Nasdaq 100 Index – Commentary - April 2024

Key Highlights

Equities finished March in negative territory amongst a CPI print that came in higher than expected and the Federal Open Market Committee’s hawkish stance.

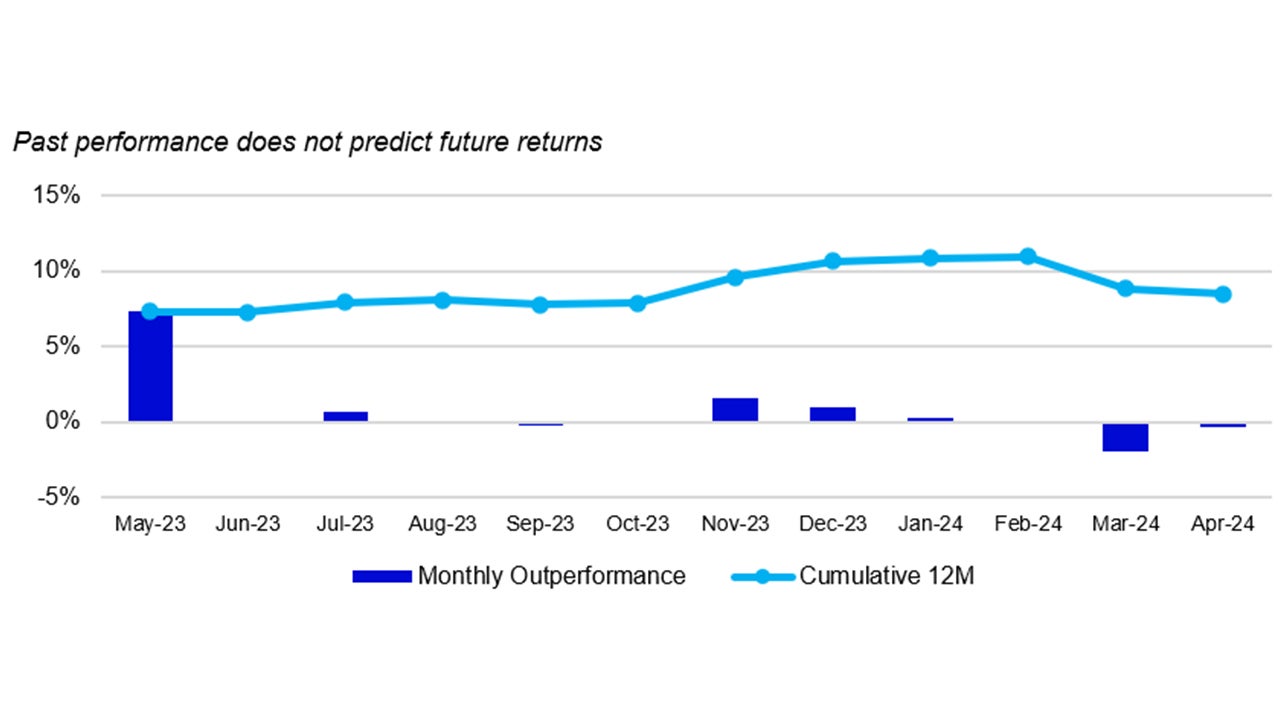

For the month of March, the Nasdaq-100 Index (NDX) returned -4.4%%underperforming the S&P 500 Index which returned -4.1%.

US Market Recap

The equity indices’ all-time highs set in March proved to be the most recent top, as stocks sold off in April. The S&P 500 Index fell as much as 5.5%, NDX down as much as 6.6%, before paring some of the losses during the last week of the month. Volatility increased to its highest level so far this year as the VIX Index hit 21.4 at one point. Contributors to the pullback were concerns of sticky inflation, rising interest rates, geopolitical unrest and corporate earnings.

April’s selloff gained steam on the 4th as several US Federal Reserve (Fed) officials provided comments on the current state of inflation and monetary policy. Richmond US Fed President Tom Barkin stated that it would be smart for the FOMC to take their time as no one wants inflation to reemerge.

