Nasdaq 100 Index – Commentary - November 2024

Key Highlights

Equities finished November in positive territory amid slightly higher inflation and lower interest rates.

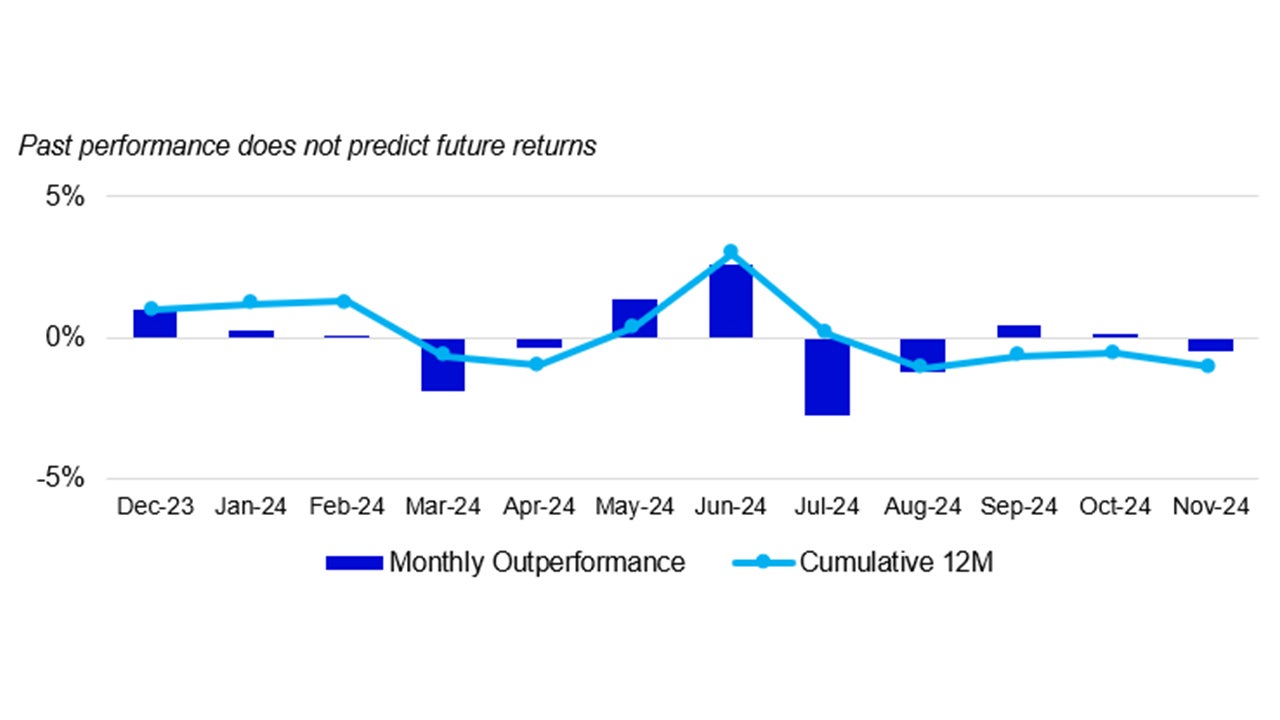

For the month of November, the Nasdaq-100 Index (NDX) returned 5.3%, underperforming the S&P 500 Index, which returned 5.8%.

US Market Recap

While the month of October marked a period of uncertainty, November proved to be a period of strong conviction to the upside for equities as shown through the major indices’ performance. The uncertainty in October was illustrated by the increase from 16.73 to 23.16 on the VIX Index, a commonly used gauge for volatility, while the S&P 500 was down only 0.88%. In November, we saw the VIX Index close at 13.51 while the S&P 500 posted its best monthly return of the year. U.S. Small-cap equities also posted strong performance for the month with the Russell 2000 Index returning 10.97%. The previous best monthly returns were 5.34% in February for the S&P 500 and 10.16% in July for the Russell 2000. Although the two primary events during the month were the U.S. Presidential Election and Federal Open Market Committee (FOMC) meeting, many investors continued to watch inflation and interest rate movement throughout the month.

