Using factors for potential return enhancement

Investors are increasingly looking to factor investing as a valuable tool to help achieve investment objectives. Today, possibly half of institutional investors use factor strategies for at least some portion of their portfolios. And when over 300 global institutional and wholesale investors who are already using factors were asked why they did so in a 2018 Invesco survey, the majority named risk-adjusted returns as their most important measure of success.1

Given expectations of a lower-return environment in the future, the desire to enhance returns is sensible. But, most investors are not experienced with factor investing nor do they fully understand the practical challenges of applying the theory to practice.

In the second paper of this series, we addressed how investors can start by looking at their existing portfolios in factor terms and understanding where they are over- and under-weighted. In this third paper we discuss how they can then deliberately position their portfolios across factors in an attempt to enhance performance.

Factors explained

Factors are persistent, quantifiable investment attributes that explain performance — risk, return, or both. True factors don’t just affect performance for one security or over one brief period; they help explain performance across asset classes, in roughly the same way, over extended time periods.

The formal foundations for factor investing were laid in the 1960s with the Capital Asset Pricing Model (CAPM) developed by William F. Sharpe, John Lintner and Jan Mossin. It made a distinction between alpha as a measure of excess return compared with a benchmark, and beta as market risk.2,3,4 The single factor approach in the CAPM gave way to multi-factor models after the work of Ross and Roll in the late 1970’s and early 1980s giving birth to the Arbitrage Pricing Theory. In the years following, multiple factors were revealed to the investment community.5,6 Possibly the best known factor model is the Fama-French three-factor model (1992), developed by Eugene Fama and Kenneth French, in which the size and value premia were combined with market risk for equities.7 In 1997, Mark Carhart expanded the model to produce the four-factor model by adding the momentum factor.8 However, studies on the size and value factors were first conducted in the early 1980s, and the first studies on the low-volatility factor date back as far as 19729,10

"Security Analysis", the famous book by Graham and Dodd, first published in 1934, touches on many of the same concepts at the heart of factors, such as value and quality. Therefore, factor strategies have long been used in active fund management as well – just not always under the “factor” label or in the systematic way used today.

Academics have since identified over 600 factors that may influence returns and risk, prompting experts to refer to a “factor zoo.”11,12 In their 2016 paper “…and the Cross- Section of Expected Returns,” Campbell Harvey, Yan Liu, and Heqing Zhu found that factor identification has accelerated as assets have poured into factor strategies; 59 new factors were “discovered” between 2010 and 2012 alone. A data-mining approach, in which analysts apply regression analysis to performance data to identify new factors, has driven a proliferation of factors, but many of these may just represent noise in the data that are not persistent elements of markets.