The Consumer Price Index (CPI) monthly reading was released on the 10th and showed year-over-year inflation higher than analysts’ expectations. Inflation came in at 3.5%, higher than the 3.4% estimate and 3.2% reading of the previous month. Three out of four CPI readings this year have been 3% or higher, well above the Federal Open Market Committee’s (FOMC) 2% target. A rise in the cost of Core Services was the largest contributor to the year-over-year numbers with the rise in the cost of Energy and the cost of Food also contributing. The cost of core good fell and was the third month in a row of year-over-year declines.

Month-over-month CPI number was announced above the street’s expectation of 0.3% and was at the same elevated level as the previous reading, 0.4%. The cost of Core Services was the largest contributor to the month-over-month increase followed by increases in the cost of Energy and the cost of Food. The cost of core Goods fell for the month of March. Many investors reacted negatively on the day of the release as the S&P 500 traded down 1.20% with NDX posting -1.65%.

The previously mentioned comments from Fed Officials, combined with the stickier inflation readings, caused many investors to push out their expectations of when the FOMC will start rate cuts. Expectations started to shift after the previous FOMC meeting and continued through the month of April. Fed Futures on Bloomberg showed that the first rate cut was anticipated to arrive in December, a significant shift back from the expectation of July, which was in place at the end of March.

Increased tensions in the Middle East contributed to the rise in volatility during April. During the evening of April 1st, it was reported that Israel launched an attack against the Iranian embassy located in Syria which left several dead. The Syrian government was quick to condemn the bombing and called it an “atrocious terrorist attack.” The news of the attack contributed to the S&P 500 trading below 5200 the next day. Approximately two weeks later, it was reported that Iran launched an attack against Israel comprised of hundreds of drones and missiles. Israeli military stated that many of the projectiles were intercepted before hitting targets and that “minor damaged occurred to the infrastructure.” This attack occurred over a weekend, but markets responded the following Monday with the S&P 500 trading down 1.20% while NDX traded down 1.65%. Another attack occurred on April 19th, taking place in the Iranian city of Isfahan, with Israel not claiming responsibility. This attack was reported to be of much smaller scale and caused limited damage. The increased tensions caused U.S. government officials, along with other countries, to urge the parties involved to work towards de-escalation.

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

-4.4% | 3.8% | 32.4% | 18.0% |

| S&P 500 | -4.1% | 5.9% | 22.1% | 11.8% |

Relative |

-0.3% | -2.0% | 8.5% | 5.5% |

Source: Bloomberg as of 30 April 2024. An investment cannot be made directly into an index.

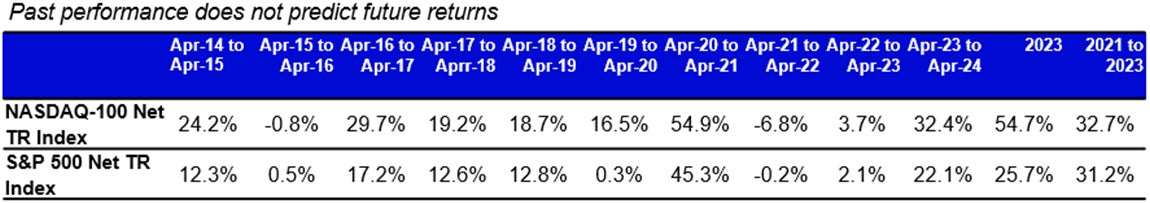

Past Performance does not predict future returns.

Source: Bloomberg as of 30 April 2024.

An investment cannot be made directly into an index.

