Why global investment grade bonds make sense now

Global equities have risen to record high recently. Why should investors stay defensive and invest in global investment grade bond (IG)?

Global equity markets have continued to climb, supported by resilient earnings and optimism around structural growth themes like AI in the US and infrastructure spending in Europe. However, this optimism may be overlooking the negative growth impact of the of elevated trade barriers.

While recent trade agreements under the Trump administration have reduced headline tensions, effective tariff rates remain approximately 15% higher than liberation day levels.

Markets appear to be pricing in a smooth resolution to trade frictions, yet the underlying cost pressures and supply chain inefficiencies from these tariffs continue to weigh on global growth.

In this context, the Global Investment Grade Corporates has demonstrated a compelling allocation for investors seeking to balance return potential with portfolio resilience:

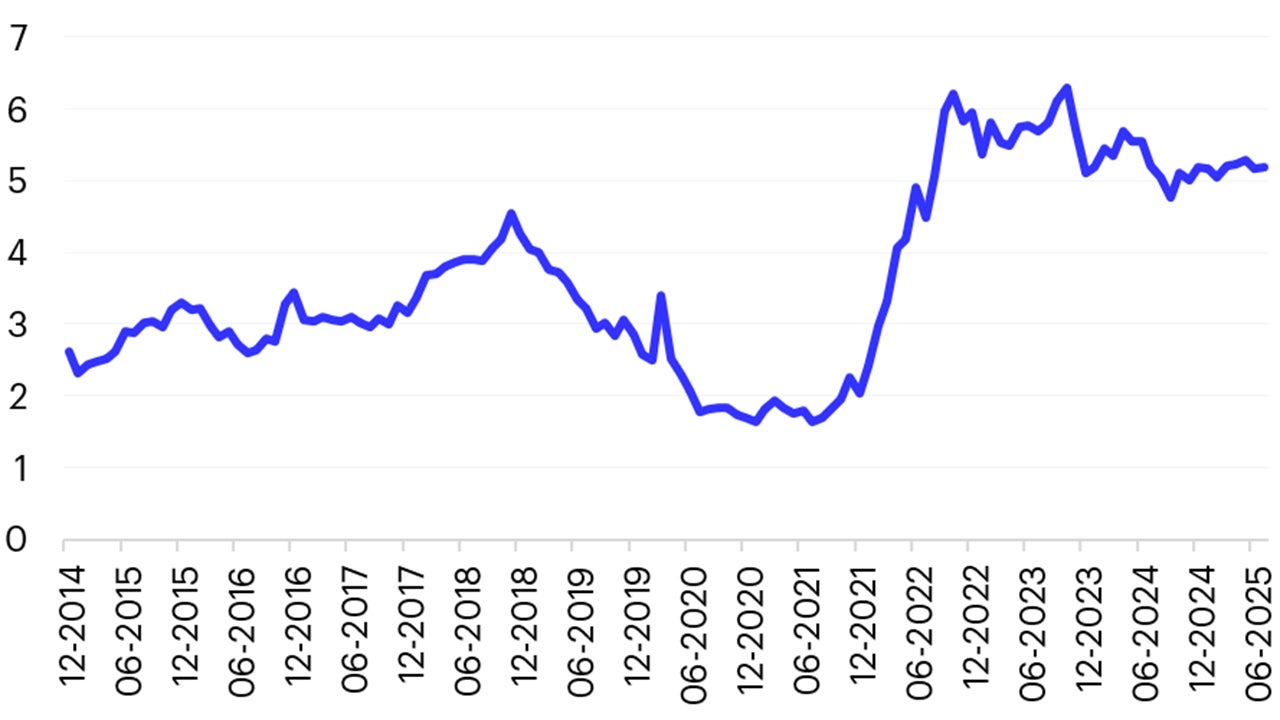

- Relatively attractive Yield Profile: Despite tighter spreads, All-in yields remain elevated relative to historical norms, supported by higher base rates and strong issuer fundamentals.

- High Credit Quality: The asset class is anchored by companies with robust balance sheets and stable cash flows, offering a buffer against macroeconomic volatility.

- Diversification Across Geographies and Sectors: Global IG credit would provide broad exposure, helping to mitigate region-specific risks and capture relative value opportunities.

- Late-Cycle Positioning: As markets price in a benign outlook, the asset class indicates a more measured approach to risk-taking, with relatively lower volatility and more predictable income streams than equities or high yield credit.

In summary, we believe that the Global IG Corp asset class presents a disciplined allocation opportunity for investors looking to enhance portfolio stability and income generation—particularly in an environment where markets may be underestimating the economic drag from sustained trade frictions.

