Nasdaq 100 Index – Commentary - March 2024

Key Highlights

Equities finished March in positive territory amongst a CPI print that came in higher than expected and the Federal Open Market Committee’s decision of “no change” to the current target rate.

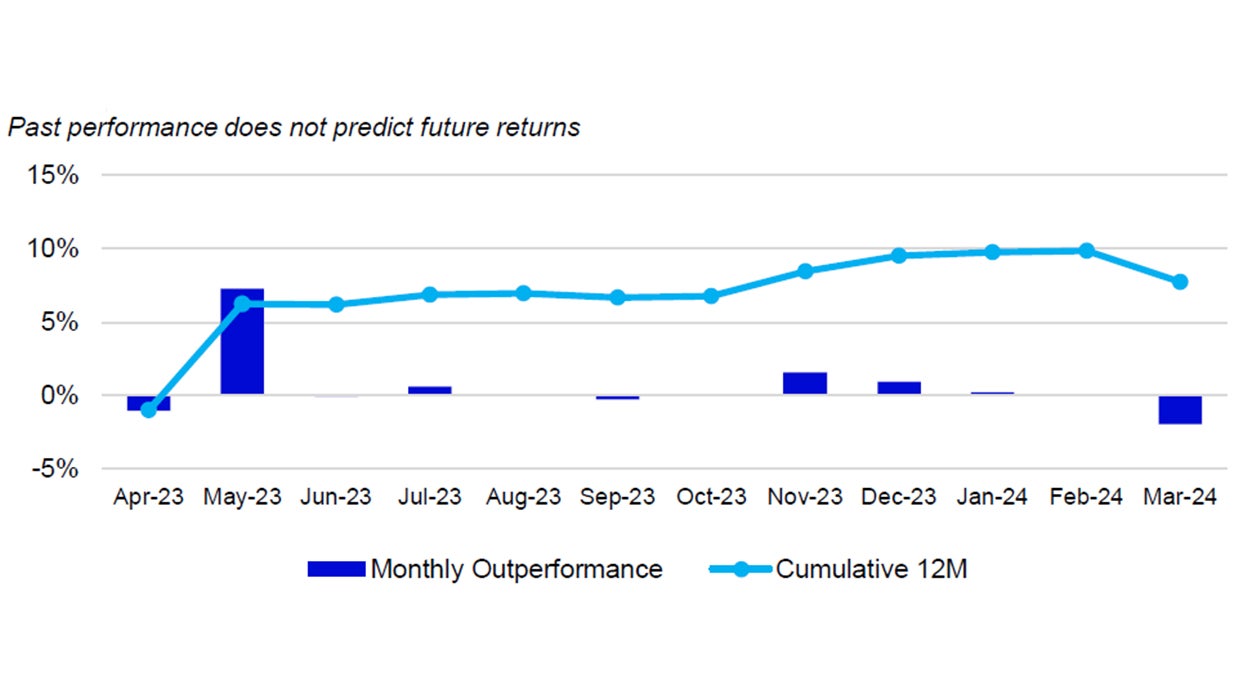

For the month of March, the Nasdaq-100 Index (NDX) returned 1.2% underperforming the S&P 500 Index which returned 3.2%.

US Market Recap

Equities finished March in positive territory, being led by Value-oriented stocks, as the Russell 1000 Value Index outperformed both NDX (Nasdaq 100) and the S&P 500. The positive monthly returns contributed to the performance seen for the first quarter of 2024 where NDX returned 8.7%, underperforming the 10.4% return of the S&P 500 Index.

The Federal Open Market Committee’s (FOMC) March meeting was held over the 19th and 20th and led to the rate decision that investors were expecting: no change to the current target rate. The upper-end of the target stayed at 5.50% where it has stood since July of last year. Fed Chairman Jerome Powell’s hawkish comments at the previous meeting allowed investors to further digest the idea of “higher rates for longer.” A new Statement of Economic Projections (SEP) was released this meeting and showed changes to the FOMC’s dot pot. The dot plot illustrates the future target rate expectations of committee members, and it had a slightly more hawkish tilt than the previous plot. While the current year expectations held at potentially three cuts in 2024, 2025 saw a shift up in the median target rate forecast. This may imply that the FOMC might not cut as quickly to ultimately get to what they believe is the neutral target rate, a target rate that is neither restrictive nor accommodative.

