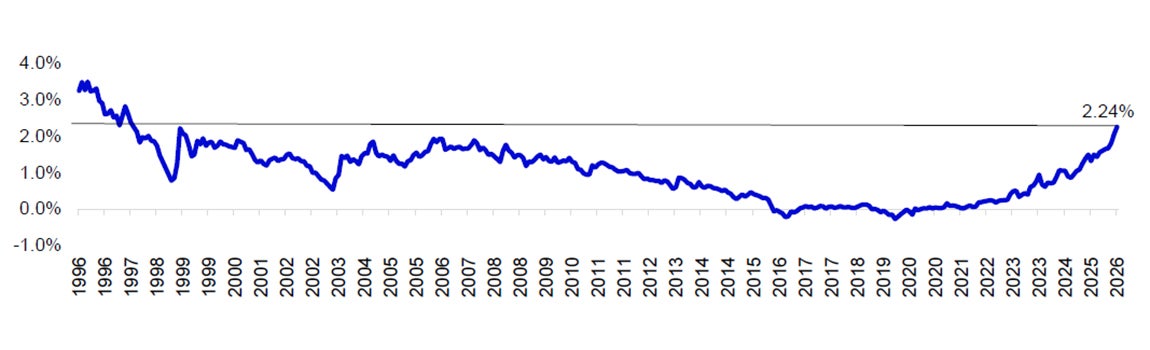

- The Japanese Yen appreciated during January as the yield on the Japanese 10yr Government Bond (JGB) rose as high as 2.35%, the highest it has been since 1997, before settling at 2.24%

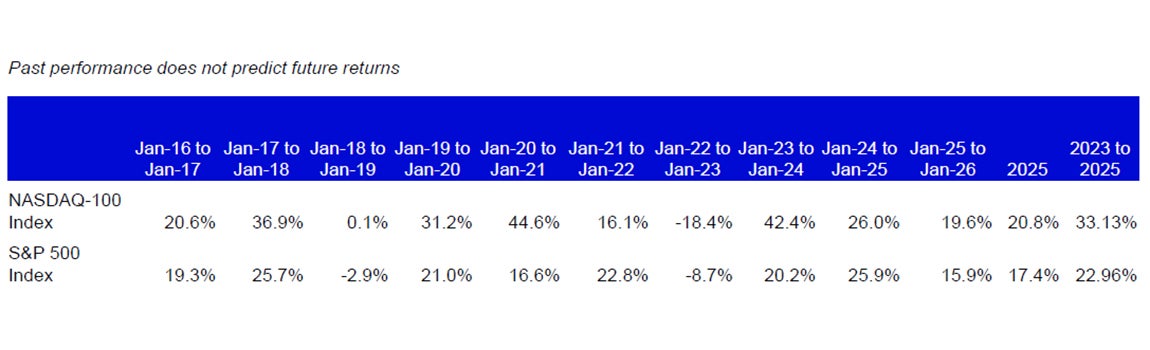

Data: Bloomberg, L.P., as of 31/01/2026. An investor cannot invest directly in an index. Past performance does not predict future results. All data is in USD unless indicated otherwise.

The Index uses the Industry Classification Benchmark (“ICB”) classification system which is composed of 11 economic industries: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities.

