Nasdaq 100 Index Commentary - November 2025

About the index

The NASDAQ-100 is one of the world’s preeminent large cap growth indexes.

The companies in the NASDAQ-100 include the largest non-financial companies listed on the NASDAQ Stock Market based on market capitalization.

Overview

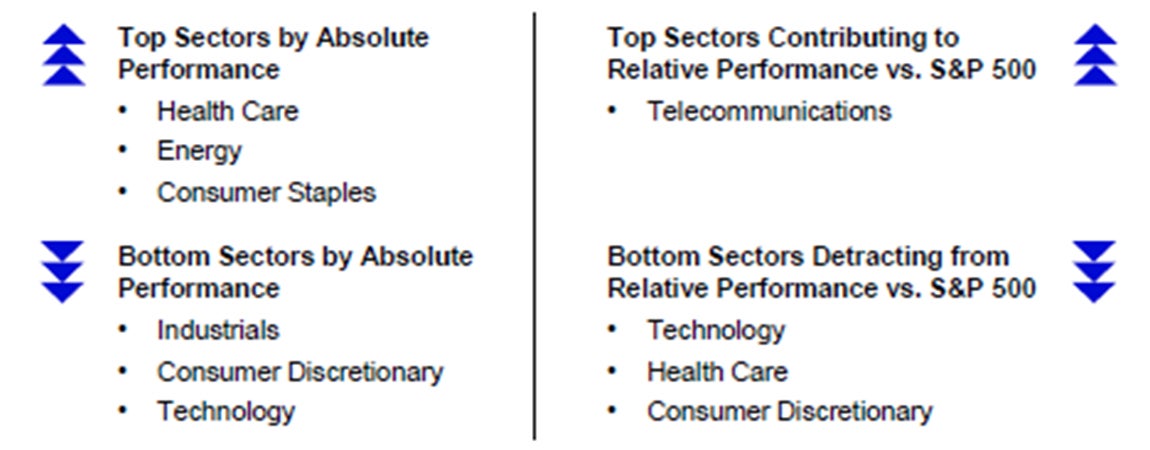

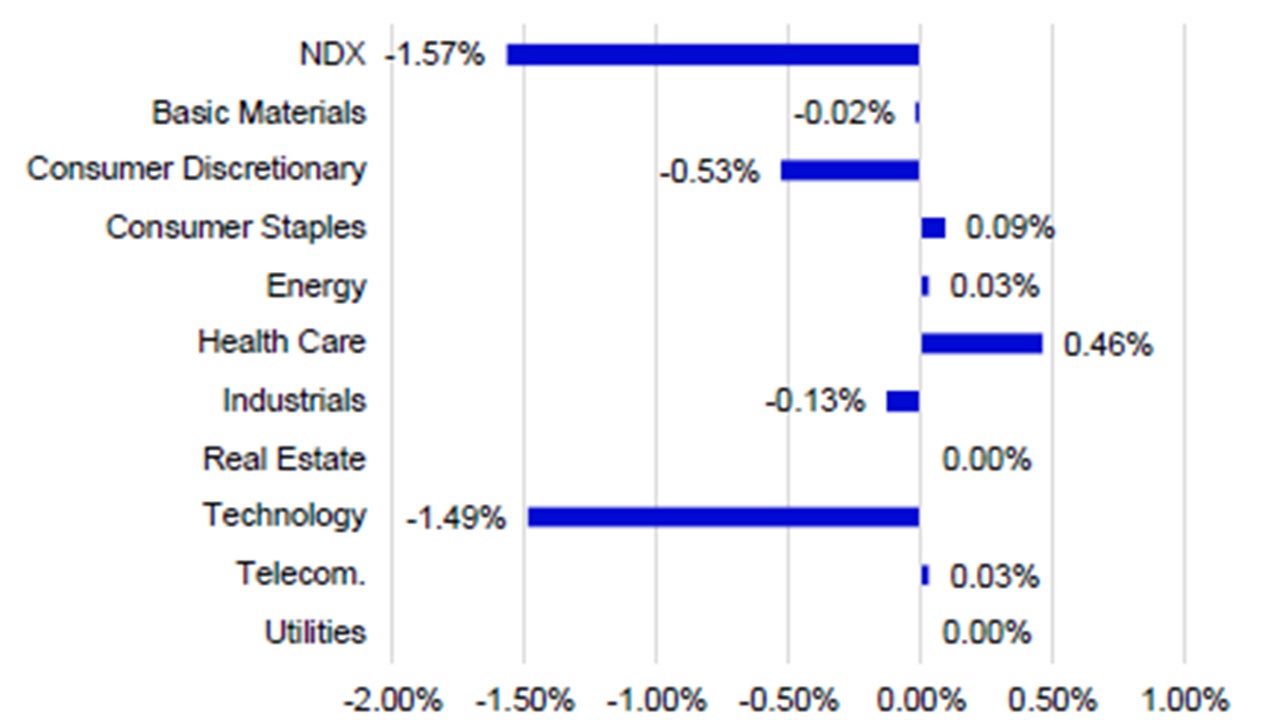

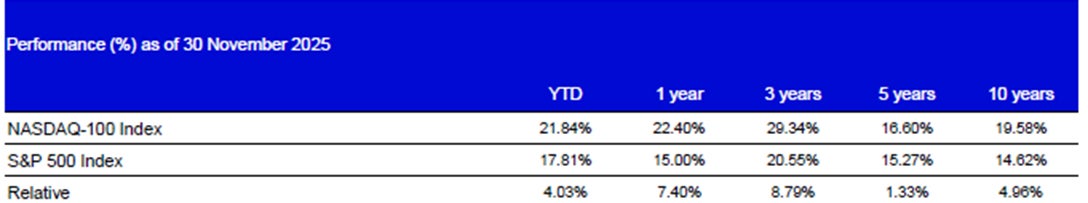

- In November, the NASDAQ-100 Index (NDX) returned -1.57% vs. 0.25% of the S&P 500.

- NDX’s underperformance was driven by its overweight exposure and differentiated holdings in Technology and its underweight exposure and differentiated holdings in Health Care.

- The increase in volatility was attributed to growing concerns around valuations of artificial intelligence related companies. Companies such as Nvidia, Oracle and Palantir were all down over 10% for the month of November.

- Many investors were concerned if the Federal Open Market Committee would cut the target Fed Funds rate at the next meeting in December. Fed Funds futures showed a low of a 34% chance of a rate cut at one point during the month before finish the month at 84%, a wide range for the indicator.

Data: Bloomberg, L.P., as of 30/11/2025. An investor cannot invest directly in an index. Past performance does not predict future results. All data is in USD unless indicated otherwise.

The Index uses the Industry Classification Benchmark (“ICB”) classification system which is composed of 11 economic industries: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities.

Individual Company Highlights

- Despite being the best performing sector in NDX, Health Care was the leading detractor to performance vs. the S&P 500. Biotech companies such as Regeneron Pharmaceuticals and Biogen were amongst the top performers in the index.

- The concerns around the health of the AI trade directly affected several of the heavyweights in NDX. Palantir Technologies, Advanced Micro Devices, Nvidia, Microsoft and several others underperformed NDX for the month of November returning -15.97%, -15.07%, -12.59%, and -4.80%, respectively.

