ETFs for higher-yielding alternatives to traditional fixed income exposures

Fixed income yields have risen substantially since central banks began acting to combat inflation. This dramatic reset has driven yields to levels not seen since the Global Financial Crisis, but still leaves today’s income investors with difficult choices. While interest rates in most major developed economies might be at or very near their peaks in this hiking cycle, inflation remains an issue and, while the US Treasury yield curve has been steepening since the end of June, it was previously deeply inverted, which has often been a precursor to recession.

Where to invest now depends on your outlook and risk appetite, but if you’re considering corporate bond markets, here are some alternative, potentially higher yielding or higher quality opportunities, that you can access with ETFs.

Finding income opportunities across the capital structure

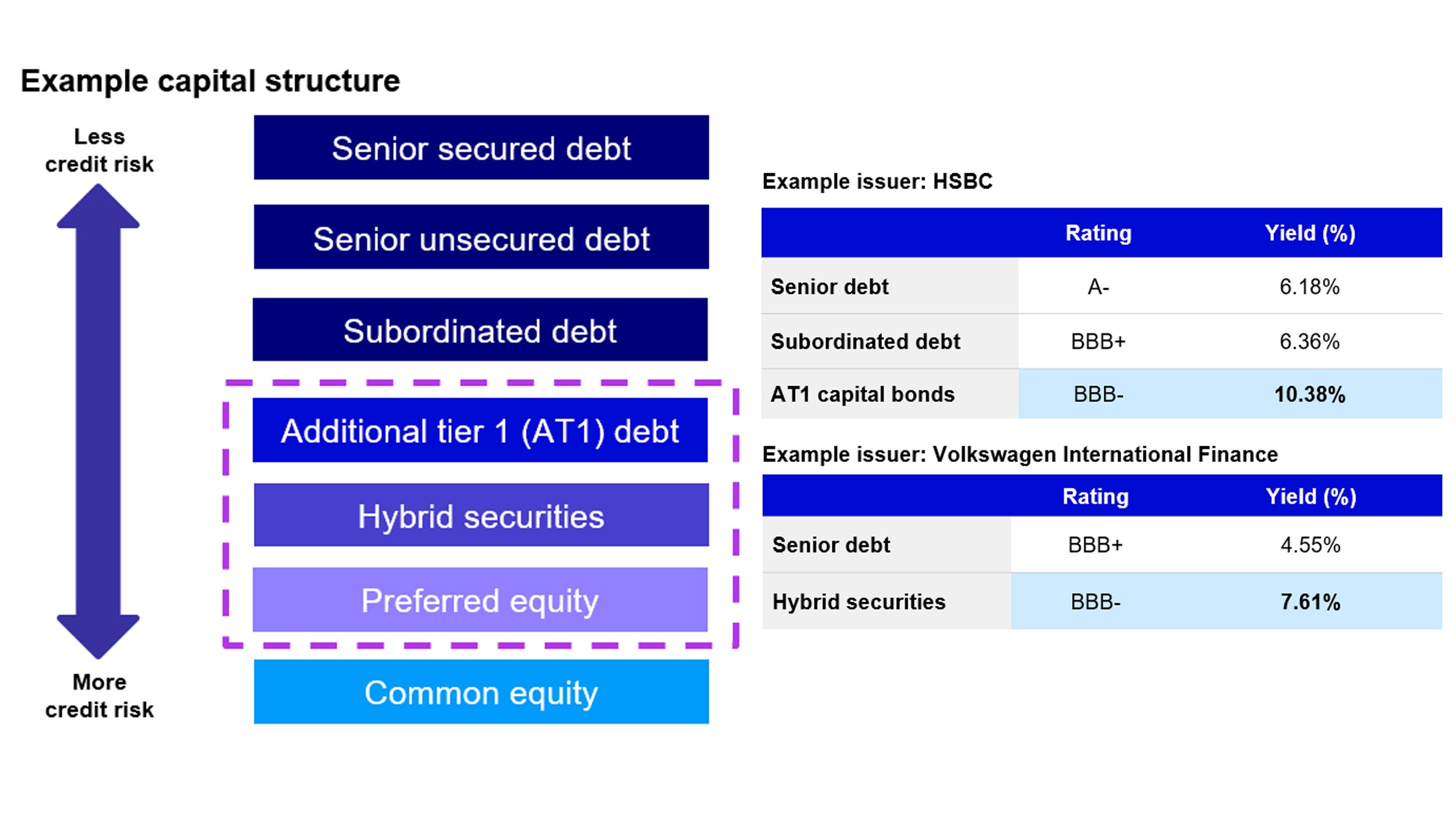

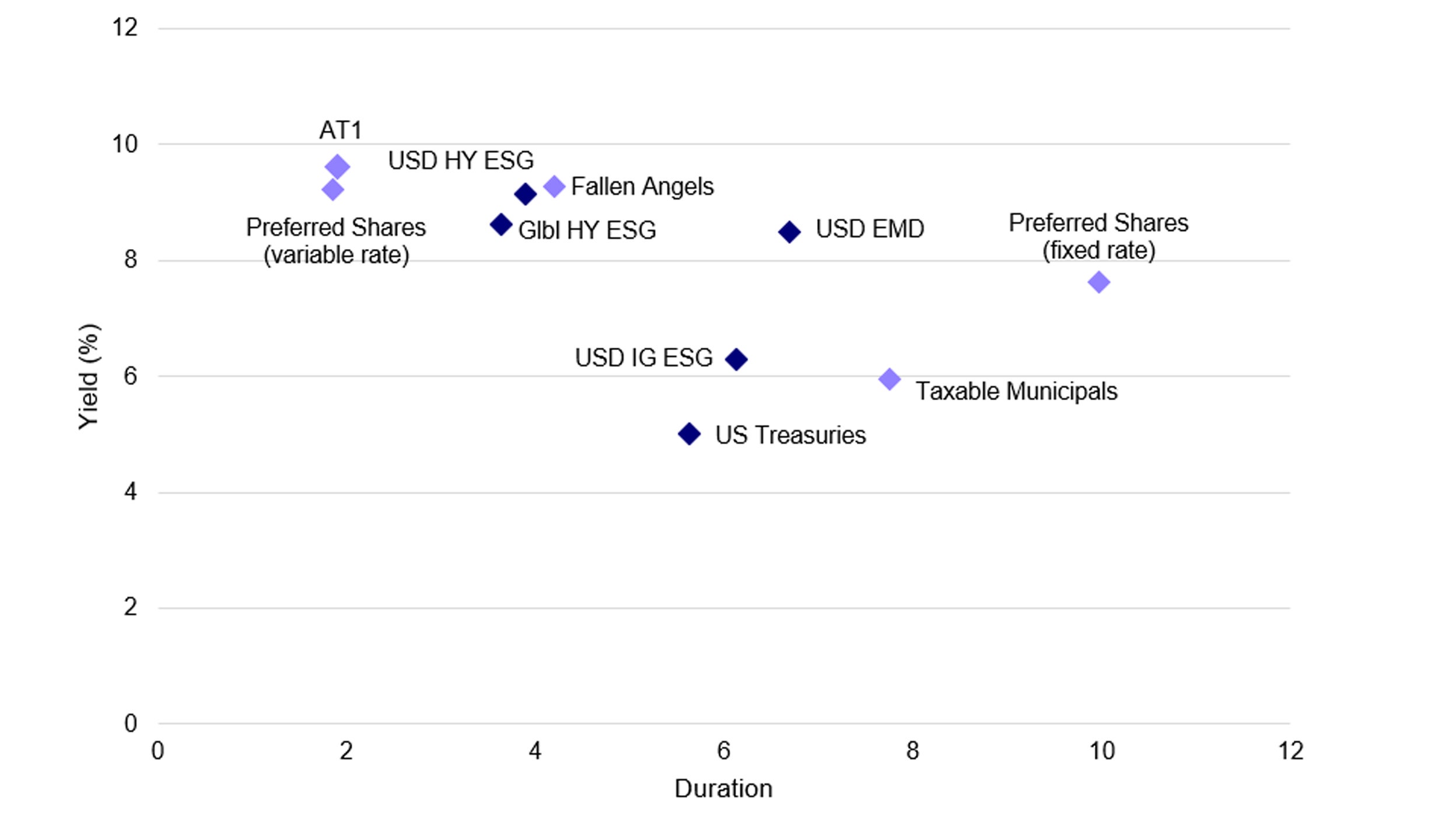

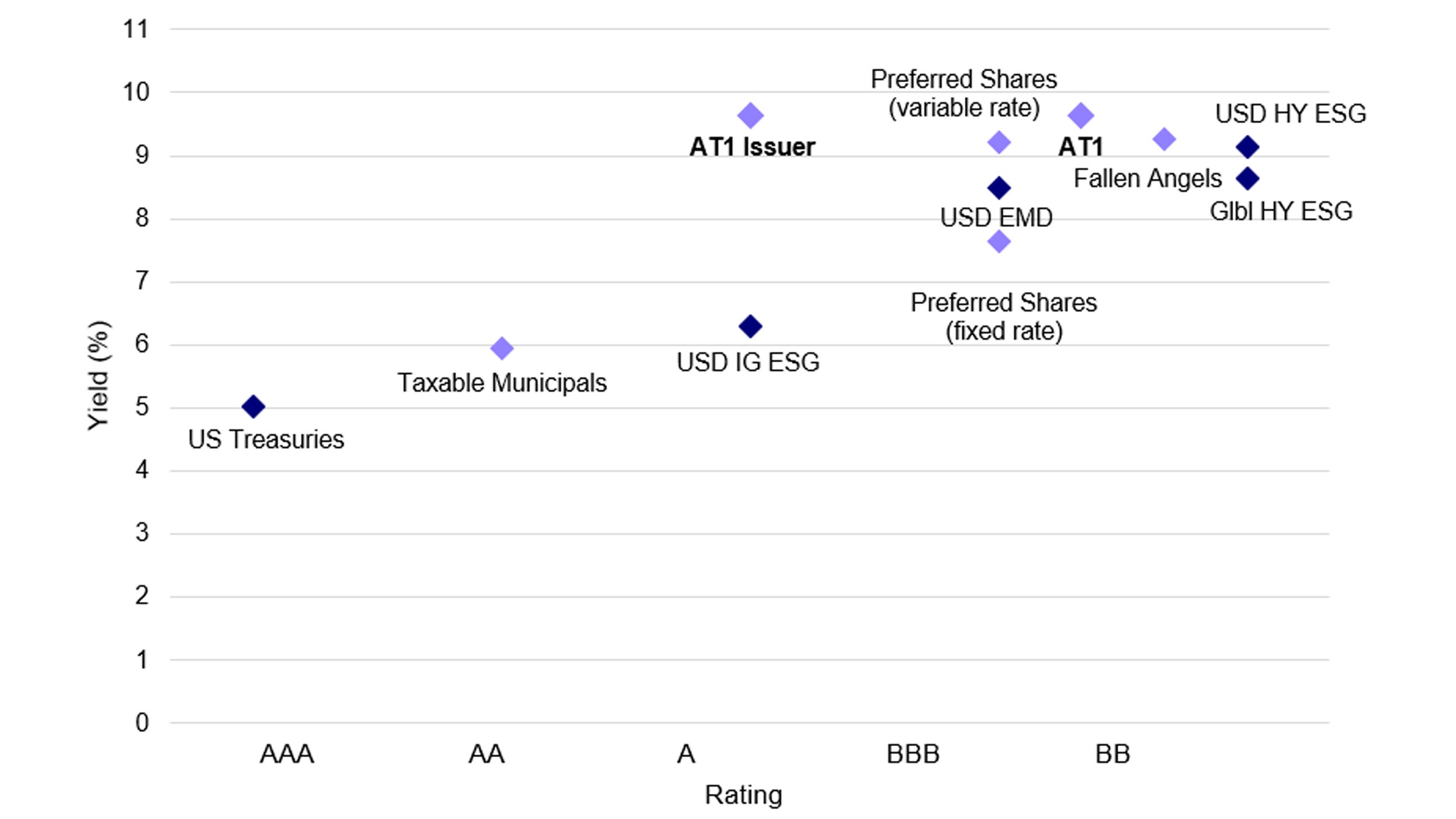

Certain fixed income asset classes can provide an interesting opportunity if you look beyond traditional senior debt. A company can issue securities across its capital structure, and different levels of seniority mean that certain securities can offer investors higher yields without having to compromise on the credit quality of the issuer. Additional Tier 1 (AT1) capital bonds, corporate hybrid bonds and preferred shares are non-traditional asset classes that have historically provided higher yields while exhibiting low correlations to traditional fixed income, often with lower interest rate risk.

Data: Bloomberg, 30 Oct 2023. The mention of securities is for illustrative purposes only and is not intended as a recommendation to invest in any particular asset class, security or strategy.

Source: Aladdin, based on ETF yields as at 30 Oct 2023

These innovative income securities have several key features that make them attractive to yield-seeking investors:

- Yield characteristics: AT1s, corporate hybrid bonds and preferred shares typically offer higher yields than the senior debt from the same issuer. In many cases (but not all), these asset classes have lower interest rate sensitivity than traditional fixed income.

