Coronavirus, the equity market sell-off and factor investing: keeping a balanced perspective

As recently as mid-February, equity markets were near all-time highs, oil prices were above USD 50 per barrel, volatility was low and credit markets were functioning well.

Since then, the global market sell-off has been sharp, only matched in terms of its scale and rapidity by that which preceded the Great Depression. In such circumstances, it would be easy to lose conviction in the fundamental principles of investing. But these will certainly survive this crisis just as they have all previous ones.

One basic principle is that securities markets are always forward looking. But at times like now that vision can be unclear. To help, however, it is useful to recognise that such forward looking behaviour consists of two elements: expectations of future cash flows and of required discount rates (Campbell and Shiller (1988), Campbell (1991) and Campbell and Vuolteenaho (2004)). Those two elements are embodied in the dividend discount model, for example, which underlies many factor-based analyses. That states that the current price of an asset depends on the sum of all its future cash flows (dividends for equities) discounted by the market’s required return. In that model, even small changes in expectations of future cash flows or of the discount rate can have a large impact on prices.1 While it is difficult to pinpoint precisely how much of the drawdown is driven by each of these two elements, we think that both were significantly repriced at the market low point.

What lies ahead?

Such a basic framework can also help us think about what might lie ahead. For instance, it is important to note that although both types of news can induce the same return shock, their resulting long-term effects are rather different (Brandt, Jin and Wang (2009) and Campbell and Vuolteenaho (2004)). A negative return shock driven by increases in discount rates tends to be more transitory. Furthermore, it is partially compensated by improved prospects of future returns.2 In contrast, negative shocks to cash flows that change the long-term prospects of companies, decrease investors’ wealth and leave investment opportunities unchanged.3 Given their long-lasting impact, cash flow shocks are of greater concern to long-term investors.

But how permanent are any cash flow shocks likely to be? For certain sectors of the economy (travel, leisure and tourism) there are clear concerns. But it is unrealistic to think of countries remaining in lockdown for a long period. Slowing and reversing the spread of the coronavirus is surely within the scope of mankind’s ingenuity. Furthermore, widespread aggressive action has been taken by governments and central banks to free up credit markets and provide income support to companies and workers. While hopes of a V-shaped quick recovery may be too optimistic, it is equally the case that expectations of economies being locked in a multi-year depression are in all probability too pessimistic.

