Thinking thematically consumers, electronics, and…robots?

Overview

This year’s CES showcased many uses of artificial intelligence, including robotics

While advanced robotics requires surmounting many challenges, industrial use cases are growing while consumer robots are on the horizon

Green shoots in venture capital spending could help pave the way to more challenging applications, opening the door for deeper integration of robots and the economy

After a year full of technological advancements in artificial intelligence, this January saw the crowds descend on Las Vegas once again for the annual consumer electronics show (CES) put on by the Consumer Technology Association. With attendees regularly surpassing one hundred thousand, the show provides a showcase for up-and-coming technologies, with companies bringing out their most sophisticated – and occasionally head scratching – new offers. This year, of course, was no different, with products ranging from a transparent television from LG to a new electric plane from Hyundai designed, in part, from the naturally aerodynamic shape of bees1.

For all the glamor of these new products, however, one thing was clear – artificial intelligence (AI) stole the show. After last year’s debut of chat-GPT set off an arms race in the industry, there didn’t seem to be a space at CES left untouched by AI. Car companies were showing off their plans for better autonomous driving. Baby-product makers even introduced self-driving strollers. Nvidia, the semiconductor company, made a splash as they announced a new line of graphics processing units (GPUs), which aims to make personal computers more AI ready2. According to analyst surveys at the show, over 80% of the companies present saw at least 10 use cases for AI in their business moving forward, including core activities like marketing and data analysis3.

The area that most grabbed our attention, however, were the robots. Ranging from a relaunch of Samsung’s robotic assistant, to a robotic vacuum that hooks up to your washing machine to refill its water tank, robots were very present this year4. Long the subject of science fiction conjecture, robotics has always captivated humanity with its promise of bringing our machines to life and integrating them more fully into our daily lives. Today, we look at different types of robots and where the world could be heading.

To be or not to be (humanoid)?

Humanity has had access to robots for nearly a century, with the first robot created in 1937. While it started simply – the first robot was controlled by a paper tape with holes punched in it to trigger motion – it had five types of movement and a crane-like look. This was followed by the first robotics patent in 1954 and the first deployment of a robot in a factory by General Motors in 19625.

Still, as we wrote in our November edition of Thinking Thematically, until now, robotics has been limited to discrete use cases with each motion requiring careful pre-programing. What AI could offer is a sort of ‘cognitive flexibility’ for robots, with recent experiments already seeming able to double robots’ ability to handle novel scenarios6. The question now is whether or not we can reach the holy grail of science fiction – the humanoid robot.

Humanoid robots would move away from crane arms and toward fully interactive machines, allowing software to enter the human realm – walking, talking, and working like humans in a way that would help them become a more central part of the economy. With aging populations, technologists hope we could see robots bolster our workforces, entering spaces like healthcare, education, and domestic assistance7. The challenge, of course, is getting it all to work.

Why is robotics so complicated?

Generalized robotics – especially of the humanoid variety – involves multiple complex systems that need to seamlessly work together. Mechanics and kinematics (the study of motion) are required to allow robots to move, providing structures for both walking and fine motor control for dexterity. Those systems must then be joined by processors and microcontrollers – the robot’s ‘brain’ – to allow the machine to respond to external stimuli and adapt as necessary. That brain must also be connected to myriad sensors – the ‘nerves’ of the robot – to allow for computer vision, tactile control, and a general awareness of the conditions of the external environment. Throw in enough artificial intelligence to make sense of it all, and you have a robot. Easy…right?7

Another problem stemming from this complexity, of course, is cost. While Elon Musk has promised an eventual $20,000 version of its humanoid robot – which was displayed last year in a ‘production-ready’ chassis picking up objects9 – advanced robots today can cost as much as $1M, limiting their deployment7. Experts estimate that by 2035, only 10% of wealthy households will have their own humanoid robot10.

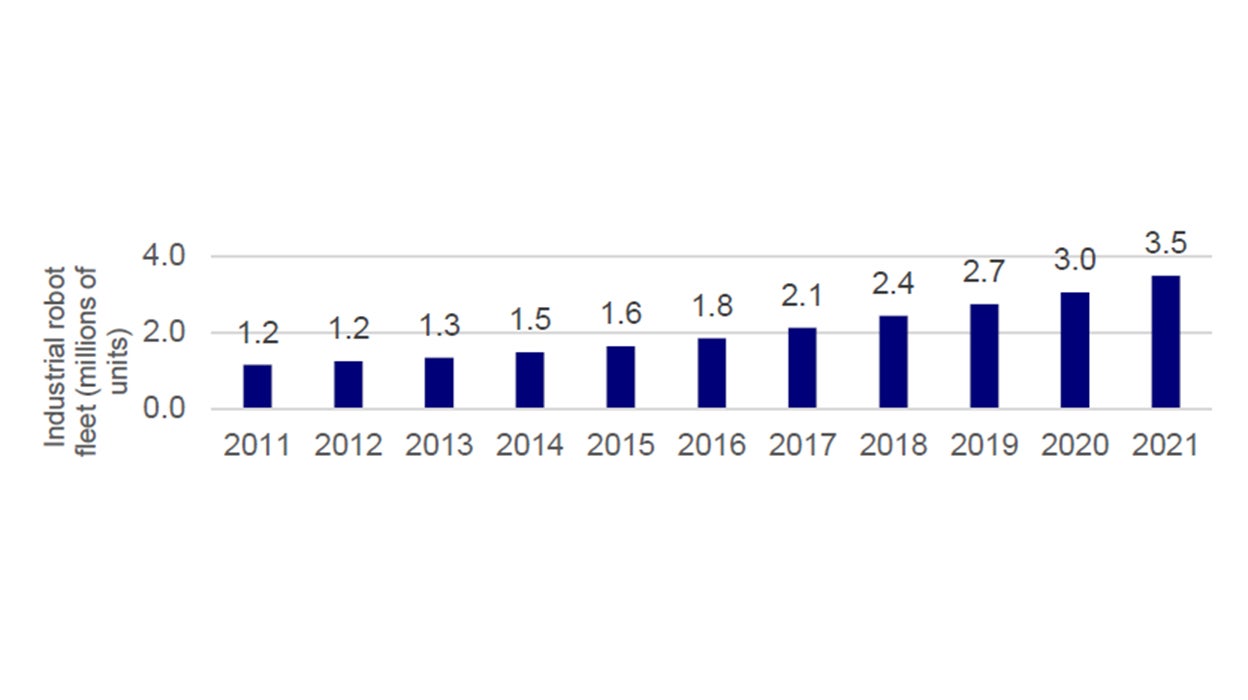

Green shoots (and dreams of electric sheep)

Despite the challenges, investments are mounting in advanced robotics, including of humanoid models. We’ve seen $4.6B of capital invested with nearly $300M of new venture capital deals in the space last year7. Beyond science fiction, robotic deployment is also a key feature of industrial spending in the here and now, with segments like logistics planning on spending upwards of 30% of their capex on automation over the next five years11. The total addressable market size of robotics is expected to almost quadruple by 2032, reaching an estimated $283B12.

The future may still be far off, but it seems to us that the path to advanced robotics is being paved as we speak. If artificial intelligence is helping to scale the way computers think, it could very well narrow the challenges to take the next leap in allowing them to move and interact. Someday, you might even read this newsletter while your robot makes your breakfast – assuming it can get the order right.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

The risks of investing in securities of foreign issuers can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues. The performance of an investment concentrated in issuers of a certain region or country is expected to be closely tied to conditions within that region and to be more volatile than more geographically diversified investments.

Investments focused in a particular industry or sector are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.