- Credit quality: The yield on a hybrid security is driven by the subordination and convertibility elements, rather than the creditworthiness of the issuer. As such, the credit quality of a basket of hybrid securities is typically higher than traditional high yield instruments, particularly when considering ratings at the issuer level.

- Low correlation: All three innovative income asset classes tend to have low correlations with broad equities and traditional fixed income, making them useful assets for portfolio diversification.

Subordination brings with it an extra element of risk, however, hence the higher yields these securities typically have to offer in order to attract investors. That many of these securities are issued by large banks or companies with investment grade credit ratings may provide you with some comfort, but you need to assess whether the additional yield compensates for the risk involved.

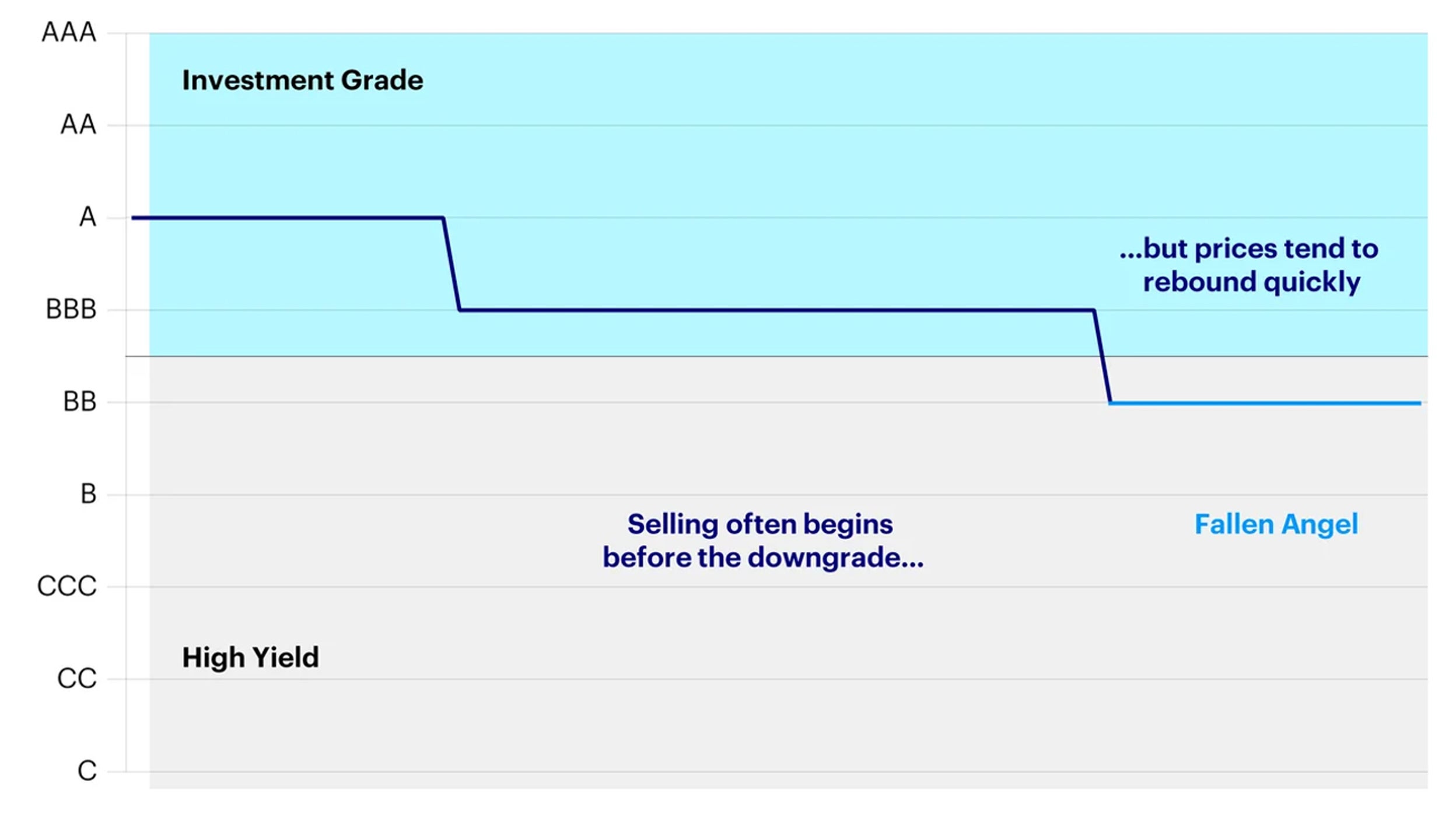

High yield credit: the fallen angel opportunity

If your risk appetite extends beyond investment grade, we can take a more selective approach aimed at benefiting from the price rebound associated with high yield “fallen angels”, while also improving overall credit quality. Fallen Angels are the bonds from issuers that have recently had their credit ratings downgraded from investment grade to high yield. These bonds offer investors the potential for both income and capital gains. Fallen angels typically generate high income and benefit from a price rebound shortly after downgrade. They also tend to have higher credit quality, with 89% rated above B+, compared to only 46% for the broader US high yield market.

