Emerging market debt attracts positive flows despite global jitters

Key takeaways

EM central banks have eased monetary policy aggressively this year, as concern has quickly shifted from inflation to growth.

Global uncertainties, like evolving US trade policies, remain a source of potential volatility but we believe EMs’ strong fundamentals and policy flexibility position them to offer compelling opportunities.

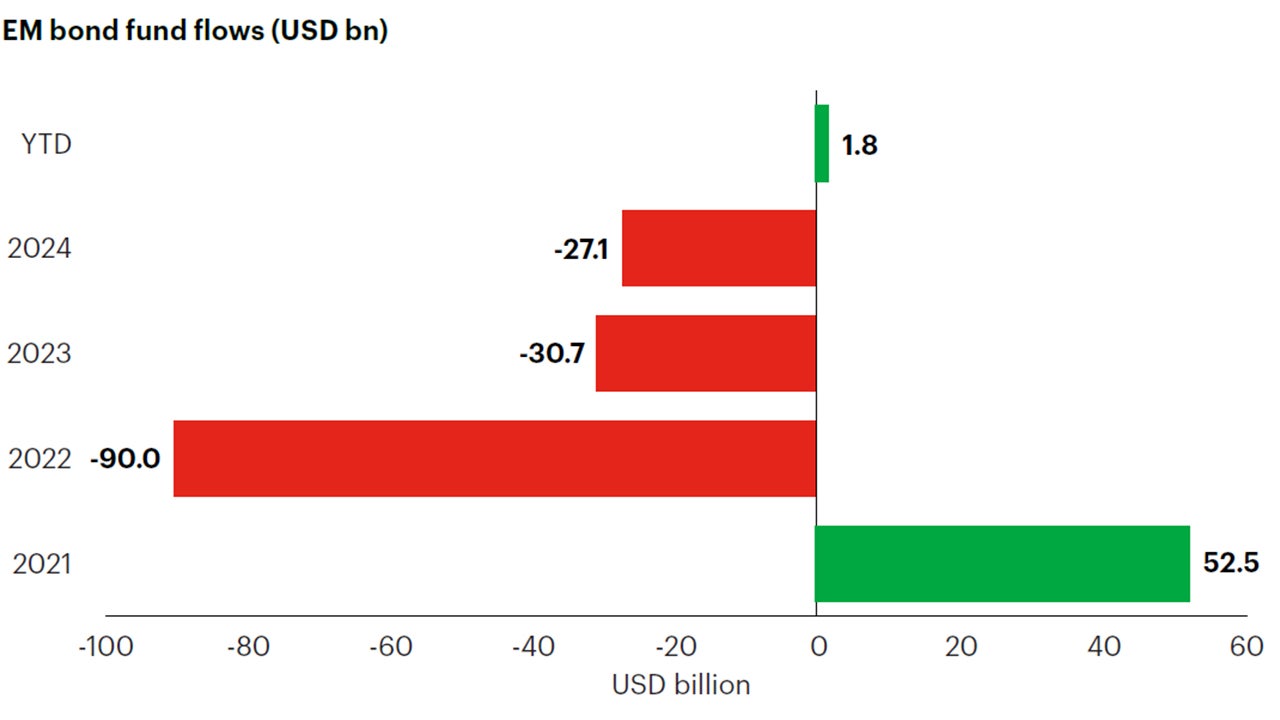

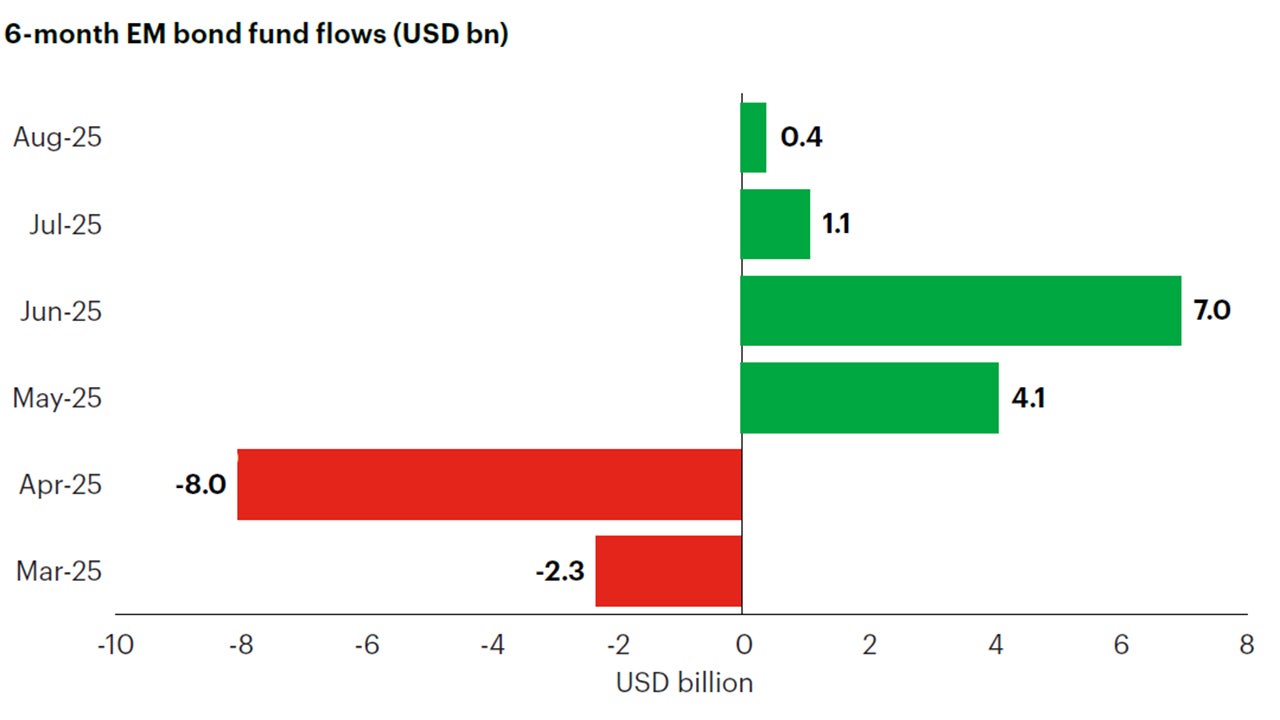

Flows into EM debt remained strong in August, and flows into EM bond funds have reached USD1.8 billion so far this year.1

Central bank moves

Emerging market (EM) central banks have eased monetary policy more aggressively this year, as their focus has shifted from inflation to growth. July was an active month for policy, marked by 25 basis point rate cuts in Indonesia, Malaysia, Poland, South Africa and Chile, reflecting generally prudent policymaking decisions. A prudent approach was also evident in Colombia and Egypt, where central banks kept rates unchanged despite some arguments for cuts. Turkey’s central bank cut rates from 46% to 43%, more than market expectations of a 250 basis point cut. The Turkish central bank remains focused on delivering a real appreciation of the lira over the balance of the year. So far, high real interest rates have been having the desired effect of keeping locals invested in Turkish lira and limiting flows into US dollars.

Trade dynamics, US tariffs and implications