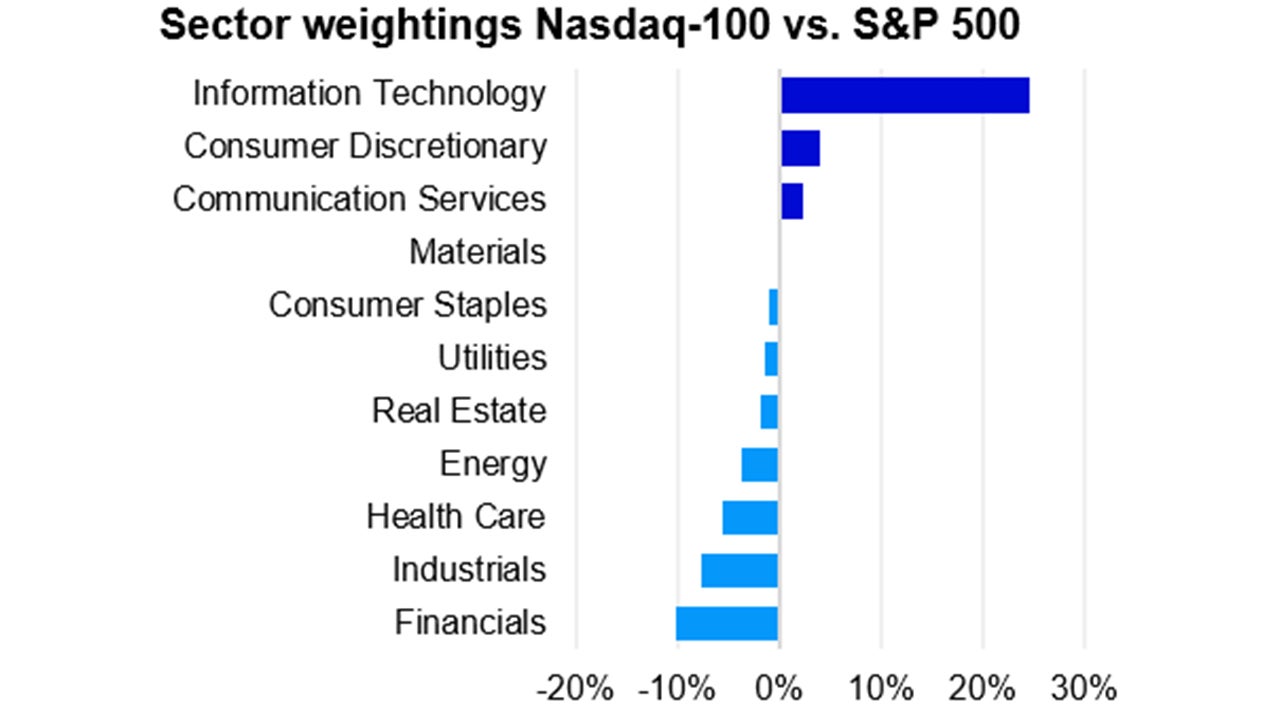

While the Nasdaq-100 specifically excludes Financials, it also currently offers very little exposure to Basic Materials, Energy, and Real Estate