Factors that matter

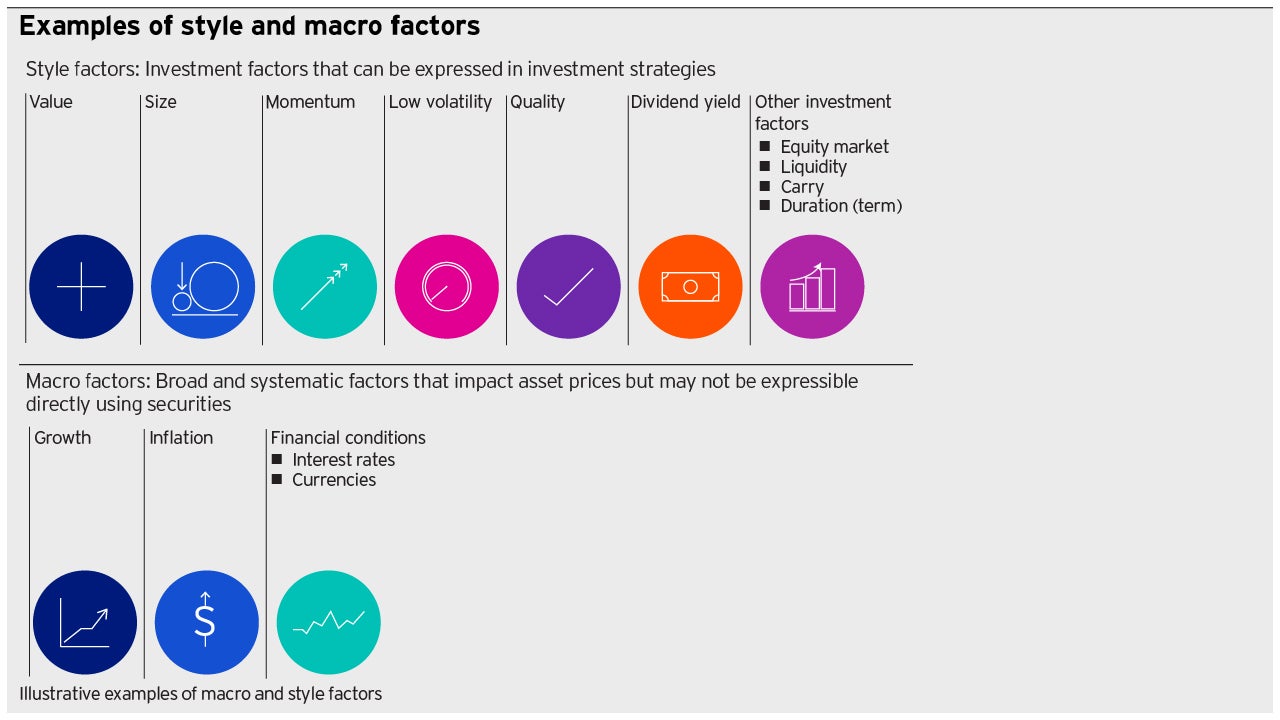

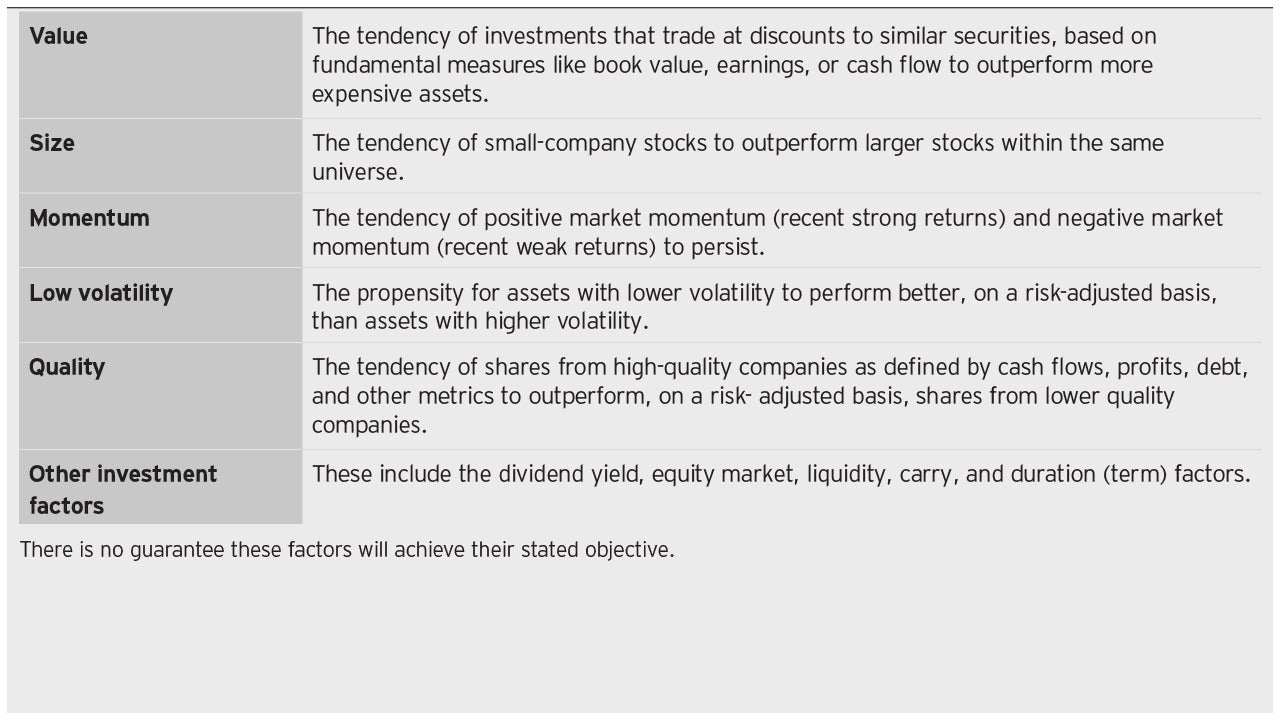

Today, most investors focus on a handful of commonly used factors, which fall into two groups: style factors and macro factors. Invesco emphasizes the following factors.

