Nasdaq 100 Index – Commentary - September 2024

Key Highlights

Equities finished September in positive territory, amid cooling inflation and a steady US employment market.

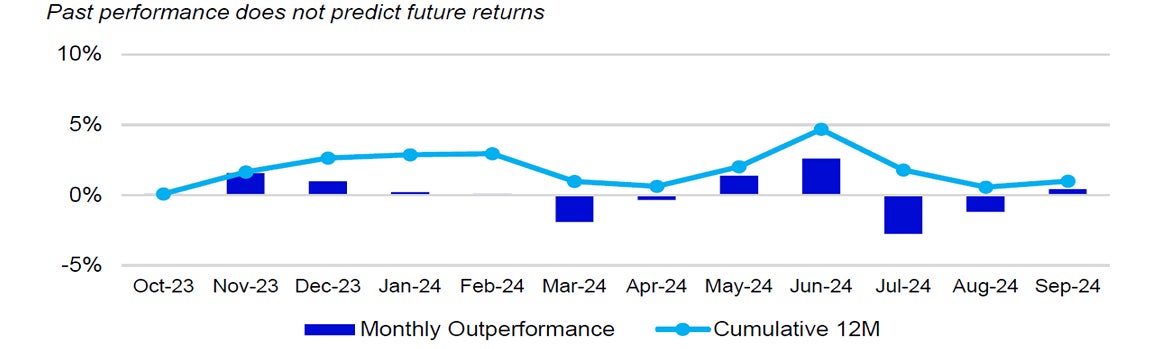

For the month of September, the Nasdaq-100 Index (NDX) returned 2.5%, outperforming the S&P 500 Index, which returned 2.1%.

US Market Recap

Equities continued their march upwards during the month of September as the S&P 500 printed new all-time-highs. After a brief spike in the beginning of the month, volatility continued to settle back to historical norms as the VIX Index, a commonly used gauge of volatility in U.S. equities, finished the month around 16.7. Shifts in policy from the US FOMC (Federal Open Market Committee), cooling inflation and a steady U.S. employment market were the primary drivers for many investors in September.

On September 18th, the US FOMC made their official shift in policy as they announced a 0.50% cut to the Fed Funds Target Rate. The range for the Target Rate was moved to 4.75% - 5.00%. While many investors anticipated at least one 0.25% rate cut, the real question was whether or not the US FOMC would cut 0.50%. Prior to the meeting, Fed Fund futures on Bloomberg indicated a 60% chance of the larger rate cut. Conversely, many surveyed analysts expected 0.25%. The divergence between these two contributed to high volatility when the announcement was made. Wide swings, both to the upside and downside, in the S&P.

The most recent US Consumer Price Index (CPI) reading was released on September 11th and continued to show falling inflation. Both the year-over-year and month-over-month readings were reported in line with expectations. Year-over-year inflation was reported at 2.5%, below the prior reading of 2.9%. Core CPI, which excludes the costs of Food and Energy, remained at 3.2%, the same as the prior reading. There was a rise in the cost of Core Services, which continued to be the largest contributor to the year-over-year reading. An increase was also seen in the cost of Food. The cost of Core Goods continued to fall and was joined by falling costs in Energy. This was the first decrease in the cost of Energy since the January 2024 reading. 500 of fifty points or more were experienced multiple times during the remainder of that day.

US Unemployment was reported during the first week of the month and saw the rate drop from 4.3% to 4.2%, easing some concerns that had arisen the previous month. Contributors to the decrease primarily came from a fall in temporary layoffs and people reentering the work force.

Innovator Spotlight

Artificial Intelligence has been one of the most, if not the most, popular theme in today’s global economy. What flies under the radar is the amount of energy needed to power this theme. The rise in “Big Tech” in general has led to a sudden surge in electricity demand and the need to expand into efficient energy supply has become necessary. On September 20th, Microsoft signed a power deal to help resurrect a unit of the Three-Mile Island nuclear plant in Pennsylvania. Nuclear energy has become a popular option for technology companies since it is nearly carbon-free and is may be a more reliable energy source than solar and wind.

If the deal is approved by regulators, Microsoft would have exclusive rights to all the energy output for its AI data center needs. The plant that is planned to be reopened can generate 837 megawatts of energy, enough to power more than 800,000 homes- underscoring the huge amount of power needed for data centers and Microsoft’s ambitions in the AI space. “This agreement is a major milestone in Microsoft’s efforts to help decarbonize the grid in support of our commitment to become carbon negative,” says Bobby Hollis, vice president of energy at Microsoft.

| 1M | YTD | 1Y | 10Y(ann.) | |

|---|---|---|---|---|

NASDAQ-100 |

2.5% | 19.7% | 37.1% | 18.2% |

| S&P 500 | 2.1% | 21.7% | 35.8% | 12.8% |

Relative |

0.4% | -1.6% | 1.0% | 4.8% |

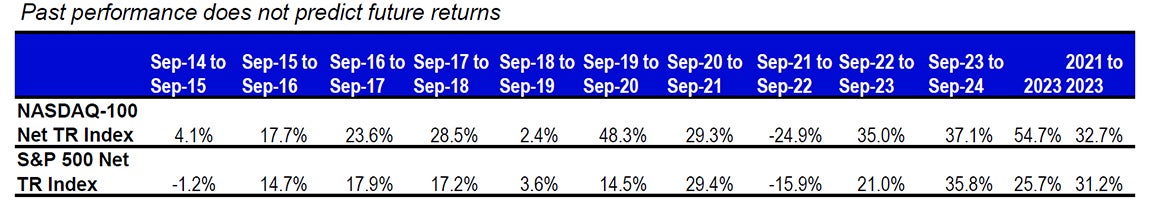

Performance as of 30 Sep 2024. Past performance does not predict future results. Innovator spotlight source: Reuters 9/21/2024

Source: Bloomberg as of 30 Sep 2024.

