2024 Investment Outlook – European Senior Loans update

Summary

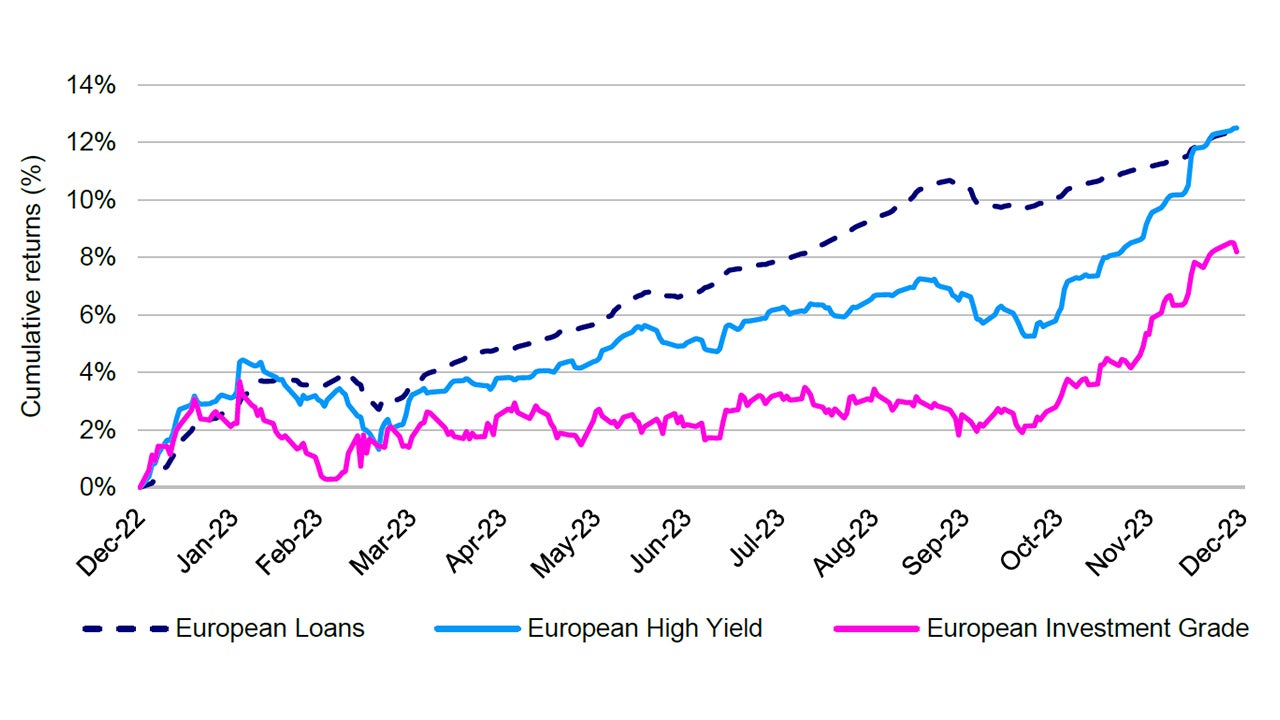

The European leveraged loan market has returned a strong 12.46% for 2023.1 We foresee a constructive 2024: inflation is slowing, interest rates have likely peaked, and sentiment is improving. While growth is expected to be muted, given Invesco’s Private Credit’s leading market position, enabling access to company management, sponsors, and sell-side participants, we continued to be well placed to navigate credit-risk. We expect a total return of approximately 8% in 2024.2

2023 recap

The loan market started strongly. A mild winter and therefore reduced energy demand helped the Euro area avoid recession (as was our base case); growth forecasts were upgraded as a “gas crisis” was avoided. Loans outperformed many other asset classes that sold-off in February amid renewed sticky-inflation fears and reactionary hawkish central bank talk. A short-lived, but sharp pull-back in risk assets followed that was triggered by concerns over Silicon Valley Bank (SVB) and Credit Suisse resulted in weak March returns. The Ukraine/Russian conflict ebbed and flowed. Natural gas prices had more than halved by summer (although well above historical averages), supply-chains were improving, and food prices were falling. Corporate earnings were steady as cost pass-through measures were supporting profit margins.

While these trends have been constructive, (global) inflation has remained elevated throughout the year. In response, the European Central Bank (ECB) has continued to tighten monetary policy to 4.0%. This has manifested as weaker consumer and business confidence and a cautious economic outlook that has endured throughout the year.