Style factors

Style factors use directly observable asset attributes to explain returns.

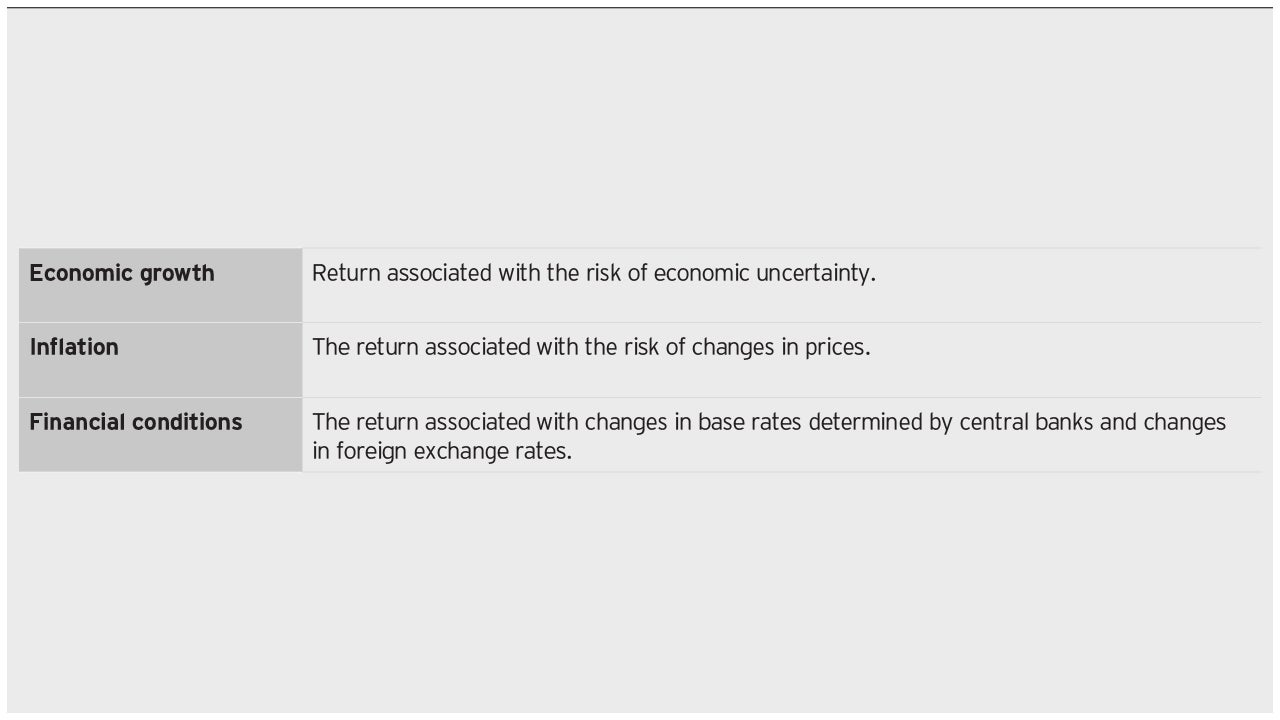

Macro factors

Macro factors use observable economic time series information to explain security returns, but may not be directly expressible using securities.

To mitigate the risk of disappointment, before deploying assets in pursuit of an investment factor, a series of criteria should be assessed, including:

- Understandable rationale. Factors that fail to be explainable or are overly complex may prove disappointing in the future.

- Objective evidence. A factor with a solid rationale should be observable in historical data, over long periods of time and persistently through most rolling periods. As the reasons for the existence of a premium are not market or asset class specific, nor should be the observations. Pervasiveness across markets and asset classes further builds confidence. Thankfully, much rigorous academic research is publicly available sometimes covering 100 years or more.