However, statements during the post-meeting press conference were interpreted as dovish and led equities to new all-time highs. Powell stated that “the risks are really two-sided here” implying that lowering rates too quickly may lead to higher inflation returning, while keeping rates restrictive for too long may have a negative effect on employment. Although the FOMC has always had a dual mandate of stable inflation and employment, reigning in inflation had become the more important goal over the past few years. This messaging may be a signal of a more balanced approach between the two mandates. Powell also answered a question on the uptick seen in the most recent inflation readings and stated that “there’s reason to think that there could be seasonal effects there.” The chairman also stated that the path down to the 2% target inflation rate may have bumps along the way. This eased many investors’ fears of rate cuts arriving even later than expected or a larger shift to a rate hike. The last comment that encouraged equities to move higher was Powell stating that he believed financial conditions were tight. Recent readings have showed conditions easing to levels seen at the beginning of 2022. Investors saw the S&P 500 close above 5200 for the first time ever on the day of the FOMC meeting.

The Consumer Price Index (CPI) monthly reading was released on the 12th and showed year-over-year inflation higher than analysts’ expectations. Inflation came in at 3.2%, higher than the 3.1% estimate and 3.1% reading of the previous month. A rise in the cost of Core Services continued to be lion’s share of the reading with the Cost of Food also contributing to the rise. The cost of Energy and Core Goods fell on a year-over-year basis.

Month-over-month CPI was announced in line with the street’s expectation of 0.4%. This reading was the highest month-over-month reading since October of last year. This was also the first reading since April of 2023 where all components, Food, Energy, Core Goods and Core Services, rose. The cost of Core Services and Energy were the largest contributors to the rise in month-over-month inflation.

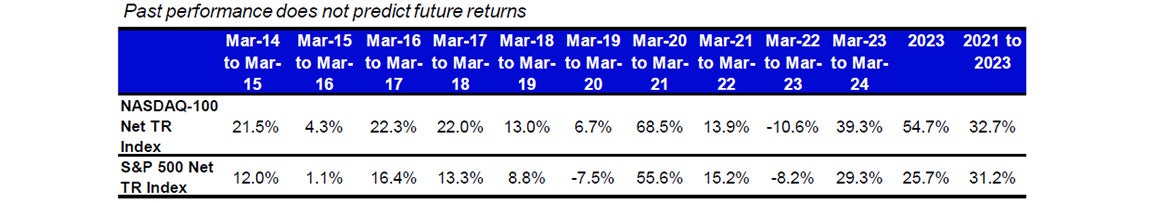

Performance as of 31 Mar 2024. Past Performance does not predict future returns.

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

1.2% | 8.7% | 39.3% | 18.5% |

| S&P 500 | 3.2% | 10.4% | 29.3% | 12.3% |

Relative |

-1.9% | -1.6% | 7.7% | 5.5% |

An investment cannot be made directly into an index.

Source: Bloomberg as of 31 Mar 2024.

An investment cannot be made directly into an index.