Source: Credit Suisse and Bloomberg as of December 31, 2023. The Credit Suisse Western European Leveraged Loan Index represents European Loans, the Credit Suisse Western European High Yield Index represents European High Yield, and the Bloomberg Euro-Aggregate Corporate Index represents European Investment Grade. All Euro-based indices are hedged to EUR. An investment cannot be made in an index. Past performance is not a guarantee of future results.

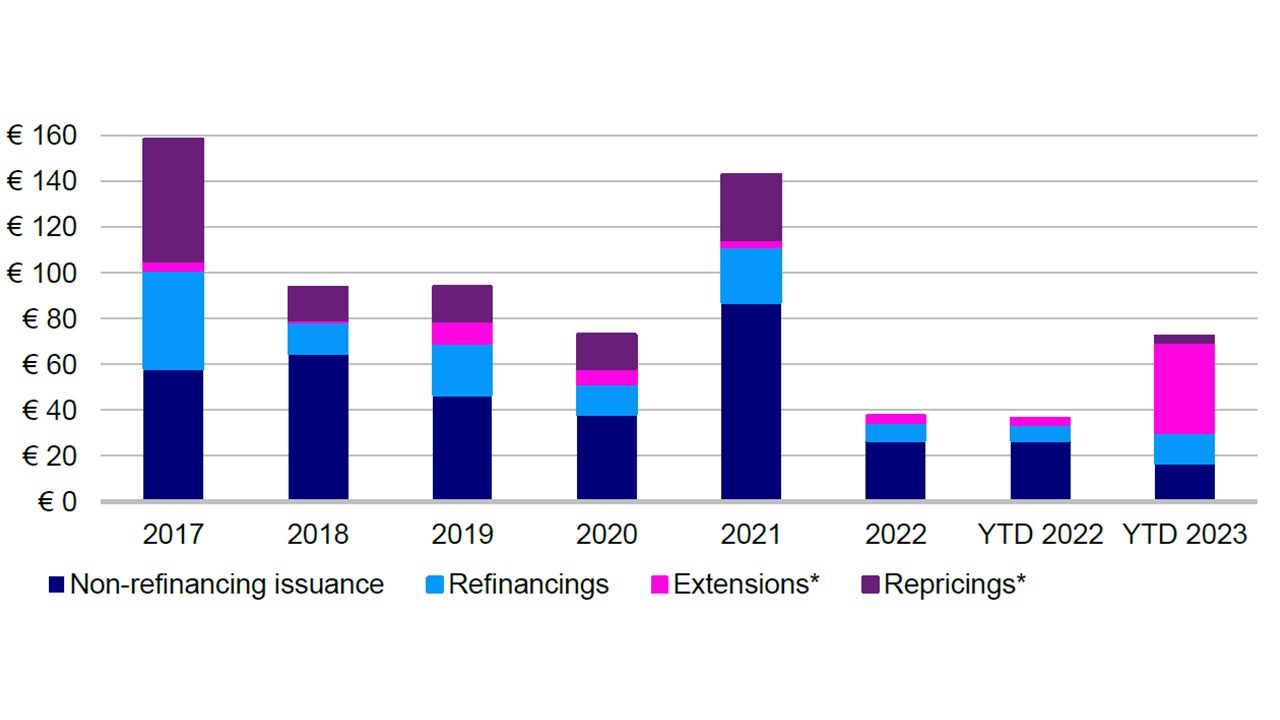

Accordingly, and in line with our expectations, year-to-date (YTD) new issue volumes have been anemic, with amend-and-extension transactions (A&E) dominating deal flow. The market has benefited from firm technical support all year. On the supply side, new money volumes are at multi-year lows, while CLO demand has remained steady as arbitrage conditions improved. CLO volumes YTD through September 30, 2023 in Europe were €20.95 billion from 55 deals, as compared to €21.41 billion from 54 deals the same time last year.3

