Nasdaq 100 Index – Commentary - May 2025

Key Highlights

Equities finished May in positive territory amid easing volatility.

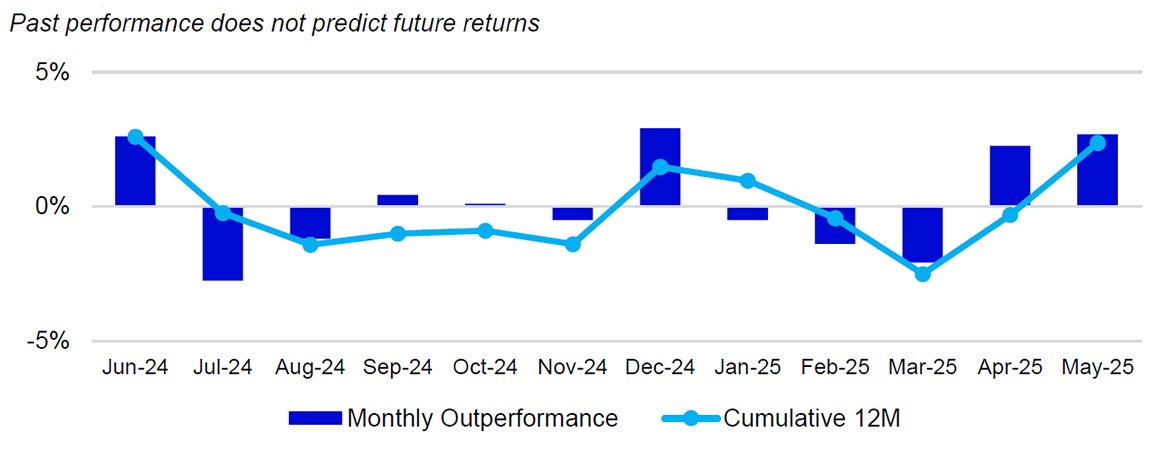

For the month of May, the Nasdaq-100 Index (NDX) returned 9.1%, outperforming the S&P 500 Index, which returned 6.3%.

US Market Recap

In May, U.S. equity markets saw a strong rebound, with the Nasdaq 100 Index rising 9.13%—its best monthly performance since November 2023—while the S&P 500 gained 6.29%. The Nasdaq 100 ended the month slightly above its 2024 year-end level and nearly 25% higher than its April low. This rally was driven by easing trade tensions, particularly a 90-day tariff reprieve between the U.S. and China, which included significant reductions in import levies and was seen as a major de-escalation. Markets responded positively, with both major indices posting sharp gains following the announcement.

Volatility also began to ease, with the VIX Index closing May at 18.57, down from April’s elevated levels. Although this was close to the 10-year average, the VIX remained above that average on most trading days, indicating lingering investor caution. The Nasdaq 100’s average daily trading range narrowed significantly, further suggesting a more stable market environment. However, late in the month, renewed tensions between the U.S. and China—sparked by accusations of trade agreement violations and potential tech sanctions—reintroduced uncertainty.

On the macroeconomic front, inflation data showed continued improvement. The US CPI came in at 2.3%, and US Core PCE at 2.5%, both aligning with expectations and moving closer to the US Federal Reserve’s 2% target. Despite this, market expectations for interest rate cuts were revised downward from four to two by year-end. Meanwhile, the bond market faced pressure after Moody’s downgraded the U.S. credit rating, citing rising debt and fiscal concerns. These worries were compounded by the passage of a major spending bill projected to add $3.8 trillion to the deficit, raising further questions about the sustainability of U.S. fiscal policy.

