Nasdaq 100 Index – Commentary - June 2025

Overview

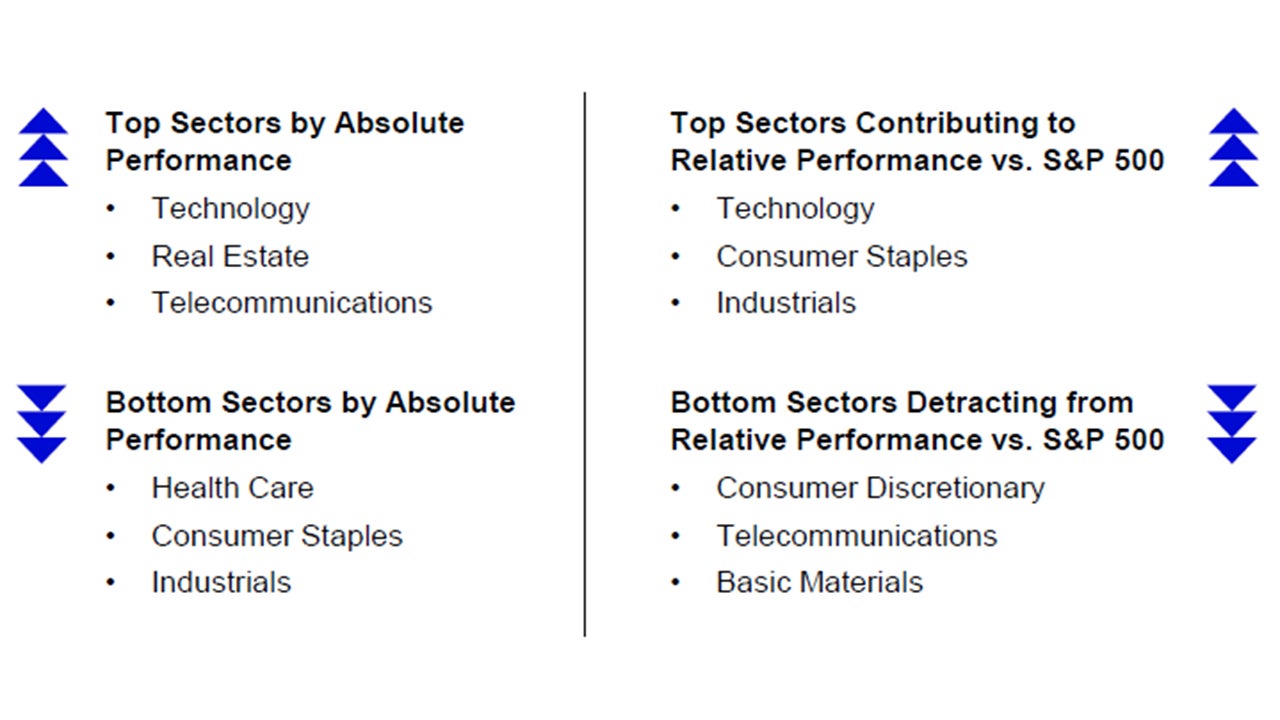

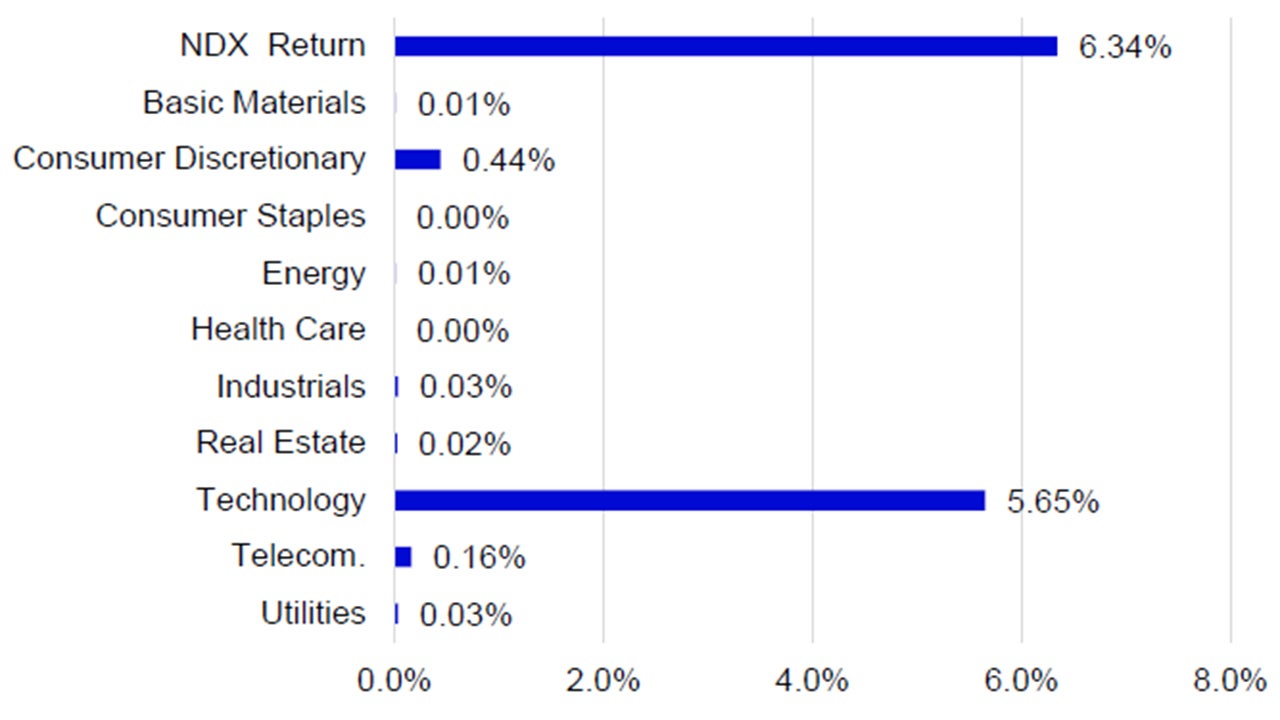