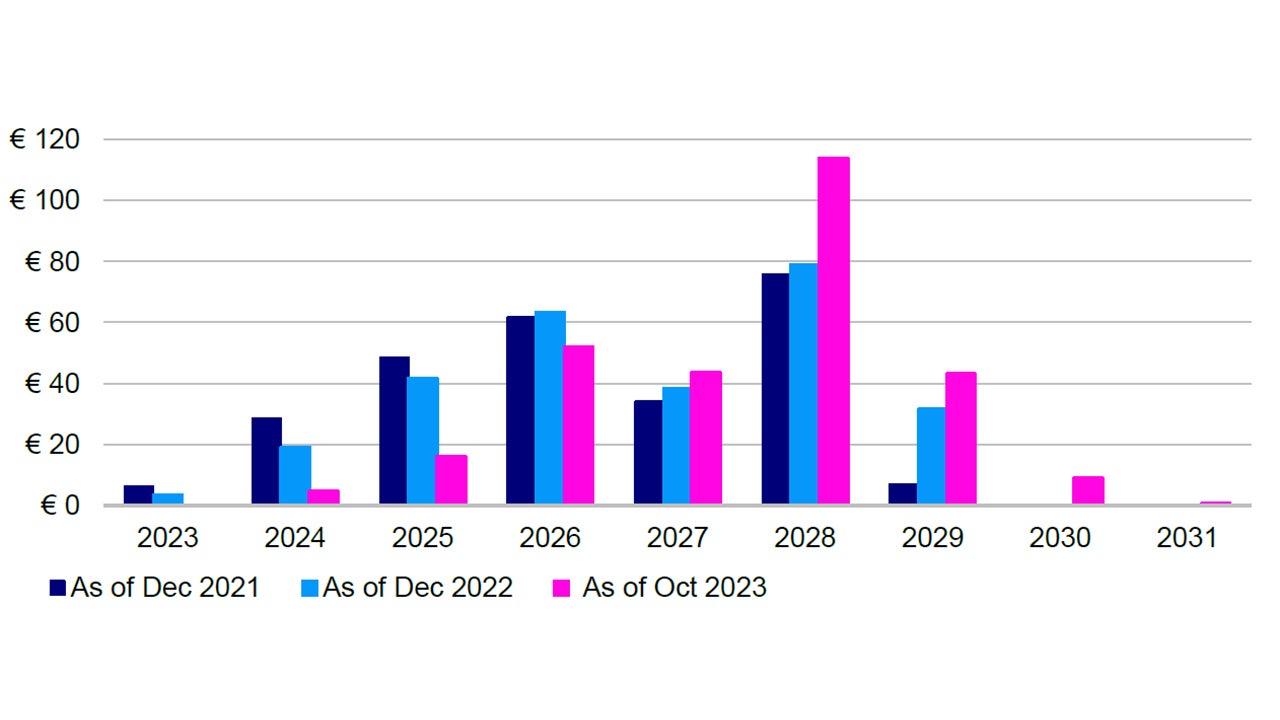

A&Es helped mitigate the “maturity-wall” risk identified last year. Distress ratios (loans trading at less than €80) have fallen throughout the year as macroeconomic events played out. Correspondingly, defaults have remained low, modestly increasing to 1.4%, well below the 2.9% historical average.4

