2022 outperformance and now offering historically attractive income potential

Overview

Direct lending performed extremely well in 2022 relative to more liquid credit

Looking forward, direct middle market loans are offering historically compelling levels of income

Manager selection is critical to mitigate risk given broader macroeconomic conditions

Challenging macroeconomic conditions around the globe continue to dominate discussion, particularly around inflationary pressures, higher interest rates, rising input costs (including materials, labor, energy, etc.) along with continued supply chain challenges. Unsurprisingly, the public markets continue to exhibit volatility as investors attempt to quantify these issues, particularly with the looming likelihood of recessionary conditions in the near to medium term. This backdrop sets the stage for the often-asked question of where to look for return in periods of significant market volatility and how is relative value considered between public and private markets?

Income Opportunities in Credit

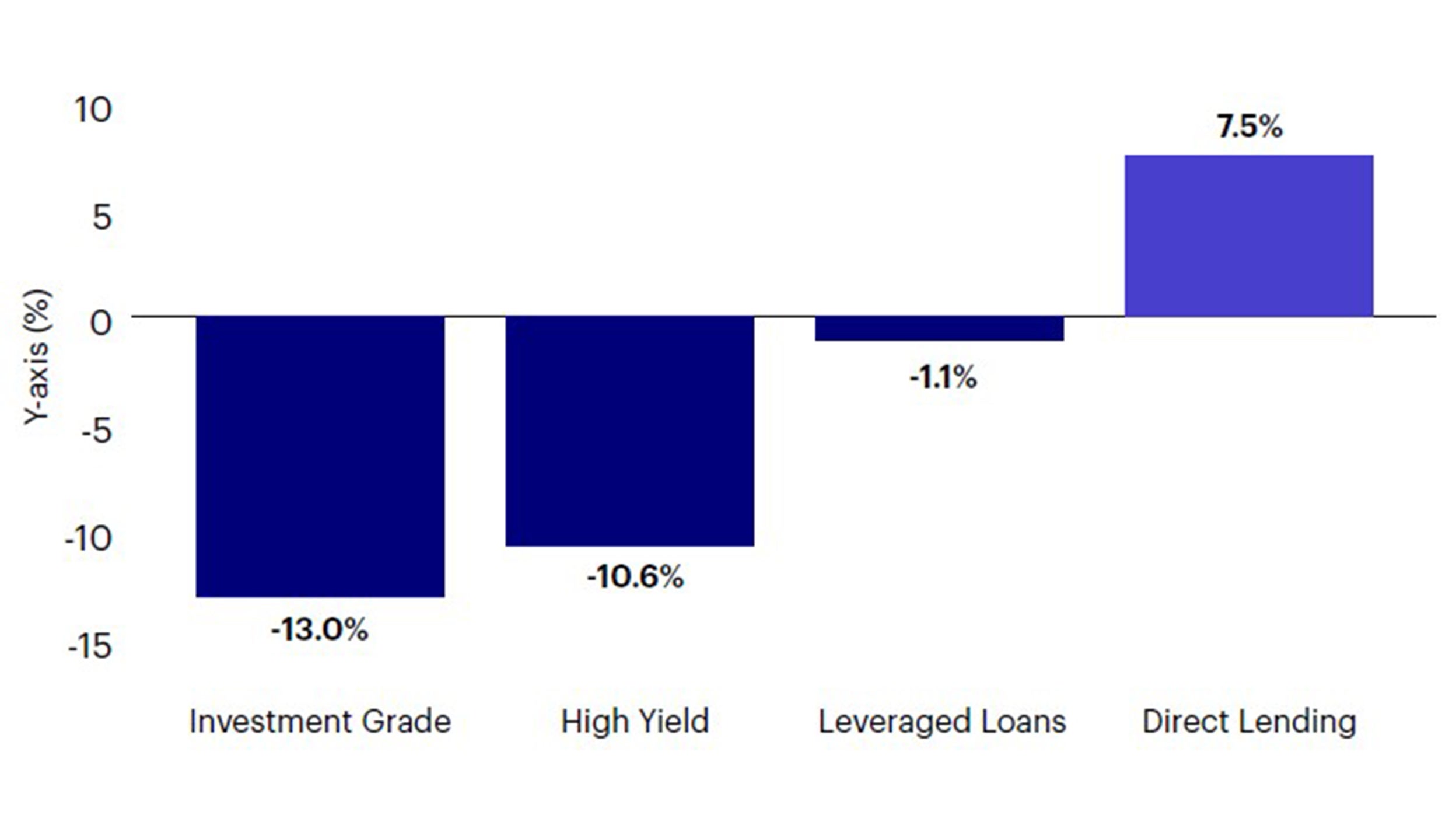

The impacts on liquid credit markets during 2022 have been extensive. Fixed income, particularly longer duration assets, have experienced one of the worst years in memory as embedded interest rate risk led to price declines. However, floating-rate assets fared far better, with broadly syndicated loans standing roughly flat for the year. The high floating rate coupon has offset price declines consistent with historical years of similar volatility. However, in stark contrast has been the experience of the direct lending asset class, which provided a +7-8% return experience, significantly outperforming liquid credit (and equities for that matter).

As of December 31, 2022. Sources: Bloomberg for Investment Grade and Credit Suisse for High Yield and Leverage Loans. Cliffwater as of September 30, 2022 for Direct Lending, utilizing trailing 4 quarters. Past performance is not a guarantee of future results.

