Thinking Thematically: Plenums, politburos, and politics – what’s happening in China this summer

Overview

China’s economy continues to struggle as post-COVID lockdown weakness transferred into an ongoing property crisis

Chinese leadership remains focused on rebalancing the economy, and while the Third Plenum didn’t take a “bazooka” approach, it seems incremental stimulus could be coming

Meanwhile, China remains focused on investing in a stronger future-state economy, where competitive technology like semiconductors and AI will likely remain key focal points

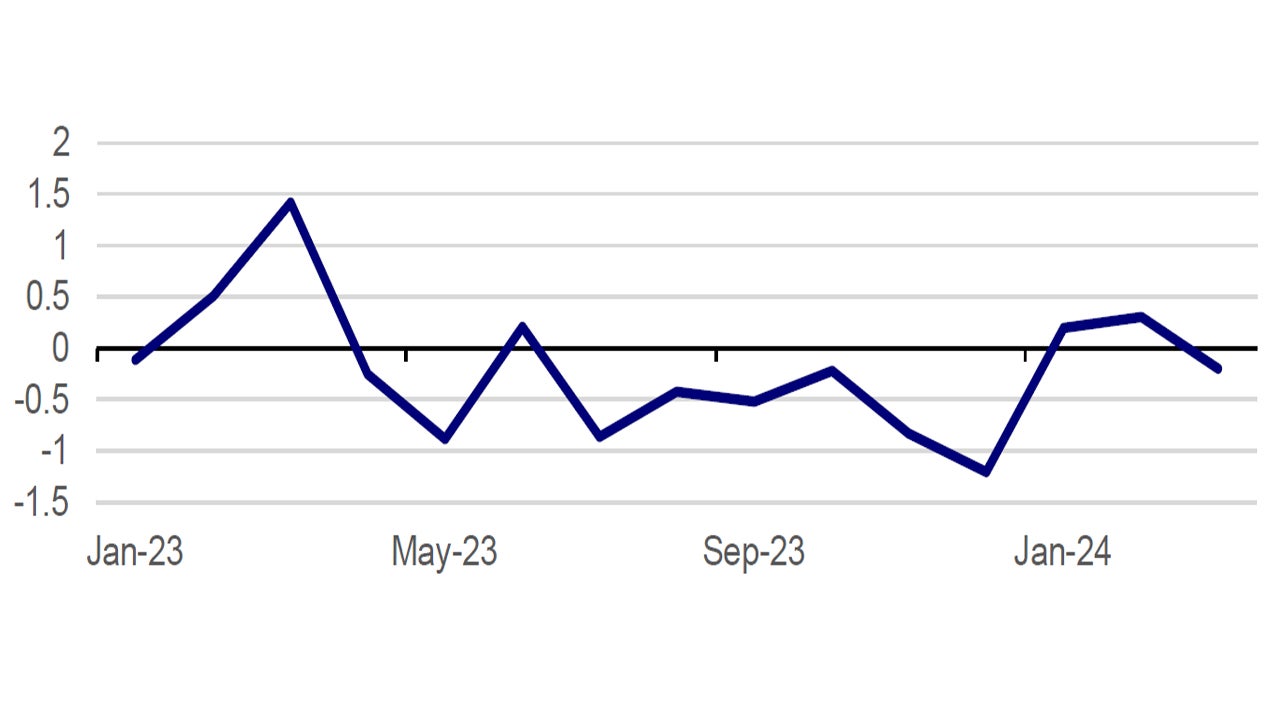

If you watch China closely like we do, you’ve probably noticed a shift this summer. After activity data rebounded around the Chinese New Year holiday, the second and third quarters have been far more languid. In the latest data, China has seen disappointments in GDP, credit growth, retail sales, and more.1 One of the only bright spots seems to be exports, with the global growth taking place around the world still best serviced by China’s massive industrial base. Meanwhile, China recently wrapped its Third Plenum five-year meeting, where leaders were closely watched for their views on economic growth and the potential for stimulus. Combine that with the ever-changing landscape of American politics, and it’s no wonder our inboxes are stuffed to the gills with China questions!

