Asian bonds are an attractive option for income and diversification

Year-to-date, the US market has experienced significant volatility. Investors are looking for opportunities for diversification, especially asset classes that have low correlation with US equities. We believe that Asian Bonds stand out as an attractive option. This Q&A aims to address the most commonly asked questions from investors.

Why Asian Fixed Income now?

- Fixed Income with attractive yields are in demand as global growth slows: Global economic outlook remains uncertain as growth slows, inflationary pressures persist and trade policies cloud outlook, according to OECD1. Against this backdrop, Asian bonds have emerged as an attractive option as they offer relatively attractive yields.

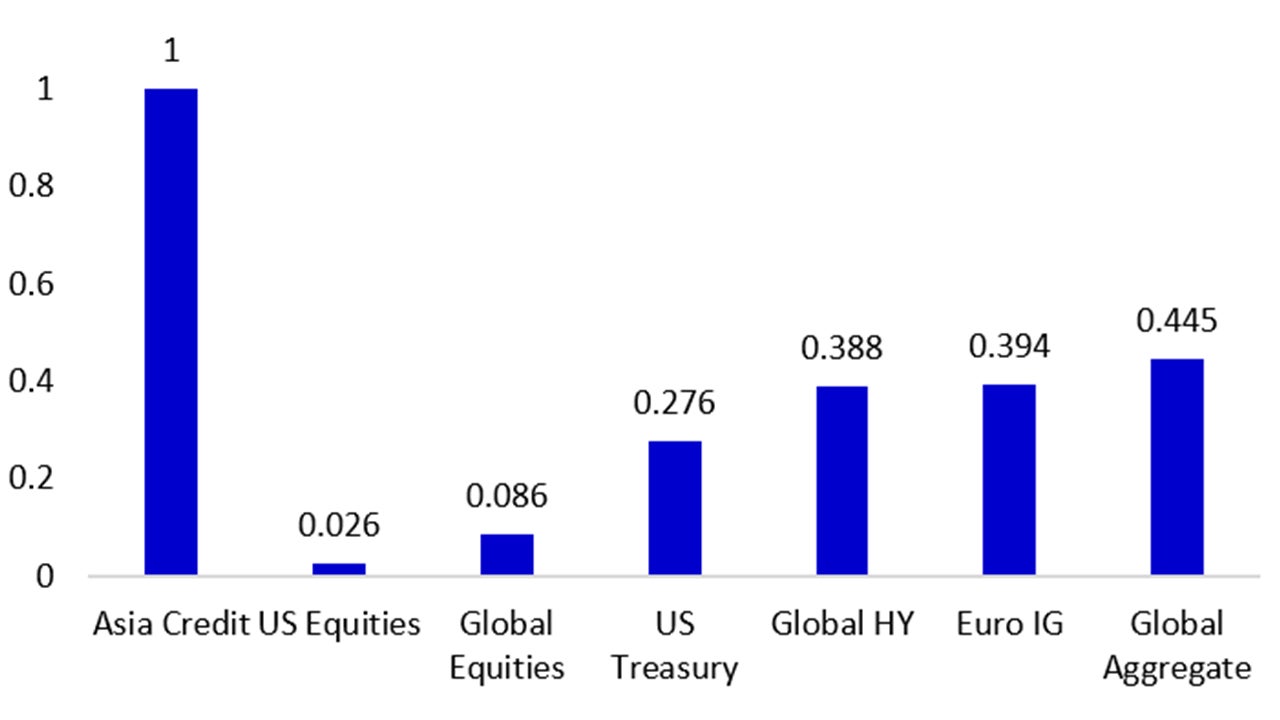

- Low correlation with US equities: Historically Asian bonds had low correlation with US and global equities, something that investors are looking for now. This offers risk diversification with stable income.

