Thinking thematically: Reshoring, robotics, and the future of US industrials

Overview

New factories being built across the US show the impact of a new generation of industrial policy

While we’re seeing the impact of the business cycle on industrials, we’re also seeing change from new technologies

From artificial intelligence to robotics, technology users could change how we view industrials and their business models

In Ningde, in the northeast corner of China’s Fujian province, a glistening blue building rises above the water. The headquarters of Contemporary a Chinese battery manufacturer and technology company, it’s the home of the world’s premier battery maker with a whopping 37% of global market share and a supplier to the likes of an American multinational automotive and clean energy company and a German automobile manufacturer 1. And these batteries are only a fraction of the global race to have enough storage for the clean energy revolution, with global capacity expected to reach 382 Gigawatts (GW) by 2030, enough to power 267 million homes2.

It might surprise you, then, that a Chinese battery manufacturer and technology company and other Chinese battery giants are pursuing multi-billion-dollar investments in US production facilities. a Chinese battery manufacturer and technology company is planning a $3.5B facility in collaboration with an American multinational automobile manufacturer – though that’s been put on pause amidst current strikes – and Gotion is planning a $2.4B facility of their own on almost 300 acres in Big Rapids, Michigan3. With even more facilities coming from Multinational conglomerate company, a South Korean multinational manufacturing conglomerate, and others, the Department of Energy expects the US to have 1,000 Gigawatt hours of battery production capacity by 2030 – enough to build up to 13 million electric vehicles per year4.

However, this is part of a trend that goes beyond batteries. After decades of US industrial production capacity going overseas, we’re seeing a wave of “reshoring” bringing factories stateside again. Driven by a surge of new industrial policy from the Inflation Reduction Act (IRA), the CHIPS and Science Act, and the Infrastructure Investment and Jobs Act, the impact is far reaching. Just look at Taiwan Semiconductor’s $40B plant being built in Arizona, which is the largest ever foreign investment in the US5.

Meanwhile, even with a wall of worry around interest rates and the risk of recession, the S&P 500 Industrials (Sector) index is outperforming the more defensive S&P 500 Consumer Staples (Sector) index by more than 10% year to date (3.56% vs -9.41%) 6. This makes us wonder: has something changed in US industrials? Has something taken this classic cyclical sector and made it somehow less so?

With a global pandemic, timing is everything…

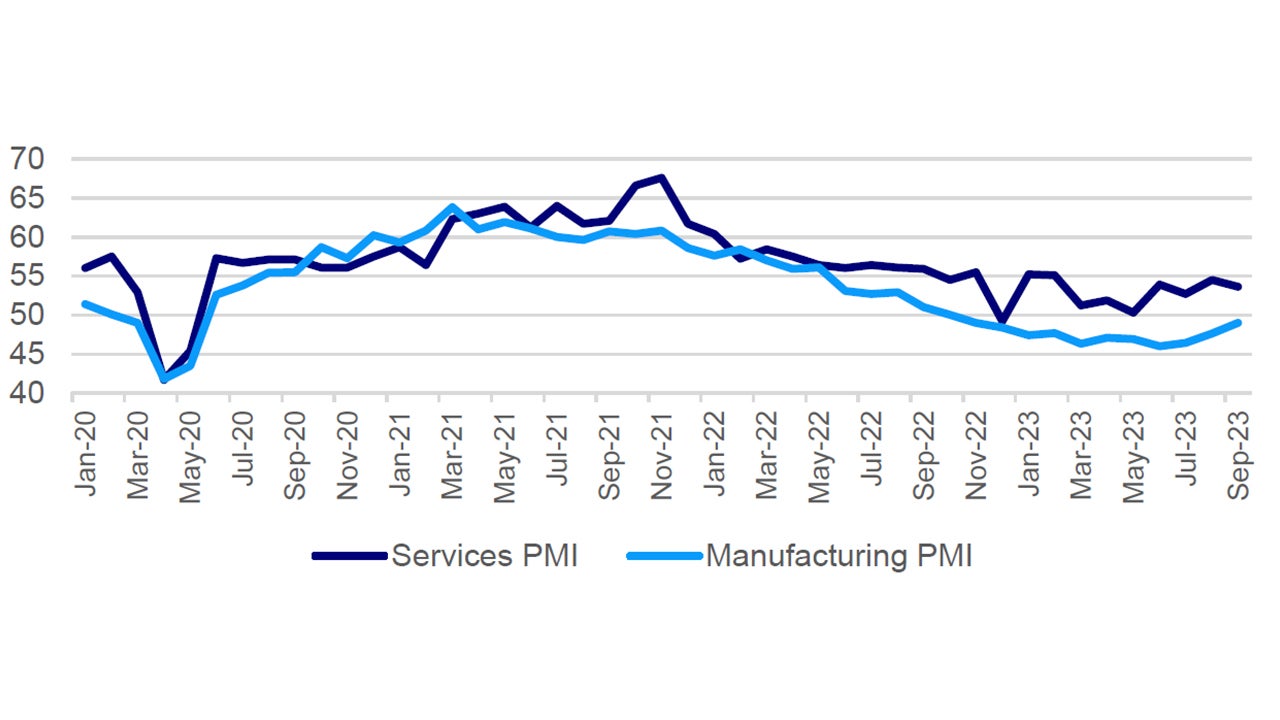

First, it’s helpful to remember that ‘cyclicals’ aren’t monolithic. While industrials are still clearly impacted by the business cycle – the S&P 500 Industrials (Sector) index was off almost 7% in 20226 – there are also cycles within the broader economic cycle. As you can see below, the initial spike in goods purchasing during the pandemic under stay-at-home orders and stimulus-boosted excess savings eventually gave way to “revenge” spending on services and a dip in the US manufacturing purchasing managers’ index (PMI).

