Nasdaq 100 Index – Commentary - August 2024

Key Highlights

The Nasdaq 100 is one of the world’s preeminent large cap growth indexes

The companies in the Nasdaq-100 include the largest non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

US Market Recap

August emerged to be one of the more interesting months of 2024 as volatility spiked to 2020 levels early in the month. The spike was short-lived, and volatility finished below the end of month July level. Illustrating these moves was the VIX Index, a commonly used gauge for volatility. The VIX rose from 16 to a high-water mark of 65, a level not seen since early in the COVID-19 Pandemic. The VIX ultimately finished the month at 15. Concerns around rising U.S unemployment, the U.S. Dollar’s relationship with the Japanese Yen and future monetary policy were the primary catalysts for equity markets during August.

The most recent U.S. Unemployment reading was released on August 2nd and showed that unemployment had risen to a rate of 4.3%. This had been the highest reading since October 2021. While the 4.3% was not necessarily high, the rate of increase over the past twelve months triggered a signal in the Sahm Rule which showed that there may be a recession on the horizon. The Sahm Rule is named after economist Claudia Sahm and states that when the three-month average of U.S. unemployment rate rises 0.5% or more above the low reading of the previous twelve months, the economy may be at the beginning of a recession. The August 2023 U.S. Unemployment reading stood at 3.8% so the rise to 4.3% represented a 0.6% rise and triggered the rule. Since 1950, the U.S. economy had seen eleven recessions and the Sahm Rule had correctly signaled ten out of the eleven. Investors saw a drop in equities on August 2nd due to the reading with the S&P 500 falling 1.84% and NDX down 2.38%.

The US Consumer Price Index (CPI) reading was released on August 14th and saw the year-over-year report beneath expectations while the month-over-month was in line. Year-over-year inflation was reported at 2.9%, below the estimate and prior reading of 3.0%. Core CPI, which excludes the costs of Food and Energy, rose at a year-over-year rate of 3.2%, in line with estimates and below the prior reading of 3.3%. There was a rise in the cost of Core Services, which continued to be the largest contributor to the year-over-year reading. Increases were also seen in the cost of Food and the cost of Energy. The cost of Core Goods continued to fall for the seventh month in a row and was the only detractor to year-over-year CPI.

Innovator Spotlight

Innovation, specifically AI, has been at the forefront of many investor’s minds. AI is showing itself to bring many benefits to our world, including early detection of certain diseases. In August, Google collaborated with an Indian AI Startup, Salcit Technologies, to launch a bioacoustics healthcare model to detect disease from human sounds. As the name suggests, Bioacoustics combines biology and acoustics to help us gain information from sounds produced by living beings.

Tuberculosis takes the lives of 4,500 people daily. The disease is treatable, but many cases go undiagnosed- early detection is the key to halting its spread. Google trained its foundation AI model with 300 million bits of audio from around the world, including coughs, sneezes, and breathing. Body sounds are filled with information about our well-being and often contain in-perceptible clues that can help screen and diagnose diseases like tuberculosis. This data feeds into Google’s HeAR (short for Health Acoustic Representations) AI model includes 100 million cough sounds that now help detect TB. The AI tool can be loaded on smartphones and can reach countries that may not otherwise have access to expensive detection tools.

