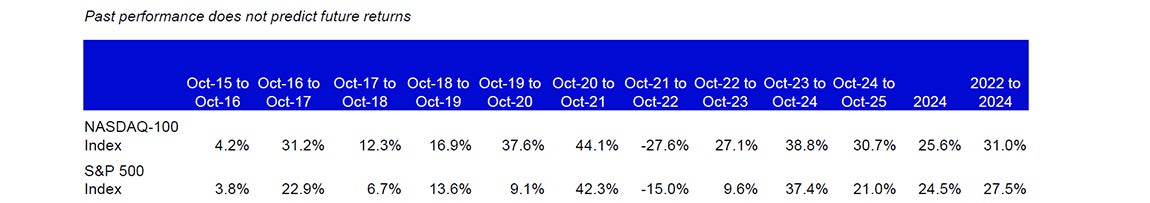

Nasdaq 100 Index Commentary - October 2025

About the index

The Nasdaq 100 is one of the world’s preeminent large cap growth indexes.

The companies in the Nasdaq-100 include the largest non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Overview

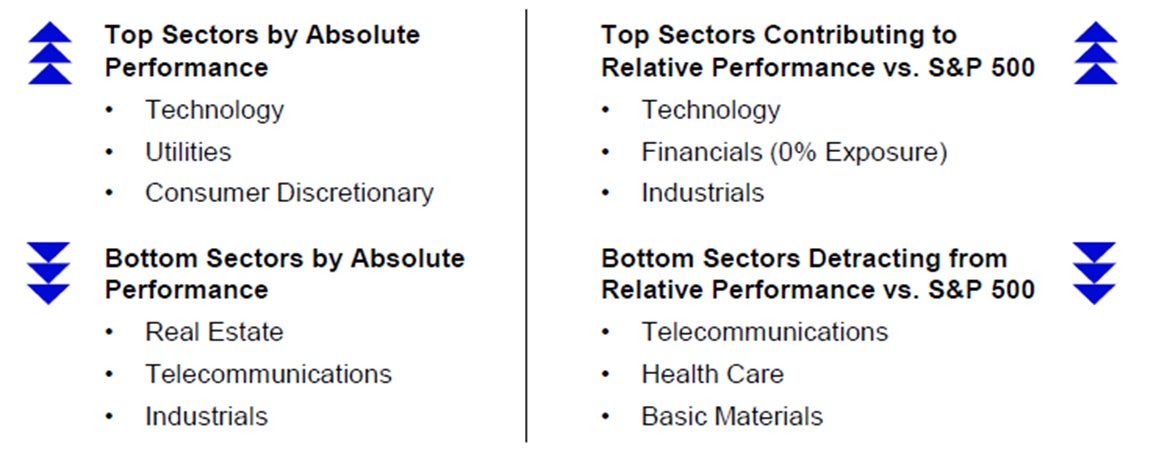

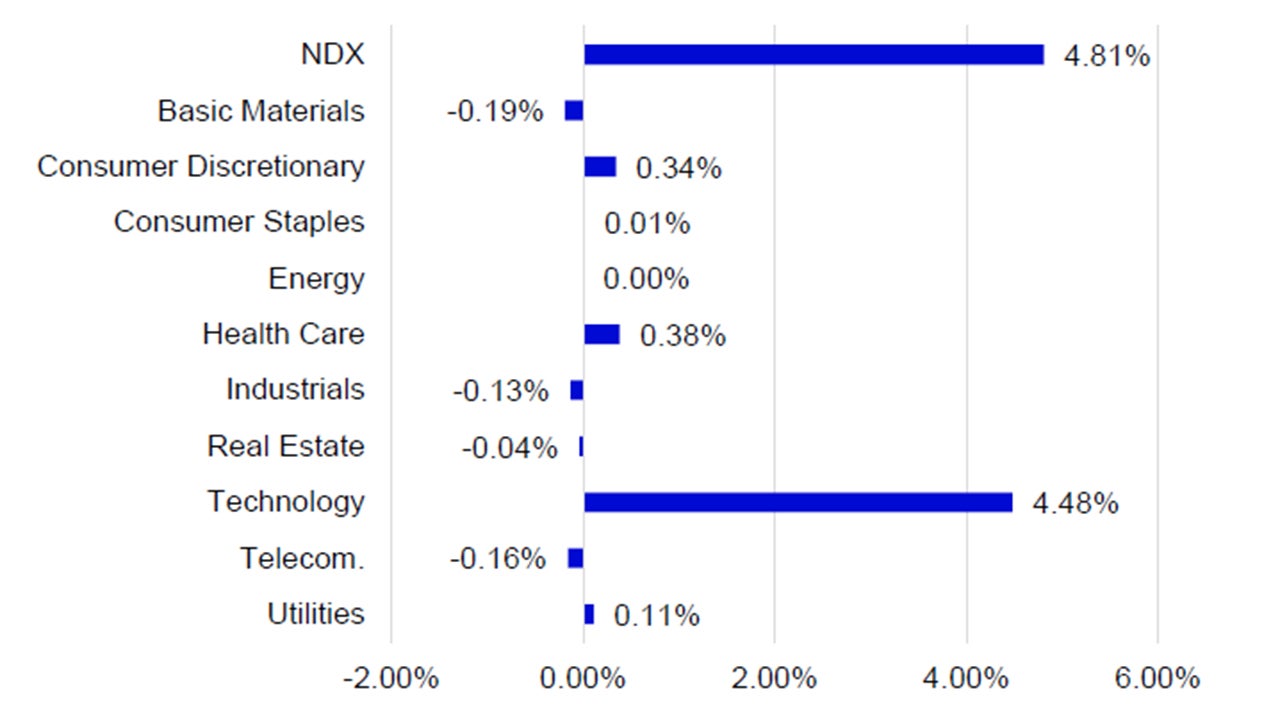

- In October, NDX returned 4.81% vs. 2.34% of the S&P 500.

- NDX’s outperformance was driven by its overweight exposure and differentiated holdings in Technology and its lack of exposure in Financials.

- The Federal Open Market Committee’s (FOMC) met on the 28th and 29th and cut the target Fed Funds rate by 0.25%, similar to the previous meeting. The excitement arrived during Fed Chairman Jerome Powell’s press conference