Global Debt Team’s active approach to EM sovereign ESG investing

Overview

The Invesco Fixed Income Global Debt Team’s expertise and differentiated approach to ESG oriented investing.

The key advantages of incorporating forward-looking sustainability momentum and sustainability potential indicators into EM sovereign fixed income investing.

Case study: assessing signals of potential risk in sovereign EM. The importance of engagement with sovereigns as a critical component of ESG integration.

With contributions from Gerald Evelyn, Senior Client Portfolio Manager

Long history of ESG and sustainable fixed income investing

The Invesco Global Debt Team is part of the Invesco Fixed Income (IFI) platform, a well-resourced team that combines local market knowledge with a strong global perspective. IFI has managed ESG-aware portfolios for more than two decades, and our approach has continually evolved over time. The evolution of our approach reflects changing industry dynamics and the growing appetite for more sophisticated and targeted sustainability-linked investment outcomes. We believe our independent research and global approach to sustainable investing could offer value to clients seeking strategic partnerships in emerging market (EM) fixed income.

The Invesco Global Debt Team manages over USD6 billion in assets, including over USD3 billion in sovereign EM debt.1 Team members have diverse international backgrounds, including fluency in 15 languages. Our sovereign investment process combines top-down global macroeconomic analysis with bottom-up country analysis to identify country-specific opportunities and determine a portfolio’s overall risk budget. Governance factors, along with the impact of environmental and social policies, are key inputs into our analysis of country-level growth and sustainability. Our approach to integrating environmental, social, and governance (ESG) factors in sovereign investment is rooted in our decades-long experience and belief that evaluating ESG criteria can lead to better long-term risk-adjusted returns.

The incorporation of financially material ESG factors is fundamental, in our view, when investing in developing countries. Our philosophy is based on our belief and experience regarding its positive impact on human welfare, long-term sustainable growth, and sustainable value creation and risk management. Our approach fully integrates ESG risks and opportunities into our investment process, specifically as it relates to investment selection and portfolio construction.

Integrating ESG factors into the sovereign investment process

We integrate ESG factors at each step of the sovereign investment process and portfolio construction. Our top-down global macro analysis aggregates individual country views into a global economic baseline and helps us determine a portfolio’s overall risk profile. Our global macro view also emphasizes a country’s growth level and direction of change toward sustainability, which includes efforts to increase the use of sustainable energy, access to health care, and food security — crucial factors for stable long-term economic growth. The identification and analysis of broad macroeconomic ESG themes allow us to identify and better monitor risks at the overall portfolio level.

At its core, our investment process is based on active bottom-up portfolio construction that is implemented at the sovereign level. For each country, we seek to identify favorable country-specific opportunities related to monetary and fiscal policy, political and social stability, the independence of institutions, adaptation to climate change, and long-term sustainability, among others. We believe that good governance and a strong pro-investment policy mindset are inherently beneficial to a country’s long-term sustainability and are likely to have an enduring positive environmental and social impact on the well-being of its citizens.