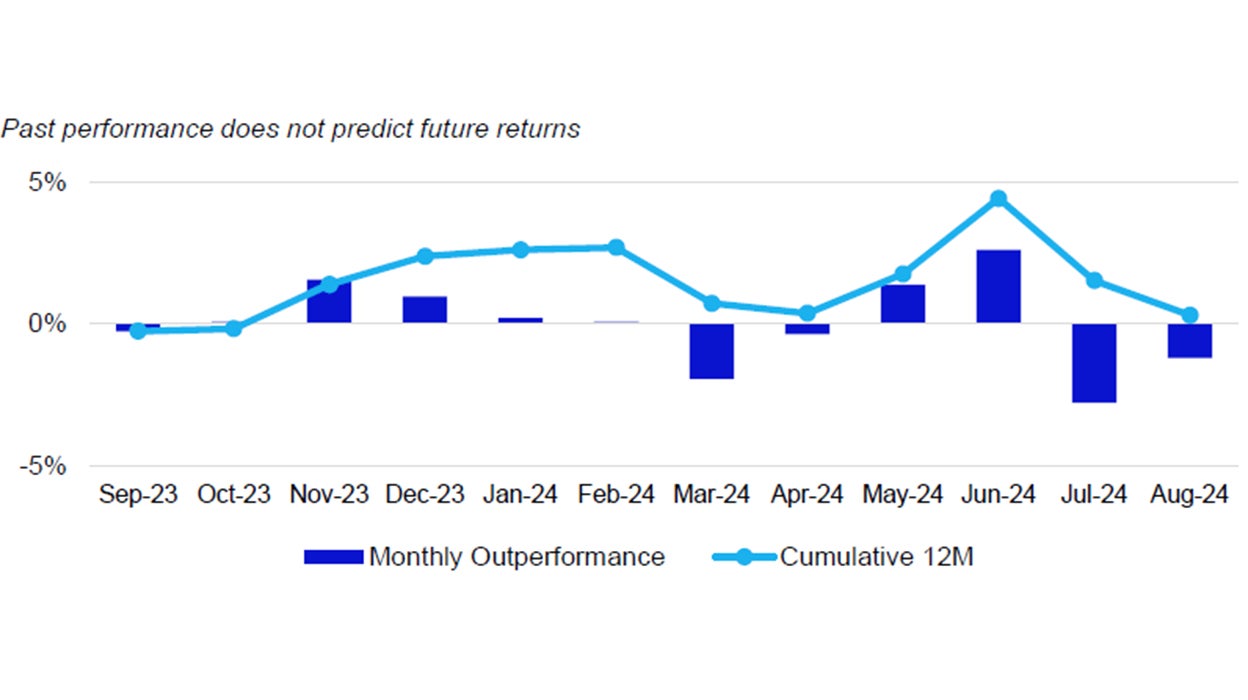

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

1.2% | 16.8% | 27.0% | 17.8% |

| S&P 500 | 2.4% | 19.2% | 26.6% | 12.4% |

Relative |

-1.2% | -2.4% | 0.3% | 4.8% |

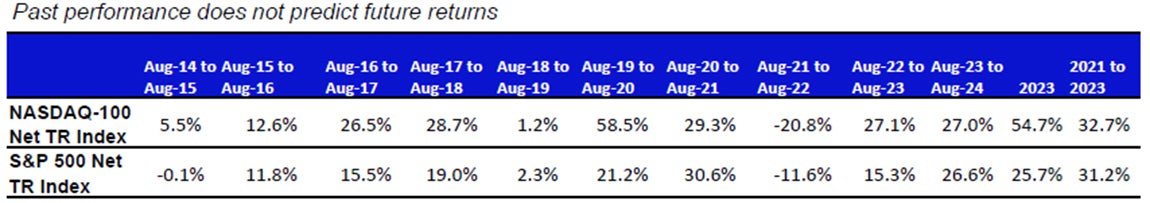

Performance as of 31 Aug 2024. Past performance does not predict future results. Innovator spotlight source: Bloomberg News 8/29/2024

Source: Bloomberg as of 31 Aug 2024.

An investment cannot be made directly into an index.

