Nasdaq 100 Index – Commentary - July 2024

Key Highlights

Equities finished July in negative territory, amid a CPI print that came in below expectations and the Federal Open Market Committee’s decision to not change rates.

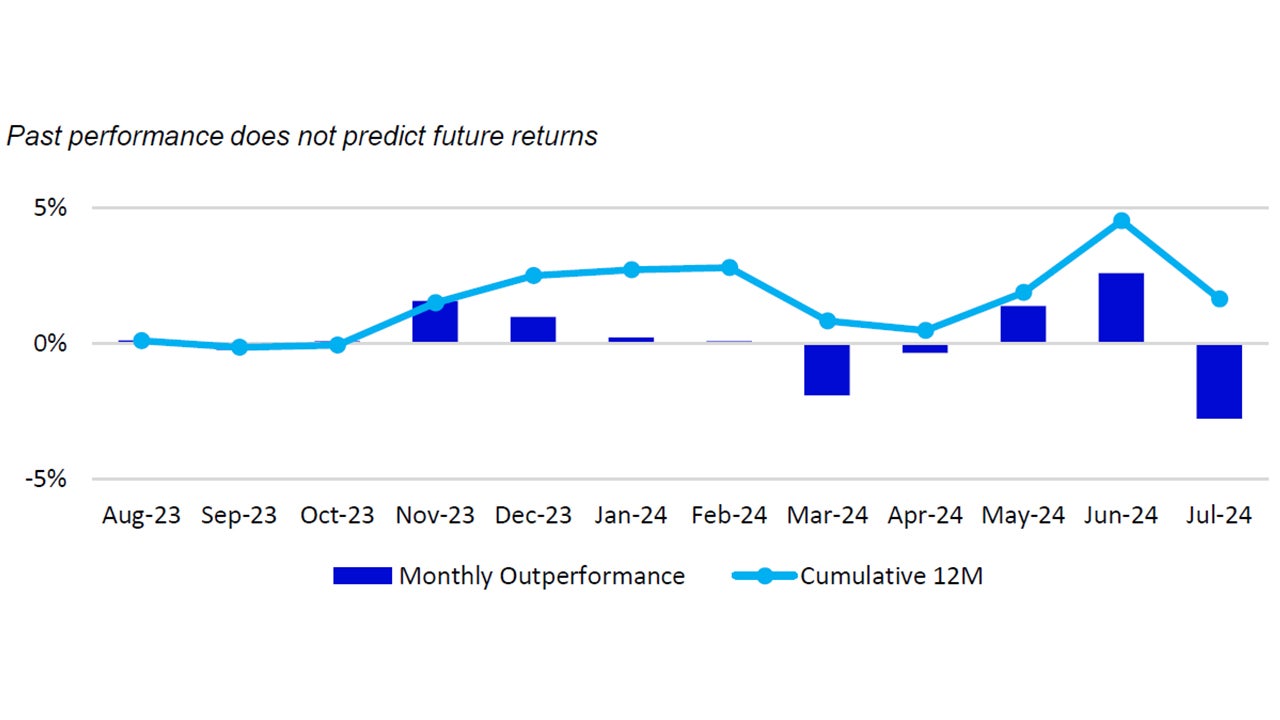

For the month of July, the Nasdaq-100 Index (NDX) returned -1.6%, underperforming the S&P 500 Index, which returned 1.2%.

US Market Recap

A large rotation to Value-oriented and Small-Cap stocks caused volatility to increase during the month of July. The VIX Index, a commonly used gauge for volatility in US equities, rose from 12.44 to as high as 19.36 before settling at 16.36 at the end of the month. The rotation caused the Russell 1000 Value and Russell 2000 to outperform, posting returns of 5.11% and 10.16%, respectively. Driving this rotation was favorable inflation readings, optimism of a US Federal Reserve rate cut in September, falling interest rates and disappointing earnings announcements from Large-Cap Growth companies.

The most recent US Consumer Price Index (CPI) reading was released on July 11th and was the first catalyst for many investors to shift their focus to Small-Cap and Value-oriented equities. Year-over-year inflation was reported at 3.0%, below the estimate and prior reading of 3.1%. Core CPI, which excludes the costs of Food and Energy, rose at a year-over-year rate of 3.3%, also below analysts’ estimates which were at 3.4%. There was a rise in the cost of Core Services, which was the largest contributor to the year-over-year reading. Increases were also seen in the cost of Energy and the cost of Food. The cost of Core Goods continued to fall and be the only detractor to year-over-year CPI.

