Nasdaq 100 Index – Commentary - February 2024

US Market Recap

Equities continued their move up despite the continued hawkish messaging from Federal Open Market Committee (FOMC) officials, higher than expected inflation and rising interest rates. Out of the eight full weeks of trading seen this year as of the end of February, six have been positive for both NDX and the S&P 500 Index. Moreover, both have not seen negative monthly performance since October 2023, four consecutive months. US small-cap equities also performed well during the month with the Russell 2000 up 5.65%.

With no FOMC meeting in February, investors turned their attention to economic readings that may impact future monetary policy decisions, movement in interest rates and earnings announcements. January’s year-over-year and month-over-month US Consumer Price Index (CPI) readings were announced on the 13th, and both came in higher than expected. The year-over-year reading was 3.1%, higher than the expected 2.9% but lower than the previous reading of 3.4%. The new reading saw the biggest contribution from a rise in the cost of Core Services, which was larger than the previous reading, and the cost of Food. Increases in the costs of Core Services and Food contributed to the rise while the cost of Energy and Core Goods fell.

Investors saw a rise in interest rates during February as investors adjust to the idea of rate cuts arriving later than initially expected. After testing the recent lows, the 10yr Treasury’s yield rose from 3.88% to close the month at 4.25%. 2023 brought a year of falling interest rates as equities rose, a relationship that has traditionally been opposite. February potentially signaled a shift back to the historical norm of positive correlation between yields and equity returns.

Coinciding with the CPI release on the 13th, volatility spiked to levels last seen in November. The VIX Index, a commonly used gauge of equity volatility, rose as high as 18.00 before closing the day at 15.85. The move higher ultimately proved to be short lived as equities rose towards the end of the month, fueled positive earnings announcements. The VIX finished February at 13.40, lower than where it closed in January at 14.35.the prior month’s reading of 3.1%. The increase in the cost of Services continued to be the primary component of year-over-year inflation while the cost of Energy continued its decline. Month-over-month CPI was 0.3%, higher than the prior reading of 0.1% and the analysts’ estimate of 0.2%. The reading showed a decrease in the cost of Energy but was offset by rising costs in Services, Core Goods and Food.

