Factor investing: A permanent shift in asset management

Key takeaways

The move to factor investing represents a big change in the way we understand and make investment decisions

Despite recent short-term volatility, factor investing is proven to deliver per formance over the longer-term, with multi factor approaches providing diversification benefits

Adoption of any new innovation takes time, with education key to increasing uptake and leading to mass acceptance and use

In our paper “Factor investing: the third pillar of investing alongside active and passive”, we looked at how factor investing is distinct from traditional alpha strategies and market cap-weighted investing. Factor investing, as we have argued, is rapidly emerging as the third pillar of investing alongside these two more established strategies.

We think the reasons are clear: factor investing offers a different perspective to balancing risk and performance, an approach that focuses on the key and fundamental drivers of returns. It unlocks an improved understanding of markets and asset allocation.

“A key finding within recent decades is that the most well researched factors help explain meaningful amounts of portfolio returns.”

Discovering an innovative approach brings change, although it may take time before the change is adopted on a widespread basis. Research into investing and financial markets has made some important breakthroughs in the area of factor investing, and even though some of these breakthroughs occurred years ago, we may only start to see adoption now. A key finding within recent decades is that the most well researched factors help explain meaningful amounts of portfolio returns. This is true regardless of the investment approach taken. What does this mean? We are all factor investors whether we know it or not.

Like all other innovations, we believe factor investing represents a fundamental and permanent shift in investing, driven by technology, on-going research and education.

Embarking on a paradigm shift

A starting point in this shift is to understand exactly what factor investing is. We define factors, namely investment factors, as characteristics that give information about the expected returns of securities. Factor investing is therefore the systematic, evidence-based approach that targets these factors.

Technology plays a big part in the emergence of factor investing as an efficient and cost-effective investment option. The continual rise of computer power enables big data, longitudinal research and artificial intelligence – all aiding techniques to capture those factors selected. It’s now easier than before to understand the risk/reward profile of a portfolio, given the information and research available to investors.

“Technology plays a big part in the emergence of factor investing as an efficient and cost-effective investment option.”

We can use our understanding of the risk and return opportunities of factor investing to adjust our allocation, increasing or decreasing the exposure to one or more investment factor. This is an active asset allocation decision, just as it is an active decision when we reweight country exposures. It is all about making informed choices: to be active or passive in asset allocation and/or portfolio management, and at what cost. Once we decide whether to actively or passively allocate across factors, we can decide whether to actively or passively manage the implementation.

How is factor investing different?

There was a practical challenge that, for quite some time, existed in the execution of factor strategies: developing strategies that efficiently and effectively capture desired factors at reasonable implementation costs. This makes factor investing different from both market cap weighted investing and active alpha strategies.

In market cap weighted investing, the market sets the asset allocation of the portfolio, with the participants investing in an index of securities. The market weights are set by competitive buying and selling of all involved, not randomly.

Conversely, active alpha strategies put asset allocation in the hands of the fund manager. But while there are managers who beat the index, there are also managers that underperform by the same level. This makes active alpha strategies a zero-sum game. Winners are balanced by losers.

Factor investing focuses on factor premia, which refers to circumstances where structural market forces cause securities with certain factors to perform relatively well, is fundamentally different from traditional alpha generated by active strategies. By choosing the types of factors they are exposed to, investors attempt to benefit from investing in factor premia, while shielding themselves from underperforming factors. The source of factor premia is risk, a market obstacle (such as a regulation) or a systematic bias which alters investor behaviour. This makes factor investing different to active alpha investing, as investors have choices about whether to pursue or avoid these market premia.

Does factor investing deliver performance?

Factors have been proven to deliver performance in academic research1, but they must be given time to work. Banz (1981) observed this in his study of the size premium; performance of small companies vs. large companies by market cap. He documented that the size premium can be material and positive in the long run, but it is less predictable and volatile in the short term.

Take value-based factor investing as another example. Over the short to medium term, value-based factor equity investing has underperformed to investor expectation and against major indices. The S&P 500 Pure Value Index recorded 5-year annualised returns of 6.71% (total return, as at 30/09/19), lower than the 10.84% achieved by the broader S&P 500 index. This underperformance can lead to questions around whether factor investing works.

“Factors have been proven to deliver performance in academic research2.”

However, against a longer-time frame of 10 years and beyond, value has delivered performance i.e. the factor has behaved more consistently with expectations. The S&P 500 Pure Value Index 10-year return hit 13.37%3 (total return, as at 30/09/19), beating the S&P 500 index’s 10-year annualised return of 13.24% even with the recent underperformance4. This helps to illustrate the long-term nature of factor investing.

There is merit to a multi-factor approach to help improve single factor performance. Not all factors are in favour (i.e. providing outperformance against a market-cap weighted benchmark) at the same time or over the same period and investors can plan for this by diversifying their exposure beyond one factor. An example of this is the outperformance of momentum in the prior 5 years. This can be evidenced by the S&P 500 Momentum index that delivered 12.25% 5-year annualized returns (total return, as at 30/9/2019) compared with the S&P 500 index 5-year annualized returns of 10.84%. If an investor was solely exposed to value and hadn’t diversified, they may be disappointed by the portfolio’s performance if their goal was to increase returns. A multi-factor approach may help improve consistency through diversification benefits across factors.

