Nasdaq 100 Index – Commentary - June 2024

Key Highlights

Equities finished June in positive territory amongst a CPI print that came in below expectations and the Federal Open Market Committee’s hawkish stance.

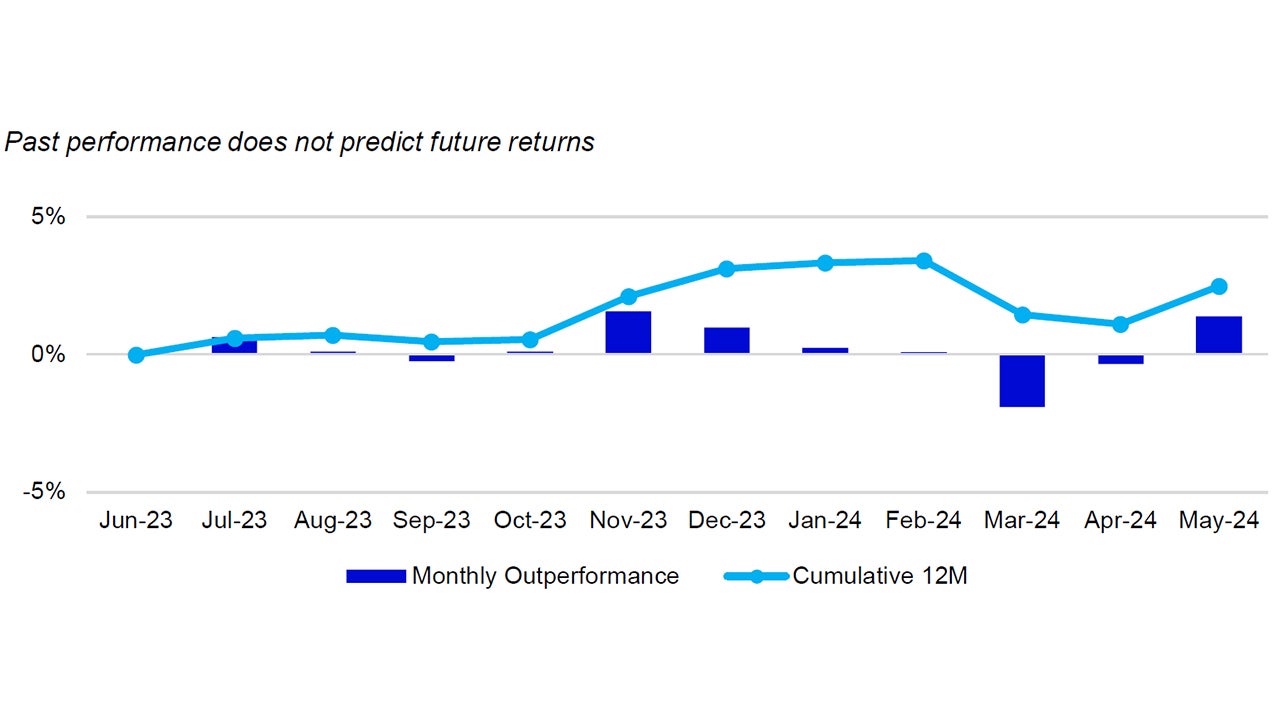

For the month of June, the Nasdaq-100 Index (NDX) returned 6.2%outperforming the S&P 500 Index which returned 3.6%.

US Market Recap

With Large-cap Growth leading the way, stocks continued their move upwards during the month of June. The Russell 1000 Growth Index returned 6.7% and outperformed the S&P 500 which returned 3.6%. NDX’s NAV also outperformed the S&P 500 returning 6.2%. Many investors continued to focus on inflation readings and messaging from the US Federal Open Market Committee (FOMC).

The most recent US Consumer Price Index (CPI) reading was released on June 12th, the same day the FOMC concluded their June meeting. Year-over-year inflation was reported at 3.3%, below the estimate and prior reading of 3.4%. Core CPI, which excludes the costs of Food and Energy, rose at a year-over-year rate of 3.4%, also below analysts’ estimates, which were at 3.5%. The components of this month’s CPI continued to look like the previous two readings. There was a rise in the cost of Core Services, which stayed as the largest contributor to the year-over-year reading. There were also increases in the cost of Energy and the cost of Food.