In today’s newsletter, we wanted to walk you through these recent developments: what’s driving the current state of the Chinese economy, what we can read into recent leadership meetings, and where we might go from here.

The call is coming from inside the house…

As many of our readers will recall, after the bruising COVID lockdowns, one of the biggest problems in the Chinese economy remains the property market. The collapse of Evergrande pointed to a long-festering problem – after years of debt-fueled building, China had a housing bubble in need of deflating. According to researchers, at the start of this year, China’s unsold housing stock stood at more than 500 million square meters, which is roughly ten times the size of all the office space in Manhattan.2

Meanwhile, this has a very meaningful impact on Chinese consumers. China famously has a much higher savings rate than the one we see in the US, and at the end of last year, Chinese household savings hit an all-time high of over $19T.3 However, while American retirees may have a heavier emphasis on stocks and bonds, Chinese investors remain heavily exposed to real estate. According to recent estimates, upwards of 70% of family assets in China are in property, and for every 5% drop in real estate prices, we could see nearly $3T of household wealth wiped out.4

This, then, helps explain why the housing crisis has cast a large shadow over the government’s attempts to reignite economic confidence and consumer demand. We saw in 2008 in the US that economic crises can have very long tails. However, China is also hamstrung by the amount of debt propping up the real estate surge. Leadership wants to rebalance the economy, and that means helicopter money to stimulate demand will be hard to come by. While we’ve seen leadership talk about such rebalancing for nearly two decades with little change, the amount of debt building up could finally change minds on that.5

China Economic Surprise Index1

What happened at the Third Plenum?

Or, for some of our readers, perhaps a better first question would be what is the Third Plenum? Roughly every five years, the plenum is a major meeting of Chinese Communist Party leadership, where the party charts its long-term goals for the country’s social and economic policy.6 Because the party is the locus of power in China, while the plenum doesn’t set out policy specifics, it acts as the major marching orders for China’s government to use in enacting new laws and programs.

This year, with the plenum culminating in a firm resolution on July 21, Chinese leadership seems to be taking the country’s economic challenges seriously. Perhaps most importantly, the communique was reform-oriented, with policy priorities geared toward modernization of the economy and restimulation of the private sector.7 In years past, Xi Jinping had seemed intent on reining in the country’s vibrant technology sector, whereas now, China is looking to technology as a potential avenue for future growth.

Still, for anyone expecting a policy “bazooka,” the third plenum looks to be a continuance on incremental policy reform. That isn’t necessarily a bad thing, though it’s a reminder that rebalancing an economy as large as China’s will take time. That could be all the more reason to focus on growth segments in the economic transition like semiconductors and AI.

How does the US election factor in?

The mood on China has shifted dramatically in the US over the past few years. During the Third Plenum, we had the Biden administration announcing new curbs on semiconductor exports to China, while Donald Trump made headlines with talk of Taiwan and his ongoing promises to enact large tariffs on Chinese imports should he win the election in November8. Trump’s proposed 60% tariffs, of course, would not be meaningless, with recent estimates finding that such high levels could potentially reduce China’s GDP by 2.5% over the following 12 months.9 Still, tariffs are not an automatic given, even should Trump win. While the 25% China tariffs from his first term largely survived legal intervention, there could be new potential legal challenges to larger tariffs, especially considering the recent overturning of the Chevron doctrine by the Supreme Court, which aims to rein in executive branch authority.10

Where do we go from here?

There’s no doubt that China’s economy continues to struggle. However, recent communications from policymakers seem to point to an ongoing focus on rebalancing the economy and preparing it for the future. While the threat of tensions with the US loom large, that could provide even more reason for China to turn away from its over-reliance on exports and begin focusing on domestic consumption and technology. However, it took China forty years of staggering growth to reach this impasse – years full of transformation and innovation. So, no matter what happens, I believe we’ll still be talking about China in the years ahead – and Thinking Thematically will be there right beside you.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular industry or sector are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.