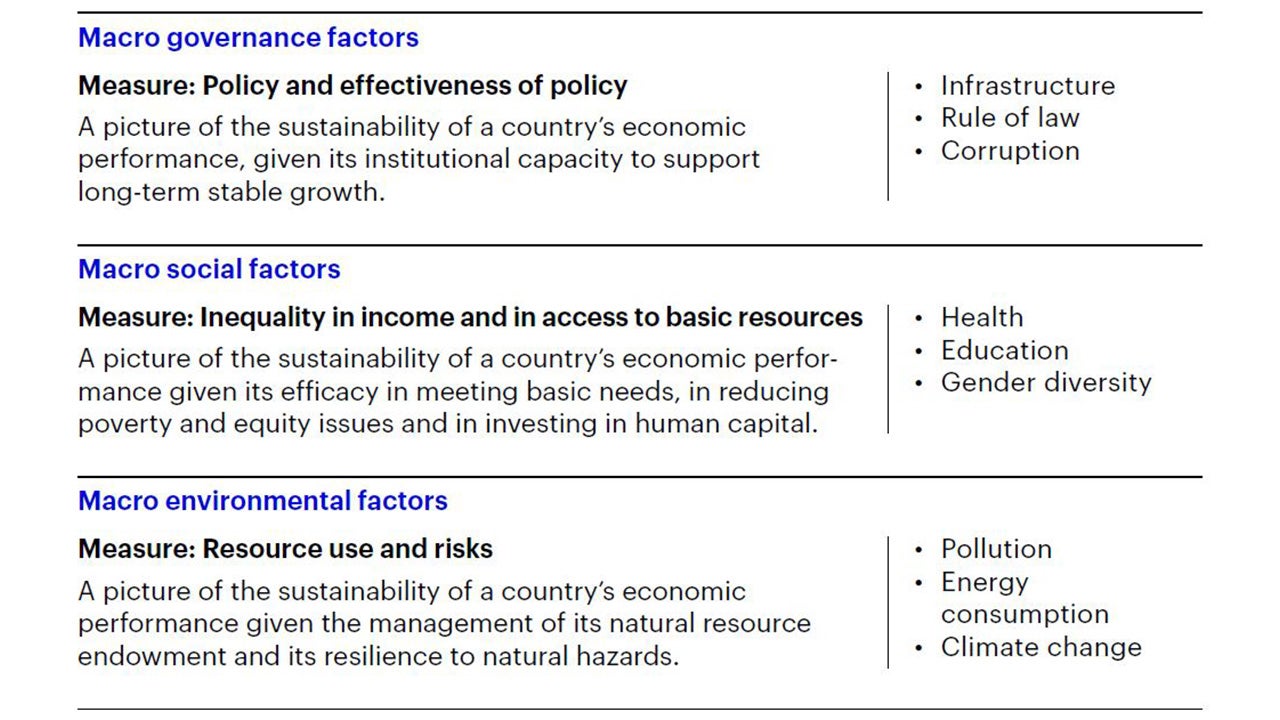

The Global Debt Team leverages its macroeconomic and ESG expertise, creating a robust approach to assessing ESG risk and opportunities by implementing a proprietary two-pronged ESG rating framework that is unique within the sovereign fixed income asset class. The First Prong is the foundation provided by a quantitative model, based on a unique formula that incorporates multiple data indicators against specified weightings for the normalization of the data. The initial output provides a numeric rating on which the Second Prong is built.

The Second Prong is a qualitative assessment that incorporates the fundamental analytical expertise of economists and macro strategists who are well-versed in ESG risk considerations specific to sovereign entities.

Our qualitative assessment builds on Invesco’s fixed income framework of sovereign debt ratings, which gathers relevant information in a proprietary scoring tool to generate a composite ESG profile for each country so that relative performance and direction of change can be compared across developed and emerging markets. We not only formalize ESG factors into our scoring tool, but we also adjust these factors to incorporate forward-looking information, seeking to minimize known biases, such as income bias, which negatively impacts lower-income countries relative to their more developed peers. Mitigating these biases helps to better inform our investment process and ultimate portfolio construction. Our general approach and the tools incorporated are repeatable and systematic across sovereigns, and are broadly highlighted in Figure 1 below.

Source: Invesco. For illustrative purposes only.

Our active approach: ESG momentum and potential

ESG factors play an important role in assessing the macroeconomic context of sovereign investing in EM. This role is manifested through our determination of a country’s sustainability momentum and potential, as we believe these are long-term catalysts for economic growth.

We believe the integration of ESG into sovereign investing should incorporate an assessment of a government’s policy intentions, which bridges the gap between specific investment projects and behavior that promotes ESG goals at the macro level. Our approach focuses on considering sovereigns along with the momentum behind their sustainability goals. We assess a country’s sustainability profile in a comprehensive manner, targeting the rate and direction of progress toward a sovereign’s long-term policies and goals. Instead of ranking countries, we seek to qualitatively analyze them on a case-by-case basis, using a repeatable process across countries to derive a holistic view that better informs our determination of the sustainability momentum of a given country.

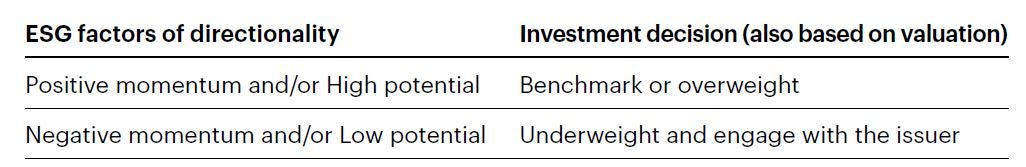

We favor countries with strong momentum and/or whose potential for success is high, and dislike countries where momentum is weak (or negative) and/or the potential for success is low.