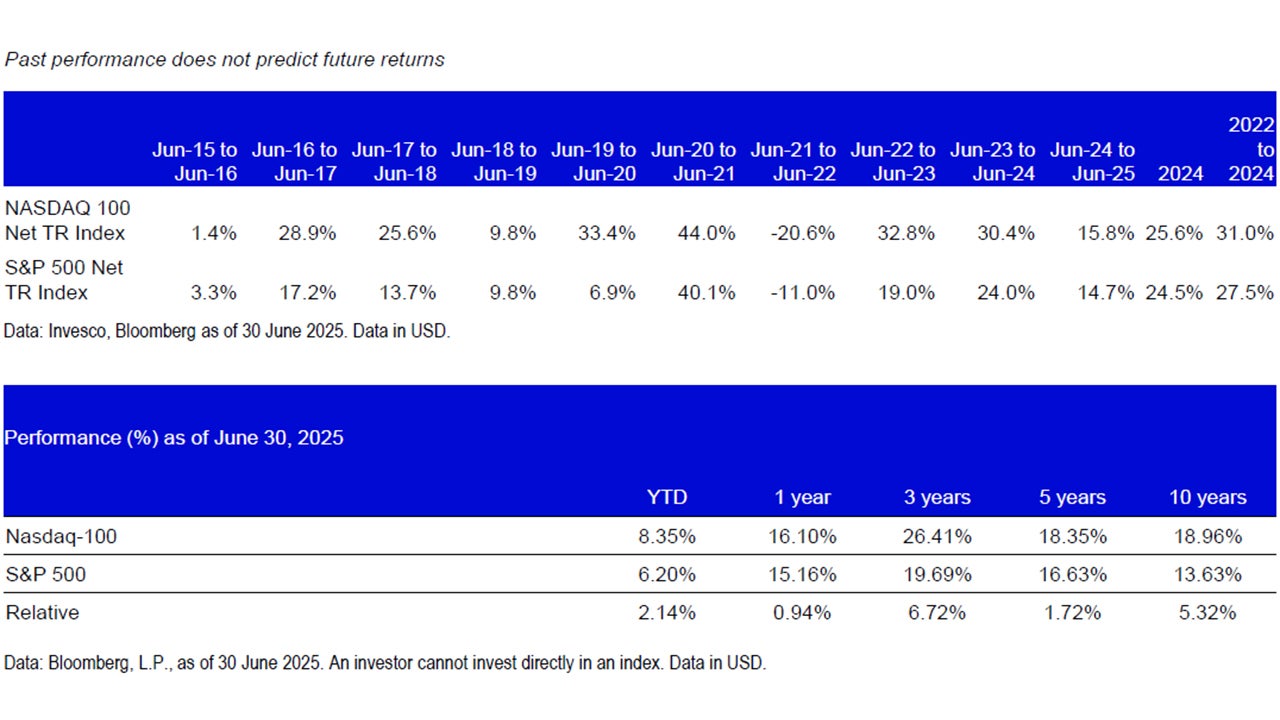

- In June, The Nasdaq-100 (NDX) returned 6.34% vs. 5.09% of the S&P 500.

