Nasdaq 100 Index – Commentary - May 2024

Key Highlights

Equities finished May in positive territory amongst a CPI print that was in line with expectations and the Federal Open Market Committee’s hawkish stance.

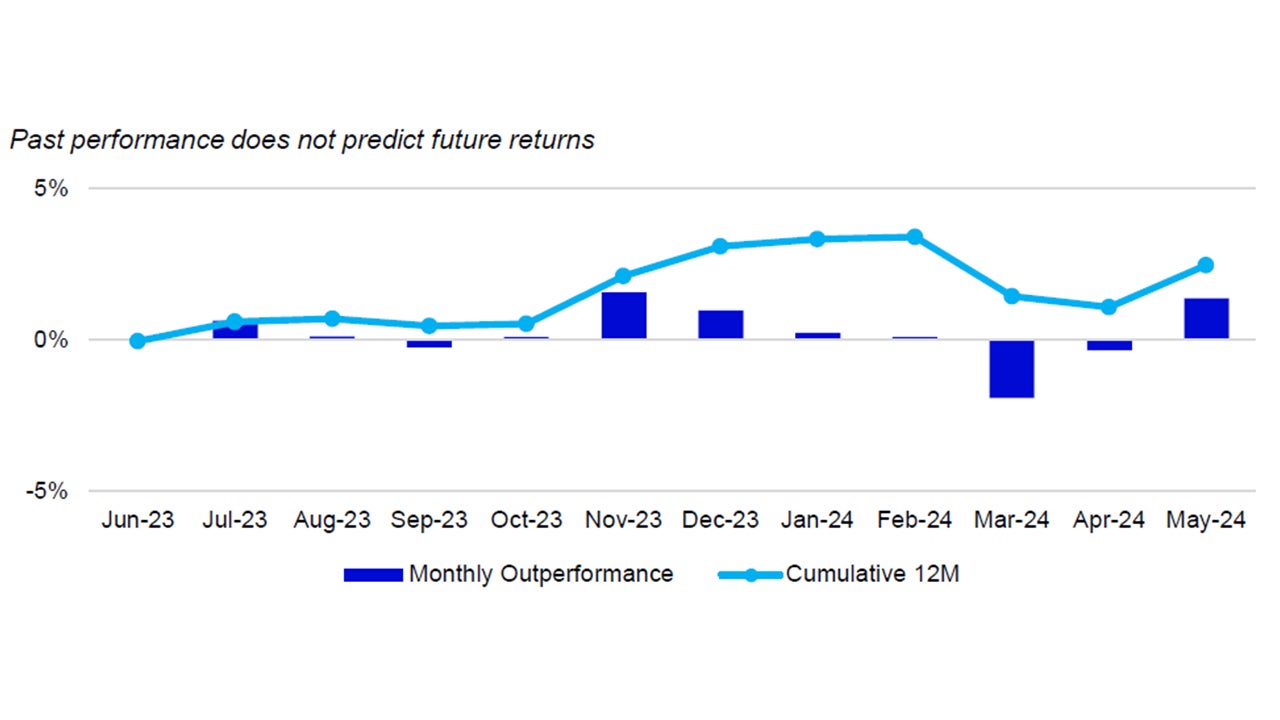

For the month of May, the Nasdaq-100 Index (NDX) returned 6.4%outperforming the S&P 500 Index which returned 4.9%.

US Market Recap

The equity indices found short term support at the April lows and proceeded to move upward during the month of May. The S&P 500 and the Nasdaq-100 managed to mitigate losses from the recent pullback and set new all-time highs before finishing the month slightly lower than these levels. Market moving events during the month included the May, US Federal Open Market Committee (FOMC) meeting, the most recent inflation readings, and the US ISM Services PMI data release.

The US FOMC held their third meeting of the year, and as expected, left the target Fed Fund’s rate between 5.25% - 5.50%. With inflation not falling as quickly as last year, expectations for the first rate cut of this cycle had been pushed further back into the year. At the end of 2023, the first-rate cut was expected to arrive at the March meeting. After the May 1st FOMC meeting, Bloomberg showed Fed Fund’s futures expected the first rate cut not to arrive until November. The US Federal Reserve (Fed) noted in its official statement that lack of continued progress in bringing inflation to its 2% target showed that rate cuts would not be appropriate in the near term.

