Nasdaq 100 Index Commentary - September 2025

About the index

The Nasdaq 100 is one of the world’s preeminent large cap growth indexes.

The companies in the Nasdaq-100 include the largest non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Overview

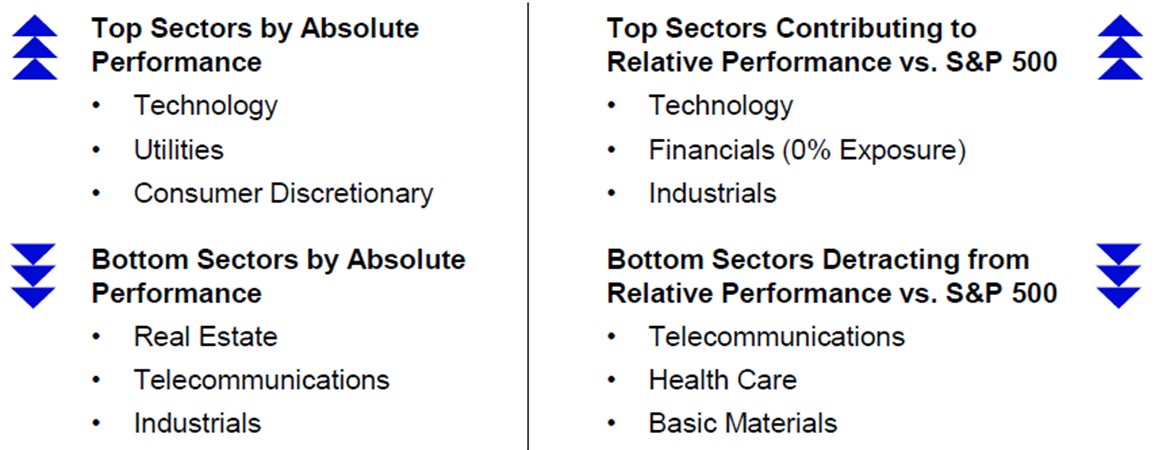

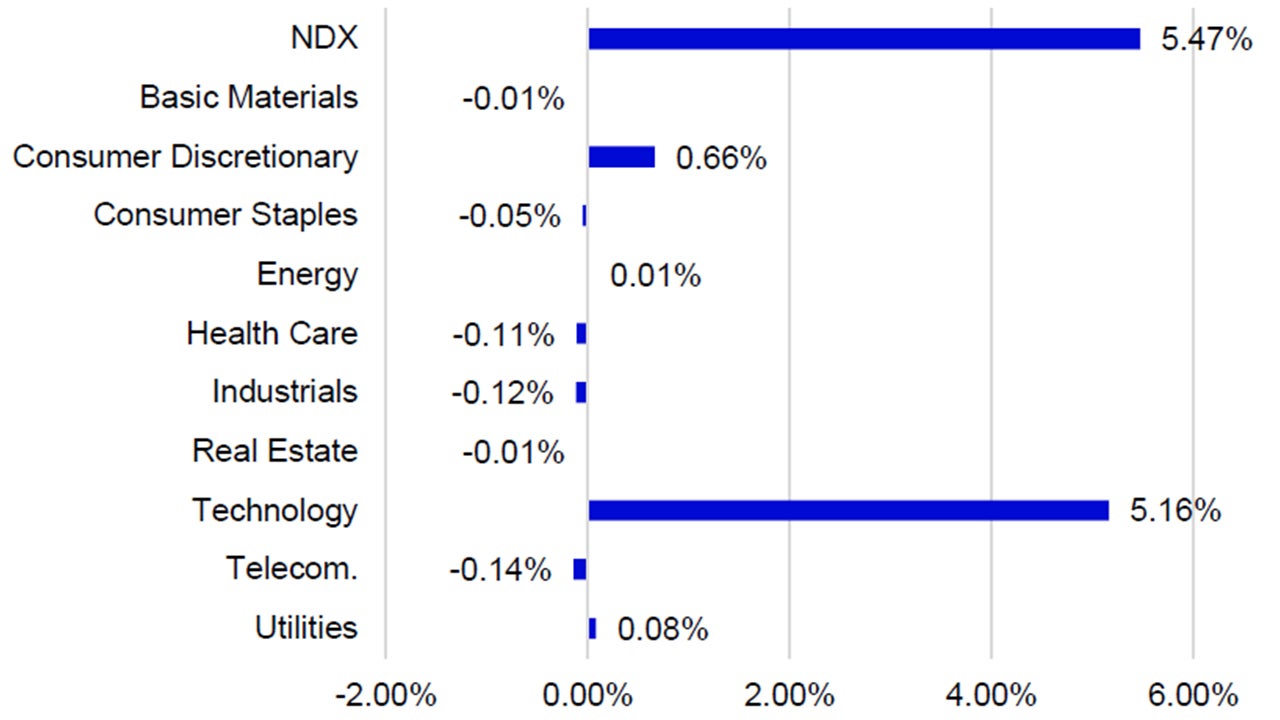

- In September, the NASDAQ-100 Index (NDX) returned 5.47% vs. 3.65% of the S&P 500.