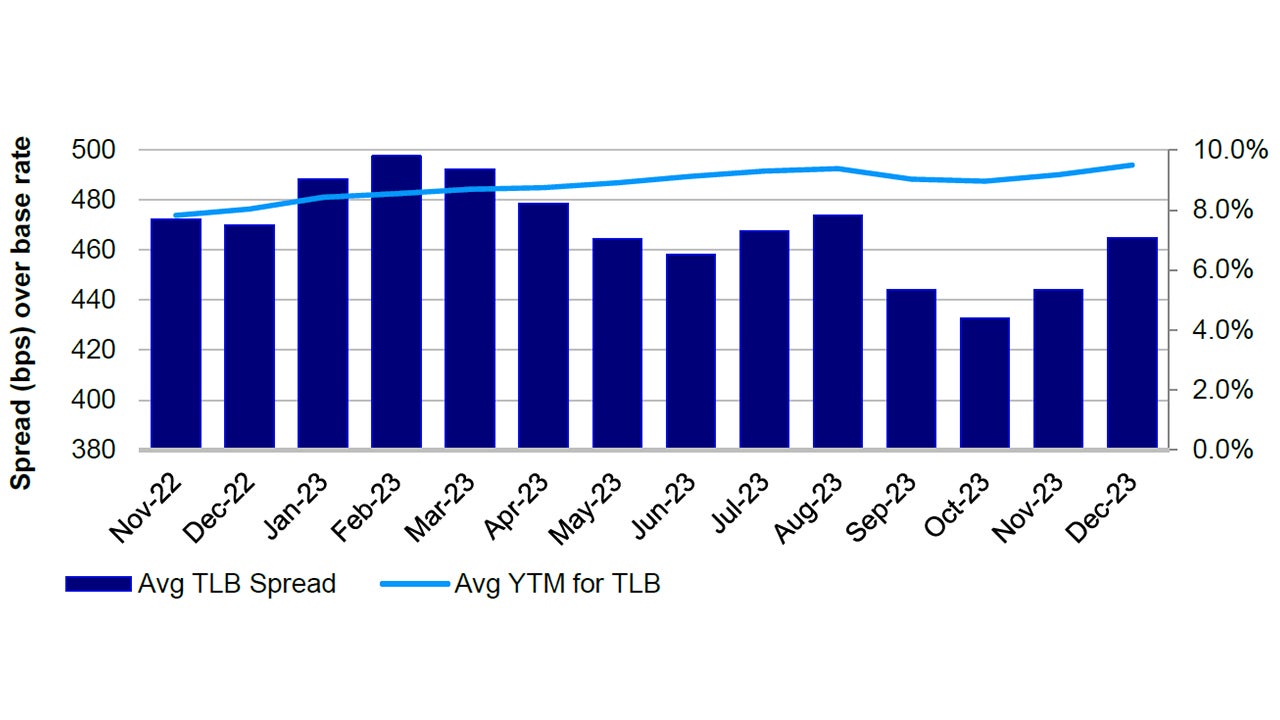

Calendar year 2023 returns were 12.46%,5 in line with our expectations. Principal return is 4.5% (with average prices rallying from 91.56 to 96.62)6 – driven by the technical dynamics outlined above. Coupon/interest returns equated to 7.9%,7 rising throughout the year in parallel with ECB hikes. Average term-loan yields (primary or via A&Es) have naturally followed suit. Loans have had a strong year, outperforming investment grade returns by approximately 4%, and nearly matching High Yields return, albeit with much less volatility.8

Source: PitchBook Data, Inc. as of December 31, 2023. Term Loan B (TLB).

2024 outlook

The ECB raised deposit rates to 4.0% in September and in October they paused, ending ten consecutive hikes. Headline inflation undershot expectations in October and again in November – suggesting that the inflationary path is set, and, moreover at 2.4% now approaching ECB target levels (2%). Core inflation fell to 3.6% in November and stickier than the headline numbers, which is benefitting by large declines in energy prices over the last year.

The Euro area (“EA”) economy growth remains subdued. 3Q23 GDP contracted by 0.1% quarter-over-quarter. For the full year, the European Commission Autumn forecasts 2023 growth at 0.6% (down from 0.8% at their previous forecast), rising to 1.2% (1.3%) in 2024, underpinned by domestic demand despite headwinds from higher interest rates (the ECB has tightened 4.50% in 15 months). Across the EA, the Commission forecasts Germany to contract by 0.3% in 2023 and return to growth in 2024, at 0.8%. Spain, France, and Italy are estimated to expand by 1.7%, 1.2%, and 0.9% in 2024, respectively.

Post the November 2023 inflation update, the market has repriced over 100bps of rate cuts by the ECB by year-end. With economic growth expected to be muted (but positive) and a shift from inflationary to growth focus, the first cut by the ECB is now priced to occur towards the end of the first quarter rather than summer as estimated in October. Falling inflation and recent wage growth should support household consumption and therefore growth.

Given the growth trajectory, we expect loan supply to remain below historical trends. Important merger and acquisitions (M&A) and leveraged buyout (LBO) activity is likely to remain muted. Enterprise valuations are resetting and if/when rates cuts occur (likely in the latter part of 2024), financing/funding will cheapen, providing some momentum for renewed activity. We note that historically, a greater-than-50-reading for PMIs surveys (i.e., indicating economic expansion) has led LBO volumes towards €45bn.9 Supply should, at least in the near term, be predominantly refinancing-driven, with A&E transactions continuing to be prominent in 2024. Loans maturing in 2026 will be the focus for bankers to address. Overall, we forecast leveraged loan supply should rise to around €35bn in 2024.