- Robust. An investment factor defined too narrowly or that requires owning a specific set of securities may not deliver at scale in a live portfolio net of all costs.

- Investable at Scale. Running a real portfolio is more difficult than creating a paper portfolio from a regression analysis. Implementation can be complex and difficult and unreliable or poorly constructed factors may not prove worthwhile net of all costs.

- Distinct. Particularly when used in a multi-factor context, redundancy of factors reduces efficiency while adding cost and complexity. Each factor we pursue should add expected value both on its own and when combined with others.

There are relatively few distinct factors that meet all the criteria. In the next section, we will explore one example of each of the main kinds of factors. Note that there are very often multiple explanations for the same factor phenomenon and definitively determining which is correct is difficult. The point is to gain confidence that there is at least one reasonable explanation.

Potential return-generating factors

Some factors help explain investment returns, providing insight into the conditions under which an investment will do well or poorly. Others can offer a persistent source of return potential. Some perform both functions, simultaneously explaining and generating returns. Of the hundreds of factors that may influence risk and return, we believe only a handful can be used as a viable source of persistent returns.

Three types of explanations typically explain why a factor strategy could deliver a longterm premium: i) exploitation of a risk premium (rewards for taking on risk beyond market risk), ii) collective behavioral biases of investors, or iii) structural inefficiencies caused by constraints placed on investors. These three attributes persist over time, either because they are rooted in conditions that don’t easily change — either basic human psychology or the ways that markets are structured and regulated — or (in the case of risk premiums) because they aren’t as attractive to most investors. They create an opportunity for earning returns that are more consistently compensated for, given their inherent risk. Here are three examples of ways factor strategies may help improve returns.

