Thinking Thematically: The sun keeps on shining – solar energy, industry trends, and the election

Overview

The solar industry has been struggling amidst oversupply and challenges in residential solar from changing offtake rates

However, experts believe that these “hangovers” in the solar industry could be showing signs of lessening

Ahead of the election, there is also concern over the fate of the Inflation Reduction Act, though experts believe it will be difficult to repeal the popular law

Our sun is a wonder. With a mass more than 322,000x larger than the Earth’s, it takes a whole lot of juice to make the sky so bright. A burning orb with a temperature of 5500 degrees Celsius, it provides the earth with more than 1300 watts per square meter – enough power in an hour to operate a refrigerator all day.1

It was under that same brilliant star that solar industry experts were meeting last month at the annual RE+ renewables conference in sunny Anaheim, California. It may also be the home of Disney and the fabled Mighty Ducks, but for three days in September, it was abuzz with 40,000 people all committed to clean energy.2

Still, for all the glitz and glamor of the conference, it’s no secret the industry is struggling – even if it’s partially a victim of its own success. Solar saw 25% installation growth in the first five months of the year3, though this occurred amidst the strain of overcapacity, leading the average solar panel price down -17.9% YTD.4 Meanwhile, all of this is industry angst is taking place under the looming shadow of the US presidential election. Today, we’ll explore how these trends have changed this year and where we might be headed.

One big sun – and enough panels to run 10 billion light bulbs

First, let’s review the state of overcapacity. In 2023, China produced 1,000 giga-watts (GW) of solar panels, more than double global demand.5 China’s deflationary exports, of course, have not gone without notice. The US and Brussels have been pushing against China with anti-dumping measures, and solar anti-dumping duties in the US are being followed up this summer with an International Trade Commission (ITC) investigation into dumping from Southeast Asian trading partners that may be acting as a passthrough for Chinese solar equipment.6

Still, even tariffs don’t mean an immediate change to an oversupplied situation. For one, companies tend to anticipate changes in international trade rules. In the US, this has led to solar installers stocking up on panels before further changes can be made to tariff rates. We now have12 months of solar supply sitting in warehouses – compared to normal supply of 4-6 months of needed panels.7 However, this should improve as supply is digested and domestic production catches up. Tax benefits in the Inflation Reduction Act offer support for domestic production as well as bonus credits for installers meeting domestic content targets. This means those stockpiles should eventually decrease, though dealing with a hangover of supply takes time.7

Source: Bloomberg New Energy Finance, September 2024

The state of the solar consumer

Another ongoing challenge in the solar industry – and one also described as a “hangover” by industry experts – has been the changing landscape for offtake rates earned by homeowners who sell solar energy back to the grid. As we’ve covered in the past, Net Energy Metering (NEM) 3.0 in California dramatically lowered the rates homeowners earn by as much as 75% – which can change how long buyers expect it to take them to pay off their panels.8

Thankfully, it seems this part of the hangover may also be slowly improving. For one, coupling solar with battery storage is becoming more popular, which can help customers use their energy in the evening when utility rates are the highest – and after the sun has stopped shining. With rising utility rates across the country, more frequent summer heat waves – and air conditioning bills – the calculus for solar customers could also start to improve despite weaker offtake rates.9

A post-election inflection?