Month-over-month CPI was announced below the street’s expectation of 0.1% and came in at 0.0%, or no increase from the previous month. The cost of Core Services was the largest contributor to the month-over-month reading, followed by an increase in the cost of Food. The cost of Core Goods fell for the third reading in a row, while the cost of energy fell for the first time since the January reading. Equities reacted positively to the reading with the S&P 500 rising over 1% after the announcement.

As mentioned earlier, the CPI release coincided with the June FOMC meeting. As expected, the committee left the target Fed Fund’s rate between 5.25% - 5.50%. This meeting saw the release of an updated Summary of Economic Projections (SEP) and the report took a more hawkish tone compared to the previous report. In particular, the SEP showed the median estimate for the year-end Fed Target Rate increase from 4.625% to 5.125%. This would imply that the FOMC may only cut rates once vs. the broader expectation that they would cut twice before the end of the year. The dot plot also revealed that there are now four voting members of the committee who feel a rate hike may be necessary this year, up from two in the previous SEP. There was also an adjustment to the long-run neutral rate, the interest rate level that neither is beneficial or detrimental to growth, which moved from 2.6% to 2.8%. These shifts provided a more hawkish tone than previous meetings and caused the market to trade down off the intra-day highs on the day.

US Personal Consumption Expenditures (PCE), which is the FOMC’s preferred measure of inflation, was released on the last day of trading of June. Year-over-year PCE was announced at 2.6%, in line with the 2.6% expectation and lower than the previous month’s reading of 2.7%. A rise in the cost of Services continued to be the majority of the reading, followed by the cost of Nondurable Goods. The cost to Nonprofits also contributed. The cost of durable goods continued to be the only deflationary component of year-over-year PCE. The 0.0% month-over-month PCE was also in line with expectations and lower than previous month’s reading which was 0.3%. This was the first zero reading since November 2023. A rise in the cost of Services was the only component with a positive value. Overall, this month’s inflation readings may provide more confidence to the FOMC that inflation is moving sustainably toward 2%.

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

6.2% | 17.3% | 30.4% | 18.5% |

| S&P 500 | 3.6% | 15.0% | 24.0% | 12.2% |

Relative |

2.6% | 2.0% | 5.2% | 5.6% |

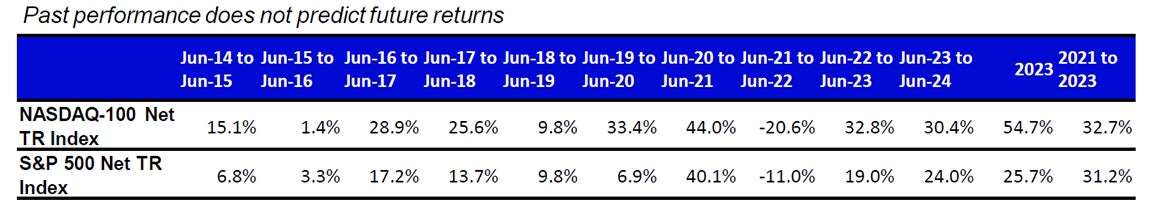

Performance as of 30 June 2024. Past performance does not predict future results.

Source: Bloomberg as of 30 June 2024.

An investment cannot be made directly into an index.

