Thinking Thematically: Leaves, pumpkin spice, and volatility – how thematics might fit into markets this fall

Overview

Markets have been sanguine for most of the summer. However, fall can be a good reminder of historic volatility

Thematic investments do not have to be focused solely on growth and technology. Thematic industries could include more value-oriented sectors and traditional technologies

Less growth-oriented themes like defense, food & beverage, or water could potentially show less economic sensitivity, though keeping the approaching US election in mind is also important

As we move into the final four months of the year, the beach will soon be a distant memory. Long gone will be the blissful days in the sun, frolicking in the ocean waves. Soon, we’ll all be back at our desks, bundled up and wondering where the time went. Of course, there are always holidays to look forward to, but we’ll always be wondering if we could have had that one last watermelon, if we could have squeezed every last drop of joy out of the summer.

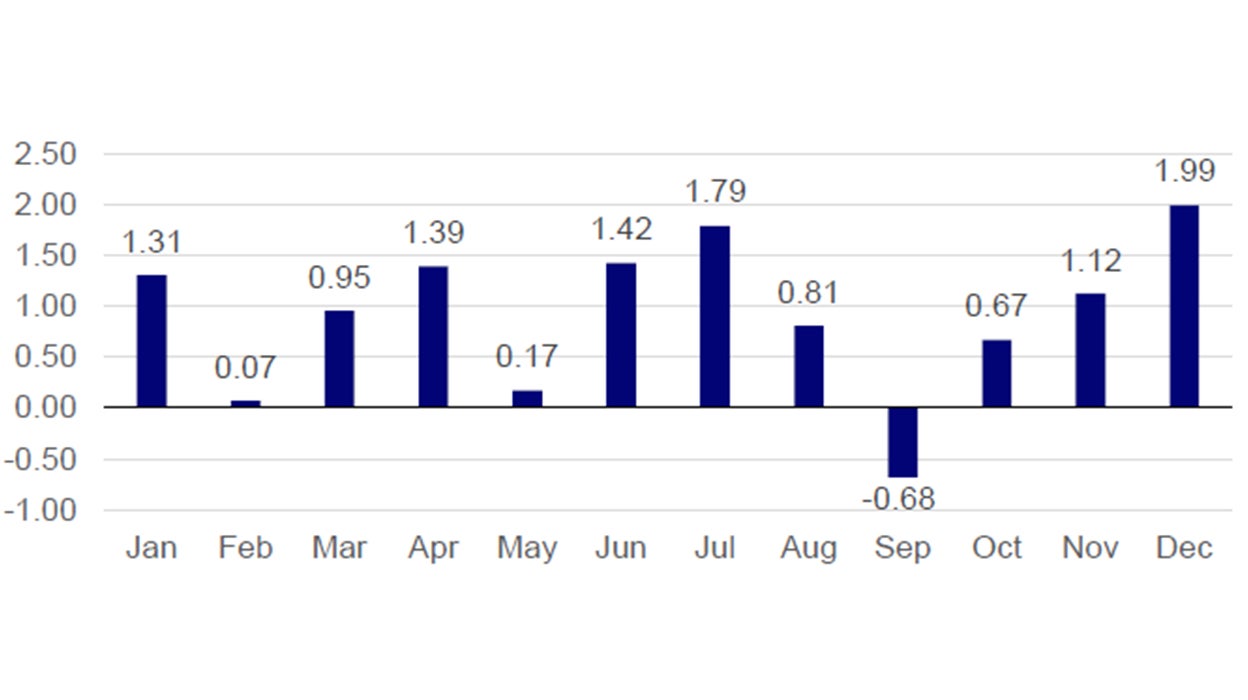

If history is any guide, though, we may also have something else to contend with – market volatility. Markets certainly had a taste of volatility in August, as July payrolls data scared investors about the potential slowdown in the US economy. Just as quickly, though, it seemed to all be forgotten, with jobless claims and CPI riding to the rescue to keep hopes alive. September, however, is a historically volatile month. As shown in the chart below, it is the only month with negative average returns between 1928 and 2024. Of course, no one knows exactly where the economy is headed – much less the market. While we still believe a smooth economic landing is possible, it may help to think about how thematics can fit into different market environments. After all, bulls may look better in a bathing suit, but it’s the bears who know how to bundle up for hibernation.