Index performance

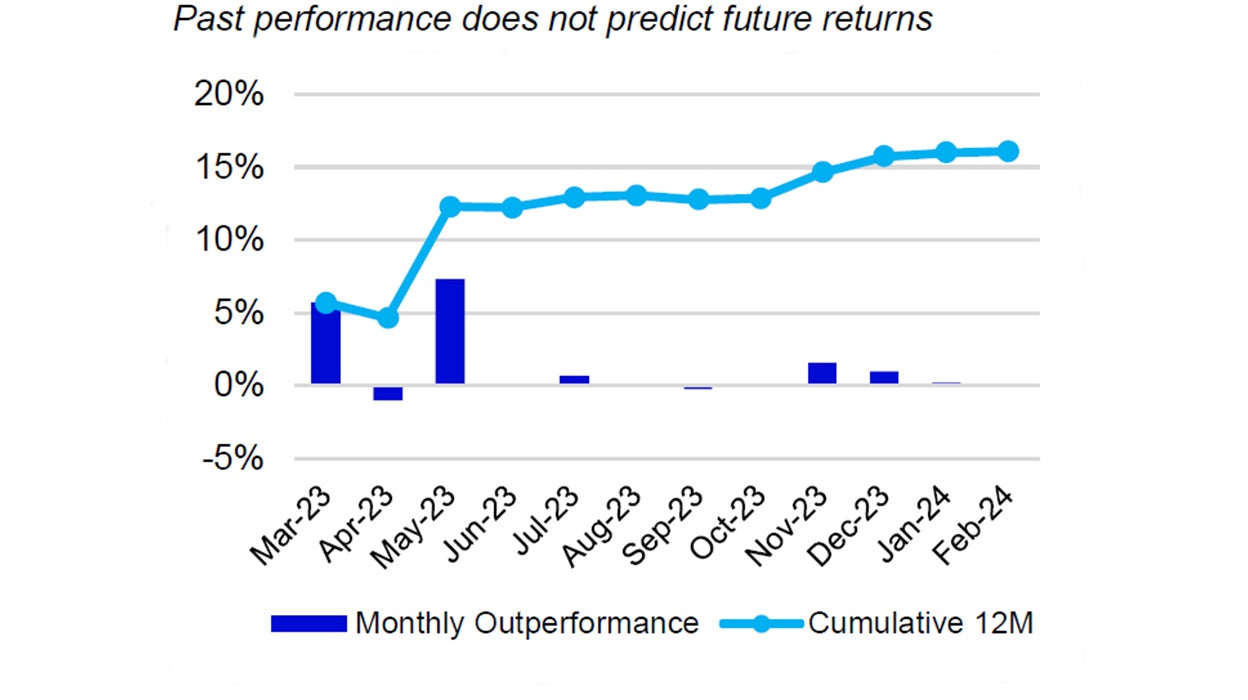

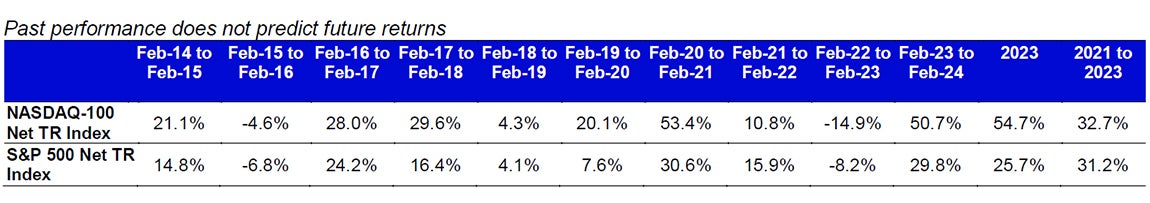

Past performance does not predict future returns.

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

5.4% | 7.4% | 50.7% | 18.0% |

| S&P 500 | 5.3% | 7.0% | 29.8% | 12.1% |

Relative |

0.1% | 0.3% | 16.1% | 5.3% |

Source: Bloomberg as of 29 Feb 2024.

An investment cannot be made directly into an index.

Source: Bloomberg as of 29 Feb 2024.

An investment cannot be made directly into an index.