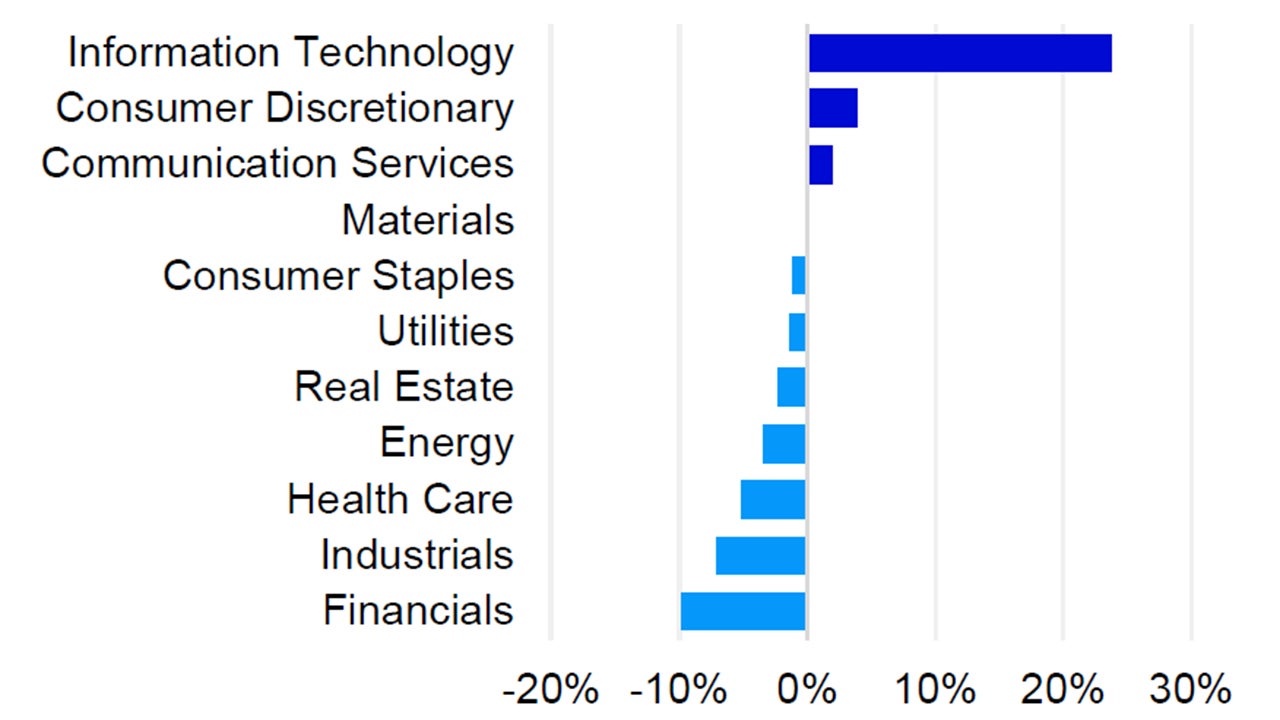

While the Nasdaq-100 specifically excludes Financials, it also currently offers very little exposure to Basic Materials, Energy, and Real Estate

