Opportunities in digital asset ETFs: Blockchain and bitcoin

What are digital assets and surrounding ecosystems?

Digital assets are blockchain-based, decentralized assets that have evolved from simple cryptocurrencies like bitcoin to a diverse array of products that utilize innovative technology backed by blockchains. They operate on peer-to-peer networks, use decentralized ledgers for information storage, and aim to leverage the security, resilience, and scalability of decentralized networks. These assets range from cryptocurrencies, to tokenized money and investment products that represent real-world assets like stocks, bonds, or real estate. A myriad of supporting financial institutions, technology companies and even manufacturing companies have helped to make innovation and progress in digital assets possible. Digital assets offer a broad spectrum of both direct and indirect investment opportunities through this ecosystem. Altogether, this emerging asset class and its economy is worth nearly US $2 trillion in market capitalization1, or around half the size of all USD cash in circulation.

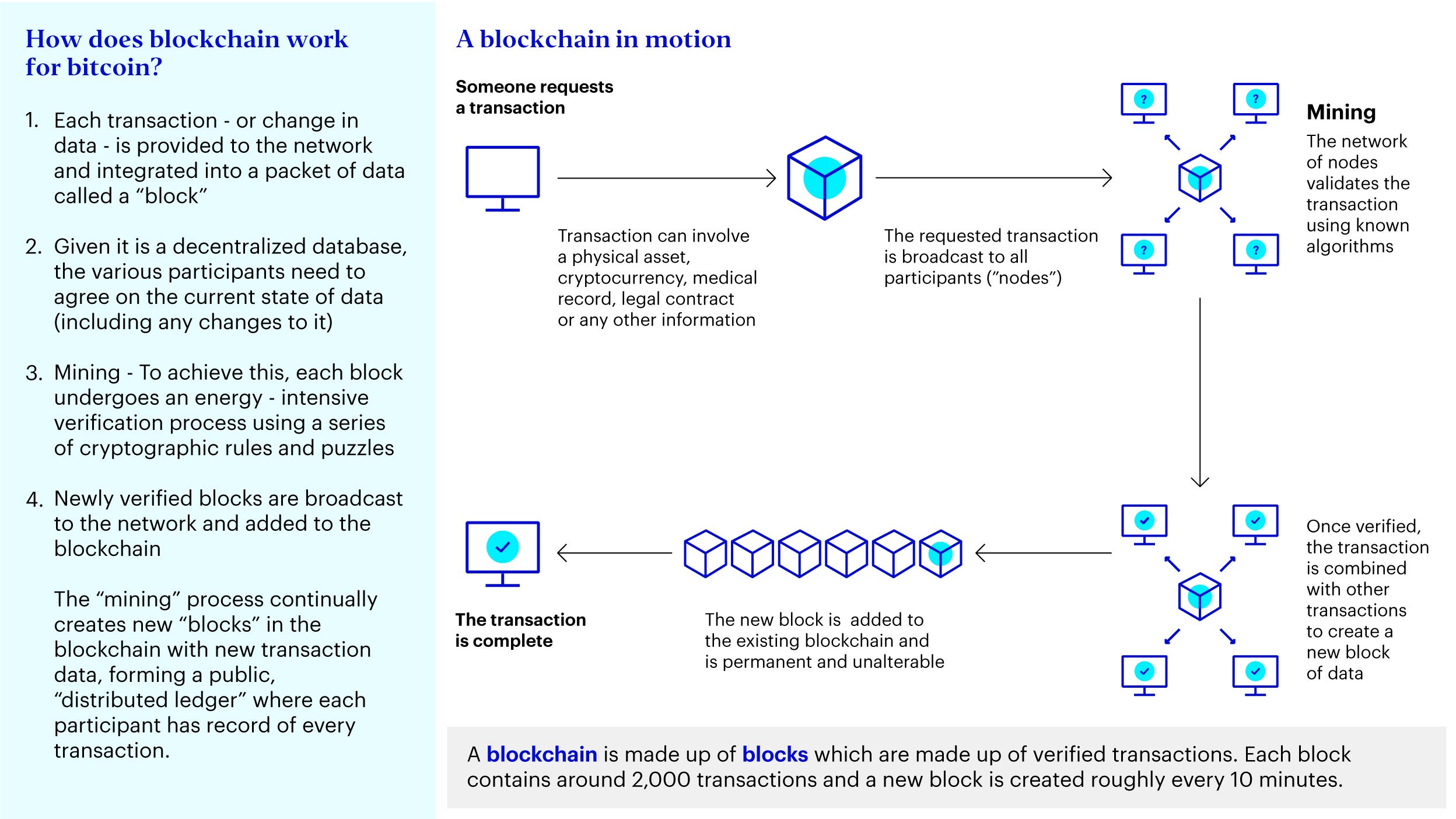

What is a blockchain?

