Finding opportunities in growth, inflation, and monetary policy divergences

Overview

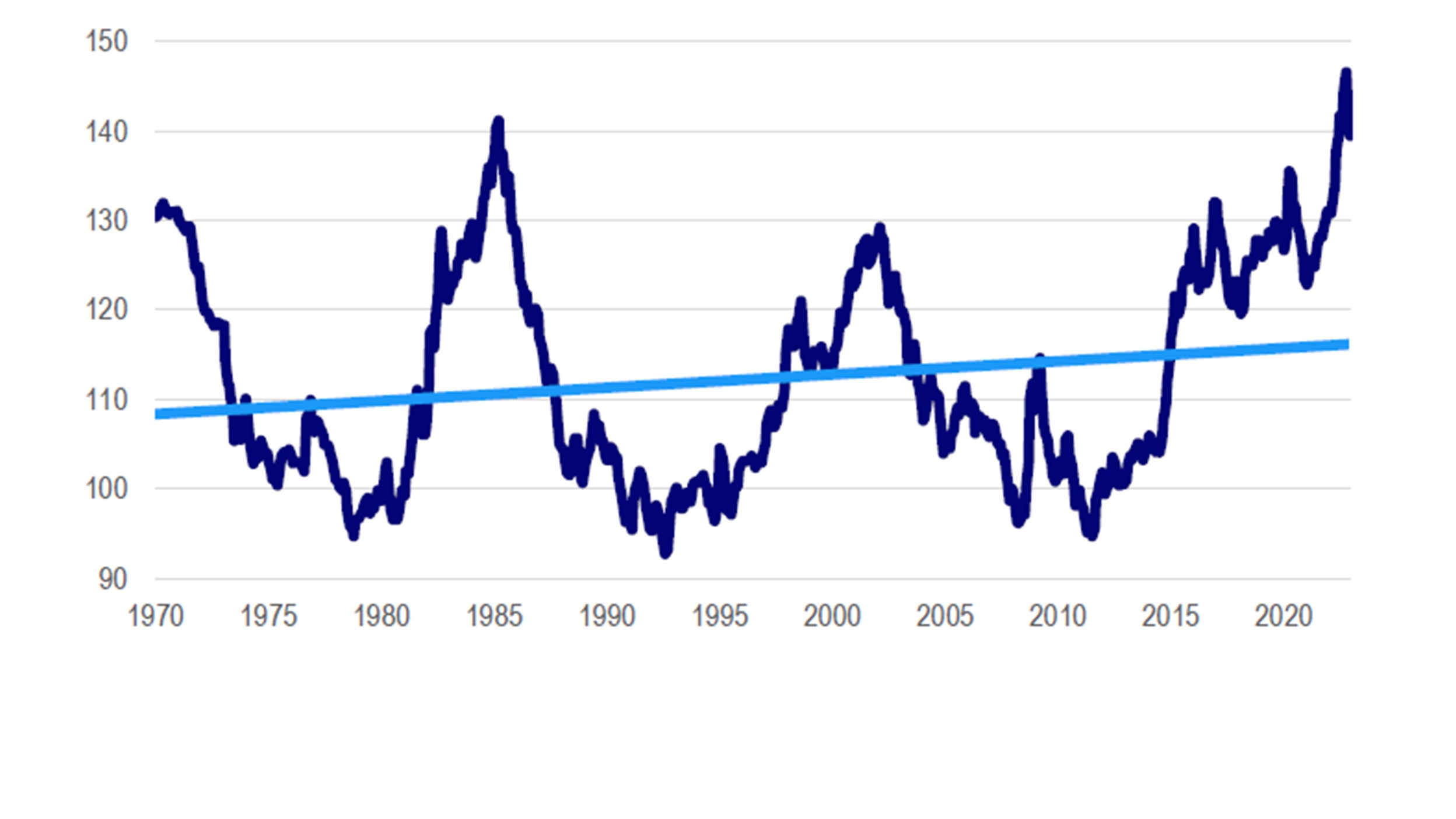

After reaching a 52-year high last fall and declining since, the US Dollar may have peaked.

Current economic data does not imply a pathway to imminent recession, and banking stress appears contained. The global landscape of still uncomfortably high inflation has not fundamentally changed.