Now, however, we seem to have reached a trough in the industrials data. After months of spending, consumers also seem fatigued, and the share of spending on services has stabilized around 67%, below the pre-pandemic level7. While this could be a sign of industrials leading the next cycle, there are also important changes taking place on a thematic level that could impact industrials moving forward.

Can technology impact cyclicality?

While investors have spent much of the year focusing on the potentially game-changing impact of artificial intelligence, most of the attention has been on enablers and scalers of the technology. However, it’s also important to remember the users of key technologies. Just like with the invention of the telephone and the internet, everyone’s business operations can benefit from calling customers and emailing coworkers – especially when compared to the more inefficient technologies that came before.

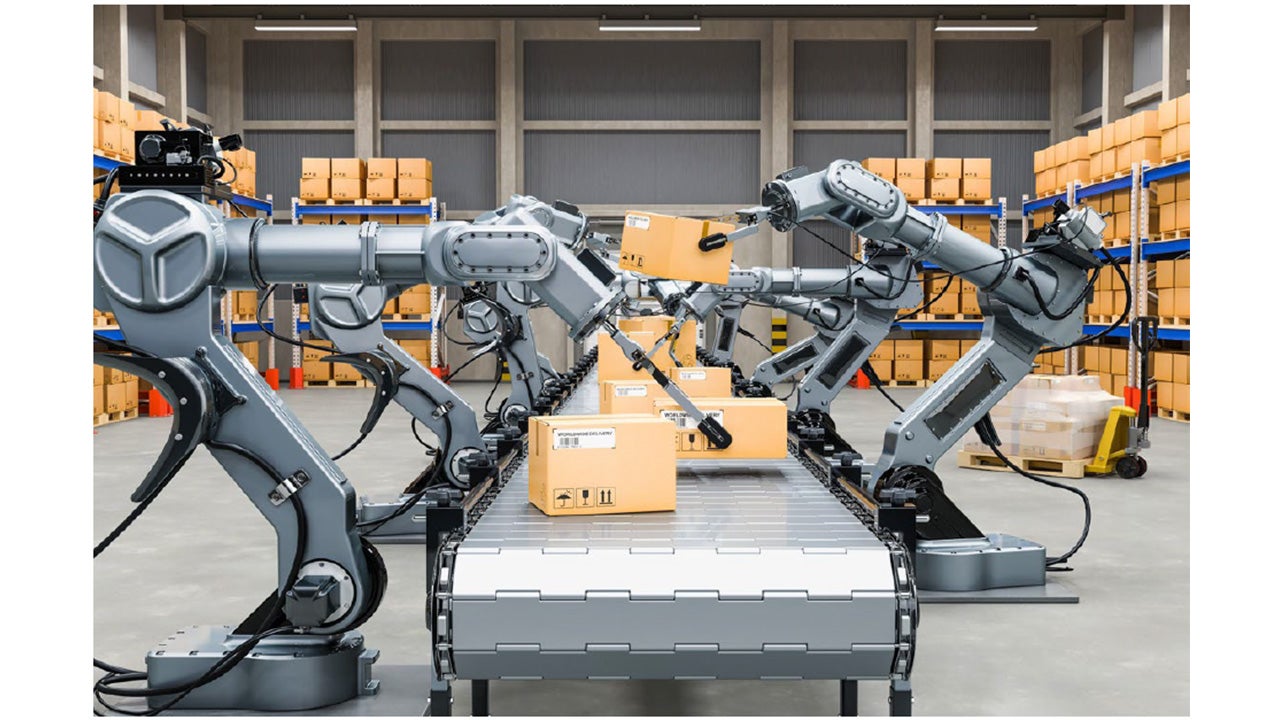

For today’s industrials, there are important contributions to be made from artificial intelligence. From predictive analytics to enhanced customer data, AI on its own could help companies make their cyclical businesses more predictable by controlling costs and finding better ways to service their clients. Through better robotics – driven even further by gains in AI – industrials could even change the way work gets done in the first place, reducing traditionally cycle-sensitive inputs like labor outlays8.

Robots that can “see?”

One great example of the impact on robots from AI is computer vision. With extensive training and research already developed in large language models, AIs have been practicing for years at improving the way they process and interpret images. For robotics programming, this can cause monumental shifts. Previously, robots had to be specifically programmed for each task – move this arm this many inches, apply this much pressure, move the object over here. This also meant that industrial applications for robotics required heavy capital outlays and extensive restructuring of factory floors.

Using more advanced AI models, researchers at Google’s Deep Mind lab have been able to describe objects and have robots pick them up – selecting a toy dinosaur, for example, from a table full of other toys. With their latest RT-2 model, they almost doubled success in novel scenarios from 32% to 62% vs. the previous RT-1 model9. Innovations like this – and businesses that choose to invest in them – could help make real what some hope will be a new industrial revolution driven by more advanced computing.

What happens next?

Moving forward, there are clearly still risks to the business cycle, including higher-for-longer interest rate policy and souring consumer sentiment. However, looking over the longer term, it’s also clear that after decades of globalization and traditional manufacturing, things are changing in the US industrial base. Someday, this newsletter might even come to you from a robot. Until then, though, we’ll be keeping our eyes on the trends to help you navigate them.

Investment risk

Thematic investing involves the risk that a given theme is out of favor, or that the industries chosen to capitalize on that theme underperform the market.

The opinions expressed are those of the author, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions, there can be no assurance that actual results will not differ materially from expectations.