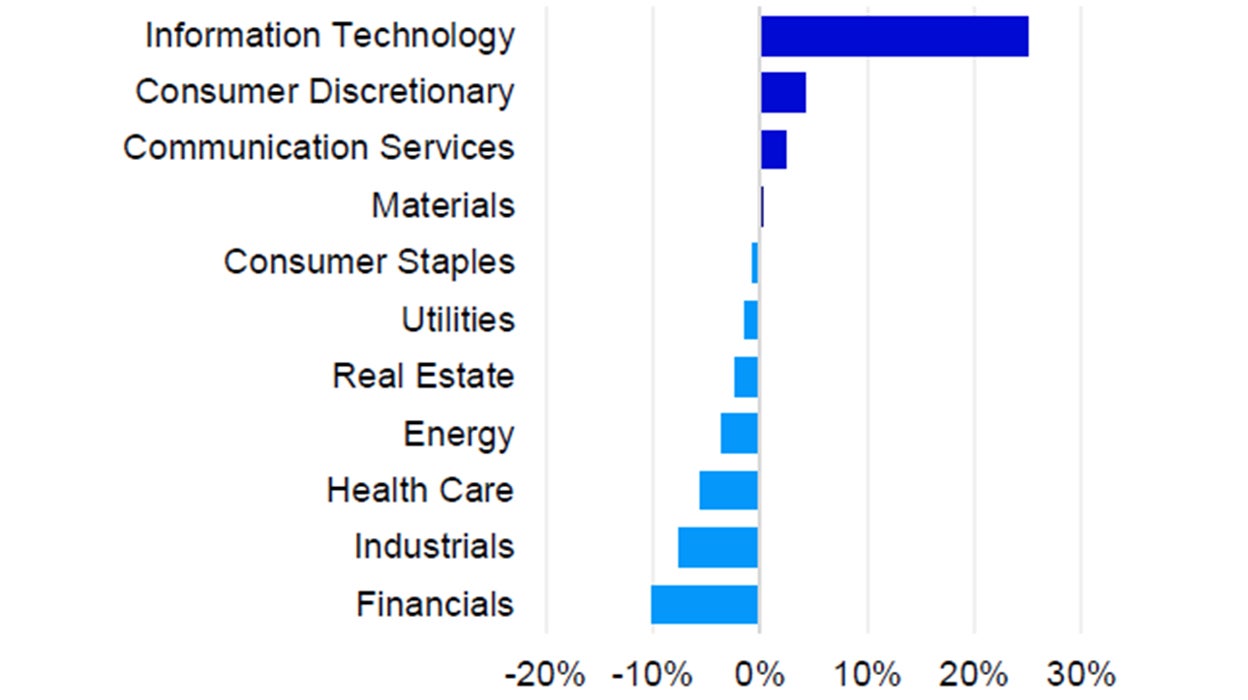

While the Nasdaq-100 specifically excludes Financials, it also currently offers very little exposure to Basic Materials, Energy, and Real Estate