Month-over-month CPI was not only announced below the street’s estimates but showed signs of declining prices. The number was reported at -0.1%, below the estimate of 0.1%. The cost of Energy was the primary driver of the negative reading with cost of Core Goods also falling. The cost of Core Services saw the largest increase and was followed by an increase in the cost of Food. On the day of the announcement, Small-Cap equites rose as the Russell 2000 returned over 3.5%. Growth-oriented companies fell as the Russell 1000 Growth declined 2.11%.

The US FOMC met on the last day of the month and announced that there would be no change to the target rate and that it would remain between 5.25% and 5.50%. Messaging from the statement brought balance back between the FOMC’s dual mandate which is stable inflation and employment. The change in tone implied that the officials will be paying close attention to future employment readings such as Nonfarm Payrolls. An unexpected spike in unemployment has the potential to be met with faster easing of monetary policy. However, this would also signal that the economy is weakening at a quicker pace than what the FOMC is anticipating. Moreover, the unemployment rate has risen over the past few readings. Further increase could lead some to believe the US may be entering a recession.

Coinciding with the positive inflation data and adjusted expectations of when the US Fed with cut rates, interests rate continued their move down throughout the month of July. The US Treasury 10yr yield fell from 4.40% to 4.03% while the 2yr fell from 4.75% to 4.26%. A monthly move down in the yield of this size had not been seen since December. Also, prior to the FOMC meeting, Bloomberg showed that investors were anticipating the first rate cut to arrive in September with a possibility of the second arriving in December. After the close on the July 31st, it was shown that investors fully expected the second to arrive by the end of the year.

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

-1.6% | 15.4% | 23.6% | 18.2% |

| S&P 500 | 1.2% | 16.4% | 21.6% | 12.5% |

Relative |

-2.8% | -0.8% | 1.6% | 5.1% |

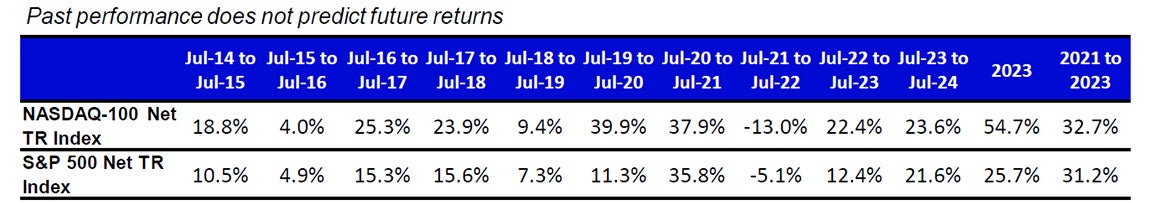

Performance as of 31 July 2024. Past performance does not predict future results.

Source: Bloomberg as of 31 July 2024.

An investment cannot be made directly into an index.