Revisiting how we think about themes

You may recall from our annual review that we think of thematics in a unique way. One of the first lenses we use to divide the thematic universe is between what we call “NextGen” themes and more traditional “Thematic Industries.” Thematic investing is ultimately about investor choice, going beneath and between traditional sectors to target a more specific global or macro trend that interests the end investors. On the NextGen side, you have familiar futuristic spaces like Robotics, artificial intelligence (AI), Sustainability and more. On the Thematic Industry side, you can have investments options in areas like defense, banking, or packaging.

Such a distinction is especially useful now after a year in which investors have focused so intently on growth technologies like AI. While growth could certainly be an important part of an investor’s portfolio, times of market volatility could also serve as a reminder of the importance of diversification – not only amongst stocks, but also between strategies, sectors, and factors. One potential of thematic investing could be to make such decisions with greater precision. Instead of choosing to invest in all industrials, for example, an investor could potentially choose between several underlying industry themes depending on their market view: homebuilders vs defense contractors, water access vs electrical equipment, and so on.

Average monthly historic return of the S&P 500 since 1928

Source: Bloomberg L.P. January 1928 – July 2024.

The history of the S&P 500 dates back to 1923, when Standard and Poor's introduced an index covering 233 companies. The index as it is known today was introduced in 1957, when it was expanded to include 500 companies.

All information presented prior to the S&P 500 Index inception date, March 4, 1957 is back-tested. Back-tested performance is not actual performance, but is hypothetical. Although back-tested data may be prepared with the benefit of hindsight, these calculations are based on the same methodology that was in effect when the index was officially launched. Index returns do not reflect payment of any sales charges or fees. Performance, actual or hypothetical, is not a guarantee future results. An investment cannot be made in an index. Bloomberg data is not available prior to 2028.

Earnings vs. the consumer

The US economy is beginning to slow down. Consumers are largely through their excess savings from the pandemic, and rumors of “consumer fatigue” are starting to settle in with high interest rates on credit cards and mortgages starting to take a toll. Still, the consumer is finding a way. In August, the retail sales print for July came out at 1% vs 0.4% expected in economist surveys.1 Maybe there’s no “Barbenheimer” to see in theaters, but with employment managing to remain relatively robust, it seems consumers are still managing to spend.

Then, in Q2 earnings, we had a “beat-and-hold” result, which means that while companies and analysts didn’t significantly raise their earnings expectations, they also managed to come in roughly in line with market expectations.2 With average earnings growth of 10%+ for the quarter amongst stocks in the S&P 500, we saw one of the strongest quarterly results since 2021.3 There was also good news in terms of market breadth, with S&P 500 stocks outside the “Magnificent Seven” – Microsoft, Amazon, Meta, Alphabet, Apple, Nvidia, and Tesla – contributing positively to earnings averages for the first time in six quarters.2 All of that could point to potentially expanding allocations outside of the previously dominant tech names and looking for segments of the market that may provide earnings growth even as the economy continues to gradually slow. Aerospace & defense, food & beverage, and water resources could be spaces where earnings are less dependent on overall growth and technological investment.

Is the election still in play?

Since Joe Biden dropped out of the race, the US election has seemed to be in constant flux. Markets, which had originally been fully pricing the “Trump Trade,” have seemed to forget the election is even happening, focusing instead on economic fundamentals. As we get closer to November, however, that may change. The candidates have different views for policy, each of which could have disparate interactions on sectors vis-à-vis regulation, investment, and tariffs. However, it could still be helpful for investors to look through the noise, looking for diversification across sectors and themes that have economic drivers unrelated to who wins the election. Some areas like banks could see an outsize impact from the election, with merger and acquisition (M&A) activity viewed more positively under a Trump administration.4 Meanwhile, more consumer-oriented could fare better under a Harris administration if tariffs on imports are less severe. Other segments like defense could potentially prove less sensitive to election concerns, with defense spending tending to be smooth across different administrations.5

Where do we go from here?

We certainly do not have a crystal ball on where the market is headed. However, we do have windows, and it’s clear – at least in our neck of the woods – that summer is coming to a close. While economic growth is proving resilient, historic trends and market fears could always bring back market volatility. Thematic investing does not provide any perfect solutions for investors. However, themes do offer choices, and we hope there could be some that fit your needs. Whatever happens this fall, we’ll be by your side.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular industry or sector are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.