Nasdaq 100 Index – Commentary - July 2025

About the index

The Nasdaq 100 is one of the world’s preeminent large cap growth indexes.

The companies in the Nasdaq-100 include the largest non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Overview

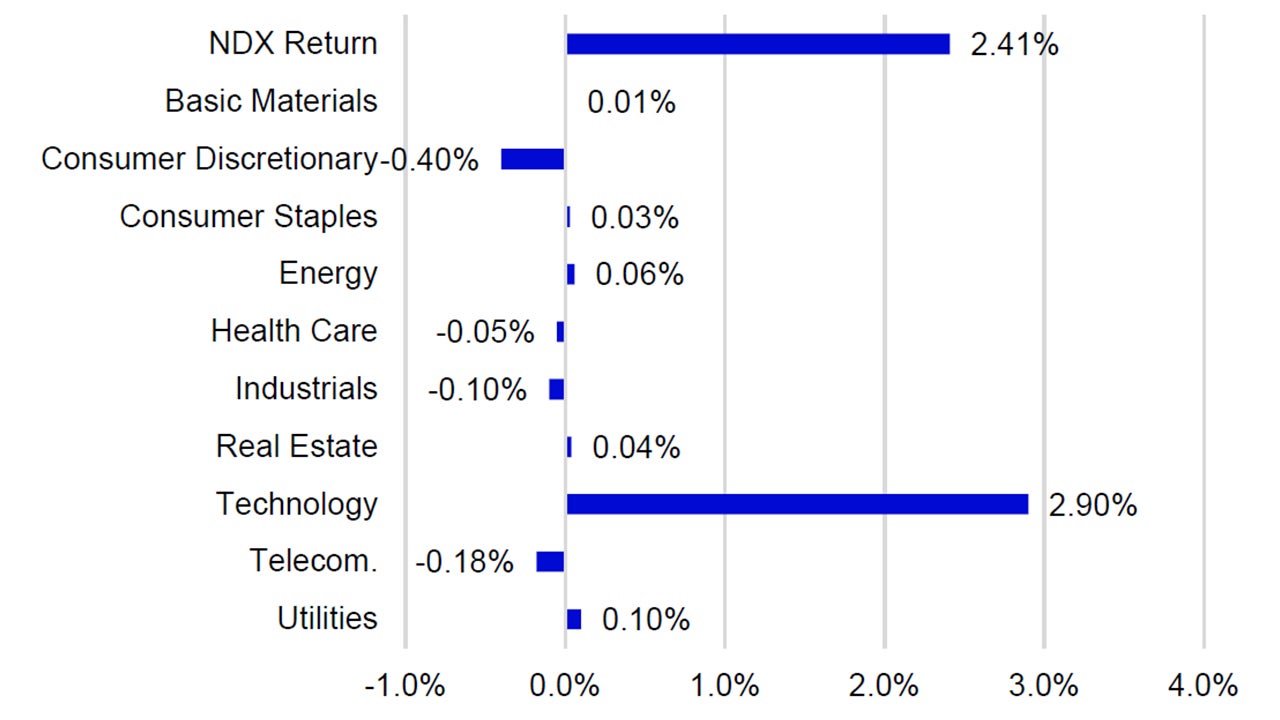

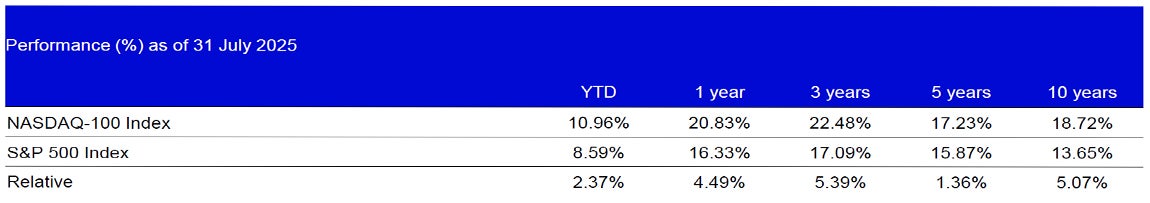

- In July, the NASDAQ-100 Index (NDX) returned 2.41% vs. 2.24% of the S&P 500.

- NDX’s outperformance was driven by its underweight exposure and differentiated holdings in Health Care and its overweight exposure and differentiated holdings in Technology.

- Trade deals between the U.S. and EU, Japan, Indonesia and the Philippines were announced in July with many investors appreciating the clarity for future policy.

- The Federal Open Market Committee met and kept the Federal Funds target rate between 4.25% - 4.50% although there were two dissenting votes who were in favor of a rate cut.

- Earnings season started with names like Microsoft, Meta Platforms, Alphabet and Amazon being a key focus for many investors.

