Emerging Market Debt 2026 Investment Outlook

Overview

- Emerging market (EM) central banks eased monetary policy in 2025, driven by disinflation and uneven growth. There is room for further rate cuts in 2026.

- We believe this interest rate backdrop, plus strong fundamentals and credible policy frameworks, positions EM debt as an attractive investment opportunity in 2026.

- Geopolitical and policy risks may introduce volatility, but long-term drivers—like favorable growth differentials and high nominal yields—remain intact.

- The Central and Eastern Europe, Middle East and Africa (CEEMEA) region offers potential high-yield opportunities in sovereign and corporate credit. Asia benefits from AI-driven trade cycles with selective local currency plays. And Latin America combines resilient domestic demand with easing cycles and attractive spreads—though valuations necessitate careful credit selection.

Macro developments

EM central banks

In 2025, EM central banks faced a complex landscape of disinflation and uneven economic growth. Throughout the year, many EM central banks pursued monetary easing amid subdued inflation, a generally favorable global environment and concerns over domestic growth.

Figure 1: CEEMEA, Asia and Latin America central banks lowered interest rates, while others adopted a more cautious stance

Monetary policy rate (%)

|

12/24 |

3/25 |

6/25 |

9/25 |

12/25 |

YTD change (ppt) |

|---|---|---|---|---|---|---|

CEEMEA |

||||||

Turkey |

47.50 |

42.50 |

46.00 |

40.50 |

38.00 |

-9.5 |

Egypt |

27.25 |

27.25 |

24.00 |

22.00 |

21.00 |

-6.3 |

South Africa |

7.75 |

7.50 |

7.25 |

7.00 |

6.75 |

-1.0 |

Poland |

5.75 |

5.75 |

5.25 |

4.75 |

4.00 |

-1.8 |

Czech Republic |

4.00 |

3.75 |

3.50 |

3.50 |

3.50 |

-0.5 |

Hungary |

6.50 |

6.50 |

6.50 |

6.50 |

6.50 |

0.0 |

Asia |

||||||

Indonesia |

6.00 |

5.75 |

5.50 |

4.75 |

4.75 |

-1.3 |

Thailand |

2.25 |

2.00 |

1.75 |

1.50 |

1.50 |

-0.8 |

India |

6.50 |

6.25 |

5.50 |

5.50 |

5.25 |

-1.3 |

Philippines |

5.75 |

5.75 |

5.25 |

5.00 |

4.75 |

-1.0 |

Korea |

3.00 |

2.75 |

2.50 |

2.50 |

2.50 |

-0.5 |

Malaysia |

3.00 |

3.00 |

3.00 |

2.75 |

2.75 |

-0.3 |

Latin America |

||||||

Chile |

5.00 |

5.00 |

5.00 |

4.75 |

4.50 |

-0.5 |

Colombia |

9.50 |

9.50 |

9.25 |

9.25 |

9.25 |

-0.3 |

Mexico |

10.00 |

9.00 |

8.00 |

7.50 |

7.00 |

-3.0 |

Peru |

5.00 |

7.75 |

4.50 |

4.25 |

4.25 |

-0.8 |

Brazil |

12.25 |

14.25 |

15.00 |

15.00 |

15.00 |

2.8 |

Source: Bloomberg Finance L.P. Data as of Dec. 18, 2025. CEEMEA is Central and Eastern Europe Middle East Africa.

EM central banks have increasingly taken the lead in shaping domestic policy cycles, prioritizing internal domestic economic conditions while remaining mindful of external factors. Since the late 1990s, EMs have made considerable progress in strengthening their monetary policy frameworks. This improvement was evident in response to the COVID-19 pandemic, when EM central banks promptly raised interest rates to curb inflation using conventional measures, like inflation targeting and flexible exchange rates. This proactive approach enabled most regions to transition from aggressive tightening to growth support earlier than many developed markets. Nevertheless, differences in the pace and scale of policy adjustments have continued.

In CEEMEA, Turkey led the way in 2025 with aggressive rate cuts, reducing its policy rate to below 40% after a series of measures designed to stabilize the economy, following a previous period of tightening. South Africa, Poland, and the Czech Republic eased throughout the year, trimming rates as inflation normalized. Hungary stood out by keeping its policy rate unchanged. Egypt made significant rate cuts early in the year before pausing to assess ongoing price pressures. It resumed easing in October, on the back of high real rates and constructive collaboration with the International Monetary Fund (IMF), as it transitions to an inflation-targeting framework.

In Asia, Malaysia and South Korea followed a similar pattern to Egypt, initiating preemptive rate cuts before adopting a cautious pause. Indonesia and Thailand eased more aggressively, while the Philippines and India opted for a more gradual approach to rate reductions. In Latin America, Mexico, Colombia and Peru eased cautiously throughout the year. Argentina and Chile largely kept rates steady as they navigated distinct economic and policy reforms. Brazil was an outlier, maintaining a hawkish stance by holding the Selic rate at 15% to anchor inflation expectations.