Data: Invesco, FactSet as of 29 Feb 2024. Data in USD

Nasdaq 100 Performance Drivers

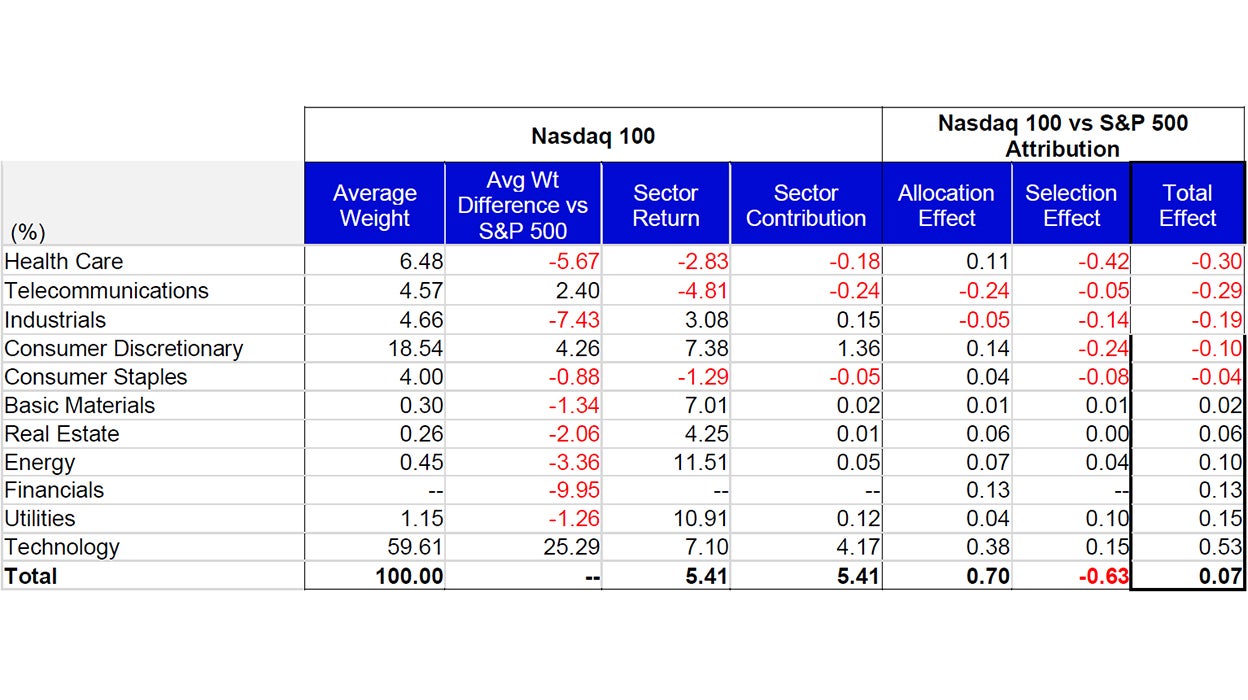

February’s performance attribution of the Nasdaq 100 (NDX) vs the S&P 500 Index

From a sector perspective, Energy, Utilities and Consumer Discretionary were the best performing sectors in NDX and returned 11.51%, 10.91% and 7.38%, respectively. During the month, these three sectors had average weights of 0.45%, 1.15% and 18.54%, respectively. The bottom performing sectors in NDX were Telecommunications, Health Care and Consumer Staples with average weights of 4.57%, 6.48% and 4.00%, respectively. Telecommunications returned -4.81%, Health Care returned -2.83% while Consumer Staples returned -1.29%.