A blockchain, in its most basic form, is a decentralized and secure digital ledger system. It records and verifies transactions across a network of computers without relying on a centralized authority. Each transaction is confirmed by numerous computers, then stored in a ‘block’ that is cryptographically linked to previous transactions, creating a ‘chain’. This structure ensures the data is tamper-resistant, as altering any piece of information would compromise the chain's integrity. Originally the foundational technology for cryptocurrencies like bitcoin, blockchain is now employed in various sectors for its transparency, security, and efficiency.

What are cryptocurrencies and bitcoin?

Cryptocurrencies are digital currencies that typically use blockchain for transaction verification and record maintenance instead of a centralized authority. The most common cryptocurrencies include bitcoin and Ethereum. Bitcoin was invented in 2008 amidst the Global Financial Crisis (GFC) as a decentralized alternative to the traditional banking system, differing from fiat currencies, which are backed by a government. Currently, bitcoin is the world's largest and most liquid cryptocurrency, boasting a market capitalization of over US $850 billion, which is approximately 50% of the total digital assets market.2

Source: Invesco. For illustrative purposes only.

How can I access digital assets?

While new methods to invest in digital assets are always developing, the two main ways include: buying stocks in companies that participate in the digital economy, such as bitcoin mining companies or cryptocurrency exchanges, or investing in cryptocurrencies, like bitcoin.

For investors buying stocks in surrounding blockchain technology, their goal is to participate in the innovative technology advancements of blockchain or the shift to decentralized finance. Decentralized finance (also known as DeFi) describes a system in which financial transactions are made directly between buyers and sellers without the need for banks or other centralized financial institutions. Globally, next year, this emerging sector is forecast to generate US $1.4 trillion in revenue.3 The strategy aims to capitalize on the transformative impact of blockchain and decentralized ledger on the future of finance, akin to how growth tech stocks represent cutting edge technology in a variety of sectors.

However, getting diversified exposure to digital assets and the companies involved in this industry is challenging as investors need to research and find individual companies that have varying exposures to digital assets. That is where exchange-traded funds (ETFs) come in. ETFs can provide investors with exposure to narrow or broad aspects of the digital asset ecosystem, all through well-known vehicles that are simple and efficient to own and trade.