- NDX’s outperformance was driven by its overweight exposure in Technology and its underweight exposure and differentiated holdings in Consumer Staples.

- Conflict between Iran and Israel escalated during the 2nd and 3rd weeks of the month, which included U.S. involvement, with a ceasefire being agreed upon on June 24th.

- The Federal Open Market Committee (FOMC) met and kept the Federal Funds target rate between 4.25% - 4.50% citing that tariffs may cause inflation to rise in the upcoming months.

- The U.S. employment picture remained stable as Initial Jobless Claims remained under 250k in all four June readings.

Data: Bloomberg, L.P., as of 06/30/2025. An investor cannot invest directly in an index. Past performance does not predict future results.

The Index and Fund use the Industry Classification Benchmark (“ICB”) classification system which is composed of 11 economic industries: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities.

Individual Company Highlights

- All sectors within NDX had positive performance for the month with Technology returning the most at 9.55% while Health Care returned the least at 0.03%. Over 70% of the holdings had a positive return for the month.

- Nvidia became the largest company in the world by market capitalization in June finishing the month at $3.85 trillion. The company’s stock was up 16.93% for the month as the company announced the expansion of their cloud computing business until, DGX Cloud Lepton, along with new partnerships in Europe to expand AI capabilities.

- Micron Technology’s strong June performance was driven by positive financial results announced on June 25th. Revenue was announced at $9.30 billion, well above the $8.85 billion estimate. Adjusted earnings-per-share came in at $1.91, also beating the estimate of $1.60. Research and development costs were 9.42% of revenue taken in for the quarter.

Source: Bloomberg, L.P., as of 06/30/2025. Past performance is not a guarantee of future results. Holdings are subject to change and are not buy/sell recommendations. Top and bottom performers for the month by absolute performance.

Outlook

- Quarterly earnings announcements will start on 17 July with Fastenal Co.

- Of the NDX heavyweights: Netflix, Tesla, Alphabet, Microsoft and Meta will all report their previous quarter’s financial results in July.

- The US FOMC will be meeting on 30 July with US Fed Funds futures showing a 21.2% chance of a 0.25% cut to the Federal Funds target rate (as of 30/6/2025).

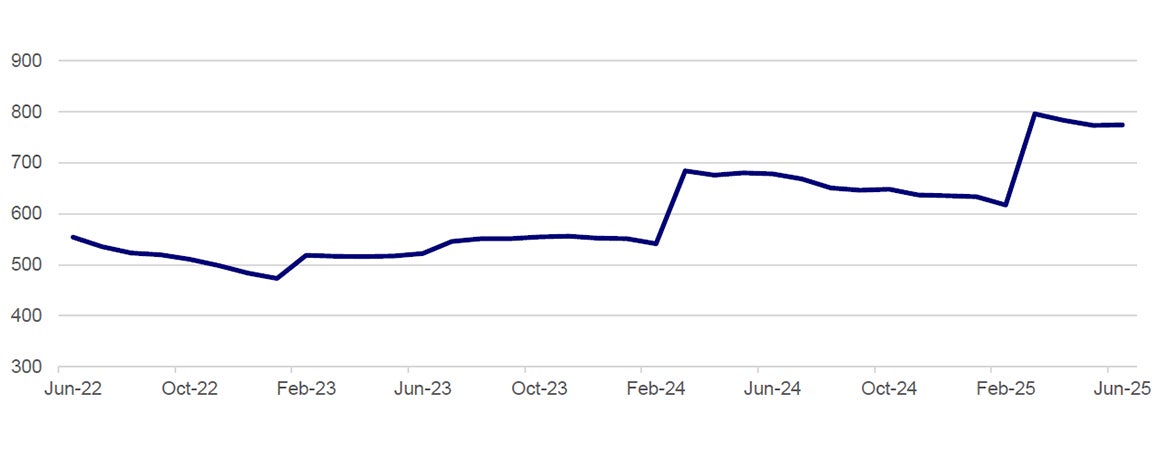

- At the index level, earnings growth has been a contributor to the long-term performance of NDX. Despite the uncertainty of tariffs, forward earnings estimates are still trending upward for NDX and are up over 14% year-over-year.

Source: Bloomberg, L.P., as of 6/30/2025. Performance data quoted represents past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than performance quoted. See Important Information for competitor ETFs’ investment objectives.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.