Nasdaq 100 Index – Commentary - March 2025

Key Highlights

Equities finished March in negative territory amid elevated volatility.

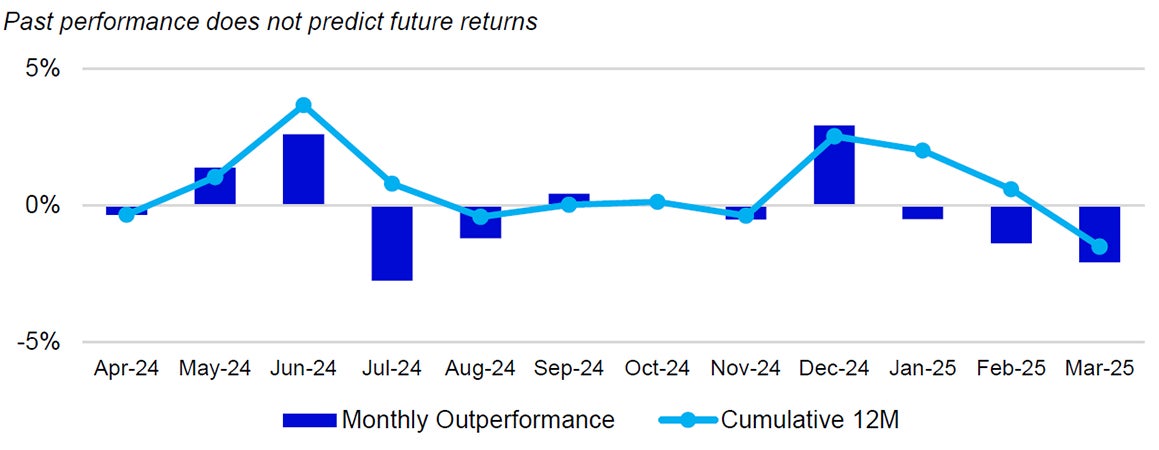

For the month of March, the Nasdaq-100 Index (NDX) returned -7.6%, underperforming the S&P 500 Index, which returned -5.7%.

US Market Recap

The all-time high of the S&P 500, set on February 19th at a price of 6144, proved to be the peak as many investors sold equities and purchased bonds during March. High uncertainty around tariffs and the future US Federal Open Market Committee (FOMC) meeting caused some investors to position more cautiously.

News around tariffs dominated headlines in March and was one of the primary sources of market movement for the month. Despite the extensive news coverage on tariffs, many investors remained focused on April 2nd, dubbed “Liberation Day” by Trump, when broader tariffs were expected to be announced.

The FOMC met for the second time of the year, and the meeting brought a wave of changes in economic projections from the US Federal Reserve (Fed). The central bank cut its 2025 GDP forecast by 0.4%, to 1.7% growth versus the previous forecast of 2.1% in December. Additionally, the forecast for inflation (measured by CPI) was raised by 0.3%, from a previous forecast of 2.5% up to 2.8% for 2025. In the statement, the FOMC noted that “uncertainty around the economic outlook has increased.” In his press conference, Fed Chairman Jerome Powell expanded on this notion by stating that inflation has started to move higher, with at least partial responsibility being caused by tariffs. They have the potential to delay further progress against price increases as the year goes on. Despite the concerns about the upward pressure that tariffs can cause on prices, the Fed’s dot plot shows that FOMC participants still expect two rate cuts this year.

Two rate cuts would bring the target rate down to 3.75% - 4.00%. The Fed also mentioned that it will slow its quantitative tightening program aimed at decreasing the amount of bonds that the central bank holds on its balance sheet. It will allow US$5 billion of Treasurys to roll off each month, down from US$25 billion. In mid-March, the market received positive reports on the inflation front. The US Consumer Price Index (CPI) reading dipped back below the 3.0% threshold, coming in at 2.8%.