Behavioral bias and the momentum factor

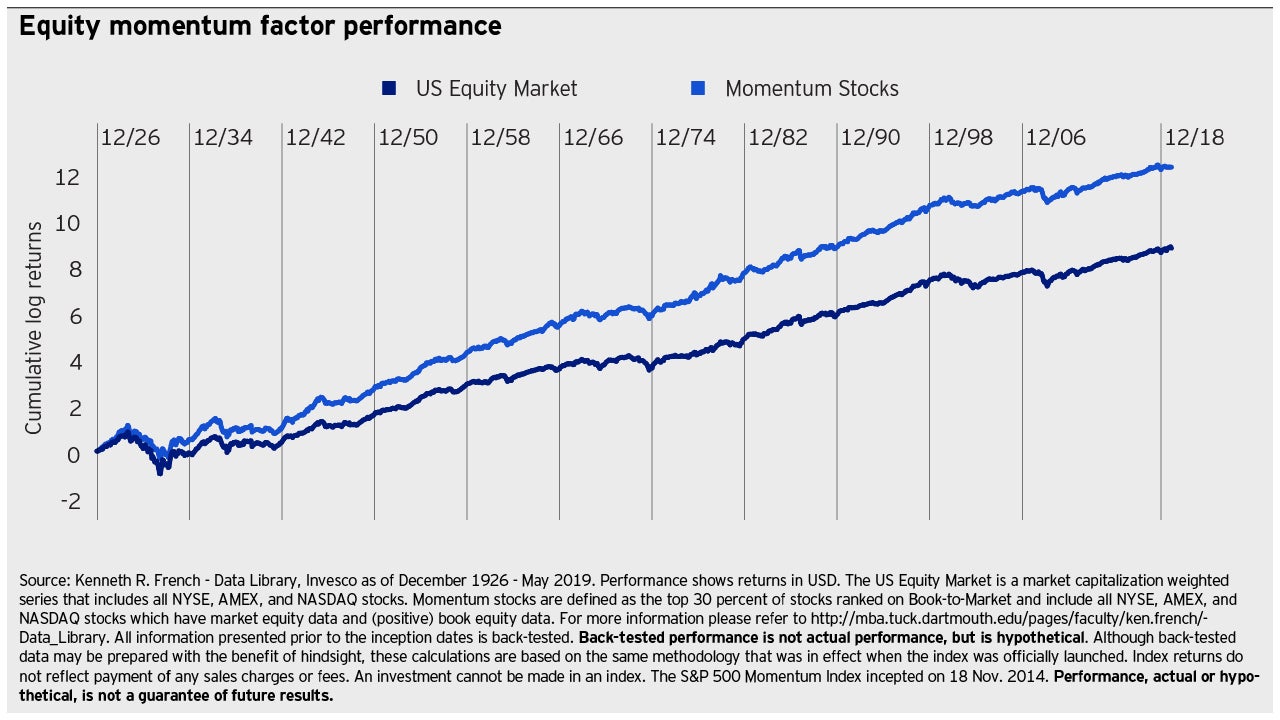

The momentum factor captures persistence of returns of securities that have performed relatively well (or poorly) in recent periods. Momentum can be measured with a variety of indicators such as price momentum, earnings momentum or other metrics such as analyst ratings.

Over time, outperforming (underperforming) assets tend to continue to perform well (or poorly) in the near term. Academics and practitioners attribute the additional return to behavioral biases. That is, it’s human nature for investors to continue driving up (or down) prices once they start a trend.

In behavioral economics this phenomenon is known as “recency bias,” which causes people to place too much emphasis on their latest experiences when they predict the future. For instance, investors might assume that a stock that has done well over the last year will continue to do well, while one that has had problems will continue to struggle. As a result, there's a systemic bias causing the trend to continue into the next period. When a momentum security begins to turn around, it can create significant losses for investors over a short period of time, but most people don’t notice until the process is well under way. As a result, momentum can be a bumpy ride at times even if it delivers a premium in the long run. Prospective investors should also bear in mind that momentum strategies also involve a high level of turnover, requiring efficient trading to capture the premium.

The chart below presents the cumulative log returns of the broad US equity market along with those of momentum stocks defined as the top 30 percent of stocks ranked by momentum (prior 2-12 month returns) from December 1926 through May 2019. Viewing these outcomes in log terms allows us to mitigate the impact of compounding and easily visualize how the factor has performed over very long time periods.

Because the human behavior driving the performance of momentum strategies is likely to persist, we would expect the premium to continue existing in the future.

Structural bias and the low volatility factor

At first glance, low volatility as a factor seems counterintuitive to the notion of greater returns being a compensation for greater risk. A lower-volatility (or lower-risk) security ought to have a lower return. Yet a low volatility factor approach has been proven to add value over time. What’s the explanation?

We first offer a point of clarification. It is not necessarily the case that lower volatility securities outperform higher volatility securities. What has been shown in the data is that on a riskadjusted basis, lower volatility securities tend to do better. Academics and practitioners believe that structural constraints likely generate the low volatility premium. If we re-revisit the Capital Asset Pricing Model, included in it is the assumption that all investors can borrow and lend at the risk-free interest rate in unlimited amounts. Clearly this assumption is unrealistic. Consider that many institutional investors are not allowed to use leverage at all or are reluctant to do so even if they can. In general, they do not seek to enhance returns through leverage. Instead, these investors seek to achieve outcomes like those that might result from the application of leverage by seeking out stocks with higher betas relative to the market.

These stocks tend to have a higher sensitivity to market movements, which can make them more volatile and also means they have the potential for bigger gains relative to the market — and bigger losses. That drives the prices of high-beta stocks up and low-beta stocks down. As a result, low-risk securities tend to be more attractively valued than high-risk securities. This phenomenon is observed not just in equities but also in bonds and commodities.

As shown in the chart below, between January 1995 and May 2019 low volatility stocks have provided better performance, on average, than the market-cap-weighted S&P 500 Index over all months. When we look at average returns over months when the S&P 500 Index posted positive returns, we find that low volatility stocks provided positive but lower returns by 0.9%, on average, than the broad index. However, when we look at average returns over months when the S&P 500 Index posted negative returns, we find that low volatility stocks posted negative but substantially better returns by 2.1%, on average, than the broad index. This aligns with the notion that low volatility stocks can achieve their returns as a function of both a lower beta and, more specifically, by having greater upside than downside.

We expect this risk premium to persist as long as institutions restrict leverage while also demanding high returns — and as portfolio managers are driven in turn to seek higher returns by investing in highly volatile securities.

Risk premium and the size factor

Some factors’ effectiveness can be attributed to risk premiums, where investors take on specific risks that are rewarded by higher returns.