Source: Bloomberg, JP Morgan, data as of 28 February 2025, daily frequency. Asia credit is represented by J. P. Morgan Asia Credit Index. US Equities is represented by S&P 500 Index. Global Equities is represented by MSCI World Index. US Treasury is represented by ICE BofA US Treasury Index. Euro IG is represented by ICE BofA Euro Corporate Index. Global HY is represented by Bloomberg Global High Yield Total Return Index. Global Aggregate is represented by Bloomberg Global Aggregate Total Return Index. Asia IG is represented by J. P. Morgan Asian Investment Grade Index.

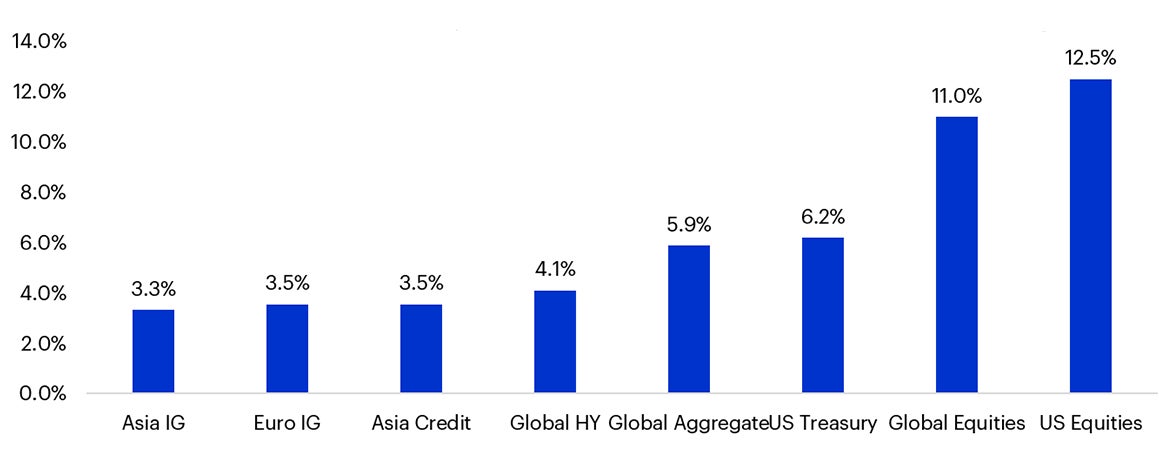

- Asia credit enjoys the sweet spot in duration: The duration positioning of Asia credit (~4-year) is a sweet spot among ultra short tenor (1-3 year) and global/US credit (5-6 year)2 - not that sensitive to US Fed policy stance while maintaining the capability to benefit from the potential capital gain under rate cutting cycle.

- Asian central banks are cutting rates despite uncertainty around Fed pricing: We observed slight deteriorating trend in the PMIs and exports across Asian economies. Inflation mostly surprised to the downside across the Asian economies. Asian local currencies also showed strength against USD recently, leaving more room for the Asian central banks to ease monetary policies. Last month, Korea, Philippines, Thailand and Australia all reduced their policy rates.

- USD recently on downward trend: A weaker USD could help improve Asia’s balance of payment position, attract capital inflows and reduce the foreign-debt burden.

What are the benefits of adding Asian Fixed Income in a portfolio?