Individual Company Highlights

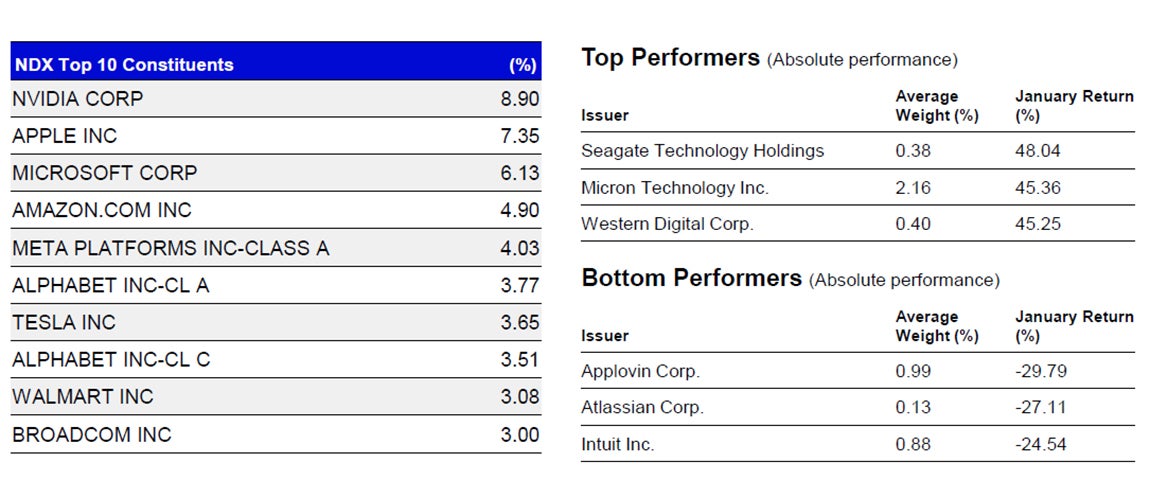

- Earnings announcements for the prior quarter began in January, with 24 NDX companies reporting results. Of the 24 companies announcing, 18 beat analysts’ expectations, two came in line with expectations and four missed.

- Meta Platforms was a standout in January returning 8.55% for the month. The strong performance was fueled by its favorable earnings announcement on the 28th after the close. Meta’s revenue came in at $59.89 billion vs. the estimate of $58.42 billion while adjusted earnings-per-share came in at $8.88 vs. the expectation of $8.19. Revenue outperformance was delivered through higher-than-expected ad revenue. The company saw daily users of all their apps exceed 3.5 billion. Meta reaffirmed their commitment to capex and anticipates 2026 spend to be in the range of $115 - $135 billion.

- Microsoft announced the same day as Meta. However, the reaction from investors was opposite with the company’s stock falling ~10%on the 29th, the day following the announcement. Microsoft beat expectations for both revenue and adjusted earnings-per-share but many investors were concerned with slowing growth in their Azure cloud business. Also, continued capex spending may pressure future margins.

- Walmart was added to the Nasdaq-100 prior to the open on 20 January. The world’s largest retailer (by revenue) replaced AstraZeneca which delisted from Nasdaq. Walmart finished the month with a weight of 3.08%, making it the eighth largest holding.

Source: Bloomberg, L.P., as of 31/1/2026. Past performance is not a guarantee of future results. Holdings are subject to change and are not buy/sell recommendations. Top and bottom performers for the month by absolute performance.

Outlook

- The majority of NDX constituents, 65, announce previous quarter’s earnings results in February. Notable announcements are Palantir on 2 February, Alphabet and Qualcomm on 4 February, Amazon on 5 February Walmart on 19 February and Nvidia on 25 February.

- The FOMC kept the Fed Funds Target Rate the same in January and signaled they would have to see convincingly lower inflation or weakening U.S. labor market conditions to continue cutting rates. President Trump also nominated Kevin Warsh to replace Jerome Powell as the next Fed Chairman. Warsh was viewed as hawkish-leaning nomination with potential to preserve Federal Reserve political independence.

- Investors will continue to closely watch the yield on 10yr JGBs. Policy set by the Bank of Japan has been shifting causing yields to rise, the Yen to appreciate and the U.S. Dollar to fall. All these changes have the potential to meaningfully affect other assets classes.

Source: Bloomberg, L.P., as of 31/1/2026. Performance data quoted represents past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than performance quoted. Data in USD.

Data: Invesco, Bloomberg as of 31 January 2026. Data in USD.

Data: Bloomberg, L.P., as of 31 January 2026. An investor cannot invest directly in an index. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.