One may be the size factor. The effectiveness of the size factor at generating excess returns can be explained by the fact that shares of smaller companies with low market capitalizations can be harder to sell in falling markets — a kind of illiquidity premium. It could also be that smaller companies are less equipped to survive unforeseen market turmoil than larger more established companies and there is less information available about them than larger companies. This might reasonably cause investors to demand a higher expected return to attract investment.

Size strategies focus on the shares of smaller companies within a larger universe. Investors have accessed the size factor for decades, from the first small-cap active equity funds of the 1980s to today’s smart beta and other cap-adjusted passive mutual funds and ETFs. Last, the size factor is a strategy for long-term investors. While the research tells us, we might expect the size premium to be material and positive in the long run, it is less predictable in the short term.

Ultimately, what is the long-term evidence for factor returns through time? Since factor investing consists in following rules-based systematic investment strategies, we can model their performance through time.

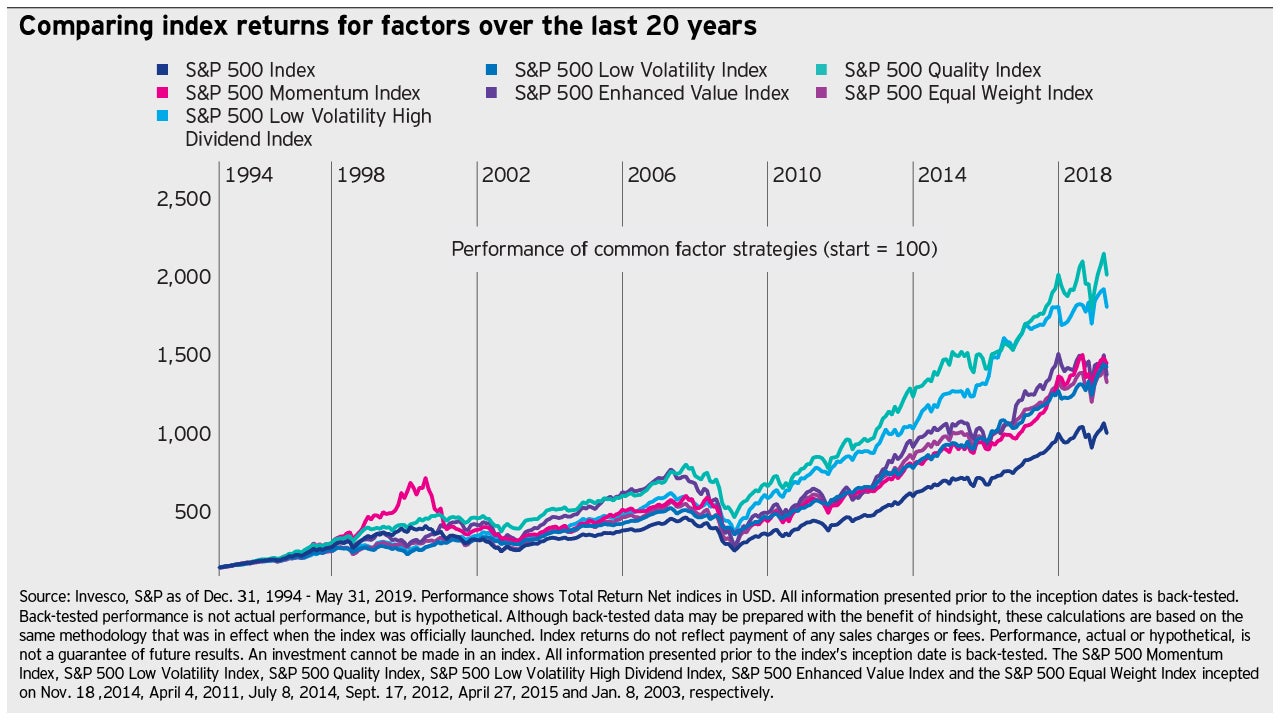

The chart below shows how various factor approaches have performed from 1994 to 2019. Over this time period, quality had the strongest performance, followed by dividend yield, momentum, low volatility, and value but all outperformed the broad S&P 500 Index. Past performance alone is not sufficient, but taken together with a sound investment case, it reinforces the notion that a long-term premium does exist.