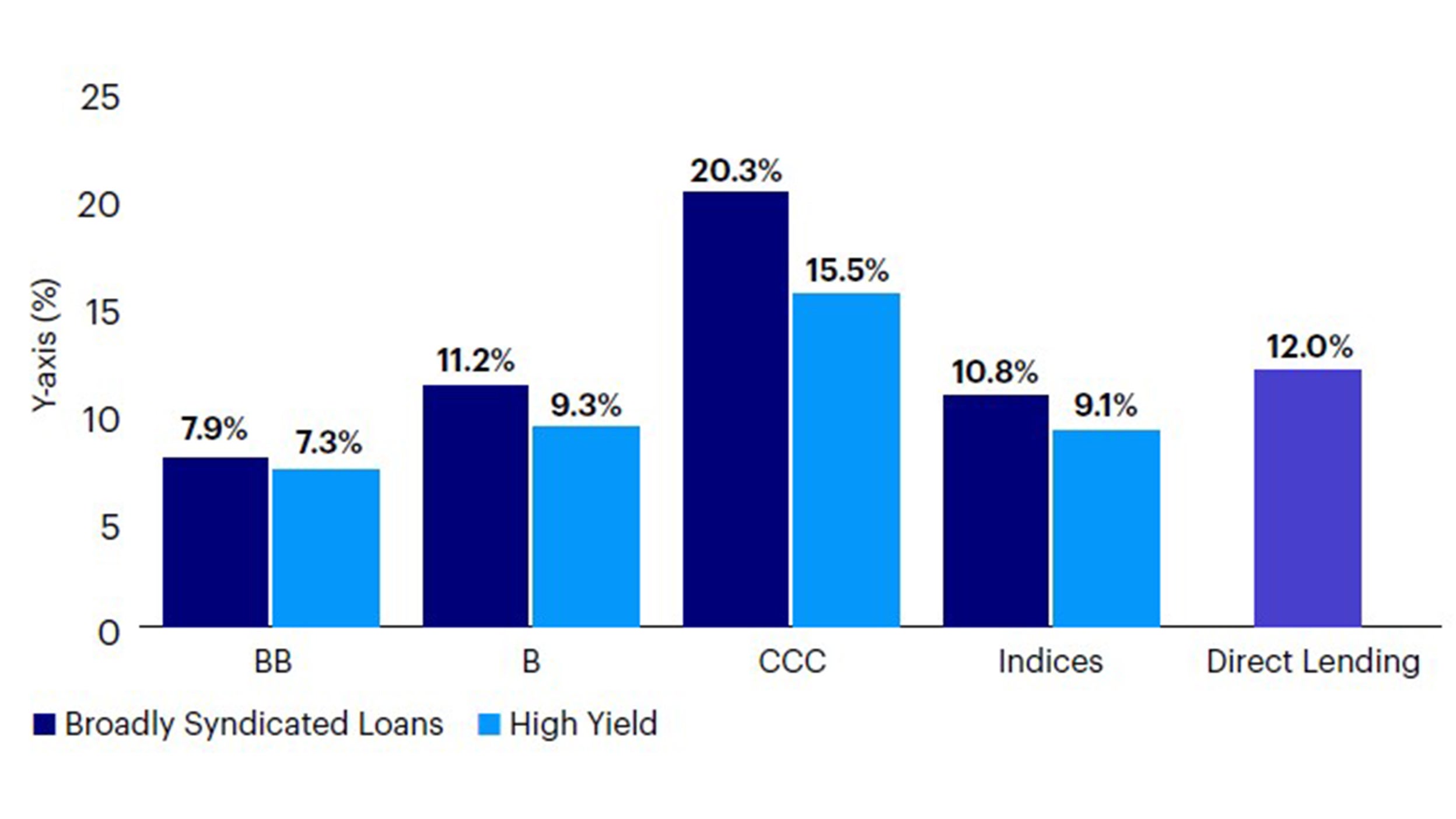

Naturally, these events are provoking discussion of a potential near-term tactical opportunity in liquid credit, given the significant increase in the yield profiles due to price declines and wider spreads. It is worth noting that this opportunity is more nuanced than first blush. As demonstrated below, the most significant portions of this yield opportunity are concentrated in lower rated credits (i.e. B- and CCC-rated, etc.). Many of these companies sit on the border of stress / distressed and raise concerns for investors looking to allocate to strong performing companies as we wade through recessionary conditions. Moreover, the higher quality range of this market has significantly recovered, with BB loans currently priced at 97-98c, yielding ~7-8%.1

Source: Credit Suisse and Invesco as of December 31, 2022.