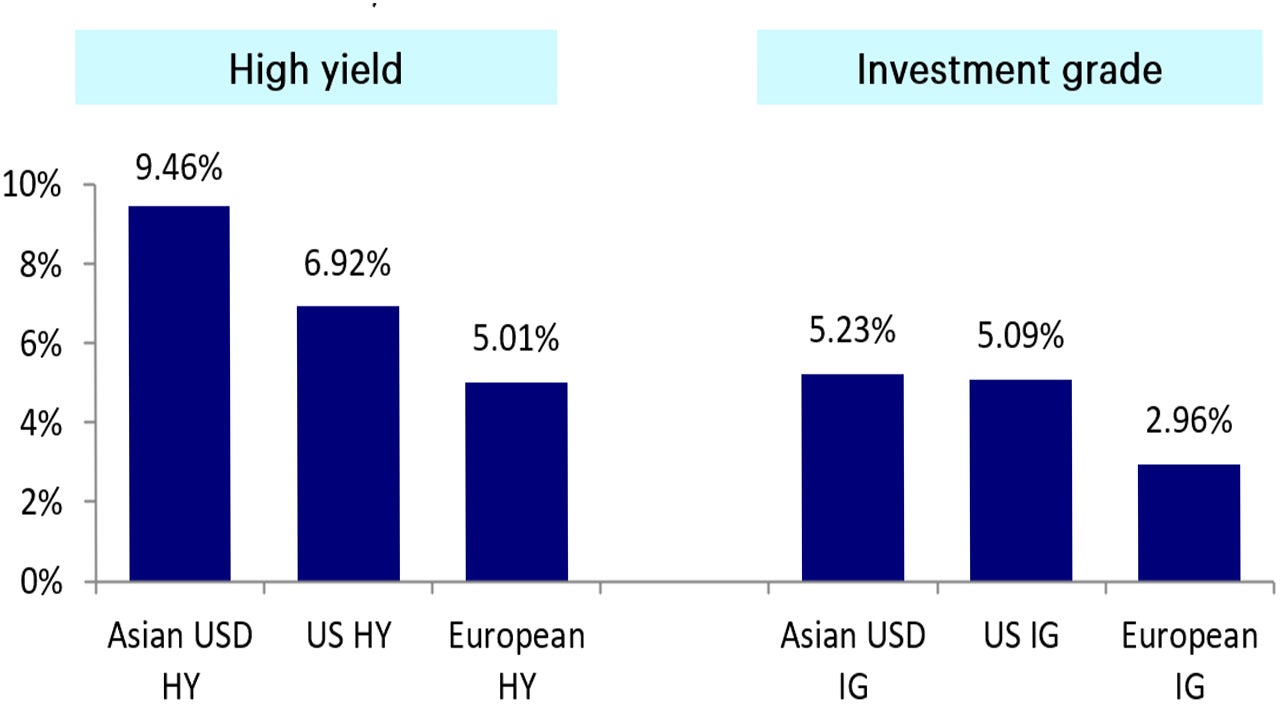

Attractive yield: Asian USD Bonds offer good opportunities to lock in high levels of yield. Resilient income opportunities remain abundant across both Asia IG and Asia HY space, e.g. there is consistently around 10% of the HY index on average in the last 2 years that sit in the 8-10% Yield category.3

Source: Bloomberg, Invesco; data as of 28 February 2025. Asian USD high yield is represented by J.P. Morgan JACI Non-Investment Grade Yield-to-Maturity, US high yield by ICE BofA US High Yield Index, European high yield by ICE BofA Euro High Yield Index, Asian USD investment grade by J.P. Morgan JACI Investment Grade Yield-to-Maturity, US investment grade by ICE BofA US Corporate Index and European investment grade by ICE BofA Euro Corporate Senior Index.

Improving corporate fundamentals: Asian IG and HY issuers generally see improving solvency capability in past years. We continue to see improving average credit rating of the investment universe and low default rates outside of China real estate sector: upgrade % surpasses downgrade %.

A great portfolio diversifier / low correlation with DM assets: Asia credit exhibits low correlation and lower volatility compared to equities, US Treasuries, global aggregate bond, Euro bond, etc, acting as an alternative with potentially more attractive risk-adjusted returns compared to money market fund when short end rates are getting lower.

Source: Bloomberg, JP Morgan, data as of 28 February 2025, daily frequency. Asia credit is represented by J. P. Morgan Asia Credit Index. US Equities is represented by S&P 500 Index. Global Equities is represented by MSCI World Index. US Treasury is represented by ICE BofA US Treasury Index. Euro IG is represented by ICE BofA Euro Corporate Index. Global HY is represented by Bloomberg Global High Yield Total Return Index. Global Aggregate is represented by Bloomberg Global Aggregate Total Return Index. Asia IG is represented by J. P. Morgan Asian Investment Grade Index.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.