Equity markets moved up due to the election results with the S&P 500 rising 2.53% and NDX up 2.74% the day after the election. Small-cap companies were the clear winners with the Russell 2000 rising 5.84% on November 6th. The FOMC met for the following two days after the election and made their policy announcement on Thursday, November 7th. Prior to the meeting, Bloomberg showed Fed Fund Futures had priced a nearly 100% chance of a 0.25% rate cut to the target rate. The Committee did announce the 0.25% cut, which brought the target rate range to 4.50% on the lower end and 4.75% on the upper end. The FOMC cited the continued stability of the decrease in inflation along with economic activity remaining healthy

The October reading of Consumer Price Index (CPI) was released on November 12th and came in line with expectations across the board. Year-over-year inflation was reported at 2.6%. This was higher than the prior reading of 2.4%. Core CPI, which excludes the costs of Food and Energy, continued to stay elevated above the headline reading and was announced at 3.3%. The largest contributor to the year-over-year reading continued to be a rise in costs in Core Services.

Innovator Spotlight

Amazon and Greenway Health have recently partnered to accelerate healthcare technology. This expanded collaboration highlights Greenway’s commitment to driving “The Automated Healthcare Practice”, a future where new technology makes healthcare operations more efficient. This partnership is said to support an ongoing innovation to accelerate GenAI-driven automation, which will expand Clinical Decision Support tools, increase health insights, and improve revenue cycle management.

By leveraging AWS platforms, healthcare providers can benefit from speed to innovation, improved user experience, and pioneer a cloud-first future. The US National Institute of Health states that ”advances in AI have the potential to transform many aspects of healthcare, enabling a more personalized, precise, predictive and portable future.” Greenway Health and AWS and Partner Networks is one of many revolutionary collaborations to improve the way the population receives and manages healthcare.

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

5.3% | 25.0% | 31.9% | 17.7% |

| S&P 500 | 5.8% | 27.6% | 33.3% | 12.4% |

Relative |

-0.5% | -2.6% | -1.4% | 4.8% |

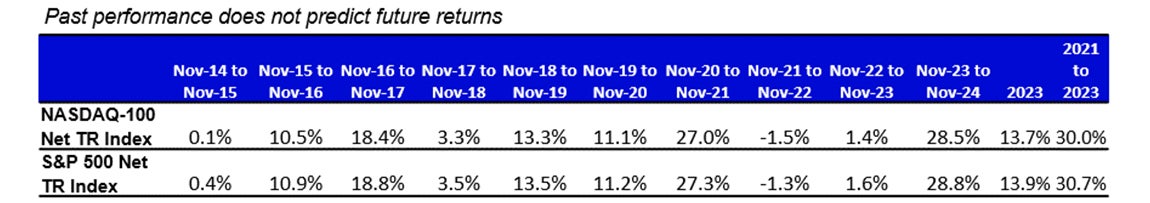

Performance as of 30 Nov 2024. Past performance does not predict future results. Innovator spotlight source: ET Insights 5 Nov 2024

Source: Bloomberg as of 30 Nov 2024.

An investment cannot be made directly into an index.