- Although Nvidia was down over 12% for the month, the company did have a positive earnings release on November 19th. The semiconductor company beat the revenue expectations of $55 billion announcing $57 billion, a 63% year-over-year increase. Data center revenue saw year-over-year growth of 66%. Adjusted earnings-per-share cam in at $1.30, topping the estimate of $1.26. GPU demand remained strong as inventory was fully utilized and sold out.

Source: Bloomberg, L.P., as of 30/11/2025. Past performance is not a guarantee of future results. Holdings are subject to change and are not buy/sell recommendations. Top and bottom performers for the month by absolute performance.

Outlook

- The U.S. government was shutdown for a total of 43 days from 1 October through 12 November. The first release of employment numbers were released on 20 November and showed an increase in the US unemployment rate to 4.4% from 4.3%. Initial jobless claims came in at 224k, higher than the estimate of 218k.

- The first inflation reading of PCE ( Personal Consumption Expenditures), the FOMC’s preferred inflation reading, will be released on 5 December and will show price changes for the month ending of September. It is expected that the October PCE reading will be announced before the end of December while the November reading currently does not have a scheduled release date.

- Although many investors believe the Fed Funds target rate will trend down in the future, consensus for a rate cut in December was a topic up for debate. Investors will be paying close attention to the FOMC announcement on 10 December with a focus on future positioning into 2026.

Source: Bloomberg, L.P., as of 30/11/2025. Performance data quoted represents past performance, which is not a guarantee of future results. Investment returns and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than performance quoted. See Important Information for competitor ETFs’ investment objectives. Date in USD.

Data: Invesco, Bloomberg as of 30 November 2025. Data in USD.

Data: Bloomberg, L.P., as of 30 November 2025. An investor cannot invest directly in an index. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.