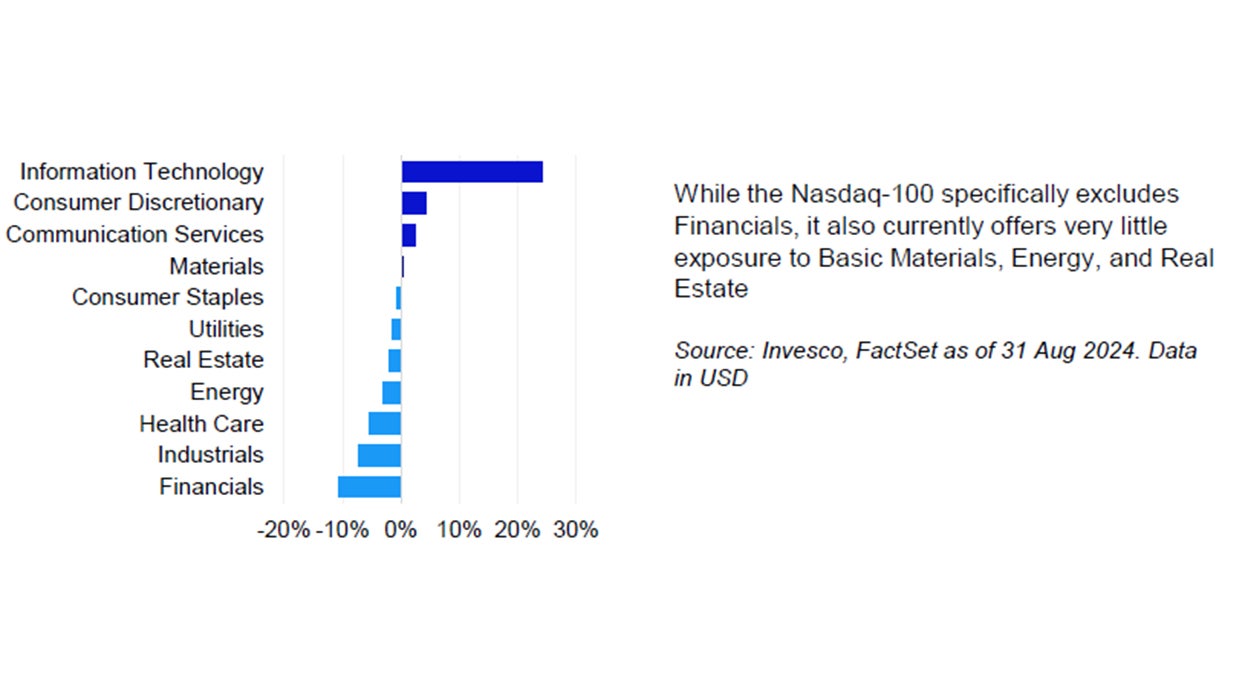

While the Nasdaq-100 specifically excludes Financials, it also currently offers very little exposure to Basic Materials, Energy, and Real Estate