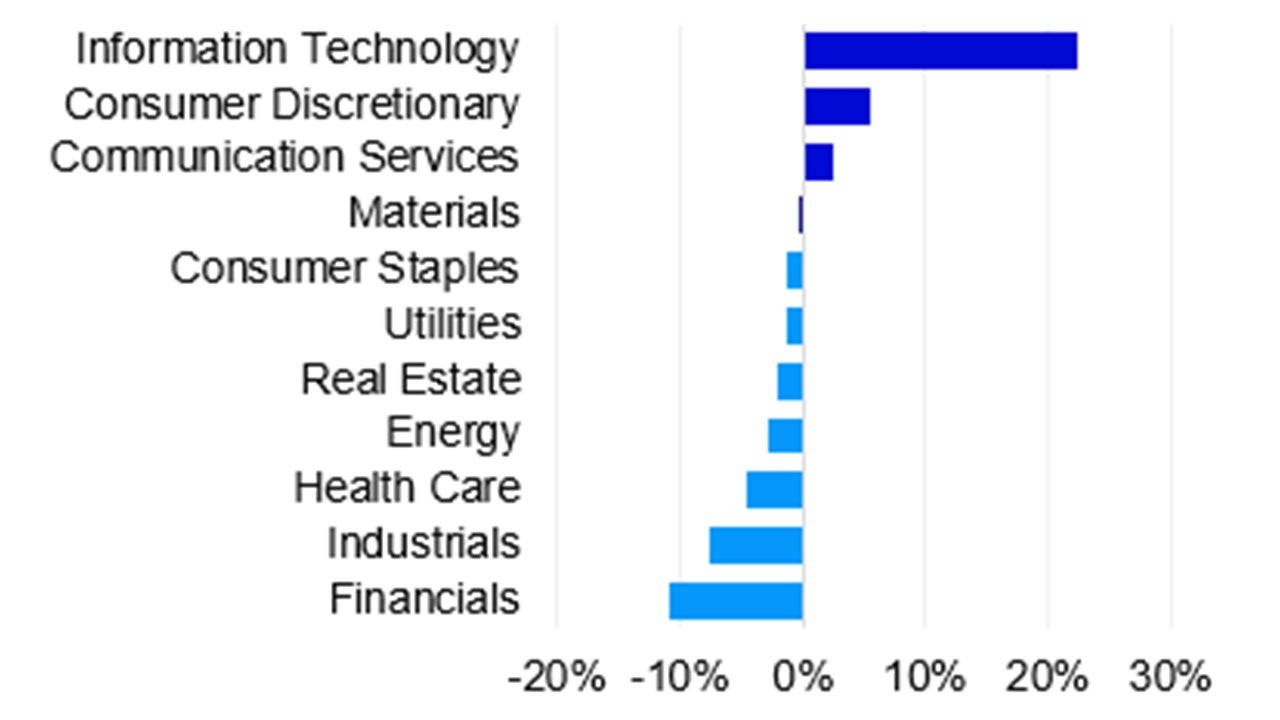

While the Nasdaq-100 specifically excludes Financials, it also currently offers very little exposure to Basic Materials, Energy, and Real Estate