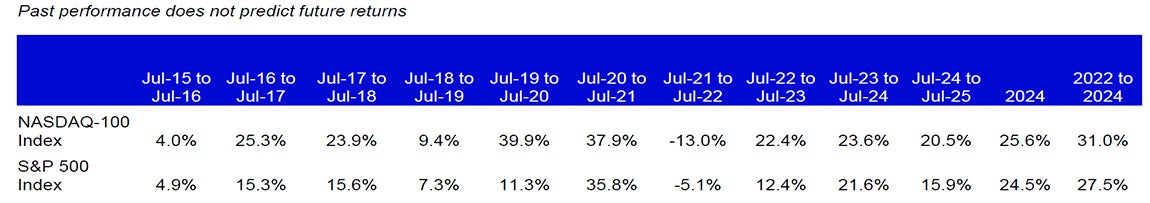

Data: Bloomberg, L.P., as of 31/07/2025. An investor cannot invest directly in an index. Past performance does not predict future results.

The Index uses the Industry Classification Benchmark (“ICB”) classification system which is composed of 11 economic industries: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities.

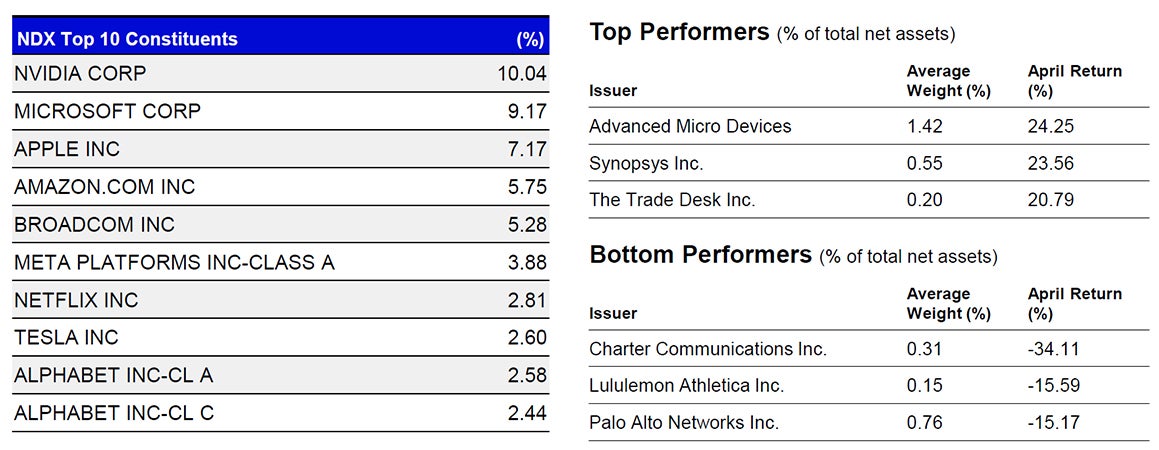

Individual Company Highlights

- NDX’s index level grinded higher through out most of the month, setting new record per share price levels multiple days. The Index closed the month of July at 23,218.12.

- Microsoft announced earnings after the close on 30 July and rose 3.95% the day following the announcement. Both revenue and adjusted earnings per share exceeded expectations. Azure and cloud services growth services growth outperformed expectations and brought in over $29 billion in revenue, equating to a 39% growth rate.

- Facebook and Instagram parent company Meta Platforms also announced earnings results after the close on 30 July which caused the company’s stock to rise 11.25% the next trading session. Revenue came in 6% above expectations while adjusted earnings per share was 21% above target. Strong advertising revenue and increased daily users contributed to the company’s results.

Source: Bloomberg, L.P., as of 31/07/2025. Past performance is not a guarantee of future results. Holdings are subject to change and are not buy/sell recommendations. Top and bottom performers for the month by absolute performance.

Outlook

- Considering the messaging from the Federal Reserve Chairman Jerome Powell at the July FOMC post meeting press conference , many investors will continue to watch new readings of inflation, job creation, unemployment and the effects of tariffs as signals of when a potential rate cut may occur in the Fed Funds Target Rate.

- As 31 July, Fed Fund futures showed a 31% chance of two 0.25% rates before the end of 2025.

- Major NDX holdings that will be announcing earnings during August will be Palantir Technologies on 4 August, Advanced Micro Devices on 5 August and Nvidia 27 August.

- Many investors will continue to watch companies’ forecasts to capital expenditures as an indicator of the strength of the current artificial intelligence trend.

Source: Bloomberg, L.P., as of 31/7/2025. Data in USD.

Data: Invesco, Bloomberg as of 31 July 2025. Data in USD.

Data: Bloomberg, L.P., as of 31 July 2025. An investor cannot invest directly in an index. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.