Innovator Spotlight

Meta Platforms is preparing to launch a fully AI-driven advertising system by the end of next year, aiming to revolutionize how brands create and target ads across its platforms, including Facebook and Instagram. According to reports, the system will allow advertisers to simply provide a product image and a budget, after which Meta’s AI will automatically generate the entire ad—complete with visuals, video, and text—and determine the most effective audience targeting and budget allocation. This initiative builds on Meta’s existing AI tools, which already assist in creating personalized ad variations, background generation, and automated video adjustments. The company also plans to introduce real-time ad personalization, where users will see different versions of the same ad based on factors like their location. With 3.43 billion unique active users globally, Meta’s platforms offer a massive reach for advertisers, and CEO Mark Zuckerberg has emphasized the importance of delivering scalable, measurable results through AI. He envisions Meta becoming a one-stop AI advertising hub, where businesses can set their goals and budgets while the platform handles the creative and logistical execution, streamlining the entire ad process through automation and personalization.

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

9.1% | 1.8% | 15.8% | 17.6% |

| S&P 500 | 6.3% | 0.9% | 13.1% | 12.3% |

Relative |

2.7% | 0.9% | 2.4% | 4.8% |

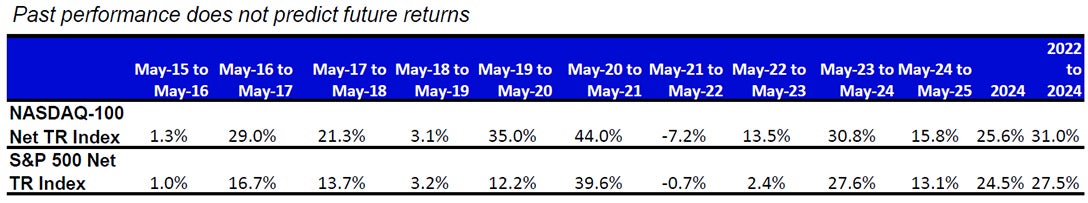

Performance as of 31 May 2025. Past performance does not predict future results. Innovator spotlight source: Reuters.com/ 2 June 2025. Holding are subject to change and are not buy/sell recommendations.

Source: Bloomberg as of 31 May 2025.

An investment cannot be made directly into an index.