US market pulse

The US economy enters 2026 with a gradual buildup in momentum after a year of slower hiring and tariff-related headwinds. Policy uncertainty under the new administration, while still significant, has peaked, tail risks have been avoided, and companies are adapting to the new trade and regulatory environment. Fiscal stimulus is filtering through, the US Federal Reserve (Fed) has delivered risk-management cuts, bringing the policy rate closer to neutral, and financial conditions have eased, while AI-related investment continues to support growth. Although the much-hyped “AI productivity miracle” likely remains a longer-term story, capital deepening is underway, helping productivity stay above its 2010s trend. Overall, we expect real GDP growth to remain above 2%, with hiring improving in 2026.

Inflation remains sticky, hovering slightly above 3% as tariff pass-through continues. While this is not a reacceleration narrative, a “three-handle” on inflation is likely to keep the Fed cautious. With growth above trend, there is little macroeconomic justification for aggressive easing. However, new Fed leadership and potential changes in the Federal Open Market Committee point to a more accommodative stance, adding uncertainty to the Fed’s policy reaction function. Our base case assumes two rate cuts in mid-2026 under new leadership, though dissenting votes and policy volatility are likely. The Fed’s challenge will likely be balancing inflation discomfort against a backdrop of improving growth and tightening labor markets.

Our outlook for 2026 is one of gradual normalization rather than dramatic shifts. Growth should strengthen as policy clarity improves and investment flows continue, while inflation will likely be sticky in the first half. We expect inflation to ease in the second half but stay above target. For EM investors, the US backdrop suggests a supportive environment for risk assets, in our view, provided Fed easing is measured, and inflation expectations stay anchored.

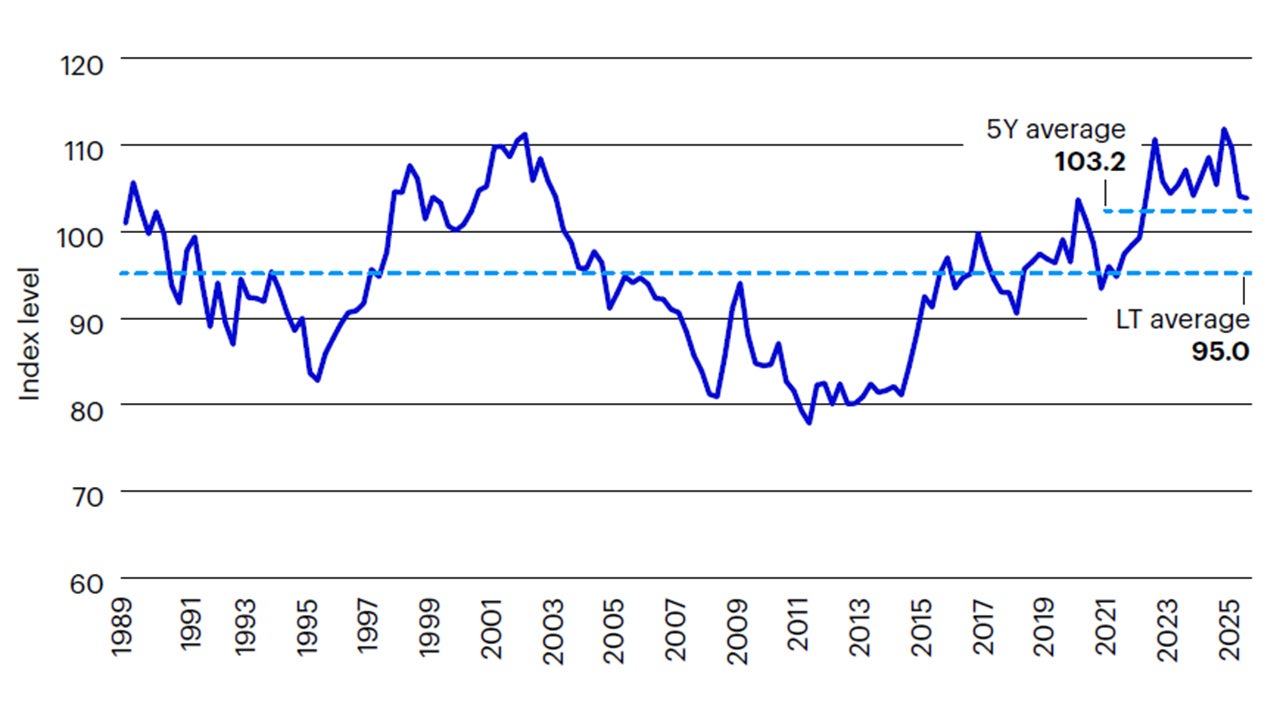

US dollar trajectory

The US dollar weakened almost nine percent in 2025 after years of strength, creating a favorable environment for EMs (Figure 2). Capital flows to the asset class, which have been negative for years, may be poised to return, as investors seek higher yields and improved diversification. Local currency EM debt returns and flows are highly correlated with US dollar movements. We believe this asset class stands to benefit from this trend, potentially offering attractive returns amid improving fundamentals.