As usual, much attention was given to the press conference with US Fed Chairman Jerome Powell following the meeting. Powell stated that the inflation data that had been reported so far this year had not given them the greater confidence needed to start cutting rates. The Chairman addressed questions around the labor market as well and stated that the Fed was prepared to respond to “unexpected weakness” in the job market. Powell also commented on rising concerns around stagflation as market readings have shown slowing growth. He stated that he did not understand “Where that’s coming from,” and added, “I don’t see the ‘stag’ or the ‘-flation’.” Powell did state that it is unlikely that the next policy decision would be another rate hike. Ultimately, the statement and comments from the press conference were interpreted as hawkish, with the S&P 500 finishing the day -0.34%.

On May 15th, the US Consumer Price Index (CPI) reading was released and provided a boost to equities. Year-over-year Inflation came in at 3.4%, in line with estimates and below the 3.6% reading of the previous month. Core CPI, which excludes the costs of Food an Energy, rose at a year-over-year rate of 3.6%. Looking at the components of headline CPI, a rise in the cost of Core Services continued to be the largest contributor to the year-over-year numbers with rises in the cost of Energy and the cost of Food also contributing. The cost of Core Goods fell and marked the fourth month in a row of declines.

Month-over-month US CPI was announced below the street’s expectation of 0.4% and came in at 0.3%. The cost of Core Services was the largest contributor to the month-over-month increase, followed by an increase in the cost of Energy and slight rise in the cost of Food. The cost of Core Goods fell for the second reading in a row. The lower-than-expected reading was welcomed by equity investors as the S&P 500 rose 1.19% on the day, with NDX outperforming which returned 1.51%.

US ISM Services PMI, which is a sentiment gauge among purchasing managers, showed another monthly decline down to 49.4. Like similar indicators, a reading below 50 would indicate a slowdown or contraction in business activity. This was the first time ISM Services PMI reading below 50 since December of 2022. However, many investors took this as positive news, since the cost of Services has been a primary driver of inflation, hoping the slowdown may lead to costs falling.

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

6.4% | 10.4% | 30.8% | 18.2% |

| S&P 500 | 4.9% | 11.1% | 27.6% | 12.2% |

Relative |

1.4% | -0.6% | 2.5% | 5.5% |

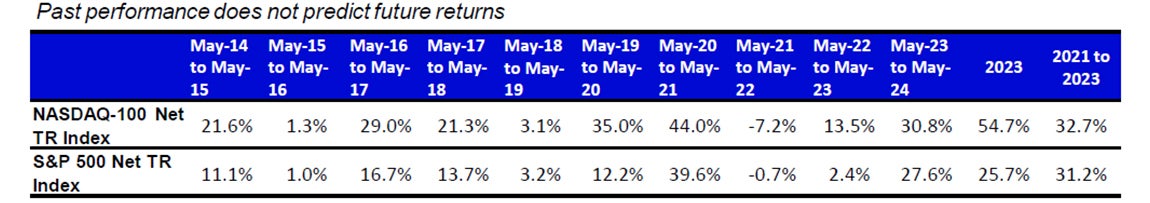

Performance as of 31 May 2024. Past performance does not predict future results.

Source: Bloomberg as of 31 May 2024.

An investment cannot be made directly into an index.