Innovator Spotlight

Nvidia's DGX Spark and DGX Station are significant advancements in AI computing. DGX Spark, the world's smallest AI supercomputer, and DGX Station, a high-performance desktop supercomputer, utilize the Grace Blackwell architecture to bring powerful AI capabilities to desktops. These systems allow AI developers, researchers, data scientists, and students to prototype, fine-tune, and inference large models locally or deploy them on cloud infrastructure. The GB10 Grace Blackwell Superchip in DGX Spark delivers up to 1,000 trillion operations per second, while the GB300 Superchip in DGX Station offers 784GB of coherent memory space for large-scale AI workloads. Developed by global system builders like ASUS, Dell, HP Inc., and Lenovo, these new DGX personal AI computers highlight the impact of AI on the computing stack and the development of AI-native applications from cloud services to desktop environments. DGX Spark's compact form factor, high performance, versatile deployment options, advanced technologies, seamless integration, and broad industry support make it a valuable tool for AI research and development on a desktop scale.

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

-7.6% | -8.1% | 6.2% | 16.9% |

| S&P 500 | -5.7% | -4.4% | 7.8% | 11.9% |

Relative |

-2.1% | -3.9% | -1.5% | 4.5% |

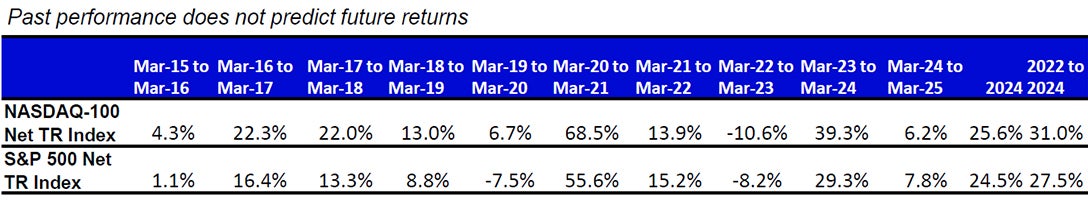

Performance as of 31 Mar 2025. Past performance does not predict future results. Innovator spotlight source: Nvidia Newsroom; Nvidianew.com 18 Mar 2025. Holding are subject to change and are not buy/sell recommendations.

Source: Bloomberg as of 31 Mar 2025.

An investment cannot be made directly into an index.