Source: Invesco, FactSet as of 31 Mar 2024. Data in USD

Nasdaq 100 Performance Drivers

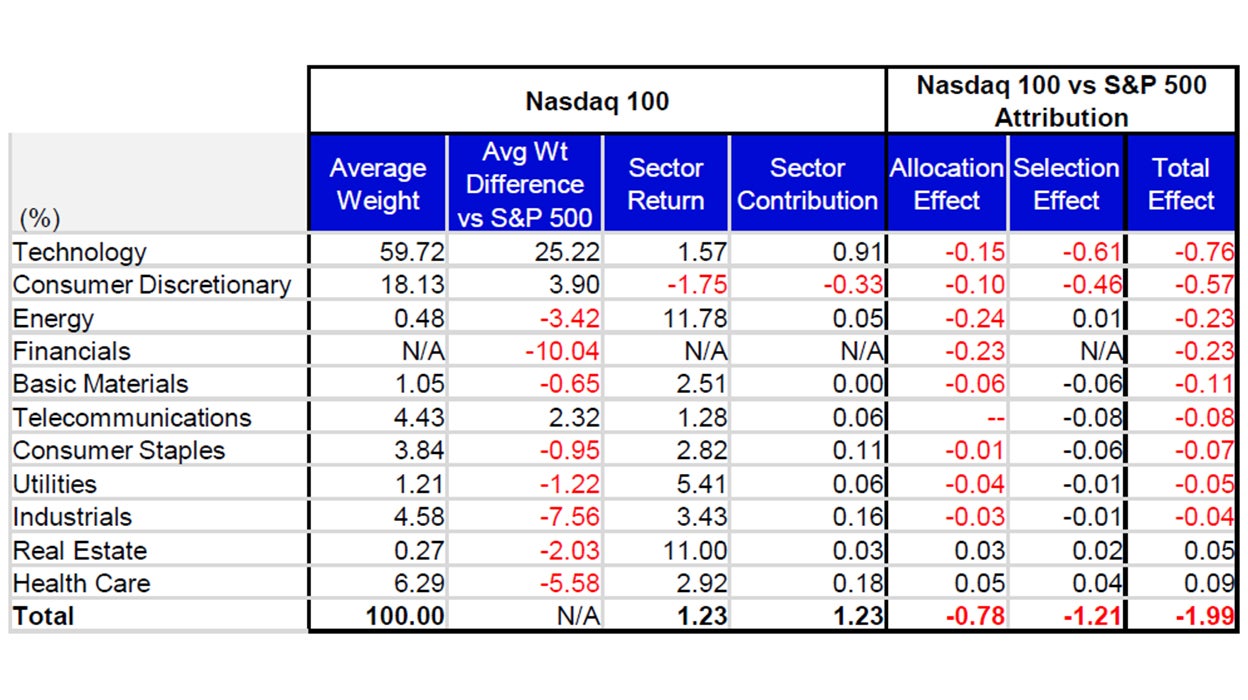

March’s performance attribution of the Nasdaq 100 (NDX) vs the S&P 500 Index

From a sector perspective, Energy, Real Estate and Utilities were the best performing sectors in NDX and returned 11.78%, 11.00% and 5.41%, respectively. During the month, these three sectors had average weights of 0.48%, 0.27% and 1.21%, respectively. The bottom performing sectors in NDX were Consumer Discretionary, Telecommunications and Technology with average weights of 18.13%, 4.43% and 59.72%, respectively. Consumer Discretionary returned -1.75%, Telecommunications returned 1.28% while Technology returned 1.57%.

NDX’s underperformance vs. the S&P 500 was driven by its overweight exposure and differentiated holdings in the Technology sector. The ETF’s overweight exposure and differentiated holdings in the Consumer Discretionary sector also detracted from relative performance. Underweight exposure in the Energy sector was the third detractor to relative performance vs. the S&P 500. The Health Care sector contributed the most to relative performance and was driven by its differentiated holdings and underweight exposure. Underweight exposure and differentiated holdings in the Real Estate sector also contributed to relative performance to the S&P 500.

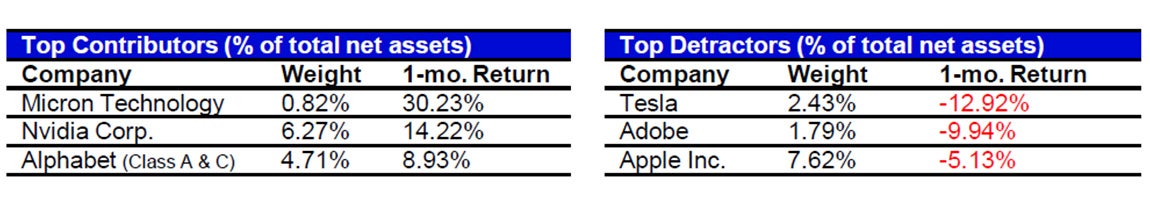

NDX Contributor/Detractor Spotlight: A favorable quarterly earnings announcement was the primary driver of Micron Technology’s strong performance during the month of March. Analysts were expecting a $0.24 loss but the semiconductor company surprised investors with a positive $0.42 adjusted earnings-per-share. This was the first time Micron reported positive earnings-per-share since the fourth quarter of 2022. Revenue also surprised to the upside and came in at $5.82 billion vs. the $5.35 billion expectation. Micron saw revenue from all its major business units outperform the estimates that analysts had in place. The company also raised guidance for next fiscal quarter’s revenue to $6.6 billion, 10% higher than the $6.02 billion analyst expectation. Micron has become one of the largest memory chip manufacturers and storage solutions providers in the world. Their products are used in several technologies such as artificial intelligence, 5G, autonomous vehicles and data centers. The company stated on their earnings call that they believe Micron will be one of the biggest beneficiaries in the semiconductor industry as the AI-enabled opportunity continues over the coming years. Micron’s stock rose over 14% the following trading session.

Data: Invesco, FactSet, as of 31 Mar 2024 Data in USD. Sectors: ICB Classification. All figures in percentage terms. Market allocation effect shows the excess contribution due to sector/market allocation. A positive allocation effect implies that the choice of sector weights in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Selection effect shows the excess contribution due to security selection. A positive selection effect implies that the choice of stocks in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Total effect is the difference in contribution between the benchmark and portfolio.

Source: Bloomberg, as of 31 Mar 2024. Past performance does not predict future returns. Top and bottom performers for the month by relative performance. Holdings are subject to change and are not buy/sell recommendations

Data: Invesco, Bloomberg, as of 31 Mar 2024. Data in USD.

An investment cannot be made directly into an index.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.