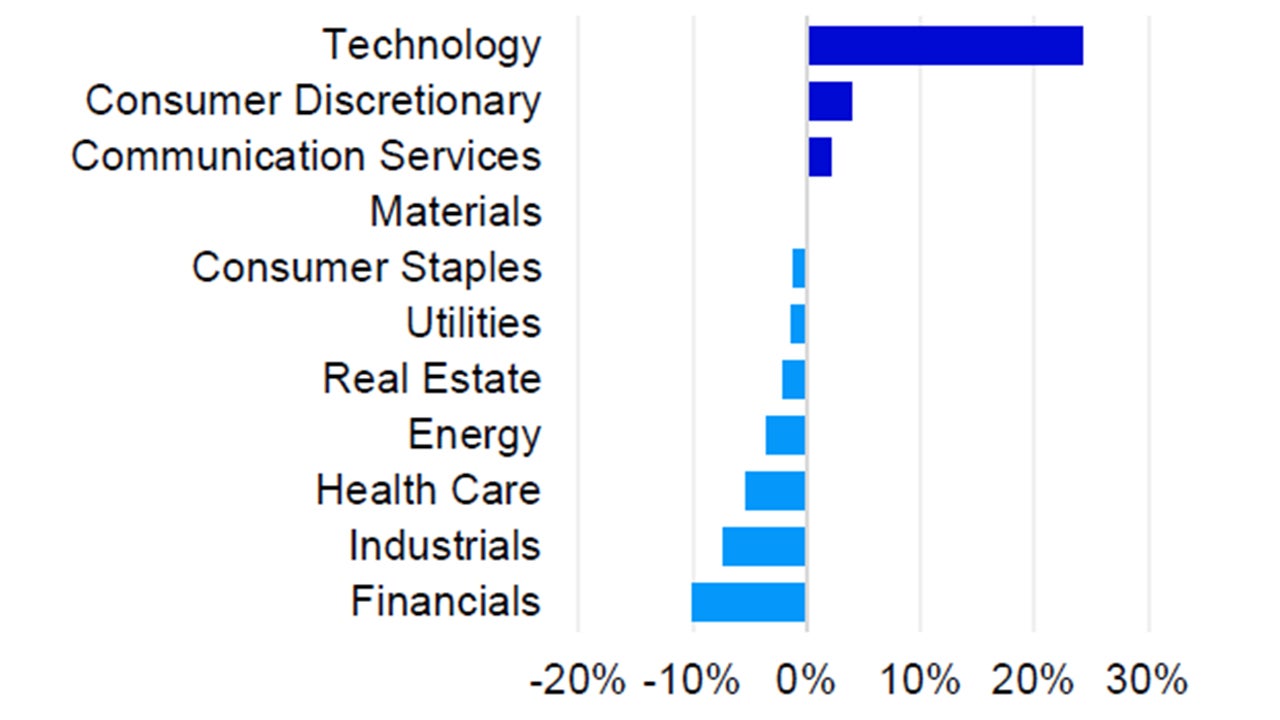

While the Nasdaq-100 specifically excludes Financials, it also currently offers very little exposure to Basic Materials, Energy, and Real Estate