where he stated that a rate cut at the December meeting was not a foregone conclusion. This led to equities turning negative on that day.

- Because the appropriate legislation was not passed in time, the U.S. government shutdown on October 1st which led to the furlough of 750k employees. During this time, economic data such as initial jobless and inflation were not released.

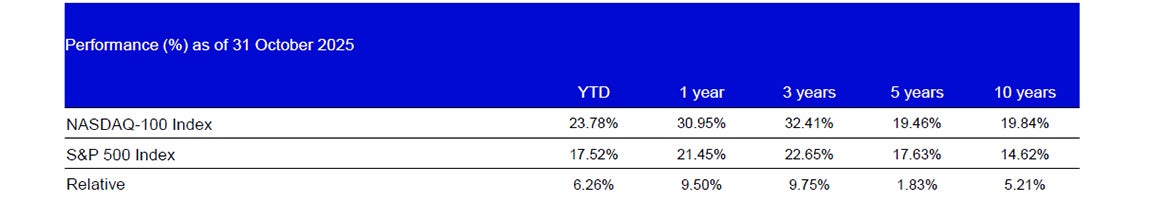

Data: Bloomberg, L.P., as of 31/10/2025. An investor cannot invest directly in an index. Past performance does not predict future results. All data is in USD unless indicated otherwise.

The Index uses the Industry Classification Benchmark (“ICB”) classification system which is composed of 11 economic industries: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities.