An investment cannot be made directly into an index.

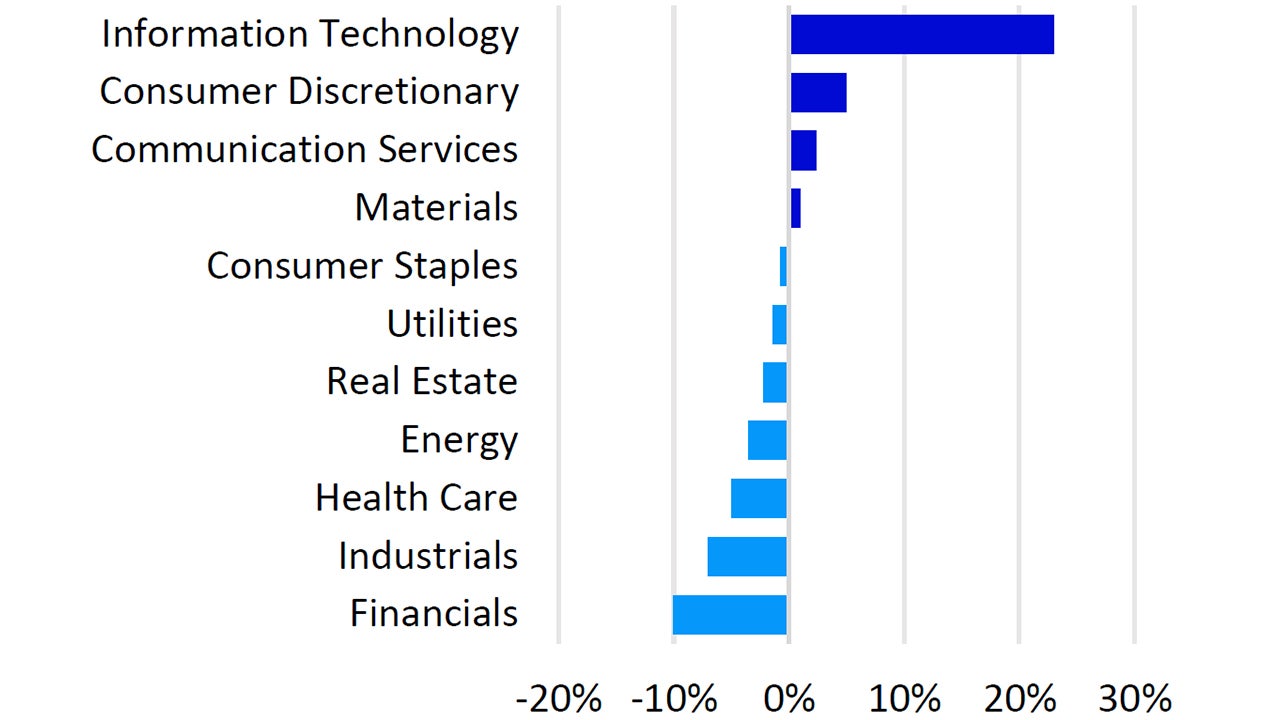

While the Nasdaq-100 specifically excludes Financials, it also currently offers very little exposure to Basic Materials, Energy, and Real Estate