A smart way to capture the price rebound of fallen angels is to use a time-weighted, systematic methodology. The FTSE Time-Weighted US Fallen Angel Bond Select Index uses this approach to efficiently capture the price rebounds of fallen angels, which targets greater capital appreciation in US high yield. ETFs can be a simple and efficient way to access this strategy.

Bonds are added to the index within 30 days of a downgrade to high yield, with weights reducing over time to maximize exposure to any short-term rebound. The gradual reduction in weighting also reflects the diminishing probability that the fallen angel will be upgraded back to investment grade.

Source: Invesco. For illustrative purposes only.

Source: FTSE, Bloomberg, as at 30 September 2023.

A higher quality alternative to investment grade credit

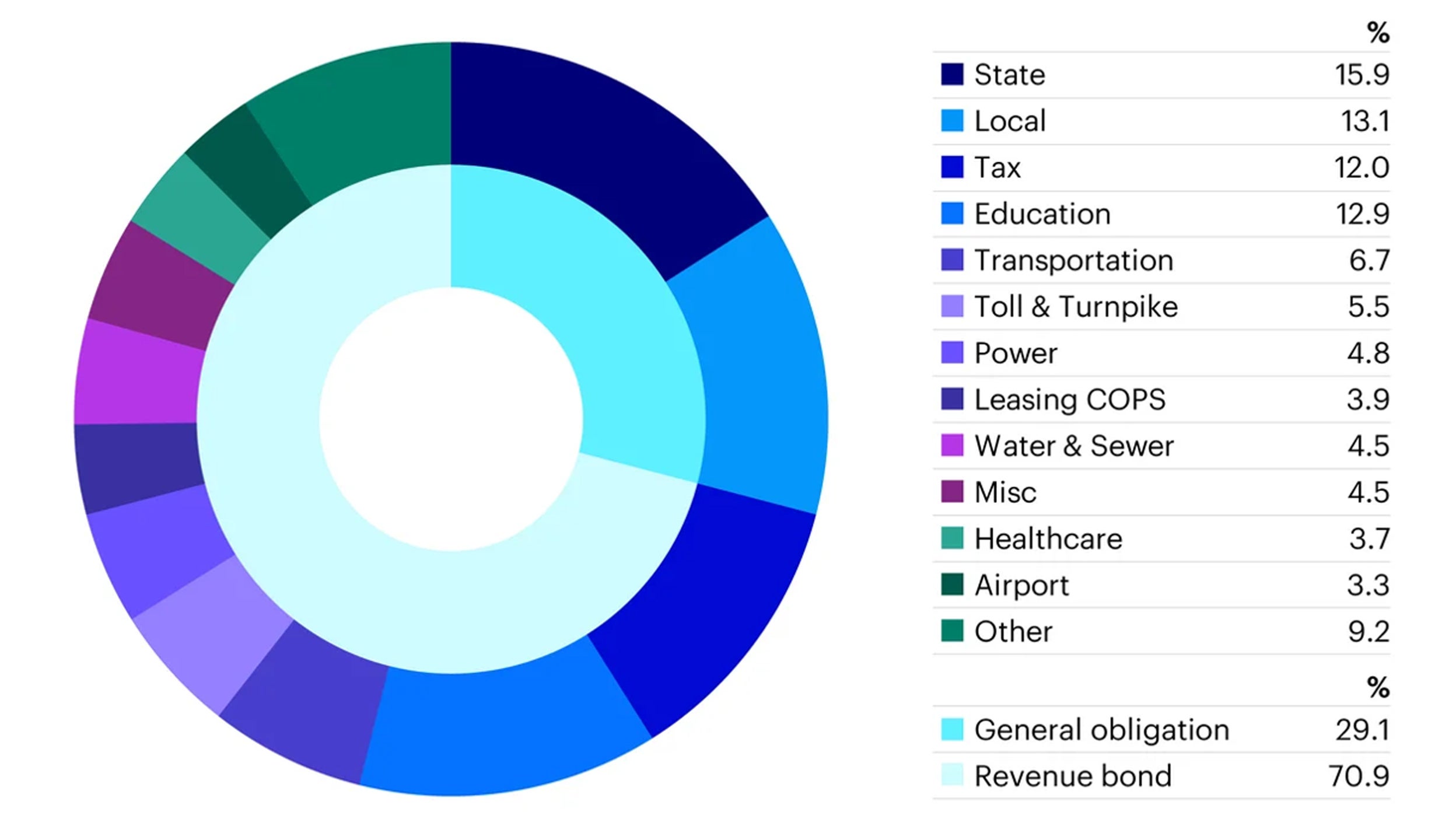

If you’re looking for a higher quality alternative to traditional corporate bonds, it might be worth considering US taxable municipal bonds (or “munis”). Their average rating sits about halfway between US Treasuries and investment grade credit, but they offer two-thirds of the spread over Treasuries that is provided by investment grade credit. While munis have historically performed in a similar manner to investment grade credit, their average rating is four notches higher and their historical default rate is just 0.18% (versus 1.74% for investment grade credit), making taxable munis superior to traditional investment grade from a credit perspective.

Source: ICE, Invesco, US Securities and Exchange Commission. Weights as at 30 September 2023 based on the ICE BofA US Taxable Municipal Securities Plus Index.

Comparing taxable munis with US investment grade credit

|

IG |

Taxable Munis |

|---|---|---|

Yield |

6.33% |

5.89% |

Spread |

132bp |

88bp |

Duration |

6.28 |

7.67 |

Ave rating |

A- |

AA |

Def |

1.74% |

0.18% |

Source: Bloomberg, ICE, 30 September 2023. Taxable Munis is the ICE BofA US Taxable Municipal Securities Plus Index. Investment Grade Credit is the ICE BofA US Corporate Index. Default rate based on http://www.msrb.org/msrb1/pdfs/MSRB-Muni-Facts.pdf using Moody’s data for 1970-2016

The taxable municipal bond market has many issuers and over 81,000 issues, making it very difficult for investors to gain diversified exposure via individual bond purchases. The market is dominated by institutional investors and access to the bonds can be difficult, unless ticket sizes are large. Liquidity is often sourced via primary market issuance (the equivalent of an IPO). Due to these challenges, ETFs could be the most cost-effective way for many investors to gain exposure.