Source: Invesco, FactSet as of 31 May 2024. Data in USD

Nasdaq 100 Performance Drivers

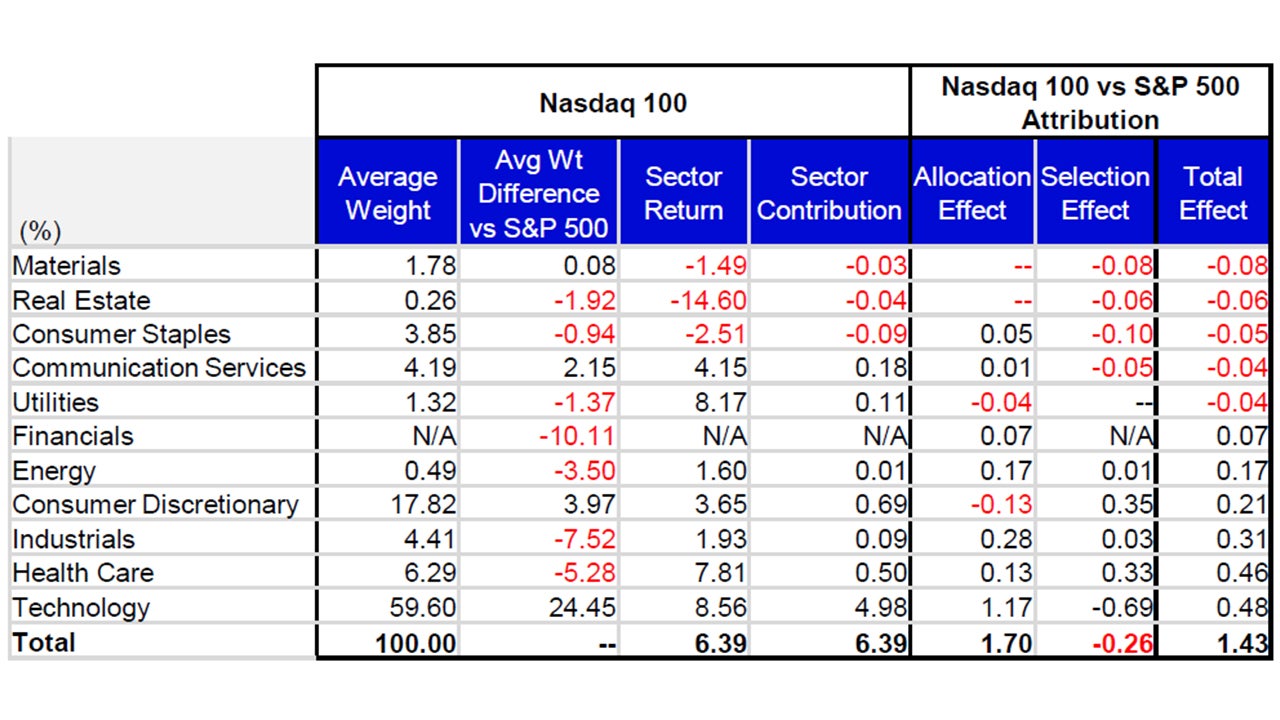

May’s performance attribution of the Nasdaq-100 (NDX) vs the S&P 500 Index

From a sector perspective, Technology, Utilities and Health Care were the best performing sectors in NDX and returned 8.56%, 8.17% and 7.81%, respectively. During the month, these three sectors had average weights of 59.60%, 1.32% and 6.29%, respectively. The bottom performing sectors in NDX were Real Estate, Consumer Staples and Basic Materials with average weights of 0.26%, 3.85% and 1.78%, respectively. Real Estate returned -14.60%, Consumer Staples returned -2.51% while Basic Materials returned -1.49%.

NDX’s outperformance vs. the S&P 500 was driven by its overweight exposure in the Technology sector. The index’s underweight exposure and differentiated holdings in the Health Care sector also contributed from relative performance. Underweight exposure and differentiated holdings in the Industrials sector was the third contributor to relative performance vs. the S&P 500. The Basic Materials sector detracted the most to relative performance and was driven by its differentiated holdings. Differentiated holdings in the Real Estate sector, along with differentiated holdings the Consumer Staples sector, also detracted to relative performance to the S&P 500.

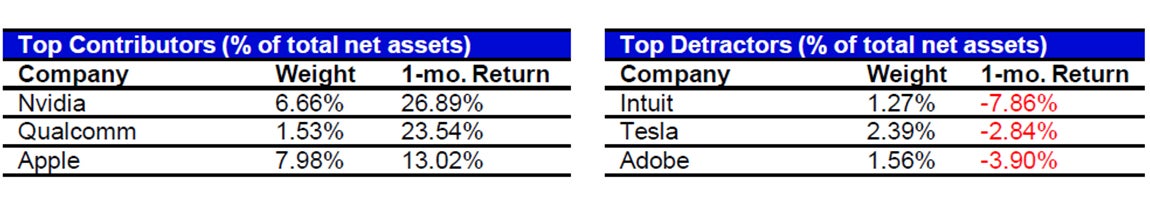

NDX Contributor/Detractor Spotlight: Nvidia: Nvidia’s quarterly earnings announcement proved to be another market moving event as the artificial intelligence (AI) chipmaker’s results surprised to the upside. Revenue beat expectations coming in at $26.04 billion vs. the estimate of $24.69 billion, while adjusted earnings-per-share was $6.12 vs. the estimate of $5.65. Data center revenue was $22.56 billion and grew nearly 23% quarter-over-quarter. Nvidia’s earnings release in the first quarter in 2023 was the catalyst that moved AI into the spotlight. The company has spent over $8 billion in research and development during previous twelve months to remain at the forefront of the new industry. Also notable from the earnings call, Nvidia announced a 10-for-1 stock split. This meant that for every one share of Nvidia’s stock a shareholder owned at the end of the day on June 6th, they owned ten shares after the split became effective after the close on June 7th. The per-share price was also divided by a factor of ten to account for the change in outstanding shares. The split-adjusted price became effective on Monday, June 10th. Nvidia’s stock rose 9.3% the day following the earnings call. Market capitalization of Nvidia stood at $2.70 billion at the end of May, making it one of four companies in the world with a market capitalization over $2 billion.

Data: Invesco, FactSet, as of 31 May 2024 Data in USD. Sectors: ICB Classification. All figures in percentage terms. Market allocation effect shows the excess contribution due to sector/market allocation. A positive allocation effect implies that the choice of sector weights in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Selection effect shows the excess contribution due to security selection. A positive selection effect implies that the choice of stocks in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Total effect is the difference in contribution between the benchmark and portfolio.

Source: Bloomberg, as of 31 May 2024. Past performance does not predict future returns. Top and bottom performers for the month by relative performance. Holdings are subject to change and are not buy/sell recommendations

Data: Invesco, Bloomberg, as of 31 May 2024. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.