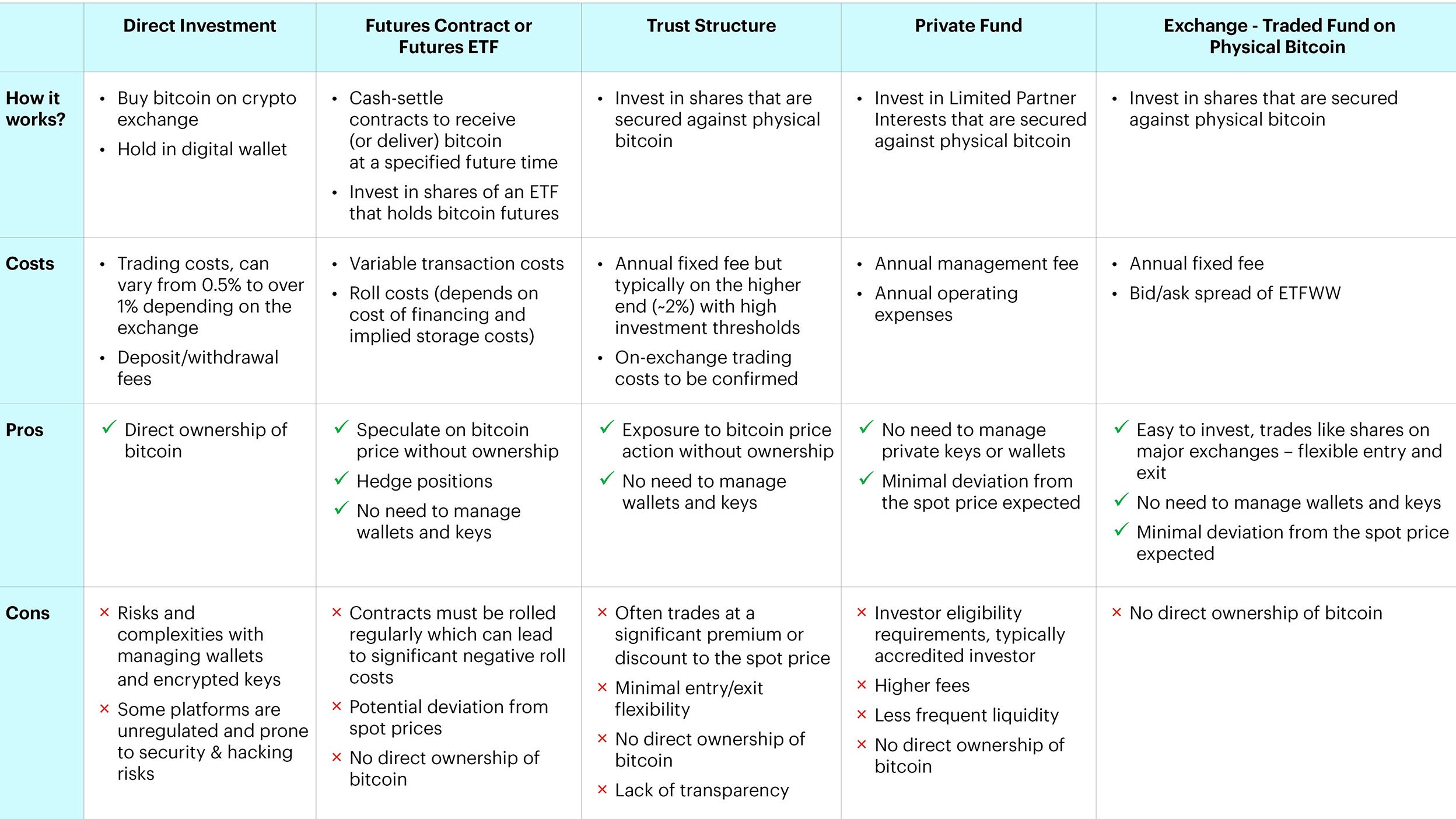

Exposure to cryptocurrencies can be accessed in three ways:

- Direct investment: Direct ownership of the cryptocurrency through major crypto exchanges

- Indirect exposure via derivatives: Access cryptocurrency via derivative instruments (e.g. exchange-traded futures) or derivatives-based ETFs

- Direct exposure via ETFs: Access cryptocurrency via an ETF whose shares values are derived from physical bitcoin stored in institutional grade custody

Source: Invesco, Galaxy Research. For illustrative purposes only.

Why use a “physical” ETF for exposure to cryptocurrencies (like bitcoin)?

Investing in cryptocurrencies through exchange traded funds (ETFs) combines the benefits of getting the asset return potential of the cryptocurrency, with the enhanced security and convenience of established financial infrastructure. Exposure via physically backed ETFs offers a simplified approach compared to the complexities and risks associated with directly managing cryptocurrencies like bitcoin in individual wallets, mitigating the potential for permanent access loss.

This approach also avoids downsides often seen with indirect investment methods like derivatives or derivative-based ETFs, especially the extra costs that can occur with fluctuating futures prices and deviation from the spot price.

Physical bitcoin ETFs are fully integrated into the regular trading system, allowing them to be bought and sold just like traditional stocks and ETFs. This integration blends the innovative world of cryptocurrency with the familiar practices of the financial market, offering an attractive investment option for financial institutions.

Why consider cryptocurrencies and the digital assets economy?