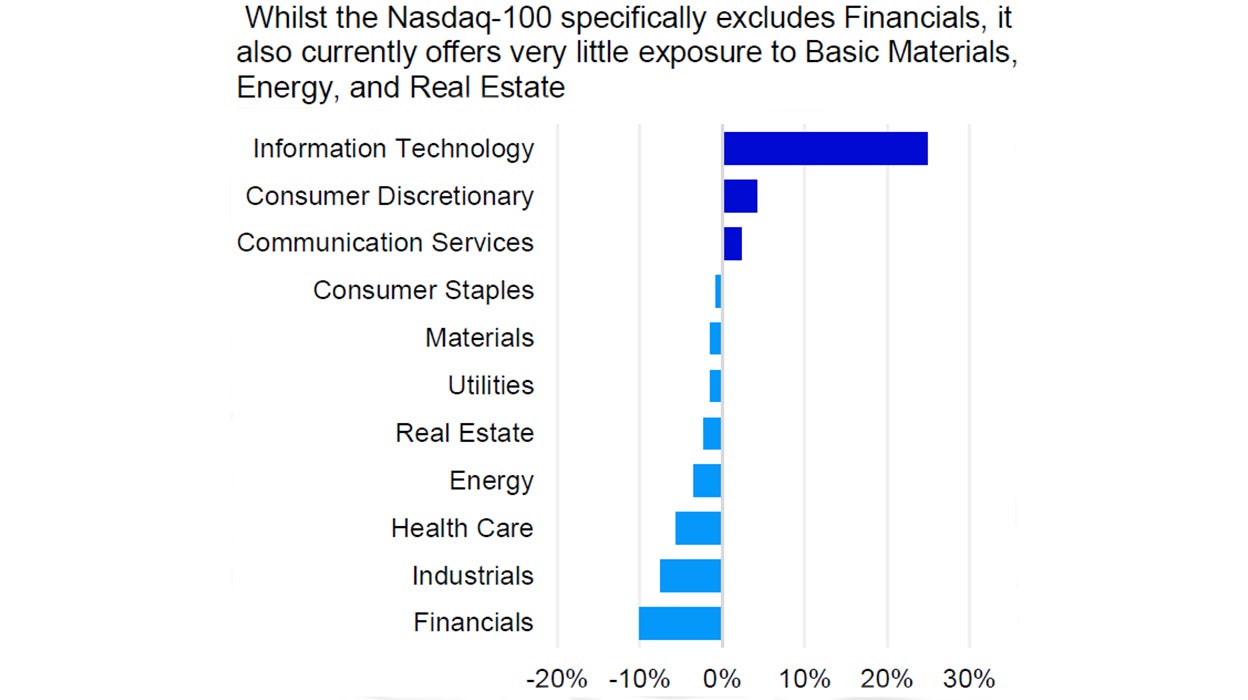

NDX’s outperformance vs. the S&P 500 was driven by its overweight exposure and differentiated holdings in the Technology sector. The index’s underweight exposure and differentiated holdings in the Utilities sector also contributed to relative performance. Lack of exposure to the Financials sector was the third contributor to relative performance vs. the S&P 500. The Health Care sector detracted the most from relative performance and was driven by its differentiated holdings. Overweight exposure and differentiated holdings in the Telecommunications sector, along with its underweight exposure and differentiated holdings in the Industrials sector also detracted from relative performance to the S&P 500.

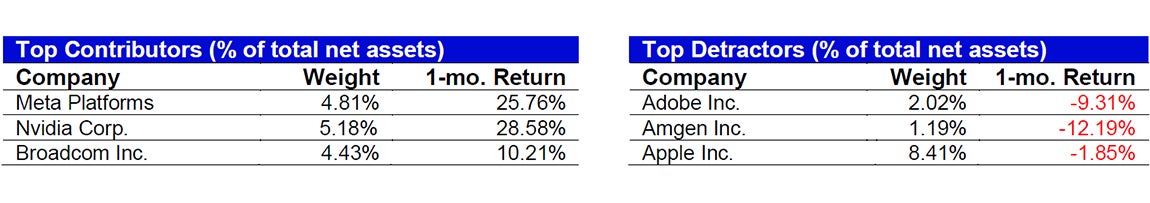

NDX Contributor/Detractor Spotlight: Meta Platforms announced earnings and surprised to the upside on both revenue and earnings. Adjusted earnings-per share were announced at $5.33 vs. the estimate of $4.91 while revenue came in at $40.1 billion vs. the estimate of $39.0 billion. Advertisement revenue accounted for over $38 billion of all revenue recognized by the social media company. Higher-than-expected daily and monthly active users was also viewed positively by investors, as these metrics showed over two billion daily and over three billion monthly users. A $50 billion addition to share buybacks also contributed to strong performance of the company’s stock. What came as the biggest surprise to investors was the announcement of the first ever dividend to be paid in March. A dividend of $0.50 per share may point to the continued maturation of the company. Meta’s stock rose over 20% the following trading session.

Data: Invesco, FactSet, as of 29 Feb 2024 Data in USD. Sectors: ICB Classification. All figures in percentage terms. Market allocation effect shows the excess contribution due to sector/market allocation. A positive allocation effect implies that the choice of sector weights in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Selection effect shows the excess contribution due to security selection. A positive selection effect implies that the choice of stocks in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Total effect is the difference in contribution between the benchmark and portfolio.

Source: Bloomberg, as of 29 Feb 2024. Past performance does not predict future returns. Top and bottom performers for the month by relative performance. Holdings are subject to change and are not buy/sell recommendations.

Data: Invesco, Bloomberg, as of 29 Feb 2024. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.