We consider each country’s individual endowment of resources, its stage of development, the opportunity presented, and the probability of achieving it. This allows us, as investors, to encourage positive development and favorable policy outcomes on various environmental and social issues, which is at the core of our sustainable investing strategy.

The ESG rating and designated momentum demonstrate a country’s potential for success, which is underpinned by a rigorous fundamental economic analysis. A country’s ESG momentum and potential contribute to the sizing of our portfolio positions, as illustrated in Figure 2.

Source: Invesco. For illustrative purposes only.

As an example, a sovereign with negative momentum and/or low potential will likely be limited to an underweight position in our portfolios and is flagged as an engagement opportunity, while a sovereign with high potential and/or positive momentum will likely have at least a benchmark weight, and often an overweight in our portfolios. By using this framework, we are able to better identify those countries, for example, that because of their allocation of capital and budgets to increased social services, efforts to improve the quality of life and provide access to sanitation (albeit at different speeds and under different incentives), they are well positioned for sustainable economic growth in the long term.

Case Study

Portfolio application of ESG Momentum: Russia-Ukraine war

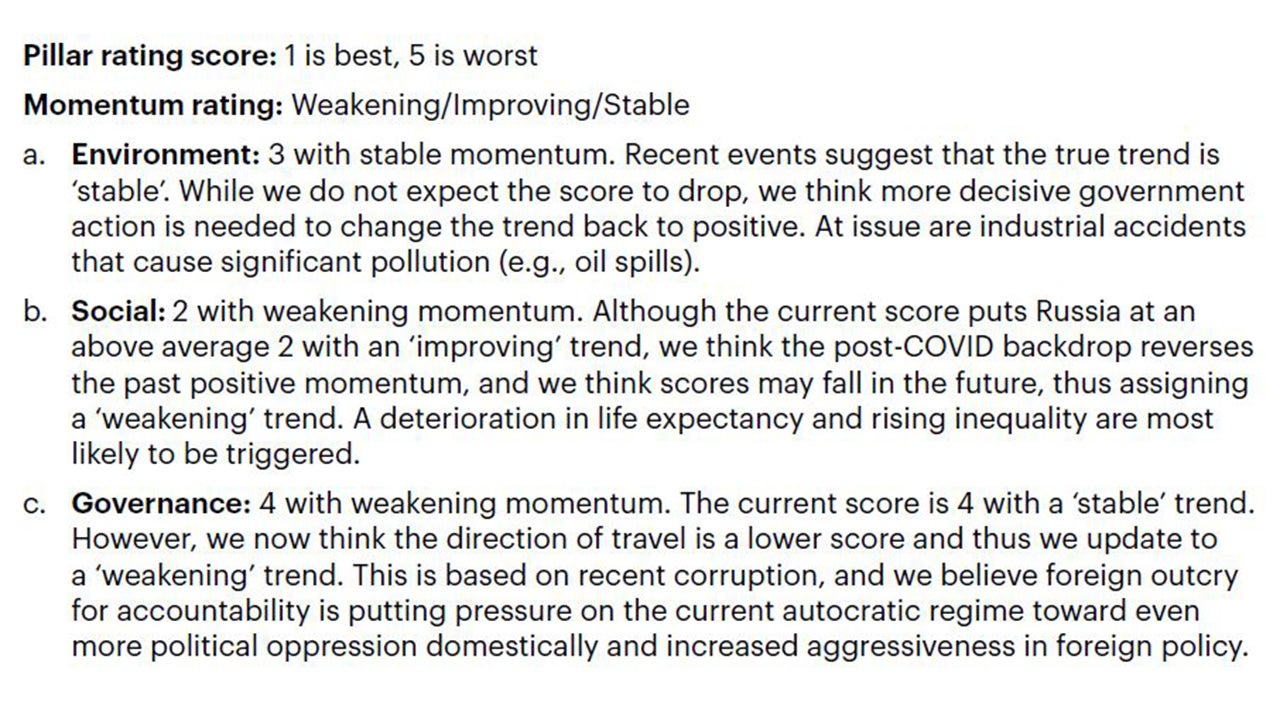

Below is an example of how our assessment of ESG potential and momentum combined with bottom-up country analysis to augment our investment process, portfolio construction optimization, and investment risk mitigation, by providing early signals of the risk that led up to the Russia-Ukraine war. In December 2021, our analyst issued a negative momentum trend assessment in both the social and governance scoring pillars of our ESG rating of the Russian sovereign. Although Russia’s absolute ESG score was not changed, the momentum trend assessments were updated:

We did not believe an immediate portfolio adjustment was necessary since the overall ESG score for Russia did not change. However, given the escalating rhetoric from both sides, we recognized the potential for the weakening ESG momentum trend to accelerate if ongoing discussions between Russia and Ukraine collapsed, leading to the team’s heightened sensitivity to portfoliosizing.