Source: Invesco, FactSet as of 30 June 2024. Data in USD

Nasdaq 100 Performance Drivers

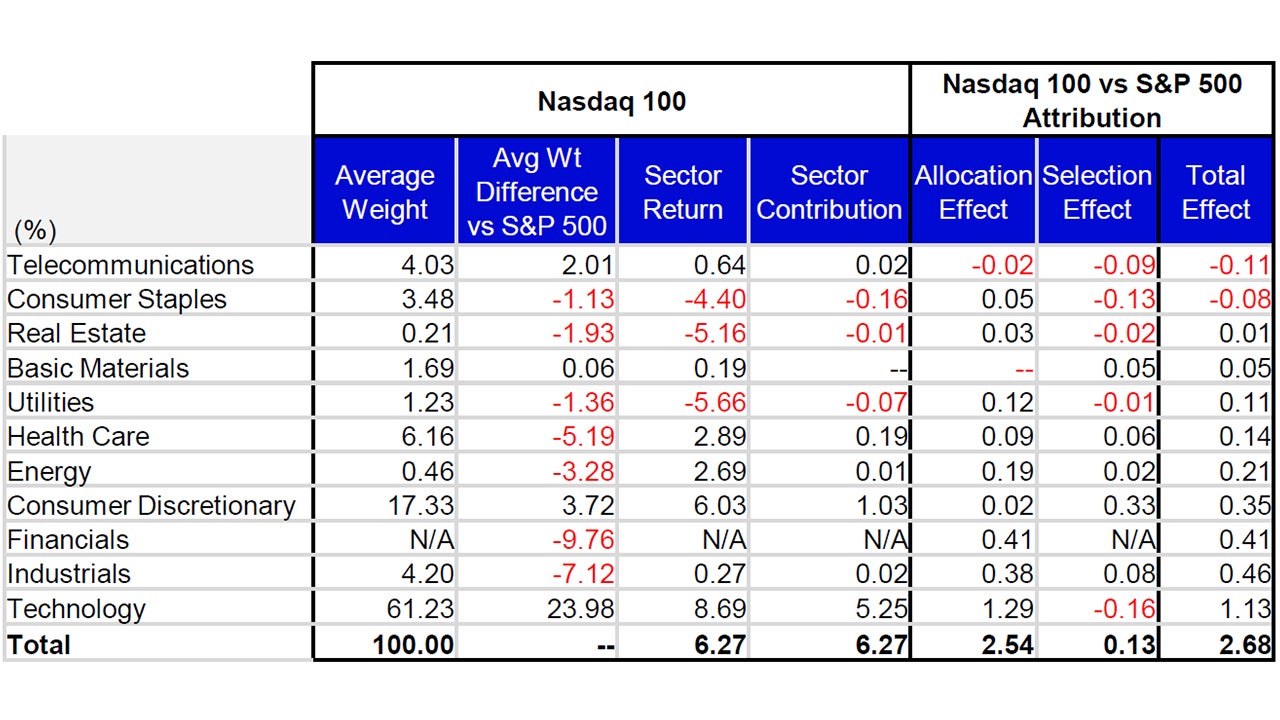

June’s performance attribution of the Nasdaq-100 (NDX) vs the S&P 500 Index

From a sector perspective, Technology, Consumer Discretionary, and Health Care were the best-performing sectors in NDX and returned 8.69%, 6.03%, and 2.89%, respectively. During the month, these three sectors had average weights of 61.23%, 17.33%, and 6.16%, respectively. The bottom performing sectors in NDX were Utilities, Real Estate and Consumer Staples with average weights of 1.23%, 0.21% and 3.48%, respectively. Utilities returned -5.66%, Real Estate returned -5.16% while Consumer Staples returned -4.40%.

NDX’s outperformance vs. the S&P 500 was driven by its overweight exposure in the Technology sector. The ETF’s underweight exposure and lack of exposure to the Financials sector was the third contributor to relative performance vs. the S&P 500. The Telecommunications sector detracted the most from relative performance and was driven by its overweight exposure and differentiated holdings. Differentiated holdings in the Consumer Staples sector also detracted from relative performance to the S&P 500. These were the only two sector exposures in NDX that detracted from relative vs. the S&P 500.

NDX Contributor/Detractor Spotlight: Adobe: Adobe performed well during the month of June with a positive earnings announcement being the primary catalyst. Revenue was announced at $5.31 billion vs. the estimate of $5.29 billion. Revenue from their Digital Media and Digital Experience segments beat estimates as total revenue grew 12.4% year-over-year. Adjusted earnings-per-share also exceed expectations and was announced at $4.48 vs. the $4.40 consensus. An upgrade to next quarter’s and the company’s full fiscal year financial forecasts also contributed to the stock’s move up. The software company is expecting adjusted earnings-per-share of $4.50 - $4.55, up from $4.48. For the full fiscal year, Adobe raised expected revenue from $21.46 billion to $21.50 billion. The company noted that they have seen an acceleration of subscribers upgrading their plans to access their artificial intelligence (AI) enabled services. At the center of this is Firefly, a family of generative AI models that integrates into several of their existing software such as Photoshop, Illustrator and Lightroom. Adobe has showcased the capabilities of Firefly which range from creating images from text, removing items from images and even creating full videos. Investors saw Adobe’s stock rise 14.5% the day after the earnings announcement and rise another 5% by the end of the month.

Data: Invesco, FactSet, as of 30 June 2024 Data in USD. Sectors: ICB Classification. All figures in percentage terms. Market allocation effect shows the excess contribution due to sector/market allocation. A positive allocation effect implies that the choice of sector weights in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Selection effect shows the excess contribution due to security selection. A positive selection effect implies that the choice of stocks in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Total effect is the difference in contribution between the benchmark and portfolio.

Source: Bloomberg, as of 30 June 2024. Past performance does not predict future returns. Top and bottom performers for the month by relative performance. Holdings are subject to change and are not buy/sell recommendations

Data: Invesco, Bloomberg, as of 30 June 2024. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.