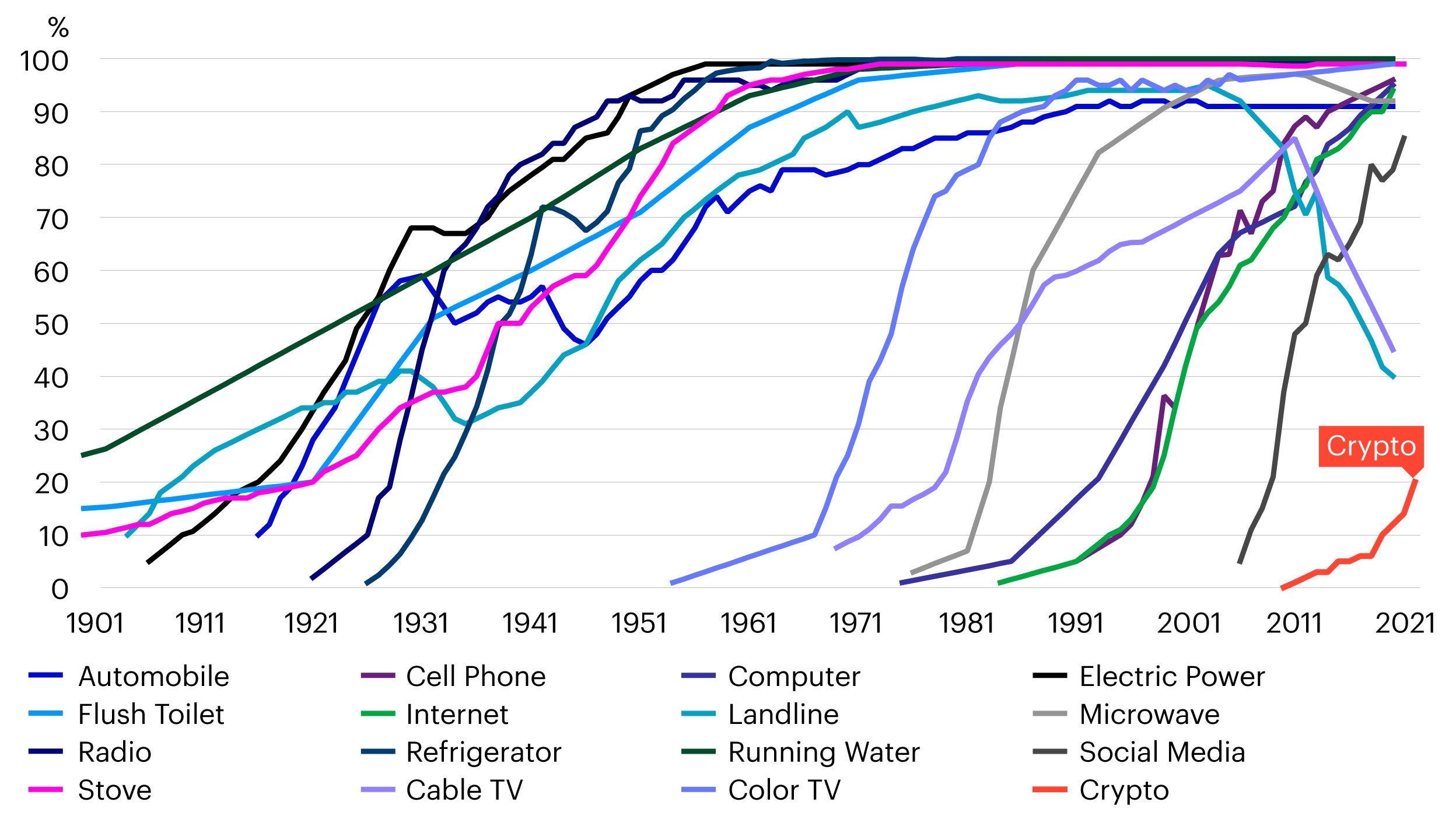

Since bitcoin’s inception in 2008, the cryptocurrency and digital assets ecosystem has transformed into a multi trillion-dollar economy in just under 15 years. At the same time the adoption of this technology is in its early stages. Beyond transforming payment methods and financial instruments, new use cases leveraging blockchain's secure and trustless nature emerge daily, drawing more users to cryptocurrencies and their underlying technology. Viewing the digital assets economy through the lens of other pivotal technologies from the last decade, it mirrors similar adoption and growth patterns, signaling that digital assets may be on the cusp of mass adoption. Globally, during 2023, the number of cryptocurrency users increased by 33% to 575 million people.4

Source: Galaxy Research, Data: Our World In Data. Data as of December 2021. Most recent data available.

In addition to its growth-sector characteristics, cryptocurrencies present unique macro investment opportunities. The long-term viability of fiat currencies as a sound store of value has been challenged as the global economy grapples with rising inflation due to easy monetary policies post-GFC and increasing government debt. Cryptocurrencies like bitcoin, with their fixed total supply, offer a distinctive solution to these challenges, drawing attention from major financial institutions and investors. The mainstreaming of cryptocurrencies, particularly bitcoin, as investment vehicles has been further bolstered by the launch of spot bitcoin ETFs in the U.S. and evolving regulatory frameworks, such as Markets in Crypto-Assets Regulation (MiCA) in the EU, setting the stage for broader adoption and growth in the sector.

