Nasdaq 100 Index – Commentary - October 2024

Key Highlights

Equities finished October in negative territory amid slightly higher inflation and a rise in interest rates.

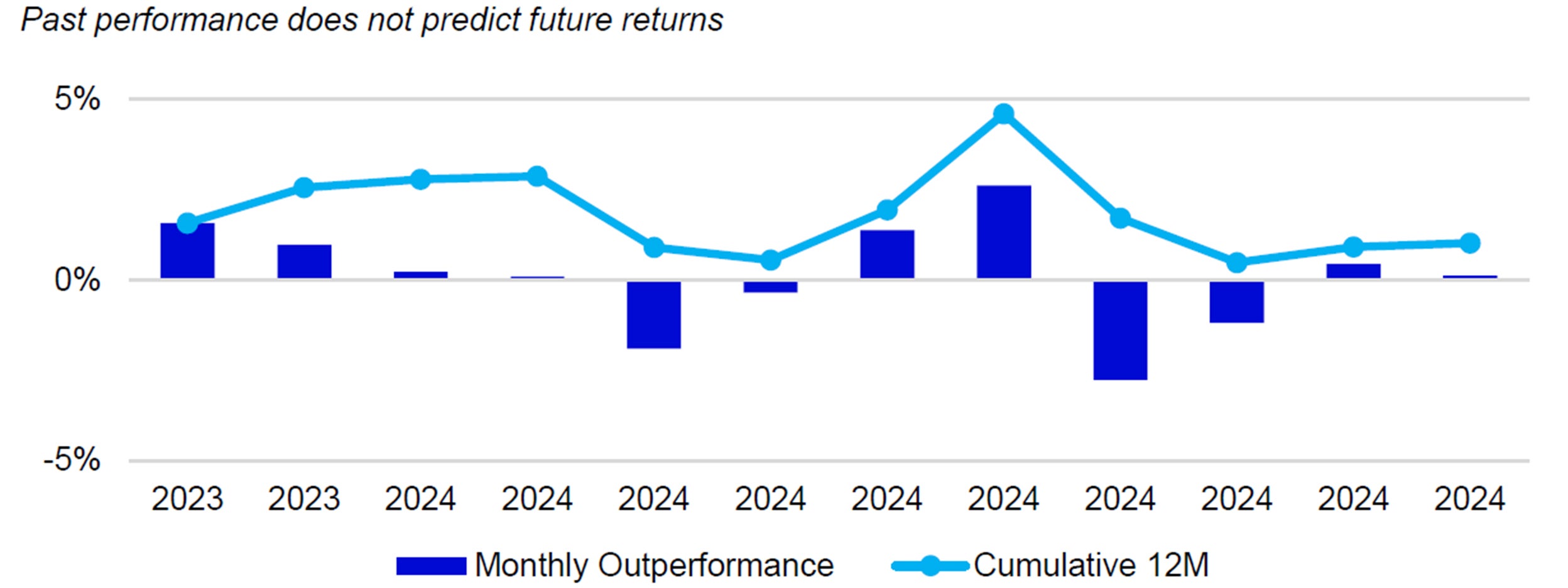

For the month of October, the Nasdaq-100 Index (NDX) returned - 0.8%, outperforming the S&P 500 Index, which returned -0.9%.

US Market Recap

After setting a new all-time high earlier in the month on the 18th, the S&P 500 pared some of the gains and finished the month relatively flat from the end of September. With no US Federal Open Market Committee (FOMC) meeting during the month, many investors turned their attention to economic releases, interest rates and earnings announcements. With the U.S. Presidential election and the FOMC meeting on deck, price action in equities remained within a tight range in October, as the difference of the high and low closing for the month in the S&P 500 was only 3%.

Investors saw interest rates rise during October as the market digested the messaging from the previous FOMC meeting and new economic releases. Although the FOMC lowered the target rate by 0.50% in September, interest rates on the shorter end and longer end of the curve have risen since then. Coincidentally, the recent low reading on the U.S. 10yr Treasury was on September 17th, the day before the rate cut announcement, and was at 3.62%. Since then, it has risen 0.66% and finished October at 4.28%, the highest yield on the 10yr since July. The U.S. 2yr Treasury also rose during the same period from 3.60% to 4.17%, a difference of 0.57%. The spread between the 2yr and 10yr Treasuries’ yield finished at its highest level since June of 2022.