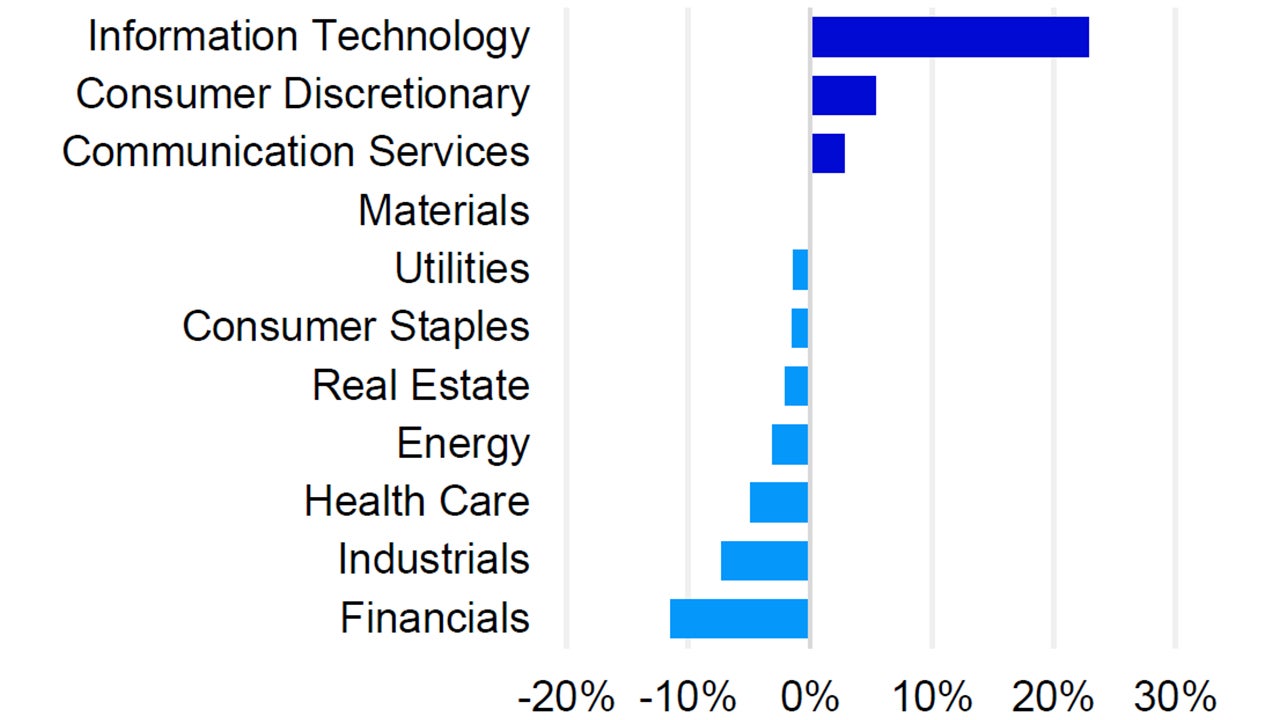

While the Nasdaq-100 specifically excludes Financials, it also currently offers very little exposure to Basic Materials, Energy, and Real Estate

Source: Invesco, FactSet as of 31 Mar 2025. Data in USD. The Index uses the Industry Classification Benchmark (“ICB”) classification system which is composed of 11 economic industries: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities.