Six factors with a historical long-term performance advantage:

It’s important to understand that while these factors have generated excess returns over the long term, they don’t always outperform over short periods. Investors should be prepared to hold their investments for long time frames in order to potentially benefit from factor strategies.

Passive factor strategies have enabled investors to seek higher than market return potential without giving up some of the attractive characteristics of passive investment strategies. By adding a factor tilt to otherwise passive portfolios, factor investors may be able to enhance returns over the broad market benchmark. Compared with traditional stock-picking strategies, factor investing strategies are generally chosen because of the predictability of results.

Based on the results of the Invesco Global Factor Investing Study 2018, new or additional factor investing mandates are generally funded from both market-weighted passive and more traditional active allocations, as well as from new cash flows.

Factor investing grew up in the equity markets as a way to add the potential for outperformance to cheap, transparent, passive stock exposure (or, conversely, to make the benefits of active management more systematic, predictable, and cost-efficient). As a result, many of the most widely used factors relate to equities. We have found, however, that factor analysis also works in fixed income, commodities, and currencies, with slight adjustments.

Making factors work in portfolios

Factor investing is an investment strategy in which securities are chosen based on certain characteristics with the goal of achieving portfolio outcomes — increasing returns, risk reduction, cost control or some combination of the three — in a transparent, structured, and disciplined way.

Of course, all portfolios have exposure to factors, whether they explicitly employ a factorbased strategy or not. Factor analysis simply helps investors understand what’s driving performance, how much risk they’re taking on to achieve it, and whether they could generate better returns (or reduce risk) by changing their allocation to various factors.

But the abundance of factor strategies available today paradoxically has made it more difficult for investors to achieve the increasingly specific return outcomes they seek. Many would-be factor investors wind up unintentionally taking on more risk. They may not fully understand the risks of the factor strategy they’re considering or the factor exposures of the portfolio they’re adding it to. To illustrate how factors are ever-present but not fully appreciated, when we looked at the factor tilts of over 600 actively-managed U.S. large- cap funds, we found that on average, relative to the S&P 500 Index, they were overweight on the size factor (toward smaller companies) and underweight on the low volatility and dividend yield factors.13

Moreover, as our research has shown, naively combining factors often produces unintended and less-than-ideal consequences. Part of the reason for this is that investments can have both positive and negative factor exposures. This means that an intended positive factor exposure in one investment might be nullified by a negative exposure in another. For instance, single factor value and momentum strategies tend to exhibit negative exposure to the other factor if not deliberately controlled. Investors need the expertise and the proper analytical tools to understand the potential interactions between the strategy and their current exposures — something even sophisticated investors may not possess.

Factor strategies can be powerful tools for pursuing enhanced returns in institutional portfolios, enabling investors to harness the power of persistent, broad-based sources of return in their investment strategies. But they’re tools that must be used skillfully, methodically, and tactfully, ideally by experienced practitioners.

At Invesco Investment Solutions, we take a consistent approach to factor investing, whether the client objective is greater returns, reduced risk, or cost control:

- We diagnose the client’s situation using Invesco Vision, our portfolio management decision support system, to identify and quantify the factor exposures already present in the client’s portfolios.

- We engage in a dialogue to gain a deep mutual understanding of the return goals, expectations, and desired outcomes across a variety of assumptions and possible environments.

- We build solutions with an open, unbiased mindset from a broad set of investment tools across traditional and alternative asset classes, active/passive approaches, and vehicles.

Where the industry is headed

Factor strategies are a relatively new addition to the asset management toolbox. The appetite for factor strategies appears to be strong, however, as investors begin to recognize the benefits of using them.

Institutional investors typically start by employing factor approaches in a portion of their asset allocation, usually equities, and expand from there into other asset classes. Investors have also generally begun their foray into factors by incorporating the most common style factors (equity market, size, and value), which mirror active strategies that are already familiar.

