Monthly fixed income update - March 2024

Asset Class Returns

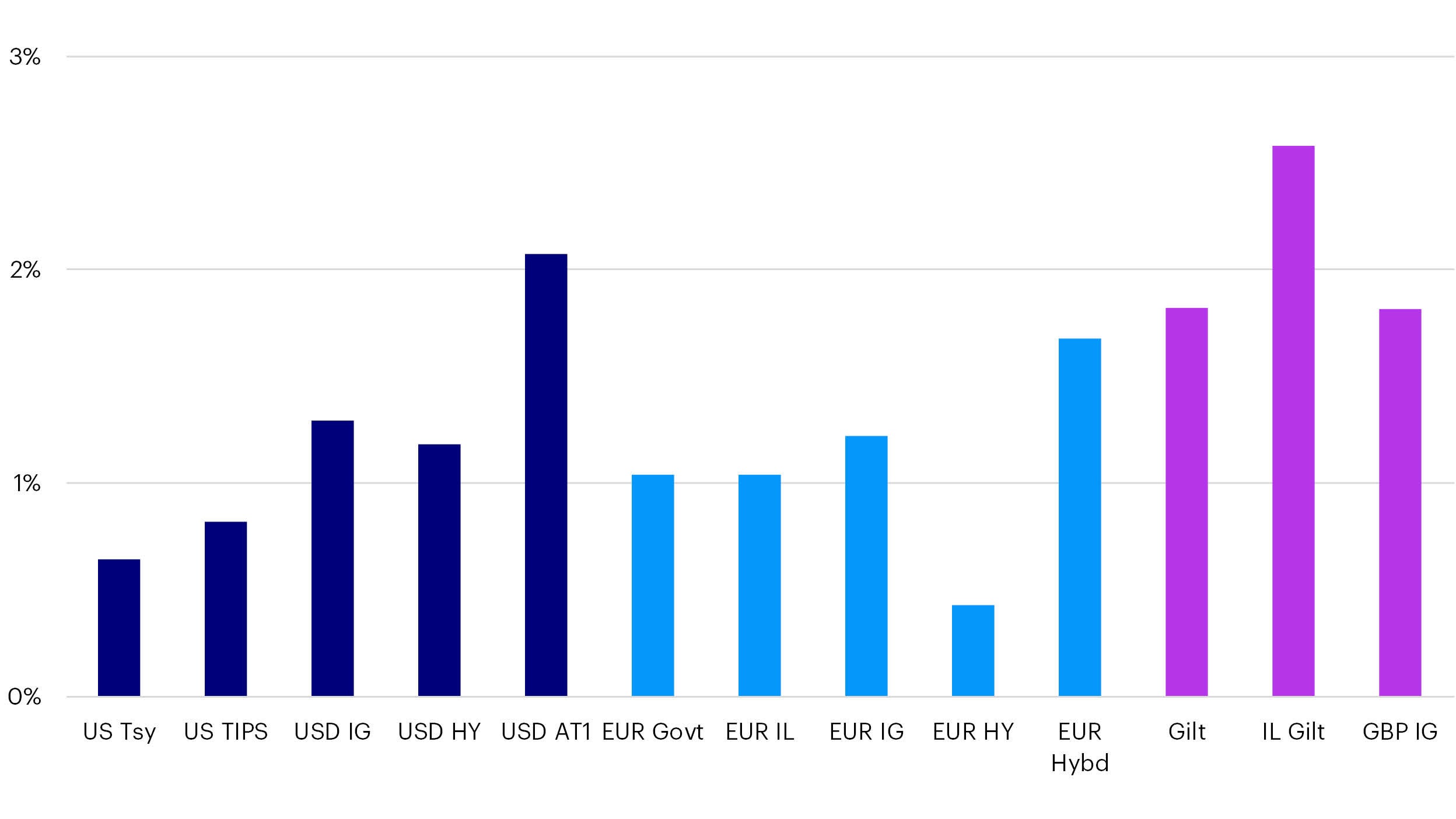

Fixed income returns were broadly positive in March, following two months of lacklustre performance, as yields on government bonds stabilised and credit spreads tightened. While economic data was mixed, signals from central banks were generally perceived as being dovish, indicating that some easing of monetary policy remained likely later this year.

During March, the Reserve Bank of Australia dropped its tightening bias, the two hawks on the Bank of England’s Monetary Policy Committee (who had been voting for further rate hikes) voted to leave rates unchanged, and the Swiss National Bank surprised markets by cutting rates by 25 basis points. Even the Bank of Japan, which hiked rates for the first time in 17 years, did not appear to be hawkish with little indication about future policy tightening. However, that lack of guidance about the pace of future rate hikes did cause the Yen to weaken back above 150 vs the US Dollar, which may lead to more hawkish rate guidance in the near future. This dovish tone also supported equity markets with the S&P 500 hitting a new all-time high.