Nasdaq-100 Performance Drivers

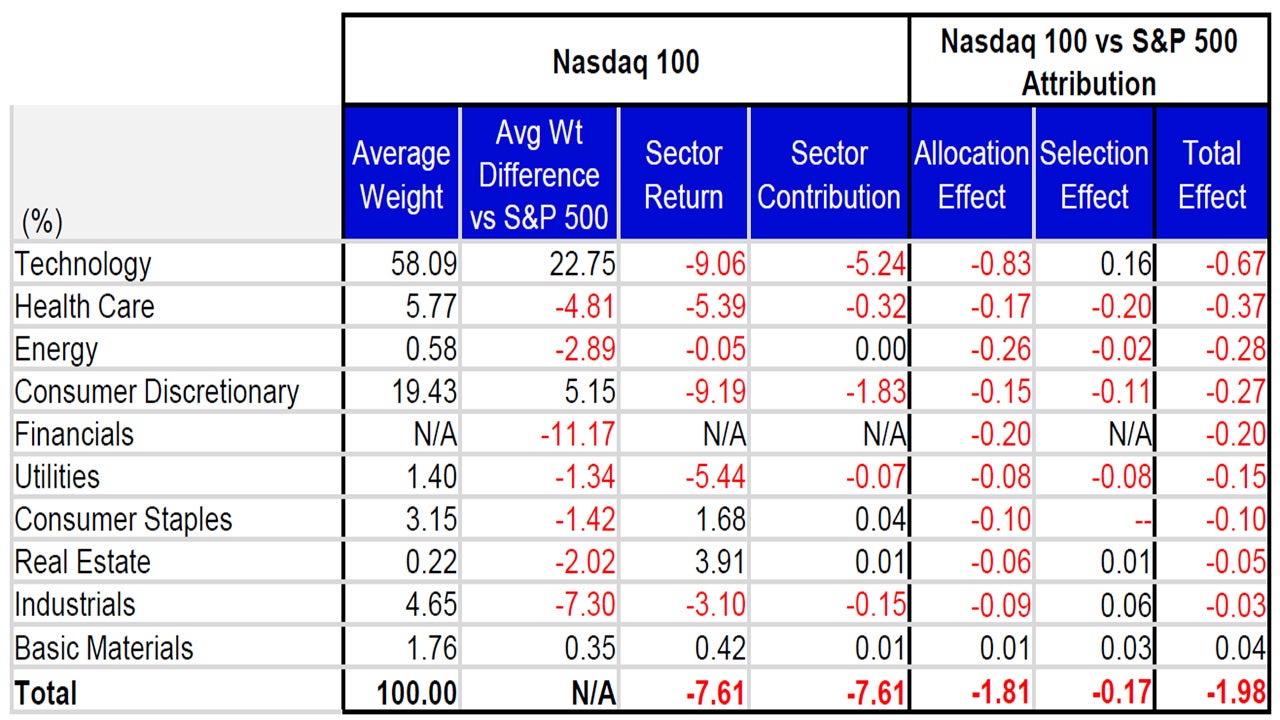

March’s performance attribution of the Nasdaq-100 (NDX) vs the S&P 500 Index

From a sector perspective, seven of the ten sectors that NDX has exposure to finished in negative territory for March. Consumer Discretionary was the worst performing, declining by 9.19% for the month. Relative NDX underperformance versus the S&P 500 was driven by its overweight exposure to the Technology sector and underperformance within the Health Care sector. The Technology sector averaged a 58.09% weighting for the month and declined by 9.06%, compared to the sector’s average weight of 35.26% in the S&P 500 and a total return of -9.33%. Within NDX, the Health Care sector averaged a 5.77% weighting for the month and saw a total return of -5.39%, compared to the sector’s average weight of 10.56% in the S&P 500 and a total return of -1.92%.

Real Estate and Consumer Staples were the best performing sectors in NDX, up 3.91% and 1.68%, respectively. Basic Materials was the only other sector to finish in positive territory, up 0.42% for the month. Real Estate averaged a 0.22% weight in NDX for March, while Consumer Staples averaged a 3.15% weighting.

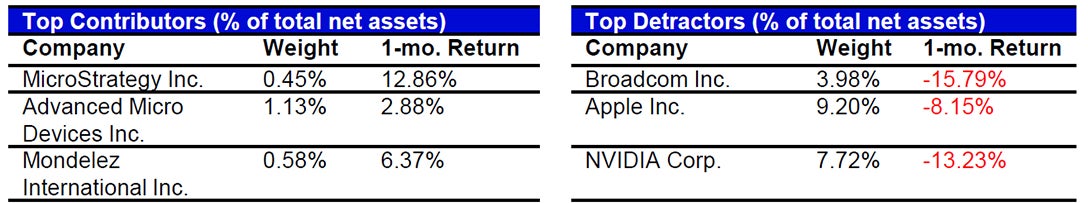

NDX Contributor/Detractor Spotlight- Broadcom: For March, Broadcom was the largest detractor from relative performance versus the S&P 500 index as it represents the second-largest overweight of any company. Shares declined by 15.97%, and the company had an average weight of 3.97% in NDX versus 1.82% in the S&P 500 for March. Earlier in the month, Broadcom had its best trading day after the company released earnings and revenue that exceeded analysts’ estimates. On March 7, shares surged by 8.64% after the company reported comparable earnings per share of $1.60 versus analyst forecasts of US$1.50 and revenue of ~US$14.92 billion versus estimates of US$14.62 billion. Beyond beating expectations, the numbers showed solid growth with earnings growing ~46% year-over-year and revenue growing ~25% on a year-over-year basis. For the current quarter, the company provided revenue guidance of US$14.9 billion, better than analyst estimates of US$14.6 billion, and CEO Hock Tan noted that US$4.4 billion of that will come from AI sales. The company referenced potential growth among hyperscaler customers as it has a relationship with three and is “deeply engaged” with an additional four.

Holdings are subject to change and are not buy/sell reccomendations.

Data: Invesco, FactSet, as of 31 Mar 2025. Data in USD. Sectors: ICB Classification. All figures in percentage terms. Market allocation effect shows the excess contribution due to sector/market allocation. A positive allocation effect implies that the choice of sector weights in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Selection effect shows the excess contribution due to security selection. A positive selection effect implies that the choice of stocks in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Total effect is the difference in contribution between the benchmark and portfolio.

Source: Bloomberg, as of 31 Mar 2025. Past performance does not predict future returns. Top and bottom performers for the month by relative performance. Holdings are subject to change and are not buy/sell recommendations

Data: Invesco, Bloomberg, as of 31 Mar 2025. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.