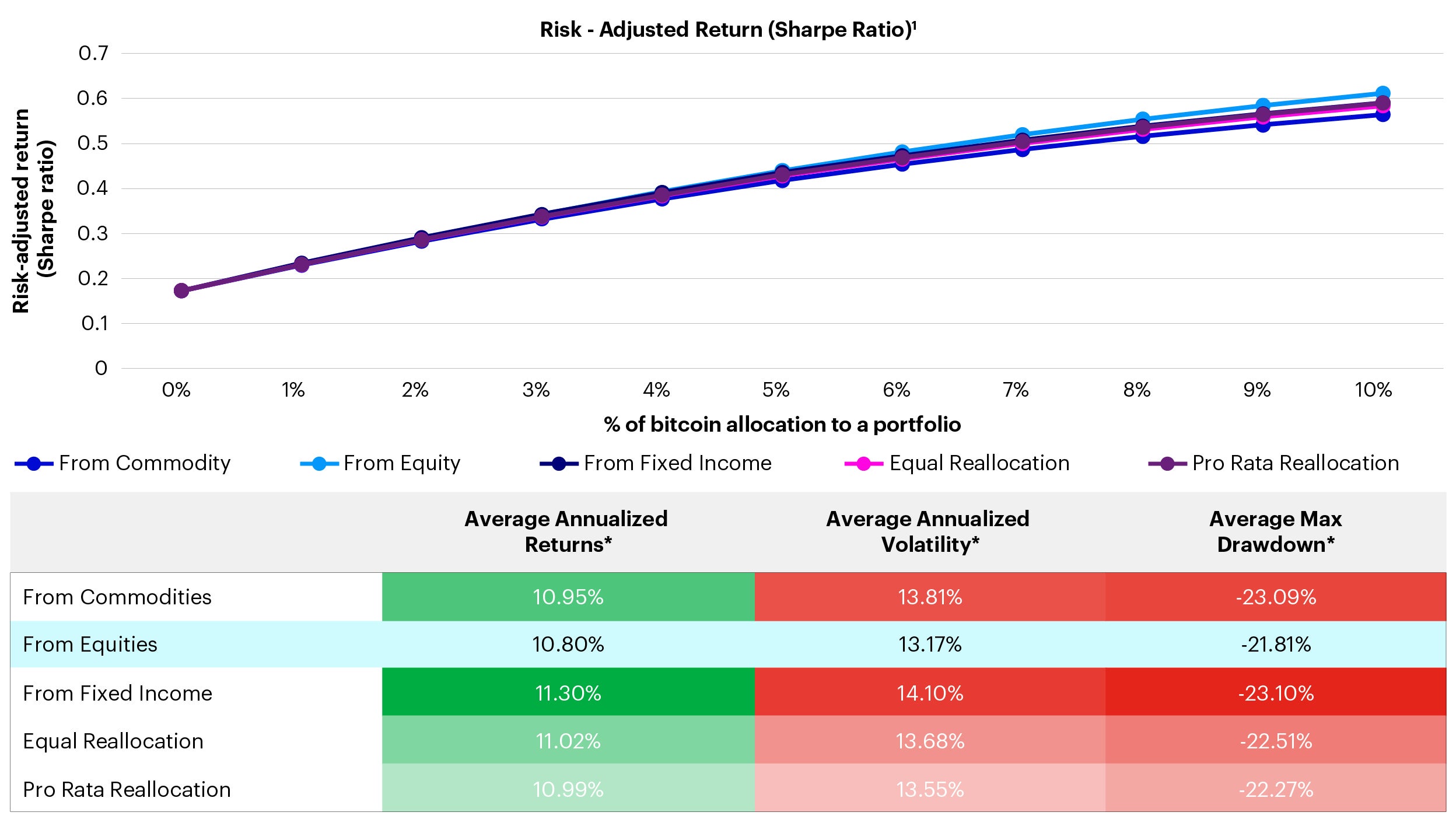

Where do cryptocurrencies fit in a portfolio?