Source: Bloomberg, Invesco as at 29 Mar 2024

Government and Inflation-Linked Bonds

Government and inflation linked bonds performed well in March although US bonds markets lagged their European counterparts, with the UK gilt market doing particularly well following lower than expected inflation data and the Bank of England appearing to have become more dovish.

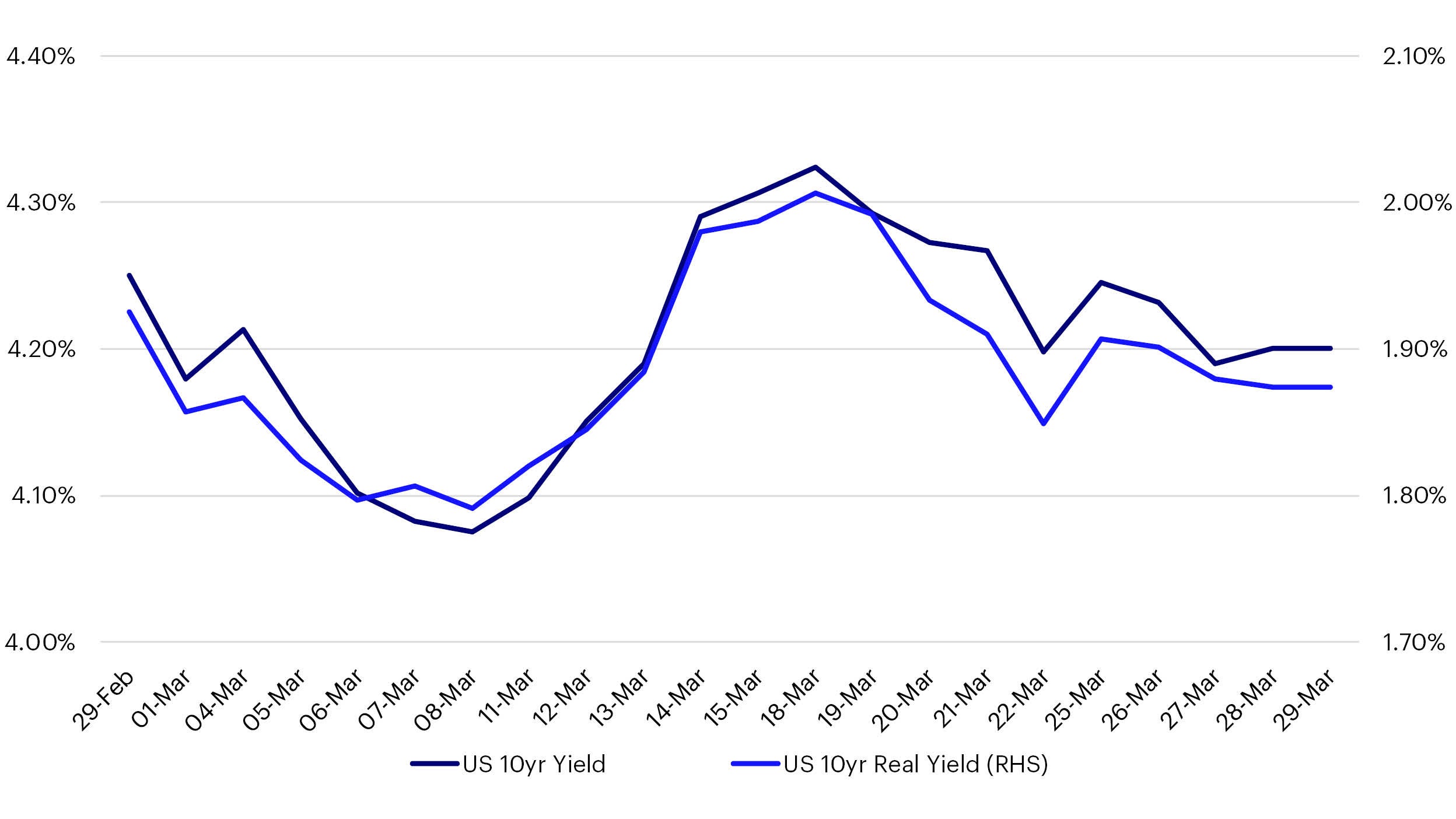

US Rates

US Treasuries rallied early in the month, primarily driven by the softer US employment report. Although the headline non-farm payrolls data was stronger than expected, it was accompanied by heavy downward revisions to the previous two months, and the unemployment rate ticking up to 3.9%. Yields then rose mid-month following the inflation data release, which showed both headline and core inflation running slightly above market expectations, before rallying once more into month end as the Federal Reserve indicated they still expect to ease rates by 75 basis points, later in the year.