Source: BlackRock Aladdin, as of July 31, 2025

*Bloomberg Global Aggregate Corporate USD Hedged Total Return Index, as of July 31,2025

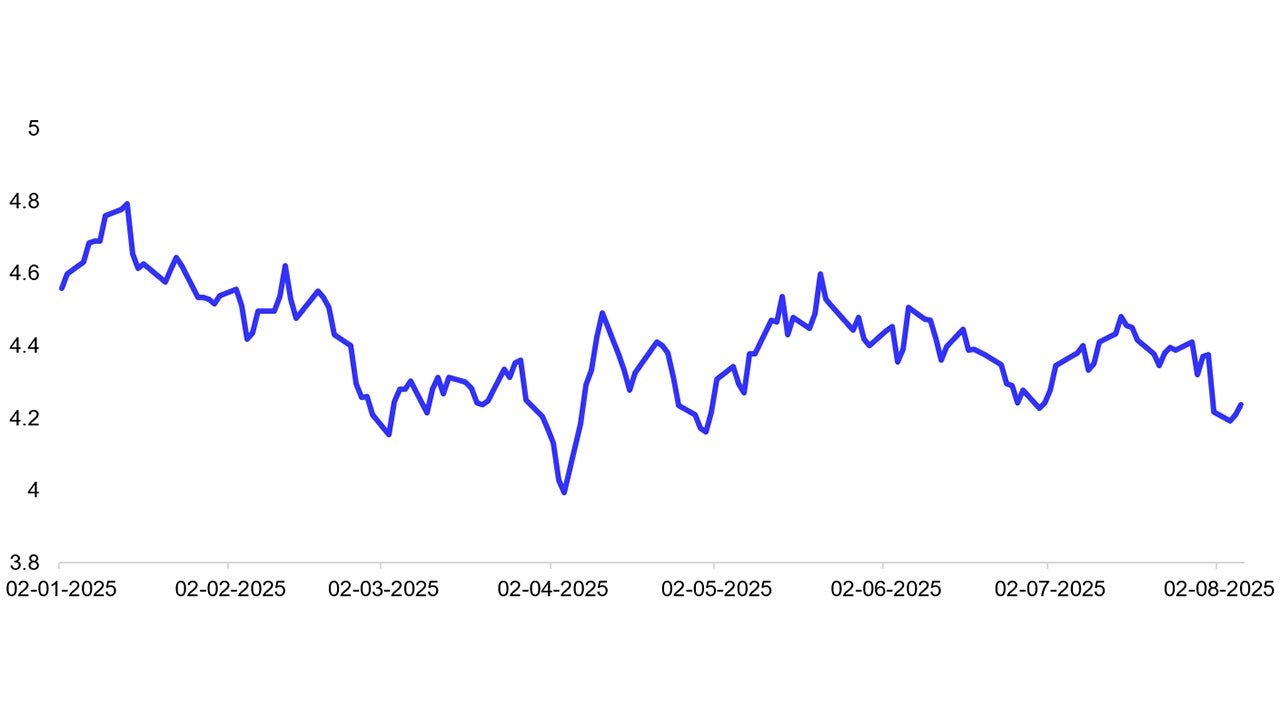

10-year US yield has started to trend down while Eurozone and UK yields are trending up. What are the implications on Global IG?

Global rates markets are showing clear divergence, reflecting differing macro narratives across regions:

- US: Despite no rate cuts yet in 2025, Treasury yields are trending lower especially in the short end. This reflects market expectations that the Fed may need to ease more aggressively in the future, driven by softening growth indicators and the lingering impact of elevated tariffs.

- The US faces de-dollarisation pressures, with rising debt issuance especially in the long end and waning foreign demand - adding fiscal strain and steepening the curve.

- Eurozone: The European Central Bank has been cutting rates in line with disinflation, and with trade uncertainty largely resolved and growth stabilizing, the region is likely approaching terminal rates. However, infrastructure spending, particularly in Germany, is expected to drive increased sovereign issuance, steepening the curve.

- UK: The Bank of England has been less aggressive than the Fed, but unlike the US, the UK remains more exposed to growth risks. Inflation remains elevated, and policy uncertainty persists.

Against this backdrop, we believe that it makes sense to consider:

- Overweight UK Duration: Given the UK's sensitivity to growth risks and the potential for rate cuts, being long duration in UK corporates would offer relatively attractive convexity and carry.

- Steepener Trades in US and Europe: It makes sense to take into account curve steepening in both regions - driven by fiscal expansion, debt issuance, and central bank easing.

Source: Bloomberg, as of Aug 5, 2025.

Recently there have been concerns that spreads could be too tight. What’s your comment on this?

We agree that the market is being complacent with growth potentially surprising to the downside as well as concerns of a Fed independence and debt sustainability could see volatility/higher yields in the long end.

- Reduced Spread Risk: Recognizing the limited upside from further spread compression, it makes sense to scale back exposure in cyclical and more tariff exposed sectors like capital goods, whilst moving into more high quality and duration sensitive as well as shorter dated securities especially in more service driven sectors like banks and insurers which are less prone to trade implications.

- Increased Duration Exposure: With central banks likely to respond to growth weakness through easing, it makes sense to increase duration exposure - particularly in the UK and US - likely to benefit from rate cuts and curve steepening.

- Defensive Tilt: It makes sense to focus on high-quality issuers ensures resilience in the event of a credit repricing.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.