Source: Invesco, FactSet as of 31 Oct 2024. Data in USD

Nasdaq-100 Performance Drivers

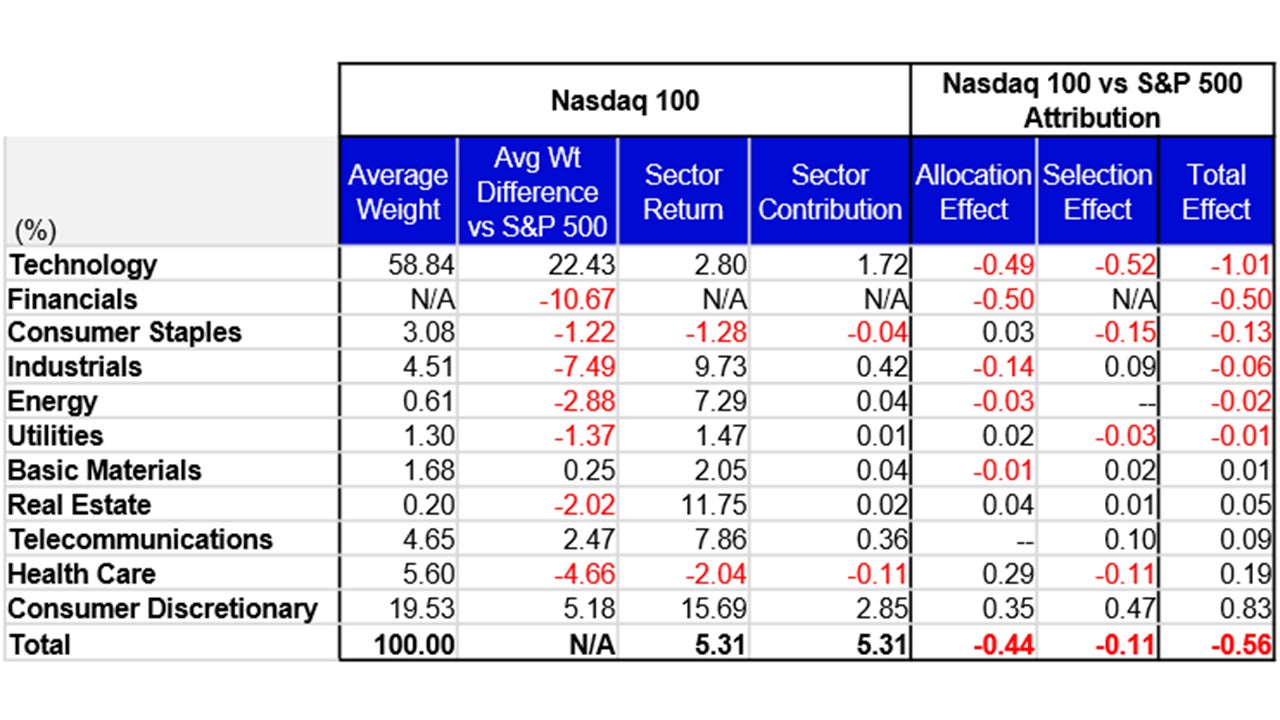

November’s performance attribution of the Nasdaq-100 (NDX) vs the S&P 500 Index

From a sector perspective, Consumer Discretionary, Real Estate, and Industrials were the best-performing sectors in NDX and returned 15.69%, 11.75%, and 9.73%, respectively. During the month, these three sectors had average weights of 19.53%, 0.20%, and 4.51%, respectively. The bottom performing sectors in NDX were Health Care, Consumer Staples, and Utilities, which had average weights of 5.60%, 3.08%, and 1.30%, respectively. Health Care returned -2.04%, Consumer Staples returned -1.28% while Utilities had a positive return of 1.47%.

NDX’s underperformance vs. the S&P 500 was driven by its differentiated holdings and overweight exposure in the Technology sector. The lack of exposure to the Financials sector was the second largest detractor to relative performance. The index’s differentiated holdings in the Consumer Staples sector also detracted from relative performance. Differentiated holdings and overweight exposure in the Consumer Discretionary sector were the largest contributors to relative performance vs. the S&P 500. This was followed by its underweight exposure in Health Care and differentiated holdings in Telecommunications.

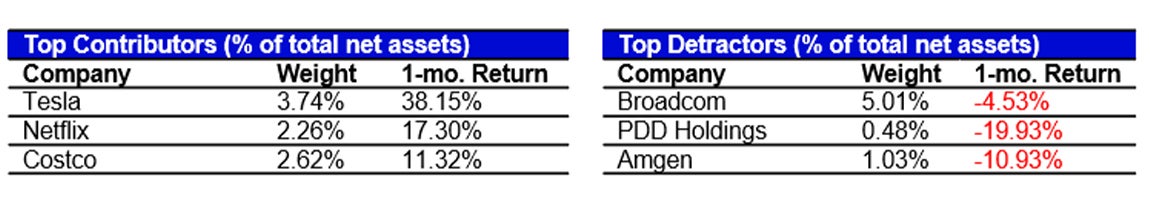

NDX Contributor/Detractor Spotlight- Tesla: Tesla’s previous earnings announce in October showed that the companies financials were improving, the EV maker’s stock rose over 38% in November. Much of the performance was attributed to the results of the U.S. Presidential election and the company’s CEO’s, Elon Musk, support of Donald Trump. Some investors believed that the new administration may create a more favorable regulatory environment for Tesla. Also, Elon Musk, along with Vivek Ramaswamy, was chosen by the President-elect to lead a new group named the Congressional Delivering Outstanding Government Efficiency Caucus (DOGE Caucus) who’s purpose will be to make government spending more efficient. While this appointment was not directly linked to Tesla, Musk’s support of Trump was viewed as positive for the company’s stock.

Data: Invesco, FactSet, as of 30 November 2024 Data in USD. Sectors: ICB Classification. All figures in percentage terms. Market allocation effect shows the excess contribution due to sector/market allocation. A positive allocation effect implies that the choice of sector weights in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Selection effect shows the excess contribution due to security selection. A positive selection effect implies that the choice of stocks in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Total effect is the difference in contribution between the benchmark and portfolio.

Source: Bloomberg, as of 30 Nov 2024. Past performance does not predict future returns. Top and bottom performers for the month by relative performance. Holdings are subject to change and are not buy/sell recommendations

Data: Invesco, Bloomberg, as of 30 Nov 2024. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.