The objective of factor investing is normally strategic due to the long-term nature of investment factors. However, a tactical use of factors is also possible, for example, to express a market view. In this way, investors who expect a market trend to continue can focus on momentum strategies. Investors who may expect heavy volatility in equity markets in the future can hedge their bets with low volatility strategies instead. Factor investing can also be used in a targeted way to reduce portfolio risk – with the objective of giving the investment additional diversification. A note of caution, however: Applying factors that have historically delivered a premium over the long-term creates an additional hurdle that must be overcome when used tactically. Market trends and economic cycles can change quickly and, sometimes unexpectedly. To benefit from tactical applications, investors must determine when to get in and when to get out.

And finally, while most institutional investors take long-only positions in factor strategies, a few are implementing pure, long-short factor portfolios to capture absolute returns. For instance, a long-short momentum factor strategy might buy the top 10% of stocks that have outperformed their peers over some recent period, while shorting the bottom 10% of stocks that have underperformed over the same period. This type of portfolio can be very useful in seeking to deliver returns with a low correlation to the market. Having a long and short position effectively eliminates market exposure. What remains is a more direct exposure to the desired factor.

Adopting factor investing

As we’ve mentioned, factor investing is based on a solid foundation of rigorous research, much of it from academia.

In the end, the use of factor investing is not strictly about moving assets into factor strategies, but also about looking at a portfolio in factor terms, understanding the biases that create opportunity, and positioning investments for exposure to factors that can meet the organization’s goals. Fully adopting factor investing requires a shift in mindset across all levels of the organization, with buy-in particularly from senior leadership.

Factor investment is transforming money management as investors begin to supplement traditional asset allocation and security selection with factor-based approaches. Investors can start by looking at their existing portfolios in factor terms and understanding where they are over- and under-weighted. They can then deliberately position their portfolios across factors in an attempt to enhance performance.

Today, investor allocations to factor strategies are relatively small, but they are growing as investors become comfortable with the approach and recognize the benefits in return enhancement, risk management, and cost-efficiency. Factor analysis provides a way to improve understanding of what drives returns in a portfolio — and, at the same time, it creates the potential to improve performance without necessarily taking on more risk. For these reasons, factor investing is likely part of a permanent shift in the way assets are managed. If you’d like to explore how factor investing might enhance results for your organization, please contact your Invesco representative.

This article was written by the Invesco Investment Solutions team in collaboration with Invesco’s Global Office of Factor Investing.

Further resources

Factor Investing: Introduction & Research

Factor Investing: The Third Pillar of Investing Alongside Active and Passive

Annual Invesco Global Factor Investing Study

^1 Invesco Global Factor Investing Study 2018, page 21.

^2 Sharpe, W.: ‘Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk’, Journal of Economic Theory, 1964.

^3 Lintner, J.: ‘The Valuation of Risk Assets and the Selection of Risky Investments in Stock Portfolios and Capital Budgets’, Review of Economics and Statistics, 1965.

^4 Mossin, W.: ‘Equilibrium in a Capital Asset Market’, Econometrica, 1966.

^5 Ross, S. 1976a. The arbitrage theory of capital asset pricing. Journal of Economic Theory 13, 341–60.

^6 Roll, R. and Ross, S. 1980. An empirical investigation of the arbitrage pricing theory. Journal of Finance 35, 1073–103.

^7 Fama, E, and French, K: ‘The Cross-Section of Expected Stock Returns’, Journal of Finance, 1992; Fama, E, and French, K, ‘Common risk factors in the returns on stocks and bonds’, Journal of Financial Economics, 1993.

^8 Carhart, M.: ‘On Persistence in Mutual Fund Returns’, Journal of Finance, 1997

^9 Rolf W. Banz, Journal of Financial Economics, 1981

^10 Robert A. Haugen, A. James Heins, Wisconsin working Paper, 1972

^11 Cochrane, J. H. (2011). Presidential address: Discount rates. The Journal of Finance, 66(4):1047–1108.

^12 “Taming the Factor Zoo: A Test of New Factors” by Guanhao Feng, College of Business City University of Hong Kong; Stefano Giglio, Yale School of Management NBER and CEPR; and Dacheng Xiu, Booth School of Business University of Chicago.Dec. 15, 2017

^13 “Factor investing: complementing portfolios with customized factor solutions,” Michael Abata, Georg Elsaesser, Brad Smith, Jason Stoneberg, Invesco Risk & Reward, #2/2017