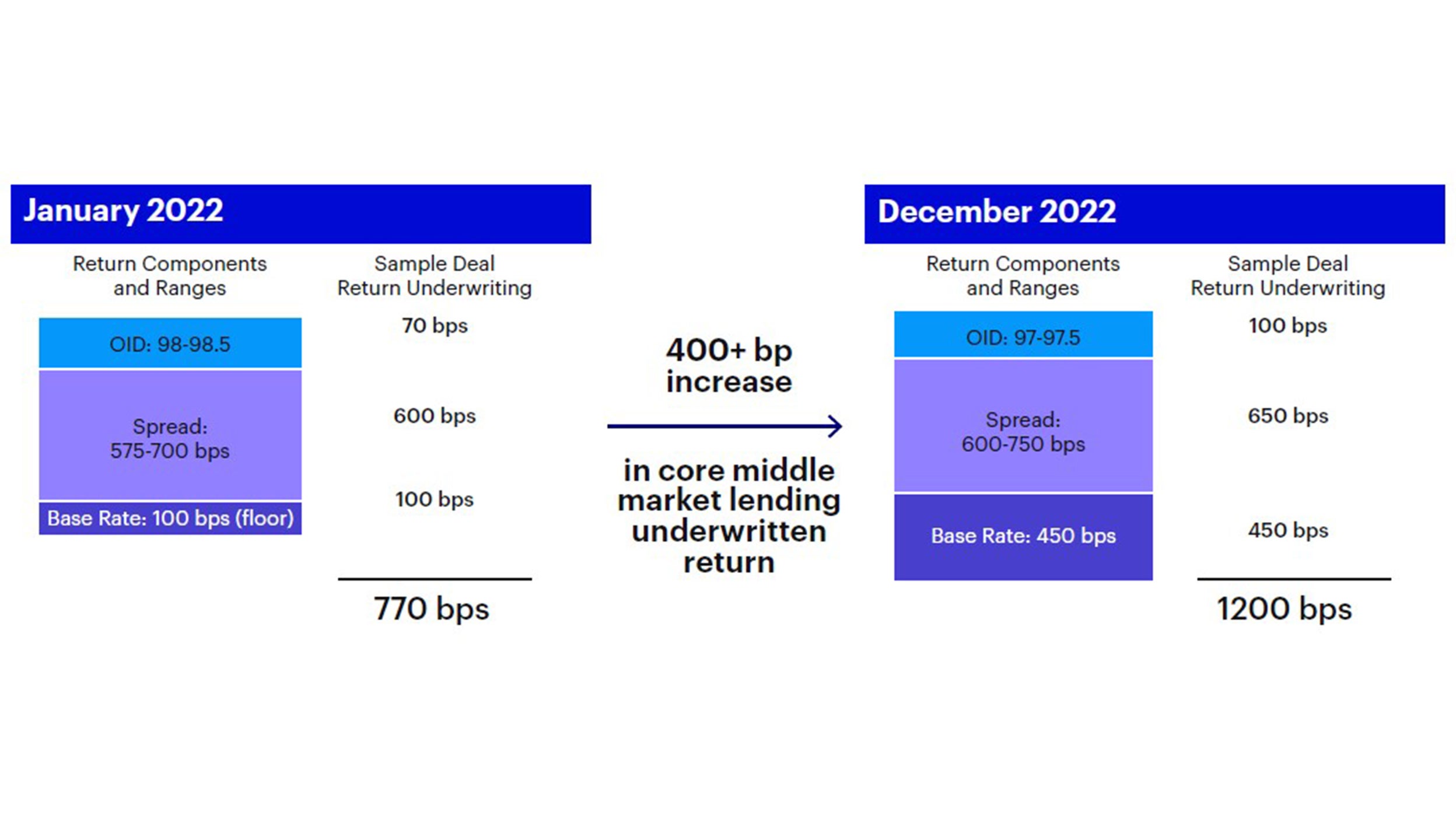

With that context, as we consider direct lending going forward, the opportunity appears to be quite attractive. As direct middle market loans are generally a floating rate opportunity, the change in environment from January 2022 to the present has introduced a material increase in the return profile for new issuance and newer vintage strategies. The significant rise in base rates (over 450bps and accounting for base rate floors accreting 350+ bps to new loans) accompanied by a widening in the original issuance discount (OID) and credit spread is leading to a dramatic increase in underwritten returns for lenders. While our team has historically targeted ~8+% for our senior secured first lien loans to core middle market sponsored companies, these transactions are currently being executed in the 12+% context2 on an unlevered, underwritten basis. Importantly, these increased yields come with stronger credit protection, lower leverage and lower loan-to-values.

Source: Invesco as of December 31, 2022. The above pricing is for provided for illustrative purposes only and representative on transaction opportunities in the Invesco Direct Lending team pipeline in January 2022 and December 2022, respectively.

Mitigating Risk

In our opinion, the current vintage in direct lending represents not only an attractive absolute and relative value within credit, but also offers historically compelling return opportunities. In isolation, this is welcome news for investors; however, given the present market environment, LP’s are rightfully curious to understand the risk profile of new issue direct lending deals.