- NDX’s outperformance was driven by its overweight exposure and differentiated holdings in Technology and its lack of exposure in Financials.

- The Federal Open Market Committee’s (FOMC) met on the 17th and enacted a much anticipated 0.25% cut to the target Fed Funds rate. The committee also released a new Statement of Economic Projections which showed a drop in the median target rate estimate for the end of 2025 from 3.87% to 3.63%.

- Stephan Miran joined the FOMC as the newest member and was the sole dissenter to the 0.25% rate, calling for a larger 0.50% cut. Miran’s forecast for the end of year targe rate was much lower coming in at 2.88%.

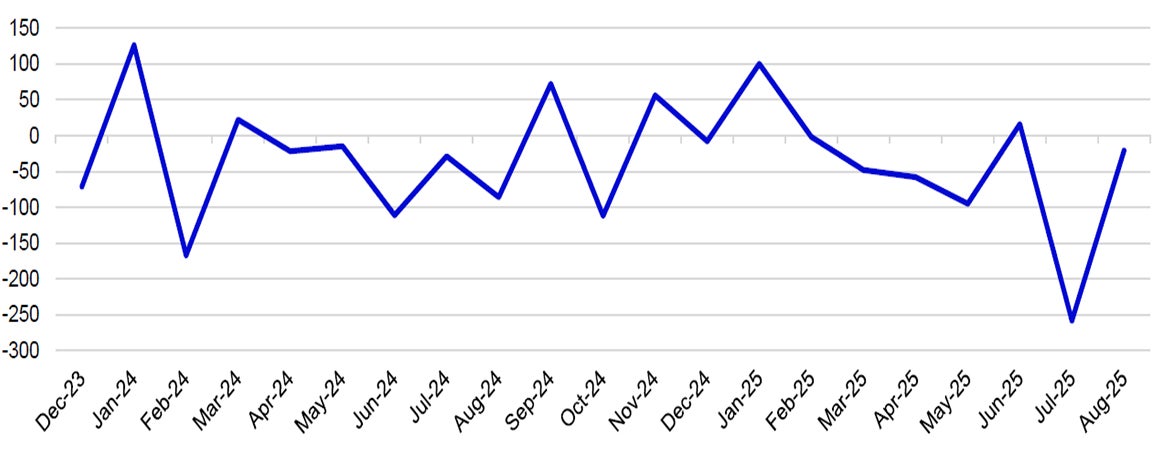

- A large negative revision to nonfarm payrolls occurred on the 9th which removed 911k jobs from the Non-Farm Payrolls reading from March 2024 – March 2025.

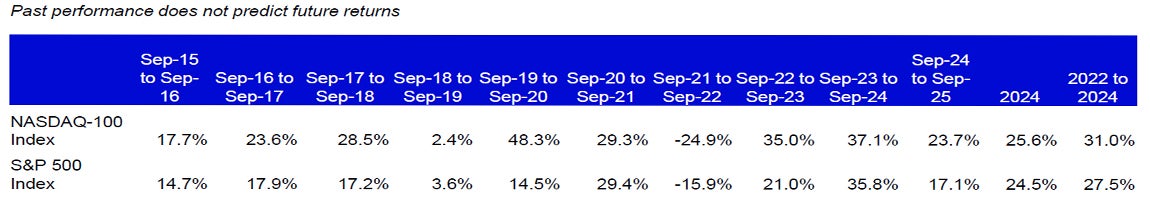

Data: Bloomberg, L.P., as of 30/09/2025. An investor cannot invest directly in an index. Past performance does not predict future results. All data is in USD unless indicated otherwise.

The Index uses the Industry Classification Benchmark (“ICB”) classification system which is composed of 11 economic industries: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities.