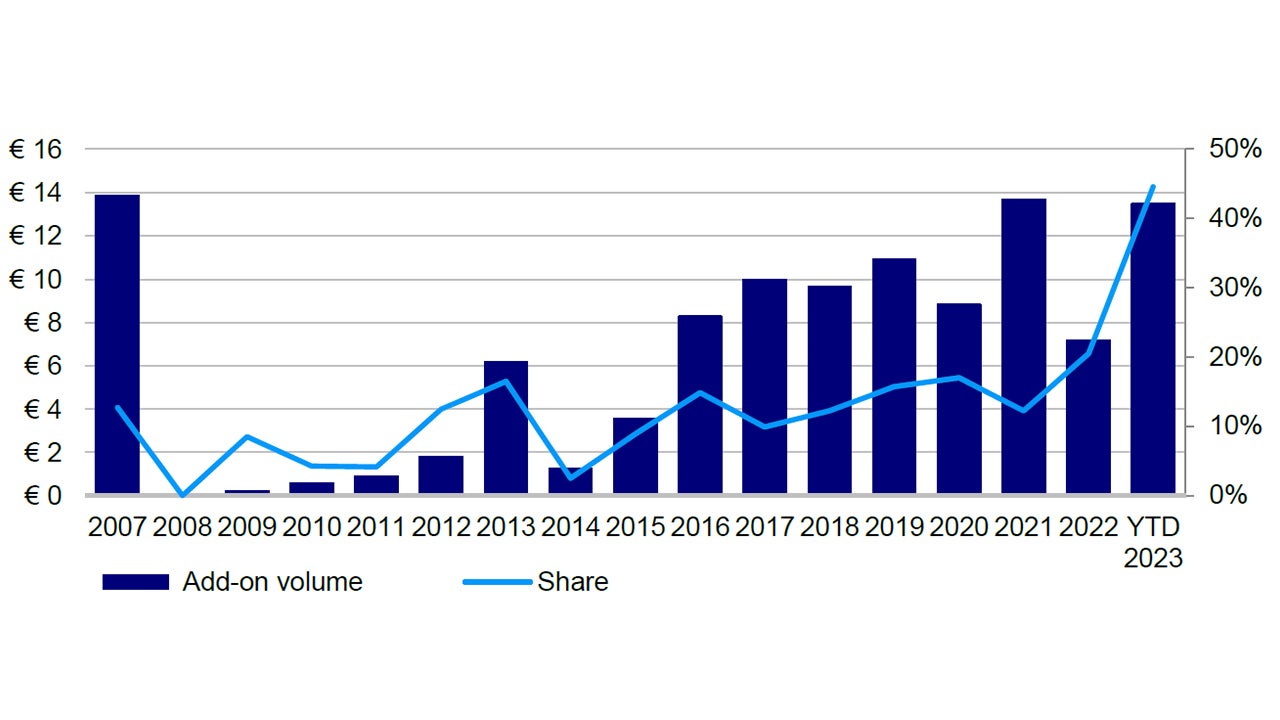

Source: PitchBook Data, Inc; Morningstar European Leveraged Loan Index as of November 30, 2023. Shown in € Euro billions.

On the demand side, CLO origination (the majority buyer-base of leveraged loans) will continue at similar volumes as 2023, providing the technical support for the overall loan market. Moreover, this will ensure A&E extensions (i.e., spreads) preserve CLO arbitrage requirements. We expect CLO new issuance of around €30-35bn in 2024.

Source: PitchBook Data, Inc; Morningstar European Leveraged Loan Index as of November 28, 2023. Shown in € Euro billions. *Reflects extensions and repricings done via amendment process only.

Given the macroeconomic landscape outlined, we foresee default rates trending back towards long-term averages to around 3.75-4.0%, but below market-implied levels. Elevated, but falling, interest rates and muted earnings growth pose some risks for levered balance sheets. At the borrower level, lower interest coverage ratios (that in our opinion will improve dramatically if implied rate cuts are realized) imply lower cash generation and, therefore, an increased risk of default; although downside risk to the overall market should be low as individual loan prices, in general, now reflect these concerns. Similarly, cyclical sectors are pricing in forward expectations of moribund earnings over the medium term. The quantum of lower rated loans maturing in 2025 remains relatively low and, as outlined above, A&E transactions with sponsors supporting refinancings with equity (as seen in 2023) provides comfort that maturity wall risks will be addressed.

A milder winter slowdown and strong rebound in PMIs would promote a risk-on tone across markets. An unexpected recession and slow policy response would likely cause inflation to decelerate faster, but the ECB’s reaction may be delayed as it waits for evidence of a slowdown. In this scenario, we envisage that loan prices lower. Geopolitics and the US election will be also ongoing themes in 2024, with several potential twists-and-turns.

Overall, for our base case, we expect average loan prices and nominal spreads to broadly remain neutral, reflecting benign macroeconomic expectations and the loan demand/supply dynamic. Running coupons will, on average, moderate in tune with the likely path of monetary policy.

Today’s market prices encode a rise in defaults – above our estimate – thus, we believe volatility to the downside should be mitigated. We anticipate another year of strong risk-adjusted returns for 2024 of approximately 8%.10

Source: PitchBook Data, Inc; Morningstar European Leveraged Loan Index as of November 28, 2023. Shown in € Euro billions.