Thinking thematically: Solar – shining a light on oversupply

Overview

While market-wide forces are also playing a role in solar stock malaise, it’s impossible to ignore the impact of oversupply on solar firms

China has been a driving force behind this supply, which has brought enough capacity online to swamp even record solar demand

Looking forward, we see reasons to be optimistic about changing supply dynamics and growing demand from artificial intelligence

This year, Lebron James became the first basketball player to score 40,000 points in his career. A legendary cocktail of consistency and skill – averaging 27 points per game across 21 seasons – Lebron seems to have finally laid to rest the question plaguing him throughout his career: is he better than Jordan? But why bring this up in the context of solar? Sure, it’s sunny in Los Angeles, where the Lakers play, but we also want to talk about the importance of records – and which ones are celebrated.1

Last year, solar energy played a champion game of its own, breaking records again for annual energy installations at 397 giga-watts (GW).2 That’s enough energy to power 39 billion LED light bulbs or 347 million homes.3 Unwilling to rest on its laurels, the solar industry is also poised to break the record again, forecasting more than 500GW of new additions for 2024, an expected growth rate of ~25% year-over-year.2

Unfortunately, despite record demand, we’re seeing solar providers struggle on every continent. From February 2023 to February 2024, names like SunRun (North America), Longi (China), and Acciona (Europe) are down -49.92%, -51.33%, and -40.14% respectively.4 While there’s clearly market-wide forces at work – high interest rates, an obsession with artificial intelligence (AI), etc. – there’s also something specific going on in solar: oversupply. While we believe these are necessary growing pains associated with expanding capacity, today, we wanted to chart how we got here and where we might go next.

Building a juggernaut

Like most manufacturing over the past three decades, it’s impossible to tell this story without China. Beyond the country’s own ambitious climate plans, clean energy technology is central to China’s strategy of transitioning their economy for the future. As President Xi Jinping has said, technologies like solar are part of the “new productive forces” for the 21st century, which will allow China to transition from old industries into new ones.5

In practice, this has looked like an incredible amount of production. Between 2021 and 2023, we saw a 117% increase in solar exports from China.2 And after decades of focus, China dominates the industry in its current form, representing 80% of global manufacturing capacity – a state expected to be in place until at least 2026. Meanwhile, China continues to invest, putting $130B into the industry last year, with plans to bring a terawatt (1,000 giga-watts) of capacity online by the end of the year.6 From start to finish – polysilicon, solar wafers, solar modules, and finally, panels – China dominates the supply chain.

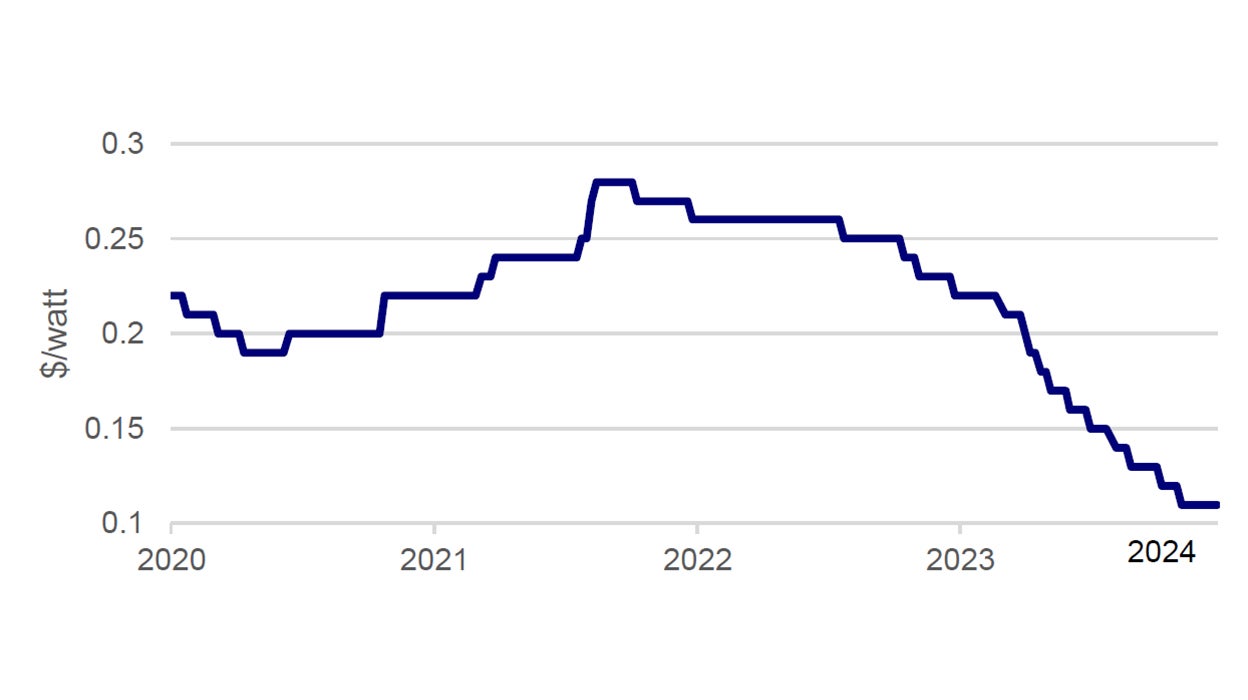

Of course, as every undergraduate economics student will tell you – *glances at old textbook* – that much supply will inevitably bring down prices. Over the past year, the supply coming online has cratered the price of solar modules from $0.22/watt to an all-time low of $0.11/watt. 7

An industry pushing through

So far, the industry is not taking these changes lying down. Solar providers like SolarEdge and Enphase have announced restructuring plans and layoffs to weather the storm, planning to cut 16% and 10% of their workforces, respectively.8 Governments are also hard at work to shore up their own domestic production of solar equipment. In the United States, for example, the Inflation Reduction Act (IRA), offers $0.17/watt for new production. Other benefits also push developers to use domestically produced content, something that has helped the US module price remain 180% higher than the global price.9 India is also working to develop its local solar industry, incentivizing free solar electricity for 10 million homes while also subsidizing giga-watt scale panel manufacturing.10

And what about China? It’s not like all off this supply is good for their solar industry. Longi, the world’s leading provider, is planning 30% staff layoffs and recently called on Beijing to crackdown on overproduction of low-quality panels.11 Meanwhile, the company is also planning on building new capacity abroad to supply local markets like the US – where production costs are higher but potentially capable of earning incentives. Last year, they announced a 5GW factory slated for Ohio.12

Demand to the rescue?

Going back to our classic supply and demand curve, one solution, of course, would be for the industry to find even higher demand to soak up all of that supply. And here, the market’s obsession we talked about above – AI – may be able to help. AI, and its computational complexity, requires an incredible amount of energy. In their most recent forecast of energy consumption for 2026, the International Energy Agency (IEA) expects AI power consumption to grow 10x over 2023 levels. Meanwhile, in 2023, Nvidia alone shipped 100,000 chip units, which will consume 7.3 terawatt hours (TWh) annually.13

Part of this rollout will require clean energy capacity – especially if companies and countries want to develop AI without abandoning their carbon commitments. As the CEO of NextEra, a clean energy provider, recently said, trying to get all these data centers online – often needing their own diffuse power sources – could increase renewable demand by 3x.14

Will this be a layup? No, we’ll leave those to Lebron James. The industry is going through growing pains. Still, we think there are reasons to be optimistic about the future of clean energy. Here’s to looking on the sunny side.