The dollar’s recent decline follows three years of dominance fueled by aggressive Fed rate hikes, resilient US growth, and massive portfolio inflows to the US. However, concerns over stretched US equity valuations, changing and unpredictable trade policy, and competitive pressures from global technology players have raised questions about “US exceptionalism”. While we believe this shift marks a correction from extreme dollar strength rather than a structural collapse, it still opens the door for EM assets to outperform, in our view.

EM economies are entering this cycle from a position of strength, with record-high average credit ratings, credible monetary policies and robust growth differentials versus developed markets. Institutional improvements and orthodox responses to past inflation shocks have left EMs well-positioned to cut rates and stimulate growth. Combined with expanding market capacity and a historical sensitivity to dollar weakness, we believe these factors make EM a compelling opportunity for global investors in the year ahead.

Source: Citi Broad Real Effective Exchange Rate Index – USD. Data from March 31, 1989 to July 7, 2025.

EM regional outlooks

CEEMEA

Hard currency sovereign and quasi-sovereign credit

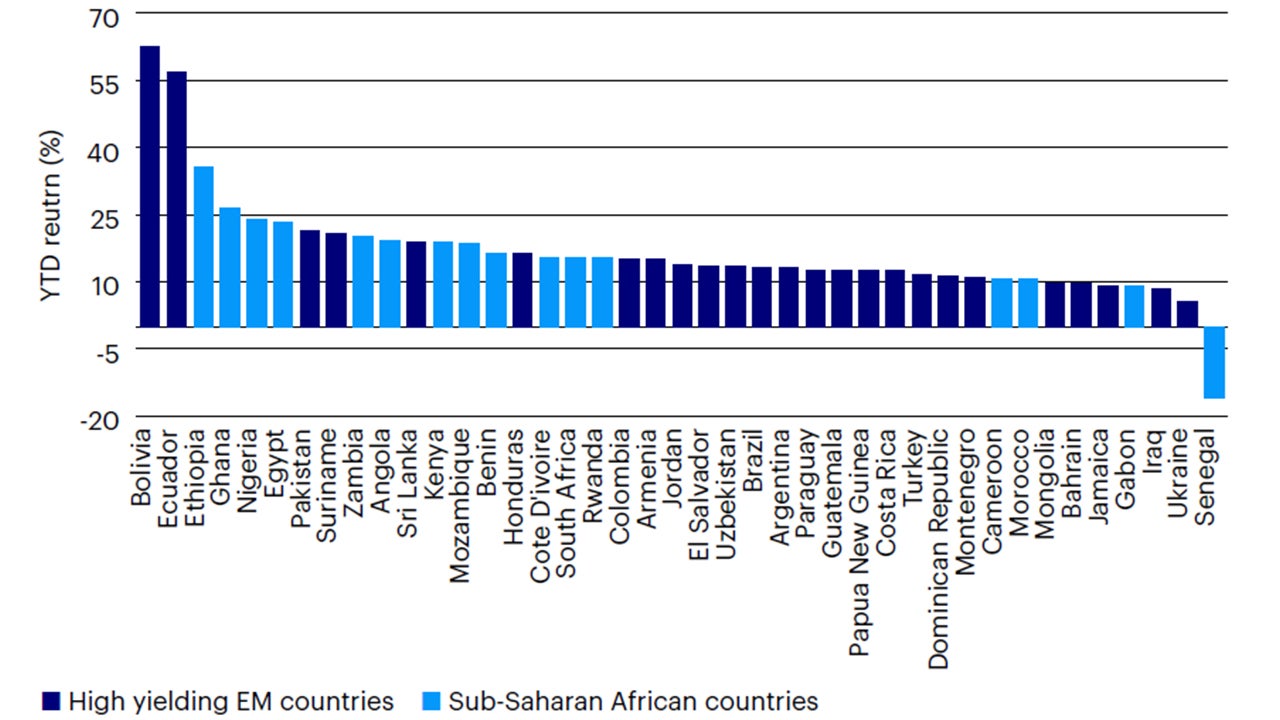

After a strong showing in 2025 (Figure 3), Sub-Saharan African (SSA) countries continue to be one of the yieldier parts of the hard currency market – although they face diverse conditions. Ghana, Nigeria, Zambia and Gabon have emerged from serious crises (political or economic) in the last few years and remain committed to reform, whereas Senegal and Kenya took the more precarious path of grappling with political and fiscal issues on their own. Meanwhile South Africa, Egypt, Cote d’Ivoire and Morocco are large and more diversified economies that offer decent yield, in our view. In the Middle East and North Africa region, the ebbing of the war in Gaza and confrontation with Iran, coupled with the normalization of Syria, should be a broad regional positive and a catalyst for the restructuring of Lebanese external debt.