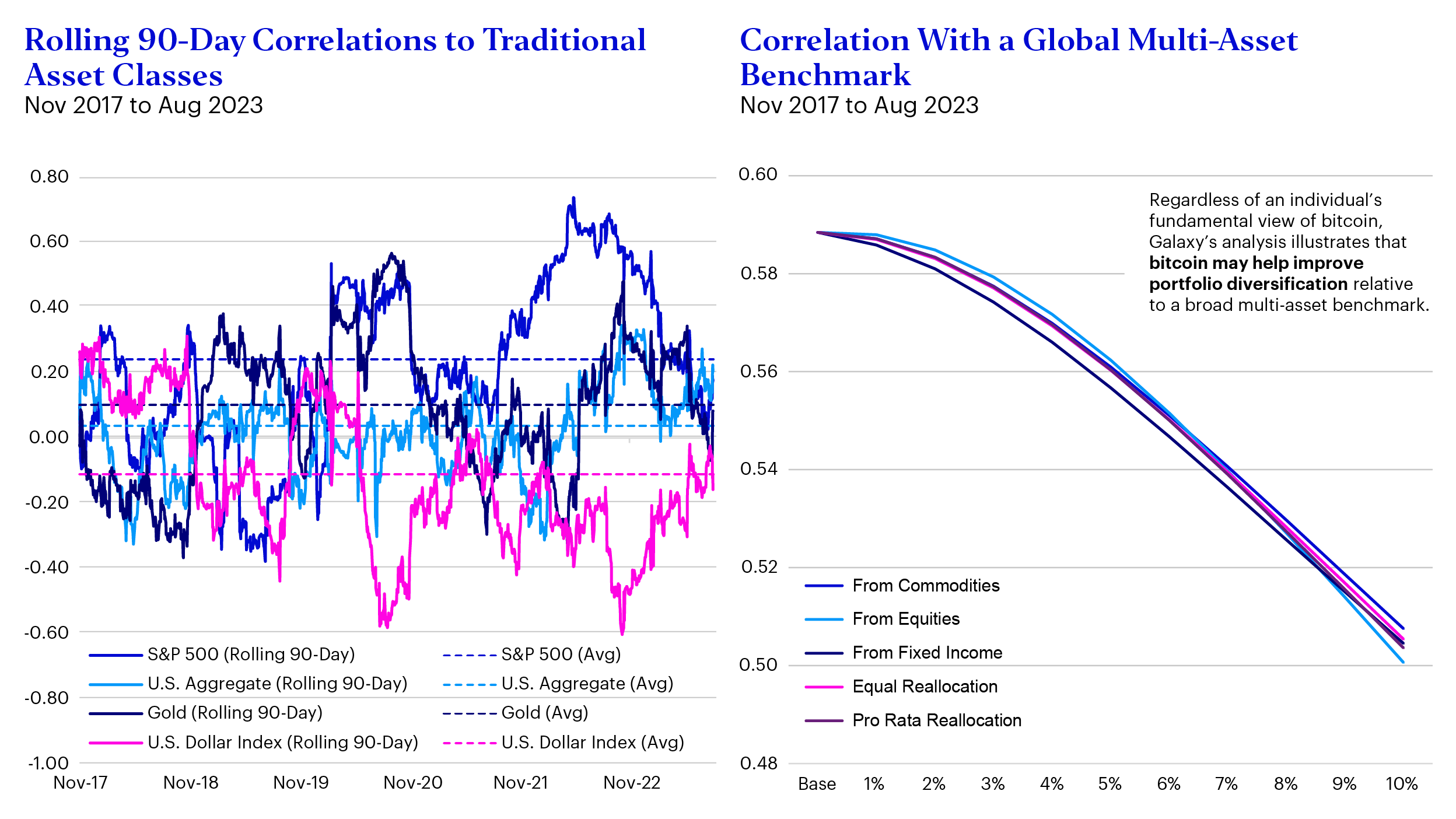

Cryptocurrencies, particularly those with a fixed supply schedule like bitcoin, are a significant store of value and can provide a liquid long-term hedge against inflation. Historically, cryptocurrencies have had a low correlation to traditional asset classes, often even displaying a negative correlation especially during periods of stress in the financial system. Thus, can act as a portfolio diversifier.5

Past performance does not guarantee future results.