Source: Invesco, FactSet as of 30 April 2024. Data in USD

Nasdaq 100 Performance Drivers

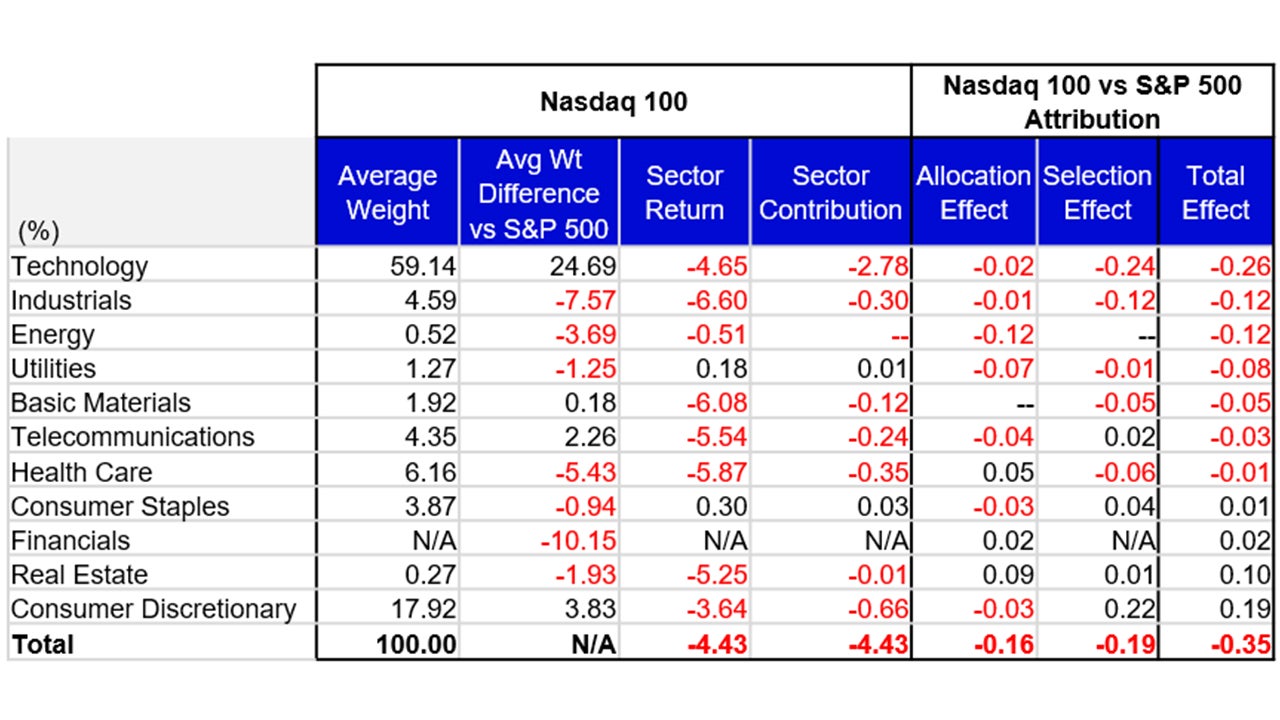

April’s performance attribution of the Nasdaq 100 (NDX) vs the S&P 500 Index

From a sector perspective, Consumer Staples, Utilities and Energy were the best performing sectors in NDX and returned 0.30%, 0.18% and -0.51%, respectively. During the month, these three sectors had average weights of 3.87%, 1.27% and 0.52%, respectively. The bottom performing sectors in NDX were Industrials, Basic Materials and Health Care with average weights of 4.59%, 1.92% and 6.16%, respectively. Industrials returned -6.60%, Basic Materials returned -6.08% while Health Care returned -5.87%.

NDX’s underperformance vs. the S&P 500 was driven by its overweight exposure and differentiated holdings in the Technology sector. NDX’sdifferentiated holdings in the Industrials sector also detracted from relative performance. Underweight exposure in the Energy sector was the third detractor to relative performance vs. the S&P 500. The Consumer Discretionary sector contributed the most to relative performance and was driven by its differentiated holdings. Underweight exposure and differentiated holdings in the Real Estate sector, along with its lack of exposure to the Financials sector, also contributed to relative performance to the S&P 500.

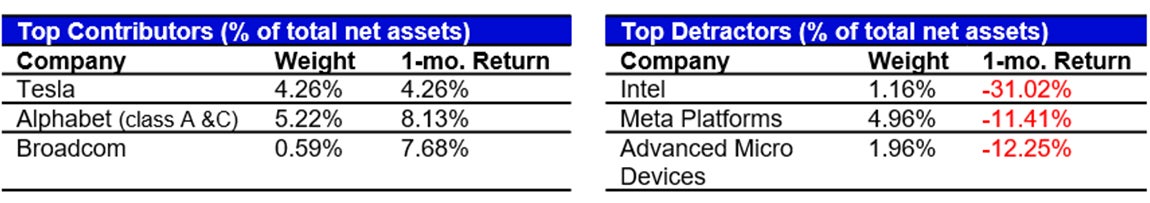

NDX Contributor/Detractor Spotlight: Meta Platforms announced earnings on the 24th and exceeded the consensus expectations for both revenue and earnings-per-share. Revenue came in at $36.46 billion vs. the $36.12 billion consensus while adjusted earnings-per-share was $4.71 vs. the consensus was $4.30. However, Meta’s stock fell over 10% the following trading session off lower-than-expected revenue guidance for the next quarter, $36.5 billion - $39 billion along with higher-than-expected capital expenditures guidance, $35 billion - $40 billion. If both come to fruition, it would place profit margins under pressure.

Data: Invesco, FactSet, as of 30 April 2024 Data in USD. Sectors: ICB Classification. All figures in percentage terms. Market allocation effect shows the excess contribution due to sector/market allocation. A positive allocation effect implies that the choice of sector weights in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Selection effect shows the excess contribution due to security selection. A positive selection effect implies that the choice of stocks in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Total effect is the difference in contribution between the benchmark and portfolio.

Source: Bloomberg, as of 30 April 2024. Past performance does not predict future returns. Top and bottom performers for the month by relative performance. Holdings are subject to change and are not buy/sell recommendations

Data: Invesco, Bloomberg, as of 30 April 2024. Data in USD.

An investment cannot be made directly into an index.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.