Individual Company Highlights

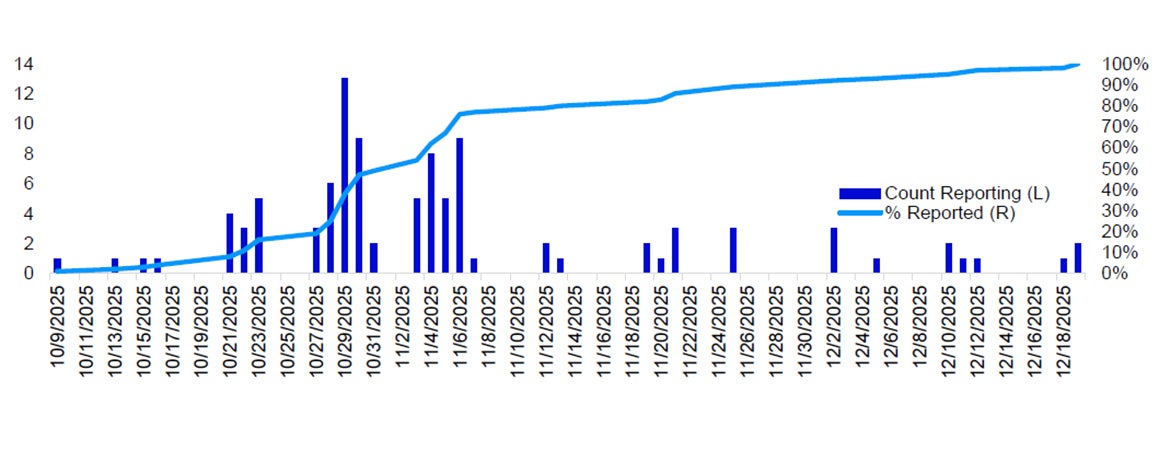

- Earnings season started in October with 49 out of 100 companies announcing by the end of the month. 91% of companies met or beat analyst expectations.

- Six out of the seven Magnificent companies reported quarterly results in October with Microsoft, Alphabet, Amazon and Apple beating analysts’ adjusted earnings-per-share expectations. Tesla and Meta missed expectations. From a revenue standpoint, Tesla was the only company out of the six that missed on revenue expectations.

- Amazon’s earnings had a strong positive reaction after the announcement with the company’s stock rising 9.58% on October 31st, the day following the announcement. Revenue came in at $180.2 billion, beating the estimate of $177.8 billion. Adjusted earnings-per-share was announced at $1.95 vs. the estimate of $1.58. Amazon Web Services revenue rose over 20% year-over-year which was the highest in 11 quarters.

Source: Bloomberg, L.P., as of 31/10/2025. Past performance is not a guarantee of future results. Holdings are subject to change and are not buy/sell recommendations. Top and bottom performers for the month by absolute performance.

Outlook

- The U.S. government shutdown has stopped the release of key economic data. Once the shutdown ends, there will likely be a large release of data for employment and inflation that has the potential to affect the market.

- After Jerome Powell’s comments after the October FOMC meeting, many investors will be looking to the December FOMC meeting to see if there will be another cut to the Fed Fund’s target rate. Prior to the meeting Fed Fund’s futures showed a 92% change of a 0.25%cut at the December meeting. This dropped to 68% on 31 October.

- In November, several other NDX companies will announce quarterly results including Qualcomm, AppLovin’, and Cisco. Many investors will be watching for Nvidia’s announcement on 19 November. Analysts are expecting the semiconductor company to announce $1.25 for adjusted earnings-per-share and $54.83 billion in revenue with $48.99 billion coming from their data center unit.

Source: Bloomberg, L.P., as of 31/10/2025. Past performance is not a guarantee of future results. Date in USD.

Data: Invesco, Bloomberg as of 31 October 2025. Data in USD.

Data: Bloomberg, L.P., as of 31 October 2025. An investor cannot invest directly in an index. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.