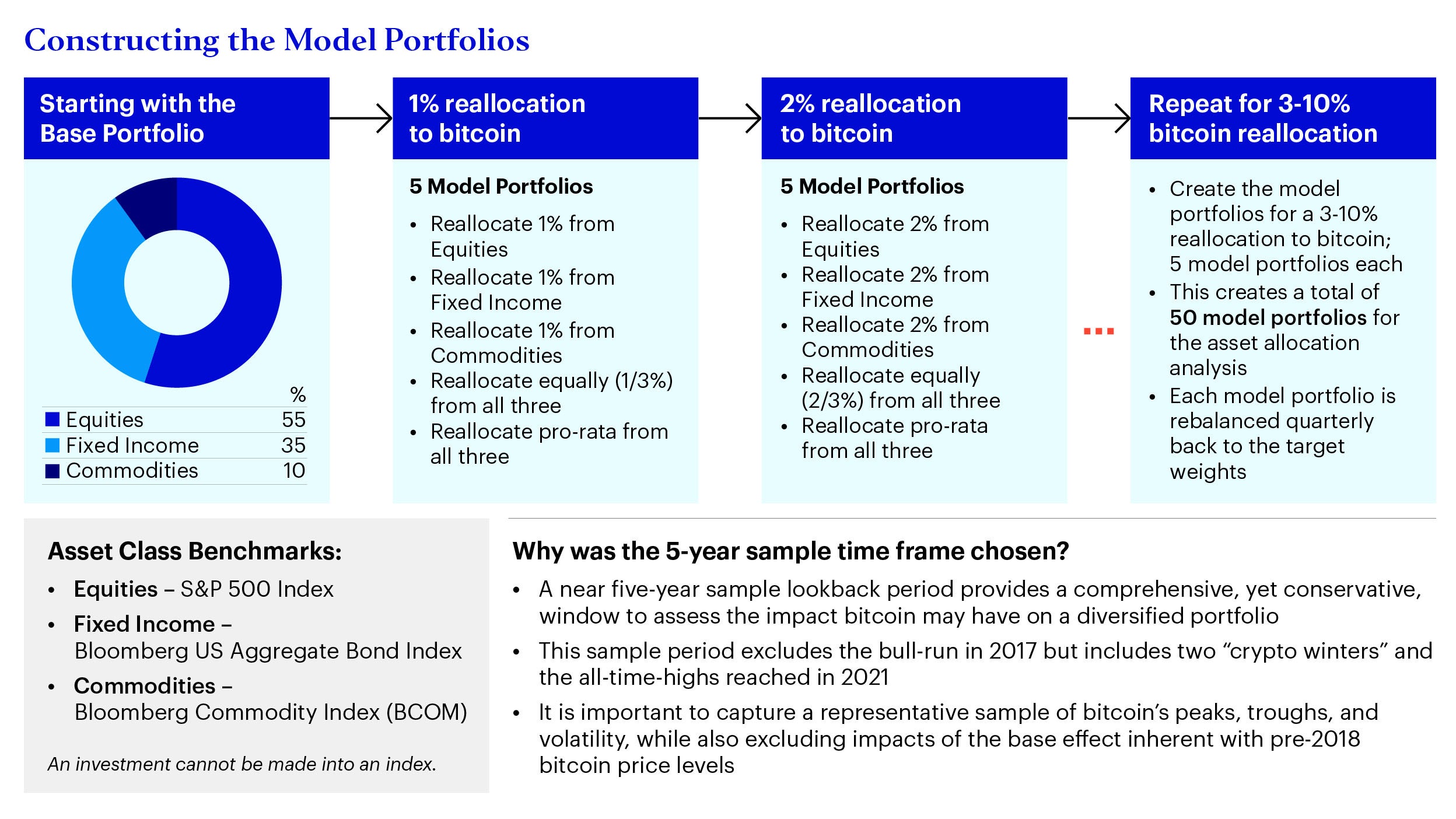

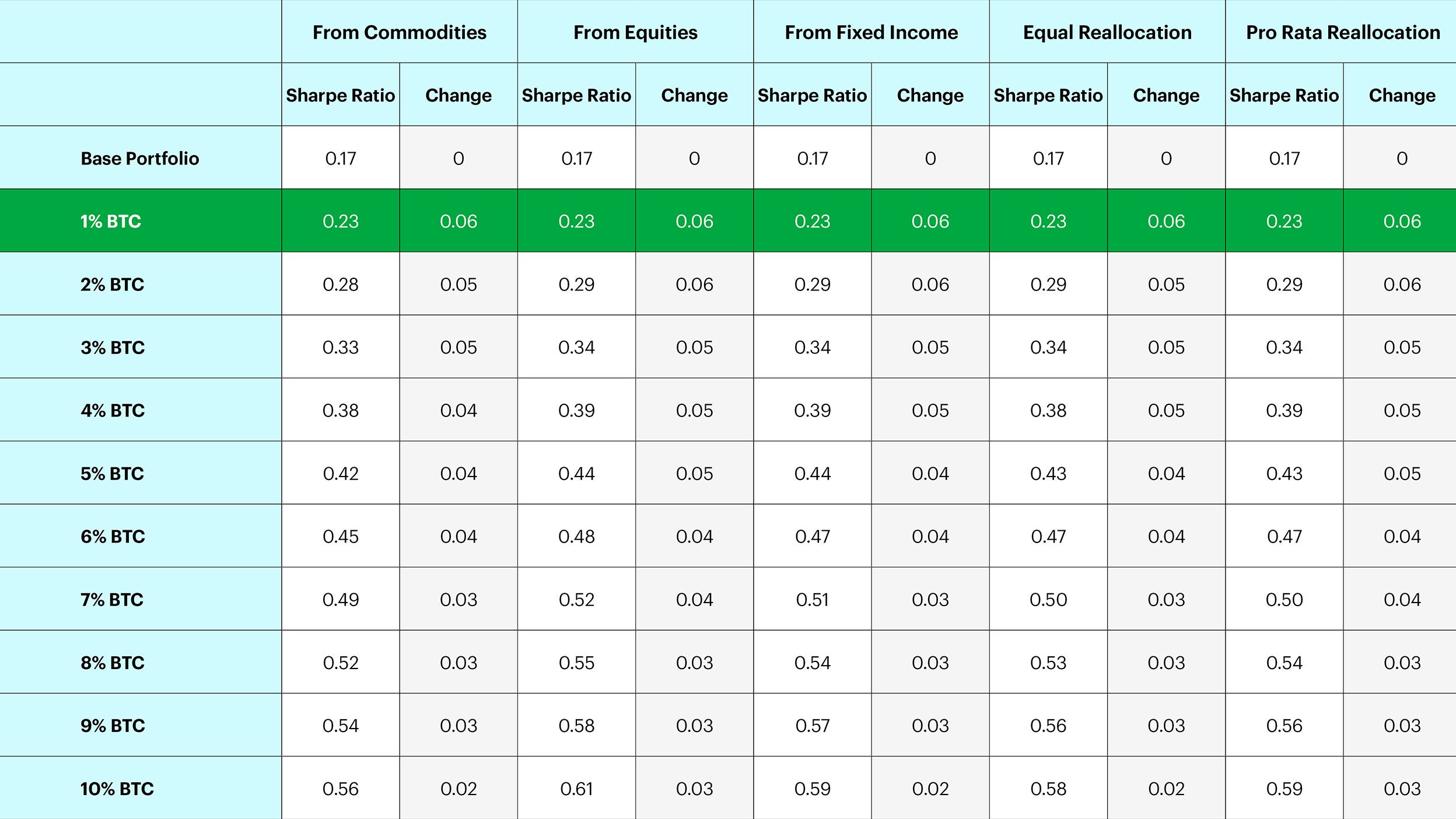

Source: Galaxy Research, The Impact and Opportunity of bitcoin in a Portfolio, October 02, 2023.1 3-month Treasury-bill as of August 31, 2023 used as risk-free rate for Sharpe ratio calculations. Data as of Nov 2017 to Aug 2023. *Average across the 10 portfolios with that allocation method. The Bloomberg Galaxy Bitcoin Index incepted on May 1, 2018 and the Barclays Global Multi-Asset Index on Sept. 13, 2021, respectively. All information presented prior to the index’s inception date is back-tested. Back-tested performance is not actual performance, but is hypothetical. Although back-tested data may be prepared with the benefit of hindsight, these calculations are based on the same methodology that was in effect when the index was officially launched. Index returns do not reflect payment of any sales charges or fees. Performance, actual or hypothetical, is not a guarantee of future results. An investment cannot be made in an index.

Furthermore, adding even just a 1% bitcoin allocation to a portfolio has been observed to significantly improve the portfolio’s risk-adjusted returns. The most improvement was seen when a bitcoin allocation was funded from equities.

Investors can also participate in the growth of the wider digital assets economy by holding an ETF that invests in companies pioneering the adoption of blockchain and cryptocurrency into daily life.

Source: Galaxy Research, The Impact and Opportunity of Bitcoin in a Portfolio, October 02, 2023. Data as of Nov 2017 to Aug 2023. Global Multi-Asset Benchmark = Barclays Global Multi-Asset index. An investment cannot be made into an index. See index definitions below. Past performance does not guarantee future results.

Source: Galaxy Research, The Impact and Opportunity of Bitcoin in a Portfolio, October 02, 2023. See index definitions below. An investment cannot be made into an index.

Source: Galaxy Research, The Impact and Opportunity of Bitcoin in a Portfolio, October 02, 2023. Data as of Nov 2017 to Aug 2023. Past performance does not guarantee future results. The performance results shown are hypothetical (not real) and were achieved by means of the retroactive application of the statistical model. It may not be possible to replicate the hypothetical results.