From our perspective, new issue transactions are all underwritten with a recession scenario as the “base case.” We believe attractive middle market opportunities exist in companies which involve non-discretionary goods and services with sticky and long-term revenue visibility. Moreover, the recency of the Covid pandemic has provided unique insight into how certain companies and management teams were able to successfully navigate through a challenging business environment – in many cases, highlighting their ability to adjust business models to be more nimble and target more stable and diversified revenue streams. In that vein, we continue to find compelling opportunities in more resilient sectors such as healthcare, business services, non-cyclical industrials, aerospace, etc. In addition to strong fundamentals for new issue transactions, we have been mindful to underwrite deals with conservative leverage (i.e strong balance sheets), significant equity subordination, and bespoke documentation inclusive of maintenance covenants.

In combining the present opportunity set with disciplined selection and structuring, we believe the present environment could result in one of the strongest vintages in recent times for direct lending.

About risk

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Alternative investment products, including private debt, may involve a higher degree of risk, may engage in leveraging and other speculative investment practices that may increase the risk of investment loss, can be highly illiquid, may not be required to provide periodic pricing or valuation information to investors, may involve complex tax structures and delays in distributing important tax information, are not subject to the same regulatory requirements as mutual portfolios, often charge higher fees which may offset any trading profits, and in many cases the underlying investments are not transparent and are known only to the investment manager. There is often no secondary market for private equity interests, and none is expected to develop. There may be restrictions on transferring interests in such investments.