How to proceed

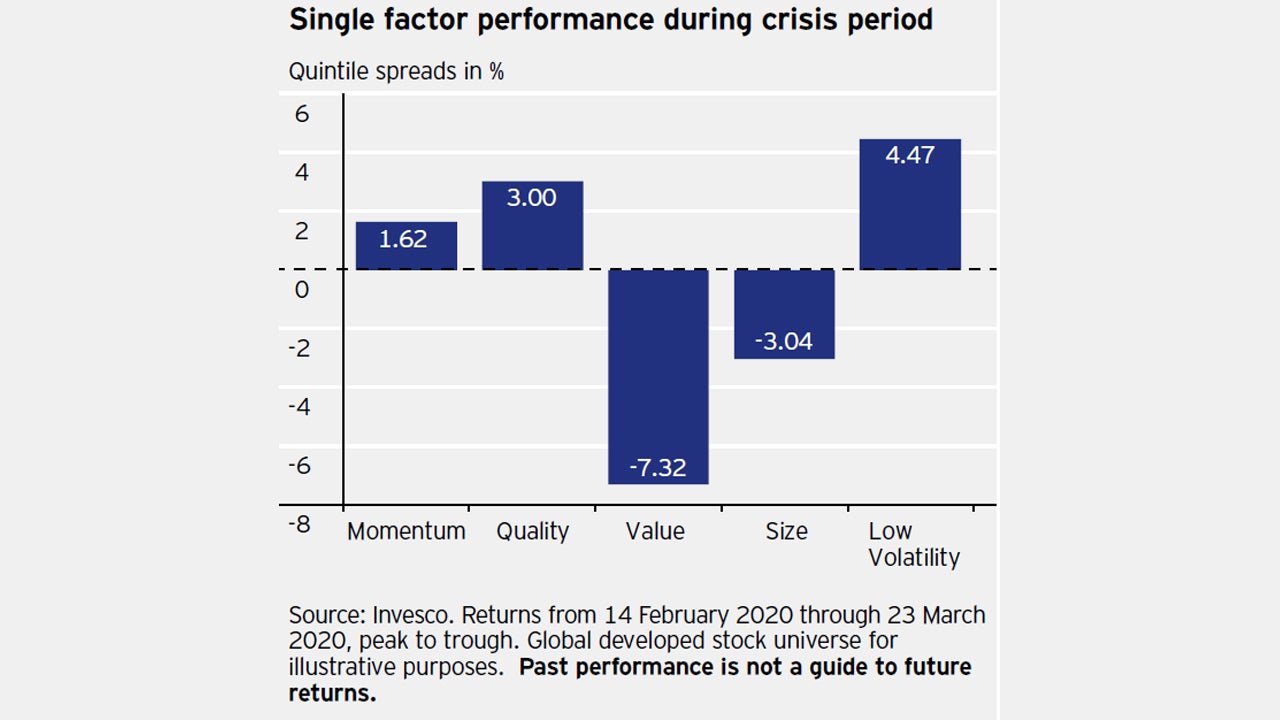

Whether we have witnessed a spike in the discount rate or a sustained deterioration in fundamentals and cash flows is too early to tell. In this light it is important not to forget the fundamental principles of diversification, discipline and time in factor investing. Empirically, Campbell and Vuolteenaho (2004); Campbell, Polk, and Vuolteenaho (2010); Campbell, Giglio, and Polk (2013); and Campbell, Giglio, Polk, and Turley (2018) find considerable differences in the cash-flow betas (sensitivities to cash flows) of factor strategies. This suggests that diversifying across factors is an adequate way of weathering different economic environments. For instance, we find that the equity factors producing the best returns in the equity market downturn have been quality, low volatility and momentum. These factors seem less sensitive to economic shocks (at least, as far as the current period is concerned, for momentum). Other factors have exhibited greater sensitivity such as value, size and yield. Should there be a reversal, these factors may reap more benefit. But perhaps the long-term investor should not try to foresee which factor will do well in the short term and construct investment portfolios on, essentially, that “guess”. A diversified multi-factor strategy based on well-researched investment factors with varying sensitivities to economic uncertainty, which would inherently provide a hedge if the crisis were to worsen or the recovery to occur swiftly, seems much more appropriate.

Nevertheless, for the more intrepid investor, a systematic method of varying exposure to factors with different cash flow betas could prove successful. For a more detailed example of how this might work, see Polk, Haghbin and de Longis (2020). Either way, we need to keep a perspective. The decline in equity prices is consistent with an increase in the discount rate and a negative cash flow shock that resulted from the intertwined impact of the pandemic, the oil price collapse and turmoil in credit markets. Uncertainty is high so volatility is likely to remain high. Investment principles help us navigate this environment just as they have in all other crises. A factor approach can help, whether the crisis gets much worse or ultimately proves less severe than expected.

Xavier Gerard PhD, CFA, is Senior Research Analyst at Invesco Quantitative Strategies. Stephen Quance is Global Director of Factor Investing at Invesco.

^1 For a perpetual asset, which a stock exchange index can be regarded as, a simplified model of the dividend discount model is the Gordon Growth Model. This states that the current asset price (P) is equal to the current dividend payment divided by the difference between the required return (r) and the long-term growth rate (g). At the end of 2019, the MSCI World Index had a total market value of USD 44.6 trillion and that year paid total dividends of USD 1.0 trillion (Source: MSCI). If we estimate the long-term growth rate of dividends at 3%, this implies about a 5.4% return required by investors. If we believe the year to date (25 March 2020) 24% drop was a result of changes in both dividends and required returns, it is surprising how little these need to change in order to be consistent with the price drop. For example, if this crisis cuts the current year dividends by 5% but leaves the long-term growth rate of dividends unchanged at 3%, the required rate of return only needs to rise from 5.4% to 6.1% for the MSCI World index to fall 24%. Given all the uncertainty, big swings in prices are not be so surprising.

^2 To understand this, assume a two-period investment which pays a dividend (D) in year 2. In year 1, expectations about D remain the same but the discount rate (r) goes up, bringing price and return down. Yet in year 2 one still earns D, and a high return because of the lower starting price.

^3 As r stays the same there is no improvement in investment opportunities: there is nothing to buy that would give a higher return.

References

Brandt, Michael W., Xing Jin and Leping Wang, 2009, “Cash-Flow Risk, Discount-Rate Risk, and the Time-Varying Market Risk Premium,” Working paper Duke University

Campbell, John Y., 1991, “A variance decomposition for stock returns,” Economic Journal 101, no. 405: 157-179

Campbell, John Y., Stefano Giglio, and Christopher Polk, 2013, “Hard Times,” Review of Asset Pricing Studies 3, 95–132.

Campbell, John Y., Stefano Giglio, Christopher Polk, and Robert Turley, 2018, “An Intertemporal CAPM with Stochastic Volatility,” Journal of Financial Economics 128, 207–233.

Campbell, John Y., Christopher Polk, and Tuomo Vuolteenaho, 2010, “Growth or glamour? Fundamentals and Systematic Risk in Stock Returns,” Review of Financial Studies 23, 305–344.

Campbell, John Y. and Robert Shiller, 1988, “The Dividend-Price Ratio and Expectations of Future Dividends and Discount Factors,” Review of Financial Studies 1, 195–228.

Campbell, John Y. and Tuomo Vuolteenaho, 2004, “Bad Beta, Good Beta,” American Economic Review 94, 1249–1275.

Polk, Christopher, Mo Haghbin and Alessio de Longis, 2020, “Time-Series Variation in Factor Premia: The Influence of the Business Cycle,” Journal of Investment Management 18.