With growth in emerging markets outshining developed markets and the US by a wide margin, now could be an opportune time to gain exposure, as we expect a positive environment for EMs.

As the macroeconomic landscape continues to evolve, Hemant Baijal, Senior Portfolio Manager and Head of Multi-Sector Management – Global Debt, and Carla Cricco-Lizza, Senior Product Manager, provide an update. The Global Debt Team follows a macro-oriented approach and actively allocates risk across interest rates, currencies, and, for some strategies, credit, with an investment horizon of 9-18 months.

US Dollar may have peaked in 2022

After reaching a 52-year high on a trade-weighted basis last fall, the US Dollar began to decline relatively swiftly on the back of peak hawkishness from the Federal Reserve (“Fed”) through the beginning of this year. We have seen a relatively muted response in the US dollar during this recent episode of banking stress, based on the view that this is a contained, US-specific issue and the Fed is close to the end of its tightening cycle – which if correct, both suggest a weaker USD going forward.

Over the past few rate hiking cycles, the dollar has historically weakened in the two-three months following the last Fed rate hike. With attractive real rates and stronger growth abroad, we anticipate the trend continues.

Index Level versus Trendline. Source: Bank of America, as of 12/31/2022.

Banking stress has not fundamentally altered the global economic narrative

We ultimately do not believe this episode of banking stress has materially changed the global economic narrative of uncomfortably high inflation. Yet we have seen heightened macro volatility as stress in the US banking sector raised the specter of a credit crunch hastening an economic downturn. Many small businesses rely on regional banks for their credit and working capital needs, so a halt in credit creation is a hinderance to growth. Overall, we expect the banking crisis to have the impact of lowering growth by nearly 0.5% in the US.

We anticipate US regional banking stress will lower the terminal rate the Fed was aiming to get to. While it is too early to say whether a credit crunch will prompt inflation to fall more rapidly, it is also quite possible that the Fed will have to remain at a higher level of interest rates for a longer period of time.

We believe imminent recession is not the base case, despite market pricing

While the possibility has increased, we continue to believe that a US recession is not the base case. Current economic data does not imply a pathway to imminent recession, and banking stress appears contained.

Market-implied pricing points to more than 100bps of Fed rate cuts over the coming year. While markets appear to be pricing a recession, we see a bi-modal distribution at this point: a high probability that US monetary policy will remain higher for longer at or near current levels with no rate cuts, and a significantly lower probability that there is an event that prompts the Fed to ease meaningfully (200bps+ type easing).

A ripe international opportunity set amidst diverging growth and inflation dynamics

Contrasting the US, the Chinese economy is in the midst of an upswing. We expect growth in emerging markets (both including China and ex-China) to be materially higher than growth in developed markets and the US, with an even wider differential this year. While growth will be lower across the board, it will be materially lower in the US and decline only marginally in emerging markets.

That growth differential, with international (specifically emerging markets) growth outshining the US, has historically driven flows into the asset class. Given international/emerging market assets are cyclically and structurally under-owned, technicals are favorable. Based on our outlook, we believe now could be an opportune time to gain exposure.

A positive environment for emerging markets (EM)

We expect the environment for EM turns positive fairly quickly once US rate uncertainty recedes. While perhaps not entirely immune to further turbulence in the US, EM assets have held up relatively well this year in the face of US uncertainty and bank stress, with no signs of ensuing contagion.

Over a 12-to-24-month investment horizon, we expect the environment to be particularly attractive as cyclical headwinds decline and secular tailwinds increase. Going forward, we anticipate opportunities for rate cuts in specific EM countries where central banks have already raised rates significantly and inflation momentum has turned. As varying inflation and growth dynamics assert themselves on a country-by-country basis, we see compelling opportunities to pursue excess returns through active management.

Data as of 04/30/2023, unless otherwise stated. All data provided by Invesco unless otherwise noted.

The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

About risk

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating. The values of junk bonds fluctuate more than those of high quality bonds and can decline significantly over short time periods.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

The performance of an investment concentrated in issuers of a certain region or country is expected to be closely tied to conditions within that region and to be more volatile than more geographically diversified investments.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.