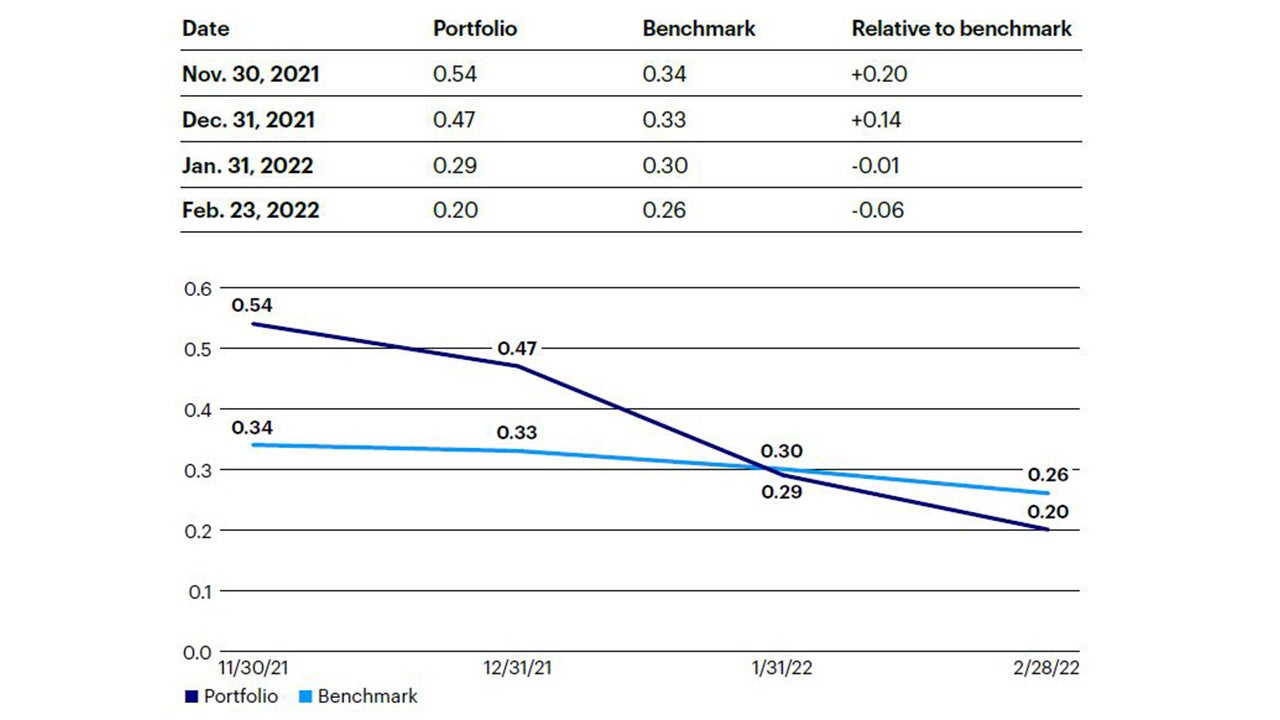

In early 2022, despite our constructive view on the ruble and Russian interest rates, based on a fundamental view that inflation was peaking and the end of the rate hiking cycle was near, we began to reduce our duration and currency exposure to the sovereign by the middle of January and were formally underweight by early February (Figure 4). We were concerned that ESG momentum was deteriorating rapidly, and that the probability of an actual conflict was increasing. Additionally, given our multi-decade experience investing in the asset class through systemic and idiosyncratic market shocks and our investment philosophy, which focuses on downside risk mitigation, we converted our remaining interest rate exposures to an interest rate swap format, as opposed to holding traditional Russian bonds (OFZ), to help guard against a sharp decline in liquidity in Russia’s bond market, were an escalation to unfold. These strategic moves proved prescient, as they helped mitigate the impact of the geopolitical event on our portfolio.