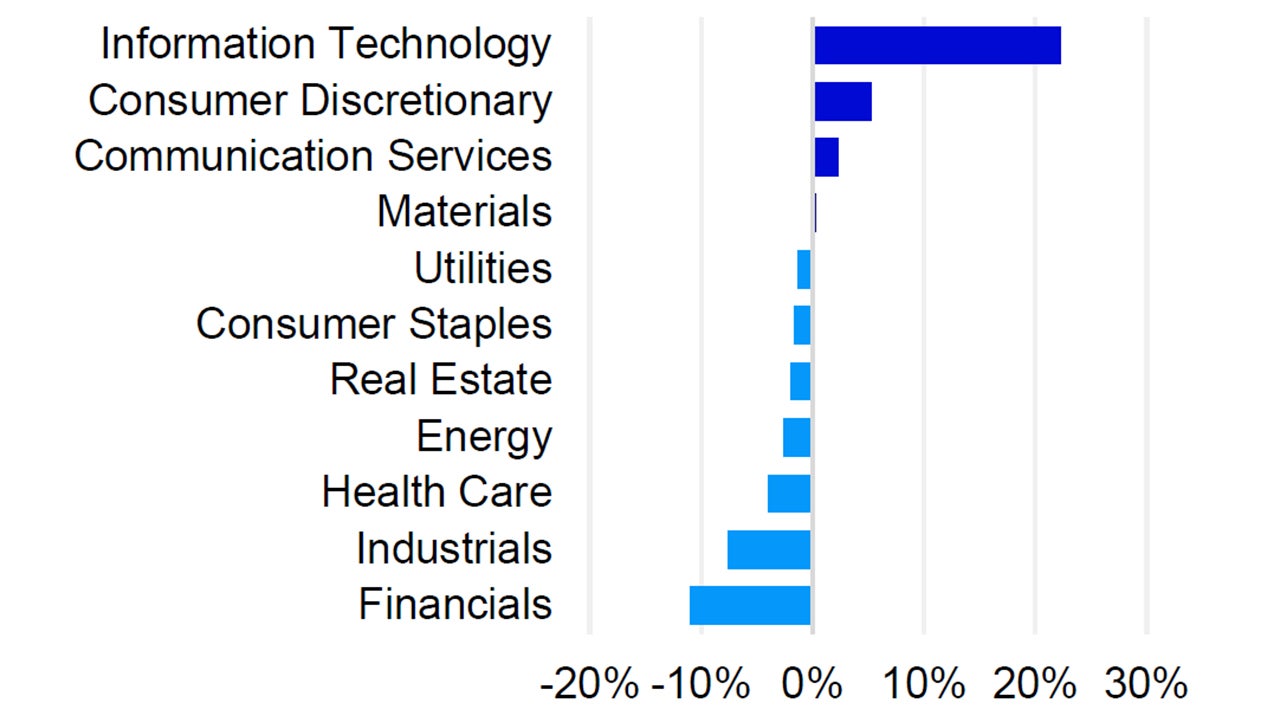

While the Nasdaq-100 specifically excludes Financials, it also currently offers very little exposure to Basic Materials, Energy, and Real Estate

Source: Invesco, FactSet as of 31 May 2025. Data in USD. The Index uses the Industry Classification Benchmark (“ICB”) classification system which is composed of 11 economic industries: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities.