Earnings season got underway during October with many investors looking for insights directly from the companies’ announcements. Through the end of October, 324 companies from the S&P 500 had reported earnings. 87% of those companies met or beat consensus estimates for adjusted earnings-per-share.

The September results of US Consumer Price Index (CPI) were released on October 10th and showed a slight rise in inflation. Both the year-over-year and month-over-month readings were reported above expectations. Year-over-year inflation was reported at 2.4%, below the prior reading of 2.5%. Core CPI, which excludes the costs of Food and Energy, rose to 3.3%, higher than the prior reading of 3.2%.

Innovator Spotlight

Innovation can be seen in many facets of our global economy, and advancements happen often. One area that has seen this advancement is wireless networks, and this new evolution could be a game-changer for many areas of data. 6G technology is being tested, having speeds of up to 100Gbps, nearly 100 times faster than 5G. Beyond just speed and performance, 6G could enhance connectivity and network efficiency, which would revolutionize how businesses communicate and process data. This could boost artificial intelligence and allow it to be more deeply integrated with cloud systems. In addition, networks will have the ability to self-manage, dynamically forecasting demand and allocating bandwidth to ensure service isn’t interrupted, particularly in times of high traffic.

The advent of 6G is poised to add significantly to the global economy. A report from ABI research estimates that 6G could add over $1 Trillion to the global economy by 2035, driven by the advancements mentioned earlier.

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

-0.8% | 18.8% | 38.8% | 17.7% |

| S&P 500 | -0.9% | 20.6% | 37.4% | 12.4% |

Relative |

0.1% | -1.5% | 1.0% | 4.8% |

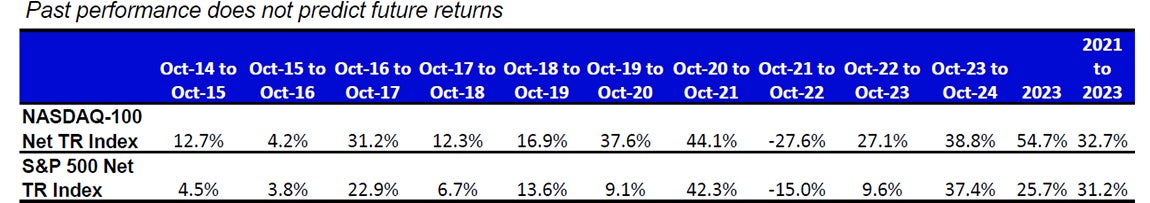

Performance as of 31 Oct 2024. Past performance does not predict future results. Innovator spotlight source: ET Insights 5 Nov 2024

Source: Bloomberg as of 31 Oct 2024.

An investment cannot be made directly into an index.