Accelerating adoption

If knowledge of factors and factor investing has been around for many years, why hasn’t it been adopted more widely?

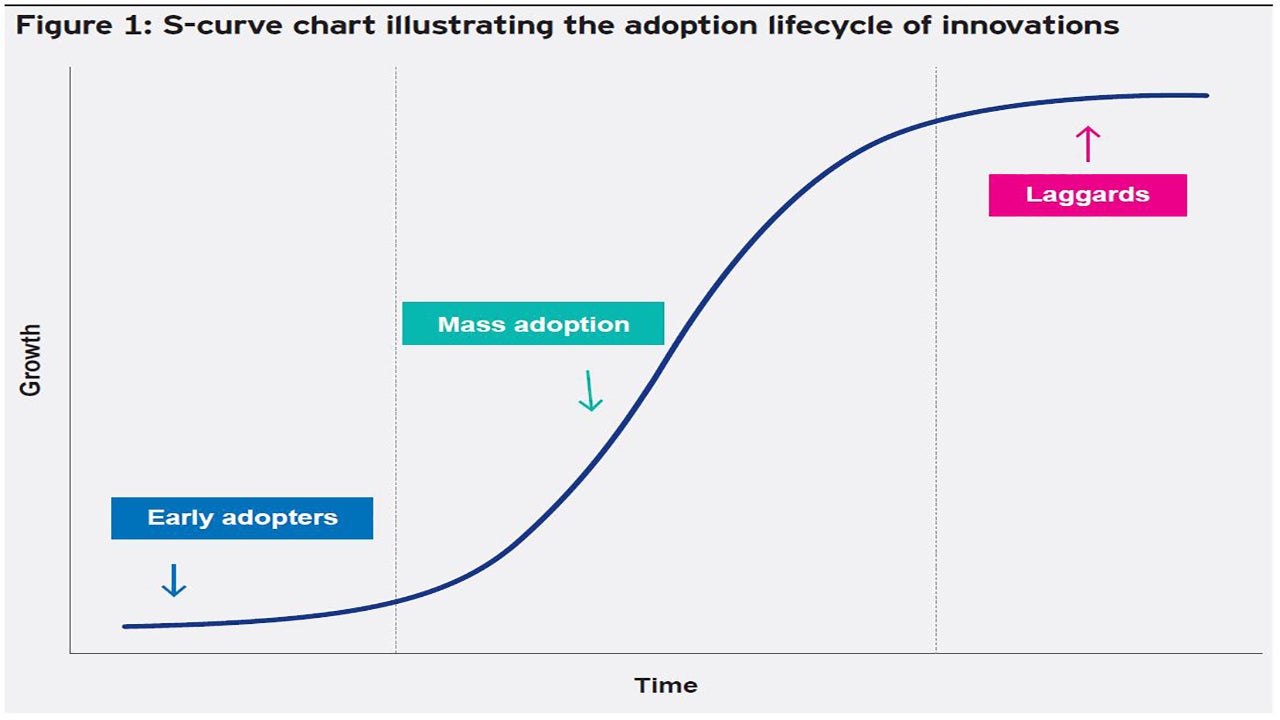

The simple answer is that it takes time. Most innovations take time to be adopted by the mainstream. This phenomenon is best captured by the S-curve.

The S-curve is the model that explains a common pattern after technological breakthroughs. When an innovation is first made, few people would hear about it. Of those who do, even fewer actually adopt it. Over time, these early adopters start to show proof of concept, providing evidence that the innovation works as awareness increases, experience grows and costs generally come down. An example of this could be the adoption of smart phones which were invented in 1992. They started off as a novelty with only a few able to afford or willing to try the new technology. Fast forward to today where they are a major appliance used by billions of people for many different functions.

As the innovation starts to move into the mainstream, slowly at first, it is led by champions of the innovation. Then an inflection point hits and adoption accelerates. Another example is the transition from film to digital cameras, which took several years. But today, digital cameras are everywhere and the predominant camera technology.

What about factor investing? According to our Invesco Global Factor Investing Study 2019, factor investing is still in the early growth of the S-curve and has not yet made the jump into the mainstream. We estimate that around half of institutional investors have taken up a factor strategy, with retail lower at around 20%. This is not surprising given that factors are still not easily understood by most of the investing population. But what is clear is that early adopters, such as institutional investors, are embracing factor investing to manage their assets.

Change is here

Factor investing is here to stay and offers a third and compelling way to think about investing. Taking a different approach from both index and active alpha investing, it offers a clear and transparent way to understand the key drivers of performance and risk. With time, it will be increasingly adopted by investors, marking a permanent shift in asset management. In the meantime, technology fuels continual research and education, helping investors to better understand and apply factor investing to their portfolios.

Stephen Quance is Global Director of Factor Investing based in Singapore.

^1 Source: Fama, E. F.; French, K. R. (1992). "The Cross-Section of Expected Stock Returns". The Journal of Finance. 47 (2): 427

^2 Source: Fama, E. F.; French, K. R. (1992). "The Cross-Section of Expected Stock Returns". The Journal of Finance. 47 (2): 427

^3 Source: Invesco, as of Sept. 30, 2019.

^4 Source: Based on S&P 500 Pure Growth Index performance as at Sept. 30, 2019.