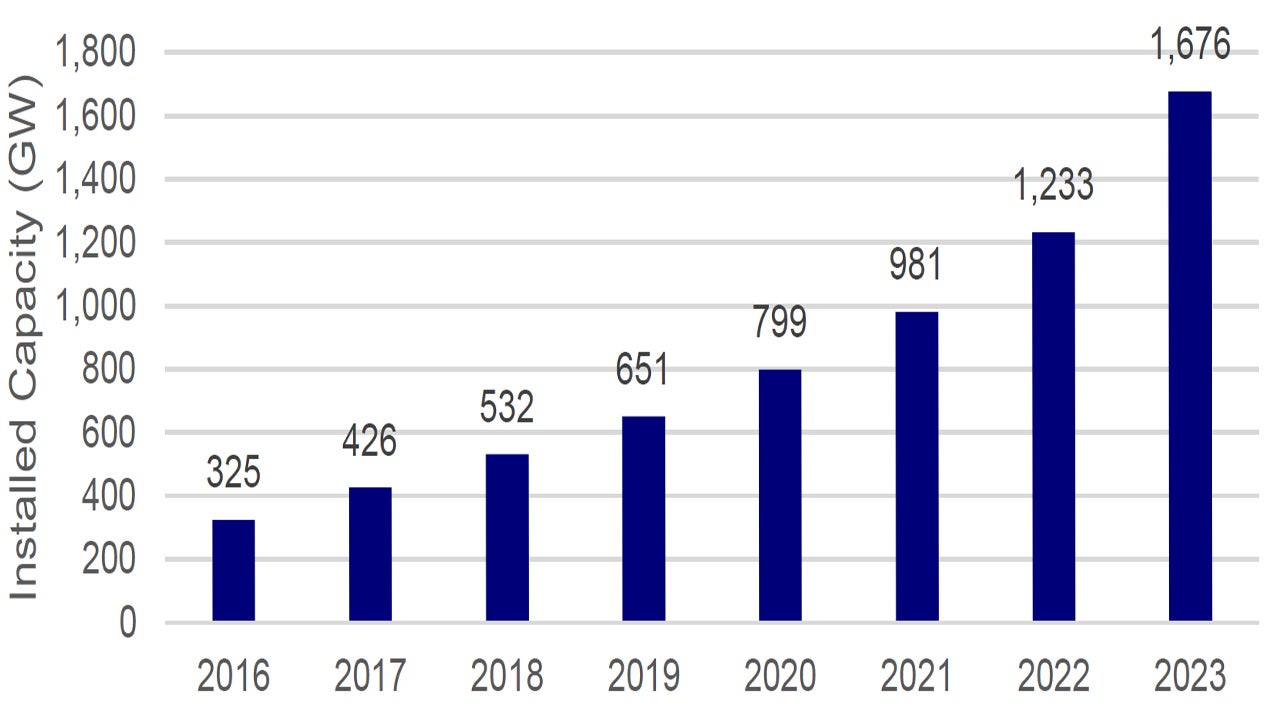

Whenever we discuss the US election and the solar industry, we think it’s important to remind readers of the ways politics do and don’t matter in clean energy. First, as the chart shows on the previous page, global solar capacity nearly doubled during the Trump administration. And that’s not just a function of other countries! The US saw 75% growth in solar capacity during that time as the competitive economics of solar influenced the power generation industry.10

Of course, the elephant in the room now is the US Inflation Reduction Act (IRA). Passed under the Biden administration, its nearly $400B of support for clean energy was the most meaningful climate legislation ever passed in the US. However, experts agree that repeal of the IRA is very unlikely, even in the event of a Republican sweep in the election.

For one, the tax benefits are very popular with voters, which may mean it proves hard to repeal – which is similar to the ultimate fate of the US Affordable Care Act. Furthermore, Republican districts have seen an outsized benefit from investments in clean energy jobs and factories – seeing $180B of investment in Republican districts in the first year of the IRA vs just $10B for Democratic districts. In August, eighteen Republican lawmakers in the House went so far as to write a letter to House Speaker Mike Johnson, asking him to preserve the law and the outsized benefits they’re seeing to their local economies.11

Where do we go from here?

There’s no question that the solar energy industry has been struggling. Still, we believe that things could be beginning to change. The industry continues to see growth in installations, which should help to lessen the oversupplied situation over time. Meanwhile, consumers still seem to have plenty of reasons to like solar, even if the rates they’re paid by utilities go down. We may continue to face uncertainty ahead of the election, but that too does not seem to be the existential threat it may appear to be at first blush. We don’t know how long it will take for the industry to process these headwinds. Still, we do know that – for the next 5 billion years, at least – the sun will go on shining.

Investment Risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investments focused in a particular industry or sector are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.