Global trade dynamics remain uncertain, as US trade policy has emerged as a significant potential shock to global growth. Even without an aggressive trade war, recent revisions to US employment data suggest that US growth will likely fall short of prior expectations. This could widen the growth gap between the US and EMs. Last month, the US introduced new tariffs, raising the average effective rate and escalating rates on goods from developed markets (DM) such as Japan, the European Union, the UK and EM countries in Asia. The new US tariff regime includes a baseline tariff of 10% on most imports, with targeted duties of 50% on copper, 25% on cars and 25% to 50% on semiconductors and pharmaceuticals. Brazil faced a 40% additional tariff related to free speech concerns.

Given these developments, we believe a potential slowdown in global growth is ahead, although the US will likely avoid a recession this year. EMs may face the impacts of the new global tariff regime but we believe EM economies will be resilient in the current global cycle. Additionally, we believe a weakening or stable US dollar provides EMs with room for helpful monetary policy actions.

Rebalancing of capital — positive flow picture for EM debt

Investment flows into EMs have been strong, especially portfolio flows driven by the search for alternatives to US assets. After a period when EM assets were largely ignored, the pickup in EM flows in the second quarter has been remarkable and coincides with the declining US dollar (Figure 1). The US dollar ended the first half of 2025 with its steepest decline since 1973, down almost 11%.2 We continue to believe that, as foreign investors scale back US allocations or repatriate capital, demand for US assets — and by extension the US dollar — may weaken further.

Source: J.P. Morgan, EPFR Global, Bloomberg Finance L.P. Data as of August 8, 2025.

Source: J.P. Morgan, EPFR Global, Bloomberg Finance L.P. Data as of August 8, 2025.