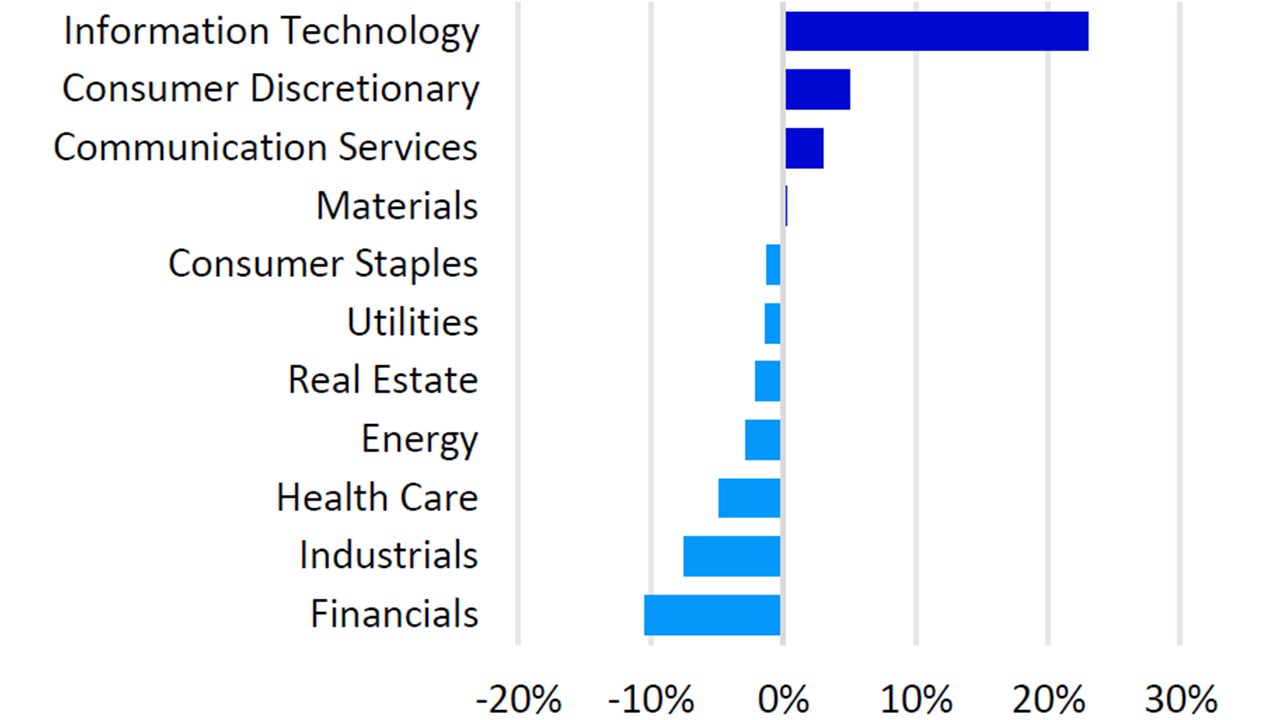

While the Nasdaq-100 specifically excludes Financials, it also currently offers very little exposure to Basic Materials, Energy, and Real Estate