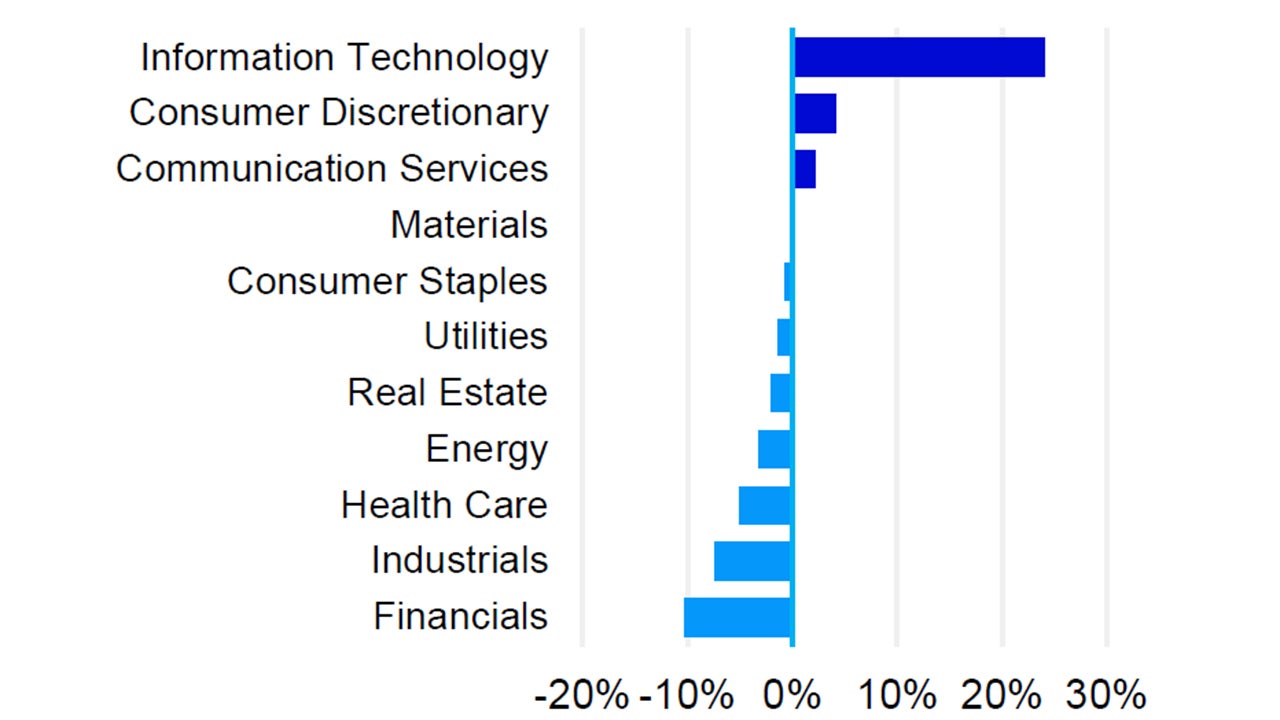

While the Nasdaq-100 specifically excludes Financials, it also currently offers very little exposure to Basic Materials, Energy, and Real Estate