EM hard currency debt outlook

The key question for EM debt (and risky assets more broadly) is what could disrupt the current environment of steady spread tightening and rising prices. Despite numerous global concerns — US policy volatility, elevated interest rates, geopolitical tensions and rich valuations — markets have been resilient and capital has continued to flow into the riskier parts of equity and fixed income markets. Expectations of a Federal Reserve (Fed) rate cut in September may support this trend in the medium-term.

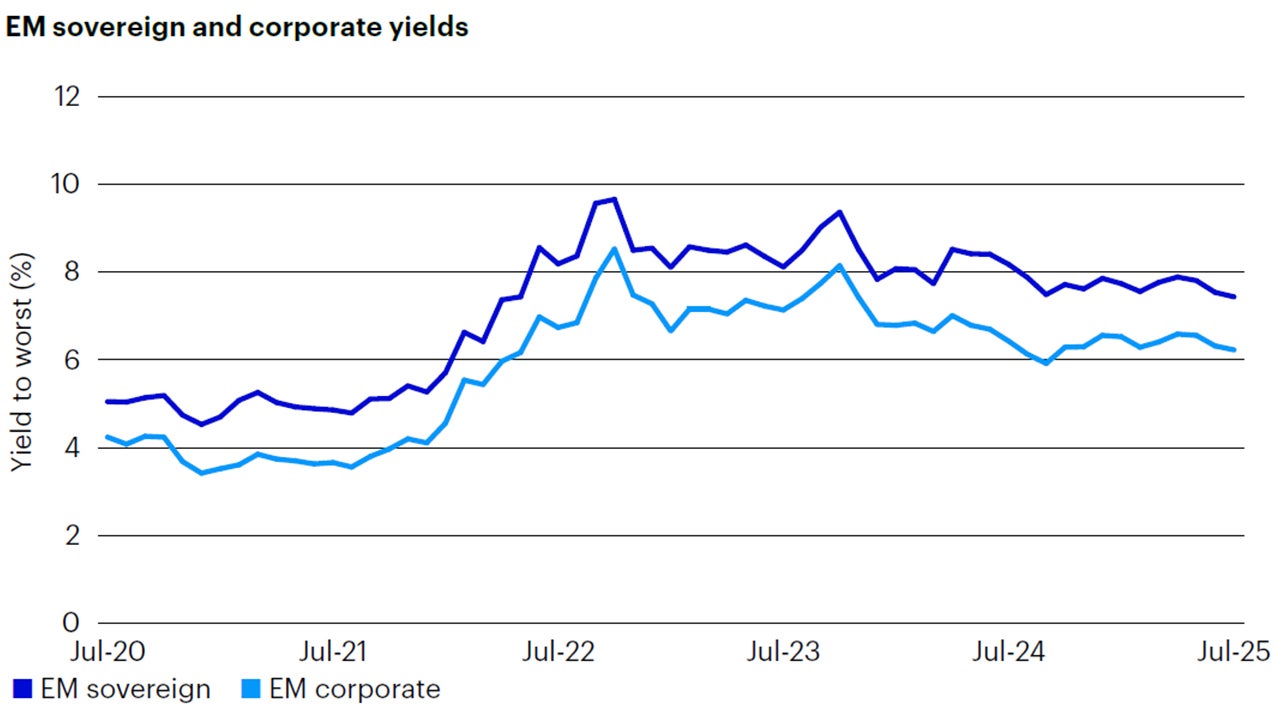

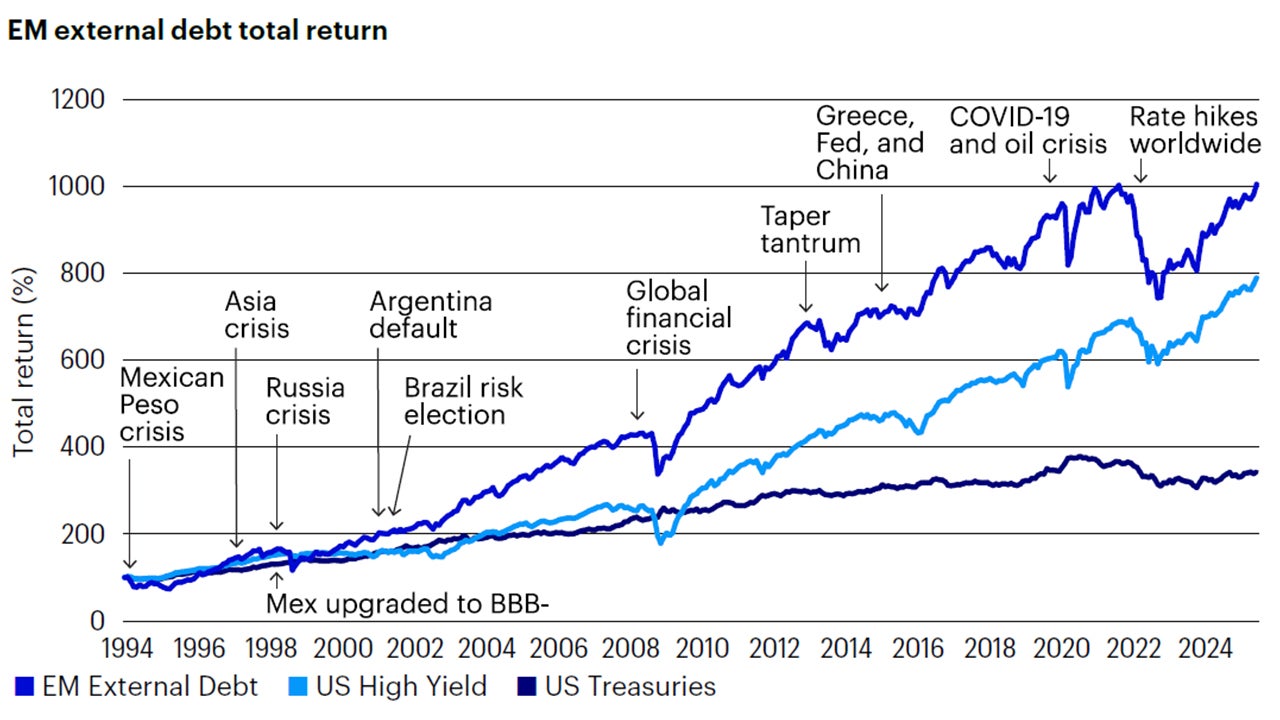

Although EM credit spreads remain tight, historically elevated yields (Figure 2) and solid EM fundamentals support compelling total return potential, in our view. Moreover, we believe improving growth dynamics in EMs relative to DMs reinforce the long-term return potential (Figure 3). Even if economic fundamentals end up weaker than expected, we believe EM credit is well-positioned to weather the impact. With fundamentals across EM issuers generally in good shape, we believe softer growth, or a weaker macro picture, would be manageable, especially since rate cuts would likely follow.

Source: Bloomberg L.P. Data from July 31, 2020 to July 31, 2025. EM Sovereigns represented by JPM EMBI Global Diversified Index. EM corporates represented by JPM CEMBI Broad Diversified Index. An investment cannot be made in an index.

Source: Bloomberg L.P., BofA Global Research, ICE Data Indices, LLC. Data from Dec. 31, 1993 to June 30, 2025. Total Return of JP Morgan EMBI Global Diversified Composite Index (EM External Debt), ICE BofA US Cash Pay High Yield Index (US High Yield) and ICE BofA US Treasury Index (US Treasuries), for a USD100 original investment from 1993-June 2025. Past performance is not a guarantee of future results. An investment cannot be made directly into an index.

EM local currency spotlight: Indonesia