Source: Invesco, FactSet as of 30 Sep 2024. Data in USD

Nasdaq-100 Performance Drivers

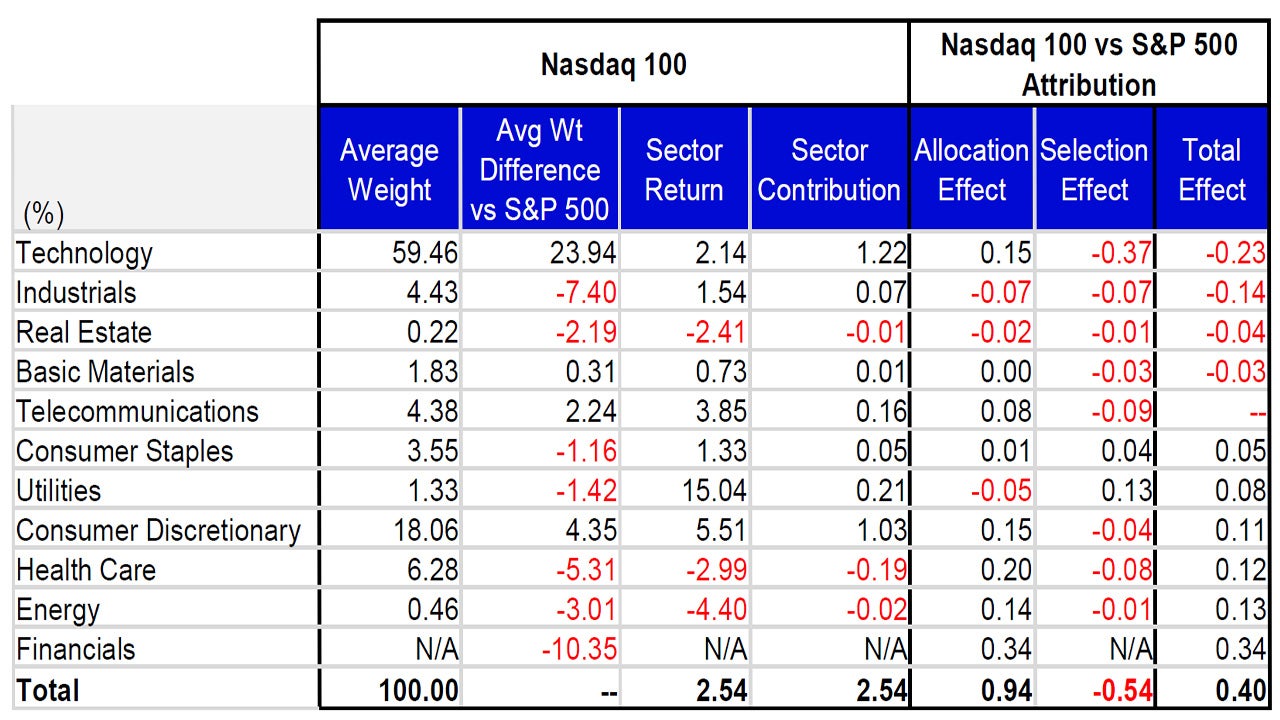

September’s performance attribution of the Nasdaq-100 (NDX) vs the S&P 500 Index

From a sector perspective, Utilities, Consumer Discretionary and Telecommunications were the best performing sectors in NDX and returned 15.04%, 5.51% and 3.85%, respectively. During the month, these three sectors had average weights of 1.33%, 18.06% and 4.38%, respectively. The bottom performing sectors in NDX were Energy, Health Care and Real Estate which had average weights of 0.46%, 6.28% and 0.22%, respectively. Energy returned -4.40%, Health Care returned -2.99% while Real Estate returned -2.41%.

NDX’s outperformance vs. the S&P 500 was driven by its lack of exposure in the Financials sector. Despite being the worst performing sector in NDX, underweight exposure in the Energy sector was the second contributor to outperformance. NDX’s underweight exposure to the Health Care sector also contributed to relative performance. Differentiated holdings in the Technology sector was the largest detractor from relative performance vs. the S&P 500. This was following by the Industrials and Real Estate sector, both detracting due to underweight exposure and differentiated holdings.

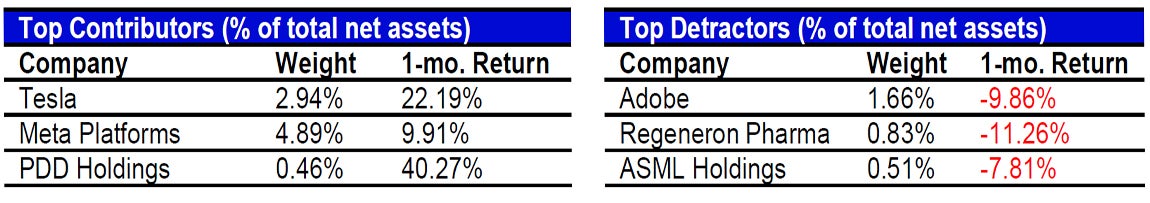

NDX Contributor/Detractor Spotlight- Tesla: The move up in Tesla’s stock for September brought its performance back to positive territory for the year. The electric vehicle company’s stock has underperformed to overall market in 2024, returning 5.3% year-to-date at the end of September. A positive forecast for third quarter deliveries contributed to the stock’s positive move for the month as analysts wrote that they were expecting higher-than-expected deliveries. Many investors were also excited for the unveiling of the Tesla’s autonomous taxi service set to be revealed in October. The EV automaker has struggled due to slowing sales and increased competition.

Data: Invesco, FactSet, as of 30 September 2024 Data in USD. Sectors: ICB Classification. All figures in percentage terms. Market allocation effect shows the excess contribution due to sector/market allocation. A positive allocation effect implies that the choice of sector weights in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Selection effect shows the excess contribution due to security selection. A positive selection effect implies that the choice of stocks in the portfolio added value to the portfolio contribution with respect to the benchmark and vice versa. Total effect is the difference in contribution between the benchmark and portfolio.

Source: Bloomberg, as of 30 Sep 2024. Past performance does not predict future returns. Top and bottom performers for the month by relative performance. Holdings are subject to change and are not buy/sell recommendations

Data: Invesco, Bloomberg, as of 30 Sep 2024. Data in USD.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular sector, such as technology, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.