Global Fixed Income Strategy - July 2024

Europe’s recovery on track as energy shock fades

We believe the energy shock that buffeted the eurozone after the pandemic is now in the rear-view mirror and a cyclical recovery is largely on track. As the energy shock abates, real incomes are once again turn-ing positive — supporting a previously downtrodden consumer. The manufac-turing sector is, however, struggling to emerge from a prolonged period of weak-ness, which is adversely impacting export- orientated economies such as Germany. But southern European countries such as Spain, Portugal and Greece, are powering ahead. Not only did these countries avoid the worst of the 2022 – 2023 energy shock, but their external accounts have been boosted by strong tourism flows.

A benign inflation environment but strong wage growth

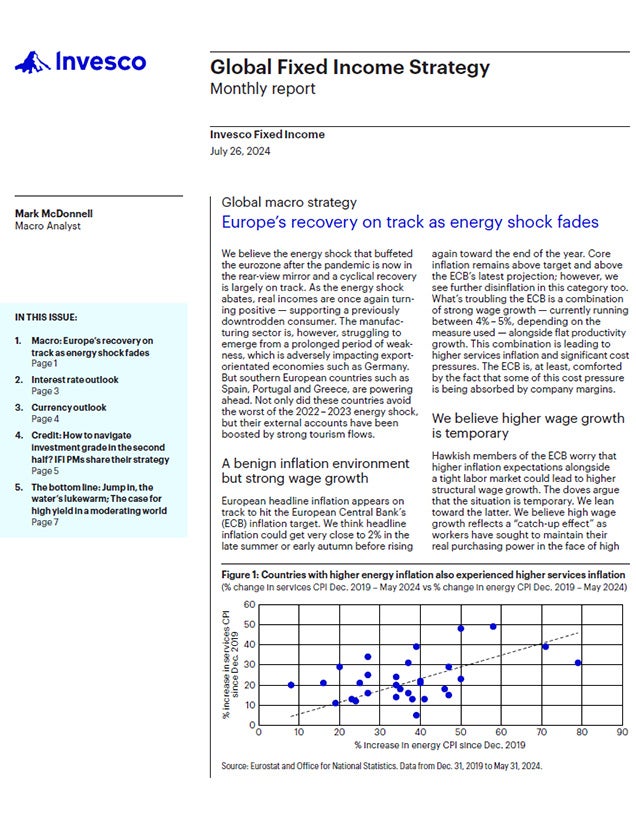

European headline inflation appears on track to hit the European Central Bank’s (ECB) inflation target. We think headline inflation could get very close to 2% in the late summer or early autumn before rising again toward the end of the year. Core inflation remains above target and above the ECB’s latest projection; however, we see further disinflation in this category too. What’s troubling the ECB is a combination of strong wage growth — currently running between 4% – 5%, depending on the measure used — alongside flat productivity growth. This combination is leading to higher services inflation and significant cost pressures. The ECB is, at least, comforted by the fact that some of this cost pressure is being absorbed by company margins.