Source: Invesco.

This example underscores the value of a fully integrated, holistic ESG approach that incorporates high frequency qualitative trend assessments. Frequent analyst assessments help bridge the “time gap” between traditional ESG data sets and real-time changes in sovereign sustainability factors, leading to improved portfolio risk signaling and better investment outcomes.

Sovereign engagement and investor stewardship

We view ourselves as proactive and engaged investors. Engagement with policymakers is a core part of our due diligence and investment process. We engage prior to investing and afterward for monitoring purposes. We assess the quality of countries’ policies via research trips and by engaging directly with local policymakers and stakeholders, including senior government officials, central bank representatives, state administrators and agencies, local politicians, non-governmental organizations and consultants, as well as senior executives from the private sector. Assembling a holistic picture gives us greater confidence in our assessment of a country’s policy feasibility and sustainability trajectory, which we believe are critical for a country’s long-term economic prospects and investment returns.

We believe engagement is the critical component that drives ESG progress at the sovereign level. Unlike companies, which face mandatory disclosure requirements, such as annual reporting, Corporate Social Responsibility and European Union Taxonomy compliancy, sovereigns are not bound by this same level of transparency or data frequency. This means that sovereign ESG engagement is an important tool to not only gauge sustainability progress, but also to obtain additional assessment data and information across E, S, and G indicators. Our conversations with sovereigns entail broad and detailed discussions around a country’s sustainability agenda.

Engagement is a key tool to provide active due diligence and stay informed on the relevant changes of a given sovereign. We understand the need for continuous interaction because ESG momentum can change significantly over time, which increases the need to provide accurate and consistent updated recommendations, which are crucial as they are ultimately reflected in investment positioning. For example, a country’s governance measures may be challenged at a point in time when the social and environmental demands of a growing middle class are not met. Oftentimes, the interplay between ESG factors first materializes as changes in policy intentions and risk assessments. We therefore continuously engage with local policymakers, not just on their fiscal and monetary policy agendas, but also on the impact of their social and environmental policies on growth and productivity.

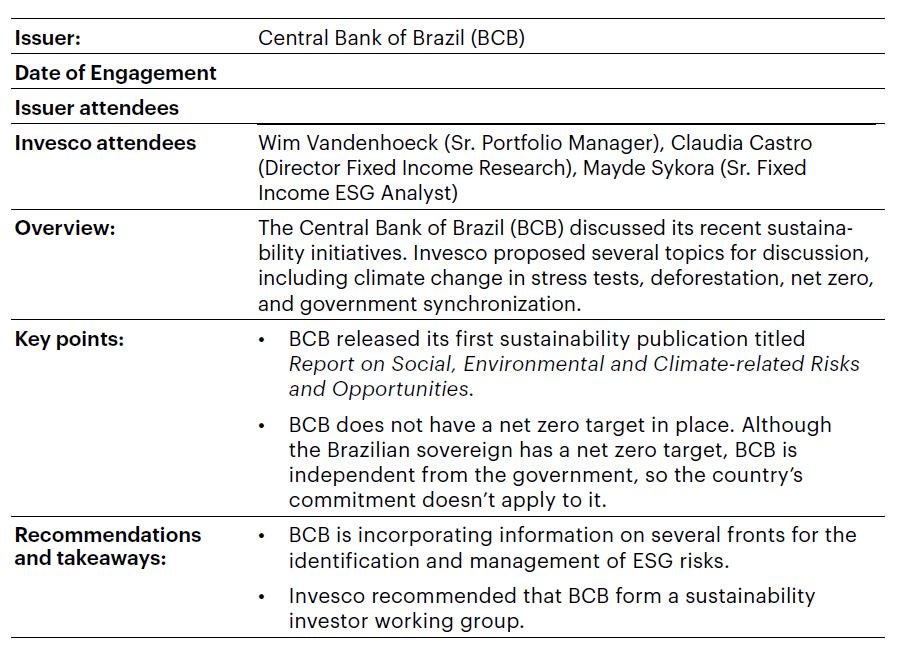

Sovereign engagement template: Example Brazil

When engaging with issuers, policymakers, and local market participants, we use the template below to track and monitor discussion topics, key takeaways, and recommendations offered. This standardized template helps to ensure that a repeatable process and consistent approach is maintained across all countries assessed, allowing for greater efficiency and comparability.

Source: Invesco. For illustrative purposes only.