Why consider fixed income ETFs?

For investors looking to gain exposure to these innovative fixed income strategies, we believe ETFs can be an attractive option for several key reasons:

- Targeted nature: ETFs can provide exposure to specific segments of fixed income markets and allow investors to express their views on credit quality, maturity, or geography. This makes ETFs the ideal vehicles for implementing tactical asset allocation decisions.

- Diversification: ETFs offer broad and diversified exposures within these specific fixed income asset classes, which reduces idiosyncratic risks.

- Portfolio management: Experienced portfolio managers handle all ongoing rebalancing needs within the fund. As coupons are automatically reinvested (with accumulating share classes) or paid out on a fixed schedule (with distributing share classes), there is no need for investors to monitor new issues or calls.

- Liquidity: ETFs are traded on exchanges. This creates both liquidity and transparency.

- Efficiency: ETFs are cost-efficient, can be bought and sold quickly, and offer trading flexibility that allows investors to express and fine tune their views.

ETFs provide a range of alternative exposures to traditional credit

If you’re looking at income opportunities outside of government bonds, ETFs provide a range of alternative exposures to traditional credit. Some of the more innovative asset classes can offer potentially higher yields as well as possible diversification benefits, including those seeking to take advantage of subordination in an issuer’s capital structure. Meanwhile, allocations to taxable municipal bonds and fallen angels could even improve the credit quality of portfolios comprising traditional investment grade and high yield bonds. Whatever suits your objectives, risk budget and economic outlook, ETFs are efficient investment tools to target specific parts of the bond market.

Investment risk

For complete information on risks, refer to the legal documents.

Value fluctuation: The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested.

Securities lending: The Fund may be exposed to the risk of the borrower defaulting on its obligation to return the securities at the end of the loan period and of being unable to sell the collateral provided to it if the borrower defaults.

Concentration: The Fund might be concentrated in a specific region or sector or be exposed to a limited number of positions, which might result in greater fluctuations in the value of the Fund than for a fund that is more diversified.