Source: Invesco, FactSet as of 31 Aug 2024. Data in USD

Nasdaq-100 Performance Drivers

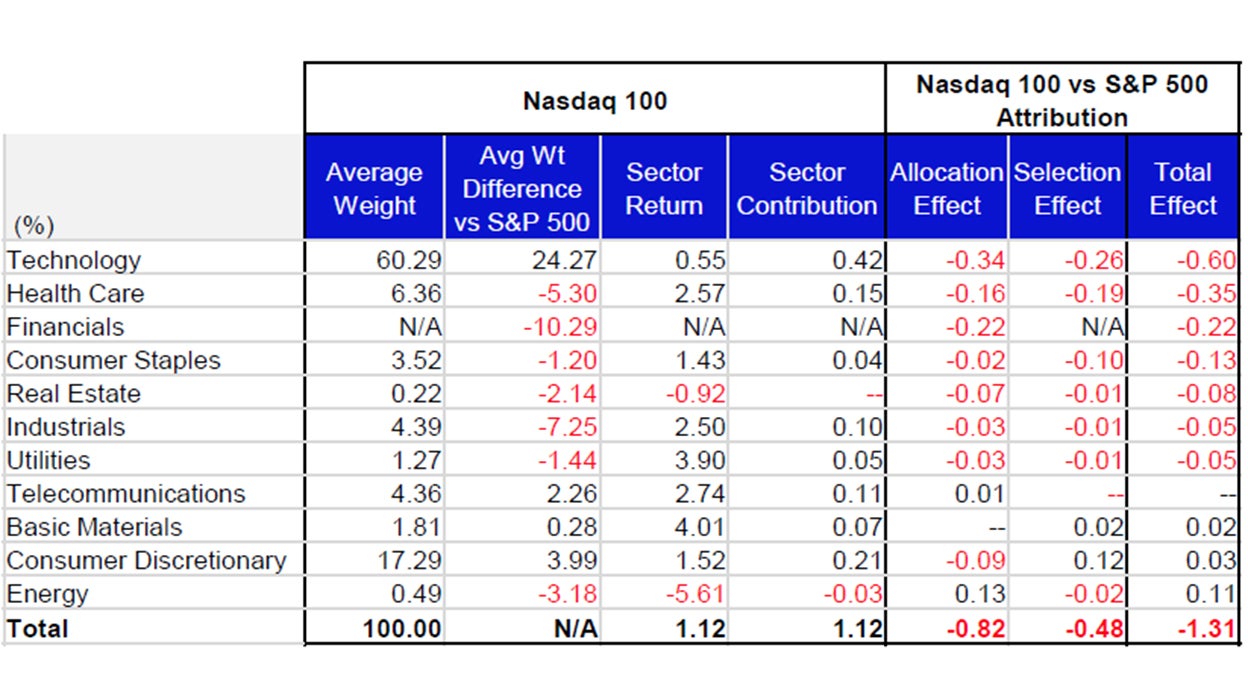

August’s performance attribution of the Nasdaq-100 (NDX) vs the S&P 500 Index

From a sector perspective, Basic Materials, Utilities and Telecommunications were the best performing sectors in NDX and returned 4.01%, 3.90% and 2.74%, respectively. During the month, these three sectors had average weights of 1.81%, 1.27% and 4.36%, respectively. The bottom performing sectors in NDX were Energy, Real Estate and Technology which had average weights of 0.49%, 0.22% and 60.29%, respectively. Energy returned -5.61%, Real Estate returned -0.92% while Technology returned 0.55%.

NDX’s underperformance vs. the S&P 500 was driven by its overweight exposure and differentiated holdings in the Technology sector. The ETF’s underweight exposure and differentiated holdings in the Health Care sector also detracted from relative performance. Lack of exposure to the Financials sector was the third detractor from relative performance vs. the S&P 500. The Energy sector contributed the most to relative performance and was driven by its underweight exposure. Differentiated holdings in the Consumer Discretionary and Basic Materials sectors also contributed to relative performance to the S&P 500.

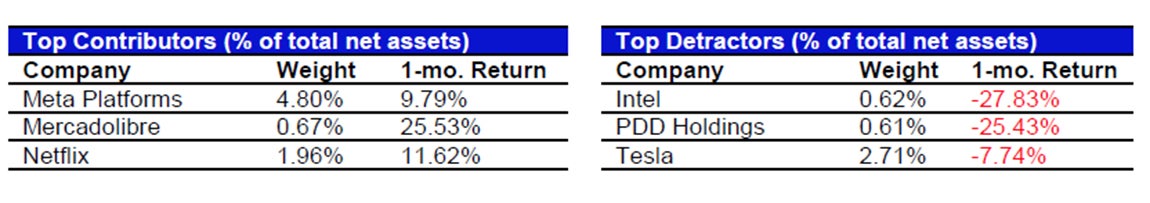

NDX Contributor/Detractor Spotlight: Nvidia: The Nvidia earnings announcement on August 28th was in focus for many investors. Some investors have used Nvidia earnings as a gauge showing the progress of artificial intelligence (AI). Moreover, Nvidia has grown to be one of the largest companies in the world and boasted a market-capitalization over $3 trillion prior to the earnings announcement. This has caused the chipmaker’s price action have a large effect on the overall market. Adjusted earnings-per-share was reported at $0.68 vs. the consensus analysts’ estimate of $0.64. Revenue also came in above expectation at $30.04 billion vs. $28.82 billion. Quarter-over-quarter EPS growth has been slowing from 147% one year ago, to 11% this most recent announcement. Nvidia also issued revenue guidance for its next quarter at $32.5 billion. If this is attained, the chipmaker’s quarter-over-quarter revenue growth would slow to 8%. Although the numbers beat estimates, Nvidia’s stock fell in afterhours trading immediately following the announcement and fell by over 6% on August 29th, the following trading day. The slowdown in growth, although still positive, may have raised concerns for some investors in Nvidia’s stock, which has returned over 140% year-to-date as of then end of August.

Data: Invesco, FactSet, as of 31 August 2024 Data in USD. Sectors: ICB Classification. All figures in percentage terms. Market allocation effect shows the excess contribution due to sector/market allocation. A positive allocation effect implies that the choice of sector weights in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Selection effect shows the excess contribution due to security selection. A positive selection effect implies that the choice of stocks in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Total effect is the difference in contribution between the benchmark and portfolio.

Source: Bloomberg, as of 31 Aug 2024. Past performance does not predict future returns. Top and bottom performers for the month by relative performance. Holdings are subject to change and are not buy/sell recommendations

Data: Invesco, Bloomberg, as of 31 Aug 2024. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.