Source: Invesco, FactSet as of 31 July 2024. Data in USD

Nasdaq 100 Performance Drivers

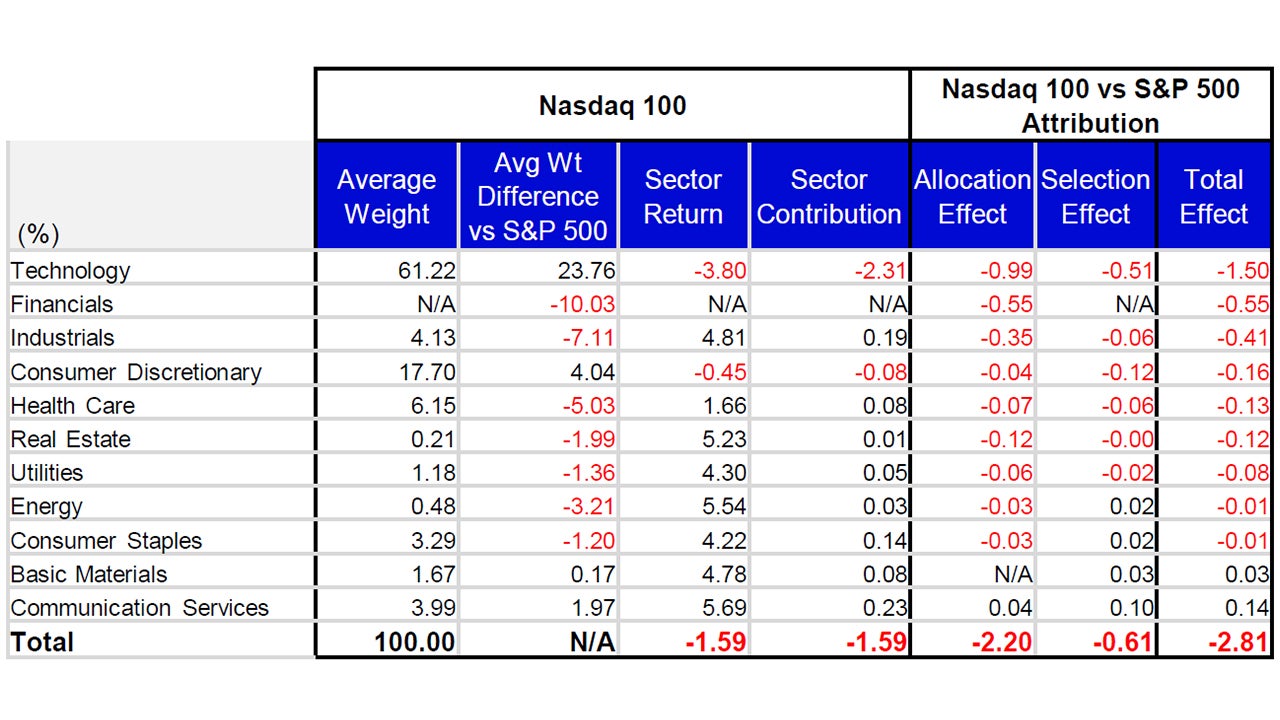

July’s performance attribution of the Nasdaq-100 (NDX) vs the S&P 500 Index

From a sector perspective, Communication Services, Energy and Real Estate were the best performing sectors in NDX and returned 5.69%, 5.54% and 5.23%, respectively. During the month, these three sectors had average weights of 3.99%, 0.48% and 0.21%, respectively. The bottom performing sectors in NDX were Technology, Consumer Discretionary and Health Care with average weights of 61.22%, 17.70% and 6.15%, respectively. Technology returned -3.80%, Consumer Discretionary returned -0.45% while Health Care returned 1.66%.

NDX’s underperformance vs. the S&P 500 was driven by its overweight exposure in the Technology sector. The index’s lack of exposure in the Financials sector also added to the underperformance. Underweight exposure and differentiated holdings to the Industrials sector was the third detractor from relative performance vs. the S&P 500. The Communication Services sector contributed the most to relative performance and was driven by its overweight exposure and differentiated holdings. Differentiated holdings in the Basic Materials sector also contributed to relative performance to the S&P 500. These were the only two sector exposure in NDX that contributed to relative performance vs. the S&P 500.

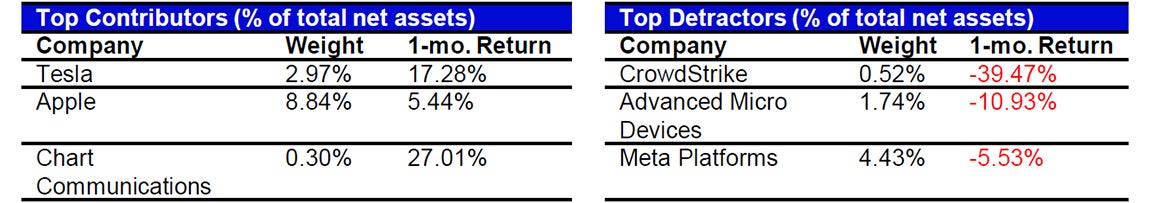

NDX Contributor/Detractor Spotlight: Tesla: Tesla announced earnings on the 23rd and was not received well. The EV maker missed on adjusted earnings-per-share (EPS) which came in at $0.52 vs. the estimate of $0.60. The miss was driven by lower-than-expected vehicles sold. It was expected that 444.12k vehicles would be sold but results showed 443.96k. Higher-than-expected operating expenses also contributed to the miss. Elon Musk announced the unveiling of Tesla’s robotaxi would be delayed from August 8th to October 10th, which also added to the negative tone of the announcement. Although Tesla’s stock fell over 12% the day after the announcement, it was up for the month of July over 17%.

Data: Invesco, FactSet, as of 31 July 2024 Data in USD. Sectors: ICB Classification. All figures in percentage terms. Market allocation effect shows the excess contribution due to sector/market allocation. A positive allocation effect implies that the choice of sector weights in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Selection effect shows the excess contribution due to security selection. A positive selection effect implies that the choice of stocks in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Total effect is the difference in contribution between the benchmark and portfolio.

Source: Bloomberg, as of 31 July 2024. Past performance does not predict future returns. Top and bottom performers for the month by relative performance. Holdings are subject to change and are not buy/sell recommendations

Data: Invesco, Bloomberg, as of 31 July 2024. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.