Nasdaq-100 Performance Drivers

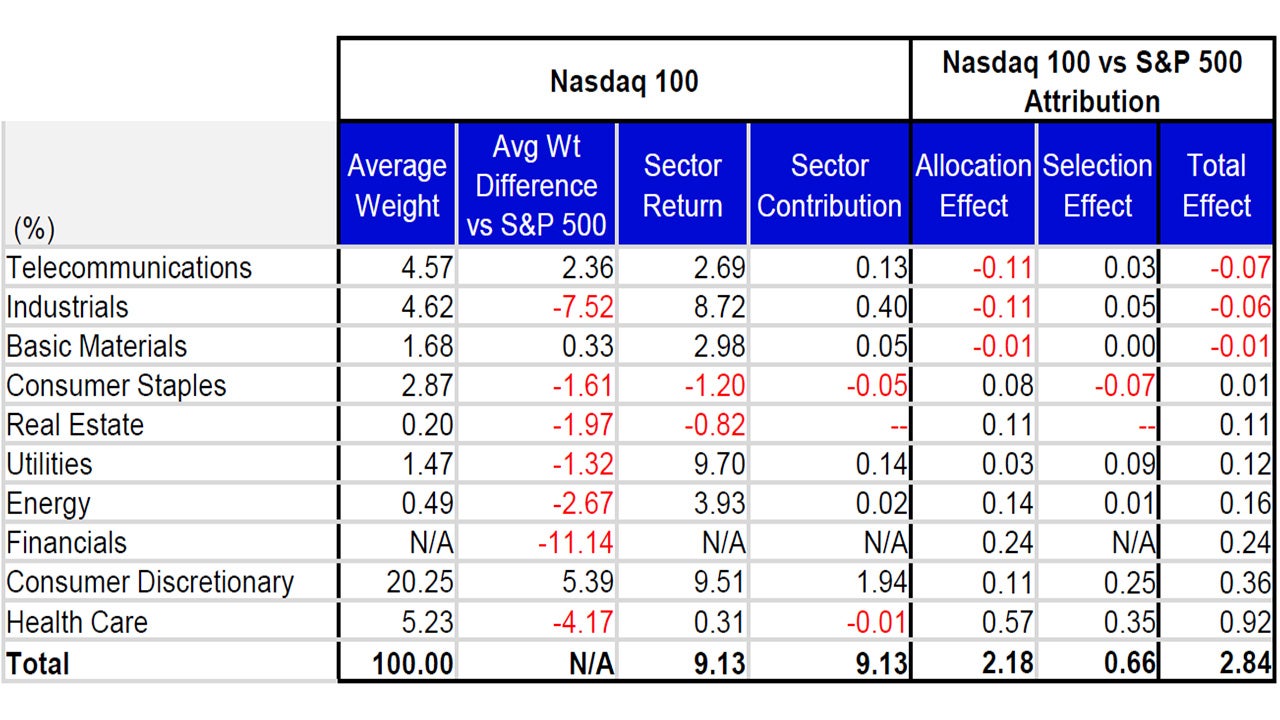

Monthly performance attribution of the Nasdaq-100 (NDX) vs the S&P 500 Index

From a sector perspective, eight of the ten sectors that NDX has exposure to finished in positive territory for May. Technology was the best performing sector, increasing by 11.25% for the month. Relative NDX outperformance versus the S&P 500 was driven by its overweight exposures within the Technology and by underweight exposure and differentiated holdings within Health Care sectors. The Technology sector averaged a 58.62% weighting for the month and saw a total return of 11.25%, compared to the sector’s average weight of 36.31% in the S&P 500 and a total return of 11.32%. Within NDX, the Health Care sector averaged a 5.23% weighting for the month and saw a total return of 0.31%, compared to the sector’s average weight of 9.39% in the S&P 500 and a total return of -5.81%.

Consumer Staple and Real Estate were the worst performing sectors in NDX, down 1.20% and 0.82%, respectively. Consumer staples averaged a 2.87% weight in NDX for May, while Real Estate averaged a 0.20% weighting over the course of the month.

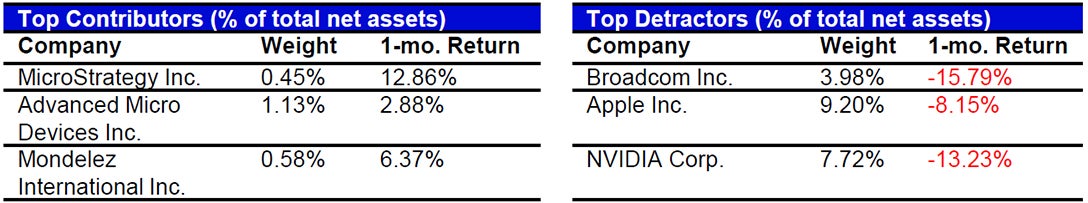

NDX Contributor/Detractor Spotlight- Nvidia: On May 28th, Nvidia reported strong quarterly earnings, with revenue reaching $44.1 billion—up 69% year-over-year and beating analyst expectations by 1.7%. The company’s data center segment led the growth, generating $39.1 billion, driven by rising demand for AI applications like large language models and generative AI. Gaming revenue also rose 42% to $3.8 billion. However, Nvidia missed bottom-line expectations, reporting $18.8 billion in net income due to a $4.5 billion write-off tied to new U.S. export restrictions on H20 chips to China, which also caused operating margins to fall to 49.1% from 64.9% a year earlier. Nvidia also announced major AI infrastructure partnerships with Foxconn, the Taiwan government, and HUMAIN in Saudi Arabia, reinforcing its global AI leadership.

Holdings are subject to change and are not buy/sell recommendations.

Data: Invesco, FactSet, as of 31 May 2025. Data in USD. Sectors: ICB Classification. All figures in percentage terms. Market allocation effect shows the excess contribution due to sector/market allocation. A positive allocation effect implies that the choice of sector weights in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Selection effect shows the excess contribution due to security selection. A positive selection effect implies that the choice of stocks in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Total effect is the difference in contribution between the benchmark and portfolio.

Source: Bloomberg, as of 31 May 2025. Past performance does not predict future returns. Top and bottom performers for the month by relative performance. Holdings are subject to change and are not buy/sell recommendations

Data: Invesco, Bloomberg, as of 31 May 2025. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.