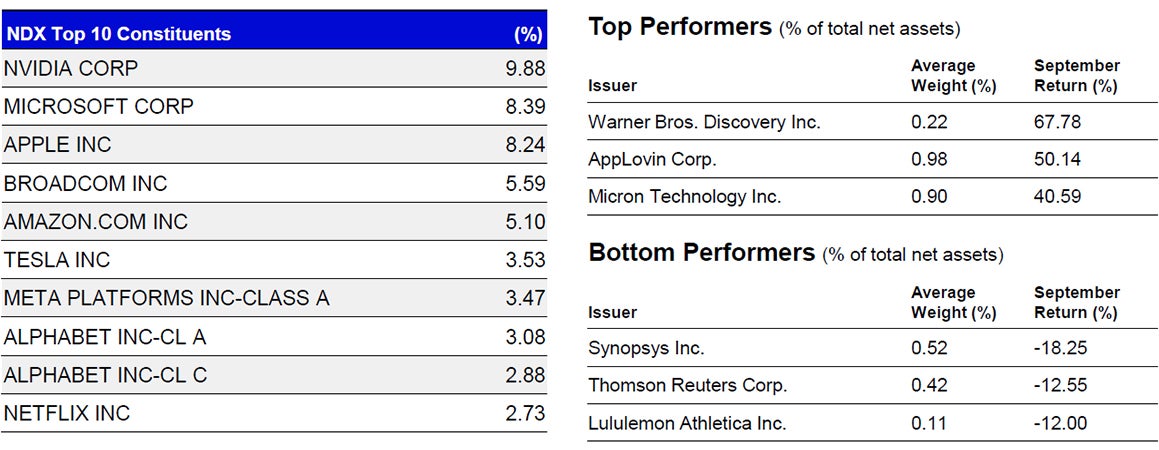

Individual Company Highlights

- AppLovin, a software and advertising company, had the best total performance for the month which was driven by its inclusion into the S&P 500 index. The announcement came on September 5th after market close and caused the company’s stock to rise over 11% the next trading day.

- Reports of a potential merger between Warner Bros. Discovery and Paramount Skydance surfaced on September 11th and caused Warner Bros. Discovery’s stock to rise 55% over the next three trading sessions. Nothing was confirmed but it was rumored it would be an all-cash deal with Paramount Skydance being the acquirer.

- Nvidia announced a strategic partnership with OpenAI who plans on building at least 10 gigawatts of artificial intelligence data centers. These data centers will utilize Nvidia components as Nvidia plans to invest up to $100 billion in the project. It is projected that the first phase will be online in the second half of 2026.

Source: Bloomberg, L.P., as of 30/09/2025. Past performance is not a guarantee of future results. Holdings are subject to change and are not buy/sell recommendations. Top and bottom performers for the month by absolute performance.

Outlook

- Messaging from the FOMC signaled that the balance of risk between U.S. inflation and unemployment has tilted more towards unemployment which led the committee to the 0.25% rate cut decision.

- Combine this messaging with the adjustment to U.S. Non-Farm Payrolls of -911k, many investors will be paying closer attention to future unemployment and job creation readings.

- U.S. Congress was unable to come to an agreement on the federal budget which led to the announcement of a U.S. government shutdown starting on 1 October. During this shutdown, approximately 750k U.S. government employees will be furloughed and not collecting a paycheck.

- Earnings season starts in October with Tesla, Alphabet, Meta, Microsoft, Amazon and Apple all announcing results during the month.

Source: Bloomberg, L.P., as of 30/09/2025. Date in USD.

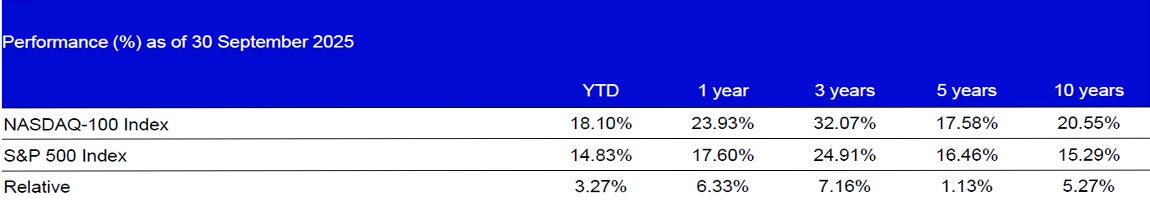

Data: Invesco, Bloomberg as of 30 September 2025. Data in USD.

Data: Bloomberg, L.P., as of 30 September 2025. An investor cannot invest directly in an index. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.