Bank Indonesia surprised markets with a 25 basis point rate cut in August, bringing total easing for the year to 100 basis points. The decision was driven by weak domestic demand, sluggish credit growth and a benign inflation backdrop, which has provided the central bank with room to support economic activity. On the external front, Indonesia finalized a tariff agreement with the US, committing to increase imports of American goods in exchange for continued access to the Generalized System of Preferences. We expect this deal to boost trade momentum in the second half of the year and support Indonesia’s 2025 growth outlook. We remain constructive on Indonesia’s macroeconomic policy mix, and with inflation stable and room for further monetary easing, we are actively engaged in the Indonesia story.

Conclusion

Prudent monetary easing, supportive capital flows and a softer US dollar provide a supportive backdrop for EM debt in the second half of 2025, in our view. While global uncertainties, like evolving US trade policies, remain a source of potential volatility, we believe EMs’ strong fundamentals and policy flexibility position them to offer compelling opportunities. We expect the medium and long-term drivers of positive EM performance to remain intact: a softening US dollar, favorable growth differentials relative to DM and high nominal yields. Additionally, we believe idiosyncratic investment opportunities like Indonesia create a diverse and potentially lucrative opportunity set for the remainder of the year.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

Non-investment grade bonds, also called high yield bonds or junk bonds, pay higher yields but also carry more risk and a lower credit rating than an investment grade bond.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

The performance of an investment concentrated in issuers of a certain region or country is expected to be closely tied to conditions within that region and to be more volatile than more geographically diversified investments.