Source: J.P. Morgan. Bloomberg L.P. Individual country high yield external debt YTD total returns. Data as of Nov. 17, 2025.

Corporate credit

CEEMEA corporate credit enjoyed a favorable environment in 2025, supported by a strong sovereign backdrop and a wave of credit upgrades. The region enjoyed a constructive macro outlook with stable or improving fundamentals in key markets such as Turkey, Ukraine, and Uzbekistan. Investors favored high yield risk over investment grade, with Ukrainian credits added to overweight lists, despite ongoing conflict-related challenges. The Middle East and Africa presented mixed opportunities, with limited value in the Gulf Cooperation Council states, due to tight spreads but selective opportunities in Israel and among certain African Multilateral Development Banks. Turkish corporates showed resilience. We maintained constructive views on the cement and electricity distribution sectors, though risks remain in export-oriented and highly leveraged names.

For 2026, we expect CEEMEA corporate credit to benefit from continued macro stability and selective credit improvements. The sovereign environment remains supportive, underpinning high yield corporates. We expect rate cuts in Turkey and Nigeria to support local currency credits, while political and fiscal risks require ongoing monitoring. The oil price outlook remains soft, suggesting caution in high beta energy credits. We prefer lower beta names with strong cash flow profiles. In Turkey, we favor domestically oriented credits with inflation-linked revenues and strong liquidity. African credits, particularly in utilities and infrastructure, offer carry opportunities, in our view, amid improving fundamentals. Overall, we believe the region’s corporate credit market is positioned for stable to modestly positive performance, given careful credit selection and risk differentiation.

Local currency

South Africa

In 2025, South Africa emerged as one of the key local currency plays. A stable macroeconomic backdrop featuring steady annual headline and core inflation at 3.0%-4.0% and a gradual recovery toward 1.0%-1.5% growth has added to a more evident reform push. On the monetary policy front, the South African Reserve Bank (SARB) lowered its inflation target from 4.5% to 3.0%, a move confirmed by the National Treasury. Meanwhile, stronger-than expected fiscal revenues, combined with a continued commitment to fiscal discipline and smaller gross borrowing needs, enabled the Treasury to reduce bond issuance forecasts for the upcoming fiscal year. Together, these factors allowed South African government bonds to outperform other EM local currency yield curves in 2025, and we expect this supportive policy environment to persist.

Hungary

Hungarian local markets delivered strong returns in 2025, primarily driven by foreign exchange gains and carry. Looking ahead to 2026, we expect this performance to continue, as Hungary paused its easing cycle in 2025, but has the potential to resume it later in 2026. The central bank is expected to maintain high real yields through the first half of 2026, making unhedged positions attractive for generating strong carry returns, in our view, while helping to reduce the inflation risk premium. Additionally, opportunities in long-end rates may arise following the parliamentary elections, where the incumbent Fidesz party faces a credible challenge for the first time in a decade. Beyond politics, Hungary’s macroeconomic backdrop remains supportive of resuming the easing cycle in 2026.

Czech Republic

Among the higher-grade local markets in the CEE4 (Czech Republic, Hungary, Poland, and Romania), the Czech Republic stands out as offering good value, in our view. The market has been pricing in late-cycle easing by anticipating rate hikes that are unlikely to materialize. We believe a rate cut is more probable, given low inflation outcomes and already elevated real rates. We expect the central bank to move cautiously, and the currency to continue its gradual appreciation.

Romania

We believe Romania presents a compelling case, combining ongoing fiscal reforms with the potential for the start of an easing cycle amid weak growth and economic rebalancing in 2026. While leadership transitions and further fiscal reform initiatives are unlikely to take center stage until 2027, next year will likely focus on delivering the two-and-a-half to three percentage points of fiscal tightening outlined in the new government’s consolidation program. We expect the flow of European Union structural funds to support investment growth, offsetting the likely weakness in private consumption and helping the government to walk the thin line between fiscal consolidation and guiding the economy to a softer landing. Policy implementation is being driven by a strong and credible prime minister, whose party recently gained momentum following the PNL’s (National Liberal Party) mayoral victory in Bucharest.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

Non-investment grade bonds, also called high yield bonds or junk bonds, pay higher yields but also carry more risk and a lower credit rating than an investment grade bond.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

The performance of an investment concentrated in issuers of a certain region or country is expected to be closely tied to conditions within that region and to be more volatile than more geographically diversified investments.