Source: Invesco, FactSet as of 31 Oct 2024. Data in USD

Nasdaq-100 Performance Drivers

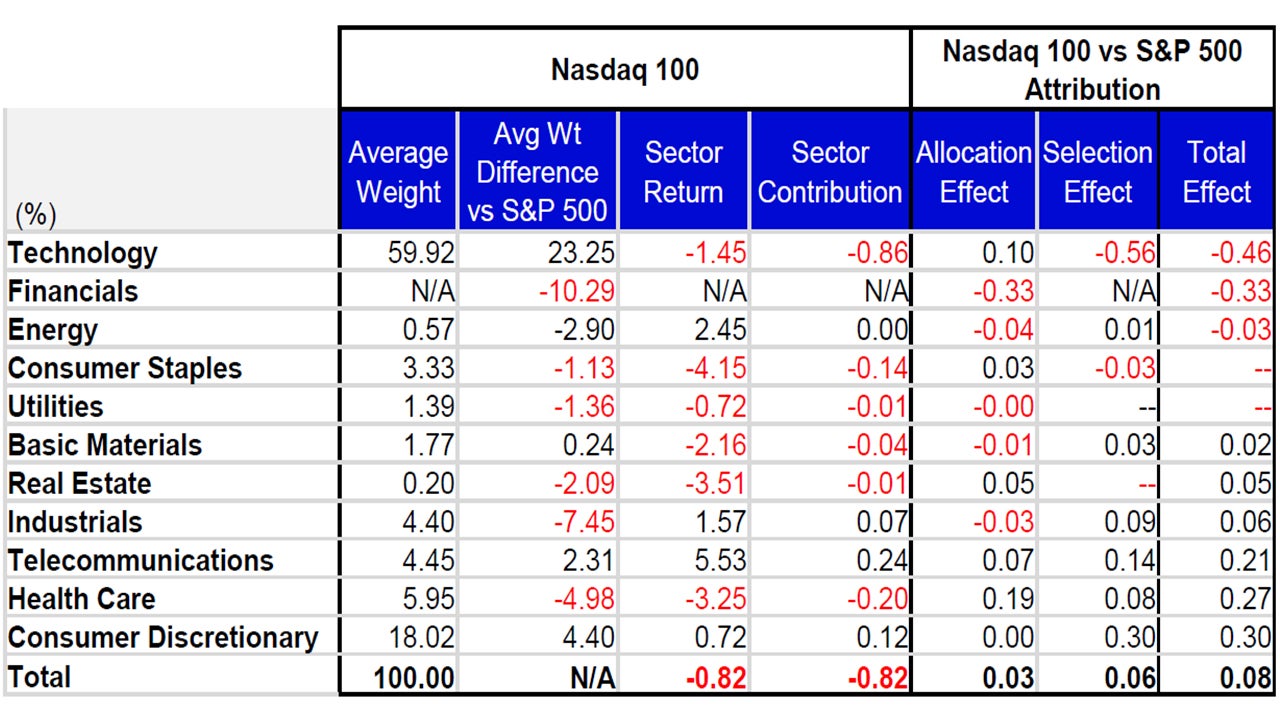

October’s performance attribution of the Nasdaq-100 (NDX) vs the S&P 500 Index From a sector perspective, Telecommunications, Energy and Industrials were the best performing sectors in NDX and returned 5.53%, 2.45% and 1.57%, respectively. During the month, these three sectors had average weights of 4.45%, 0.57 and 4.40%, respectively. The bottom performing sectors in NDX were Consumer Staples, Real Estate and Health Care which had average weights of 3.33%, 0.20% and 5.95%, respectively. Consumer Staples returned -4.15%, Real Estate returned -3.51%, and Health Care returned -3.25%.

NDX’s outperformance vs. the S&P 500 was driven by its differentiated holdings in the Consumer Discretionary sector. The Health Care sector was the second largest contributor to outperformance driven by its underweight allocation and differentiated holdings. The index’s overweight exposure and differentiated holdings to the Telecommunications sector also contributed to relative performance.

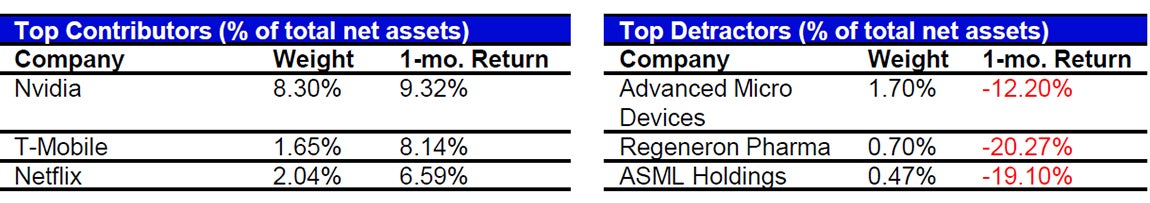

NDX Contributor/Detractor Spotlight- Netflix: Netflix was amongst the first companies to report Q3 financial results and beat revenue and adjusted earnings-per-share (EPS) expectations. Revenue was reported at $9.82 billion vs. the estimate of $9.78 billion while adjusted EPS came in at $5.40 vs. the estimate of $5.12. Driving the higher-than-expected revenue was a 5.07 million increase in net subscribers. Half of the new subscribers opted for the subscription supported by ads. The streaming service’s stock price rose over 11% on October 18th, the day following the announcement.

Data: Invesco, FactSet, as of 31 October 2024 Data in USD. Sectors: ICB Classification. All figures in percentage terms. Market allocation effect shows the excess contribution due to sector/market allocation. A positive allocation effect implies that the choice of sector weights in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Selection effect shows the excess contribution due to security selection. A positive selection effect implies that the choice of stocks in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Total effect is the difference in contribution between the benchmark and portfolio.

Source: Bloomberg, as of 31 Oct 2024. Past performance does not predict future returns. Top and bottom performers for the month by relative performance. Holdings are subject to change and are not buy/sell recommendations

Data: Invesco, Bloomberg, as of 31 Oct 2024. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.