Source: Bloomberg, Invesco as at 29 Mar 2024

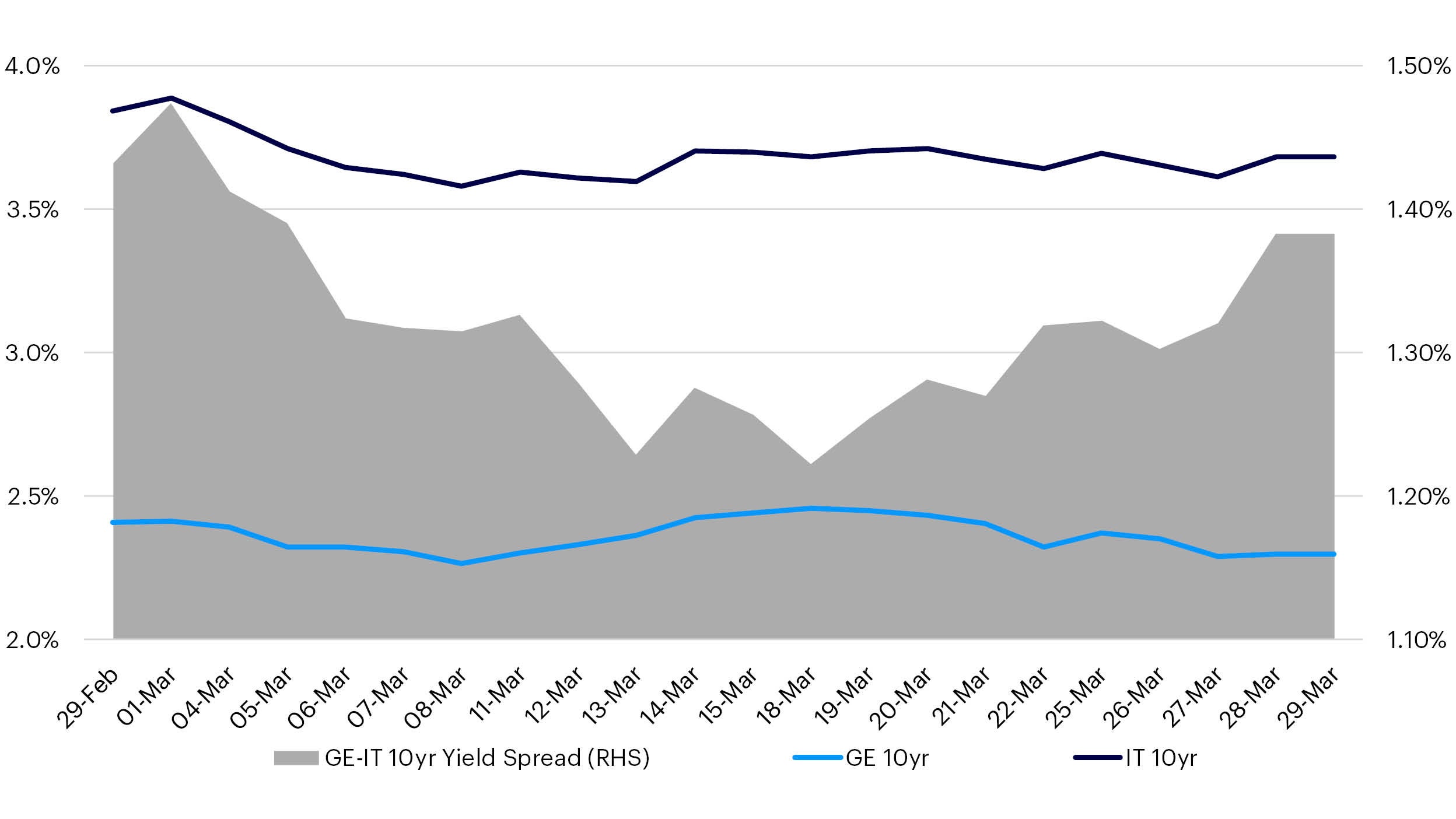

Eurozone Rates

Eurozone rates markets followed a similar pattern to US Treasuries, initially rallying before giving back those gains and then rallying once more into month end. Peripheral eurozone bond markets continued to perform well early in the month with spreads of Italian and Spanish bonds over Germany rallying to the tightest levels for more than two years before giving back some of the gains into month end.

Source: Bloomberg, Invesco as at 29 Mar 2024

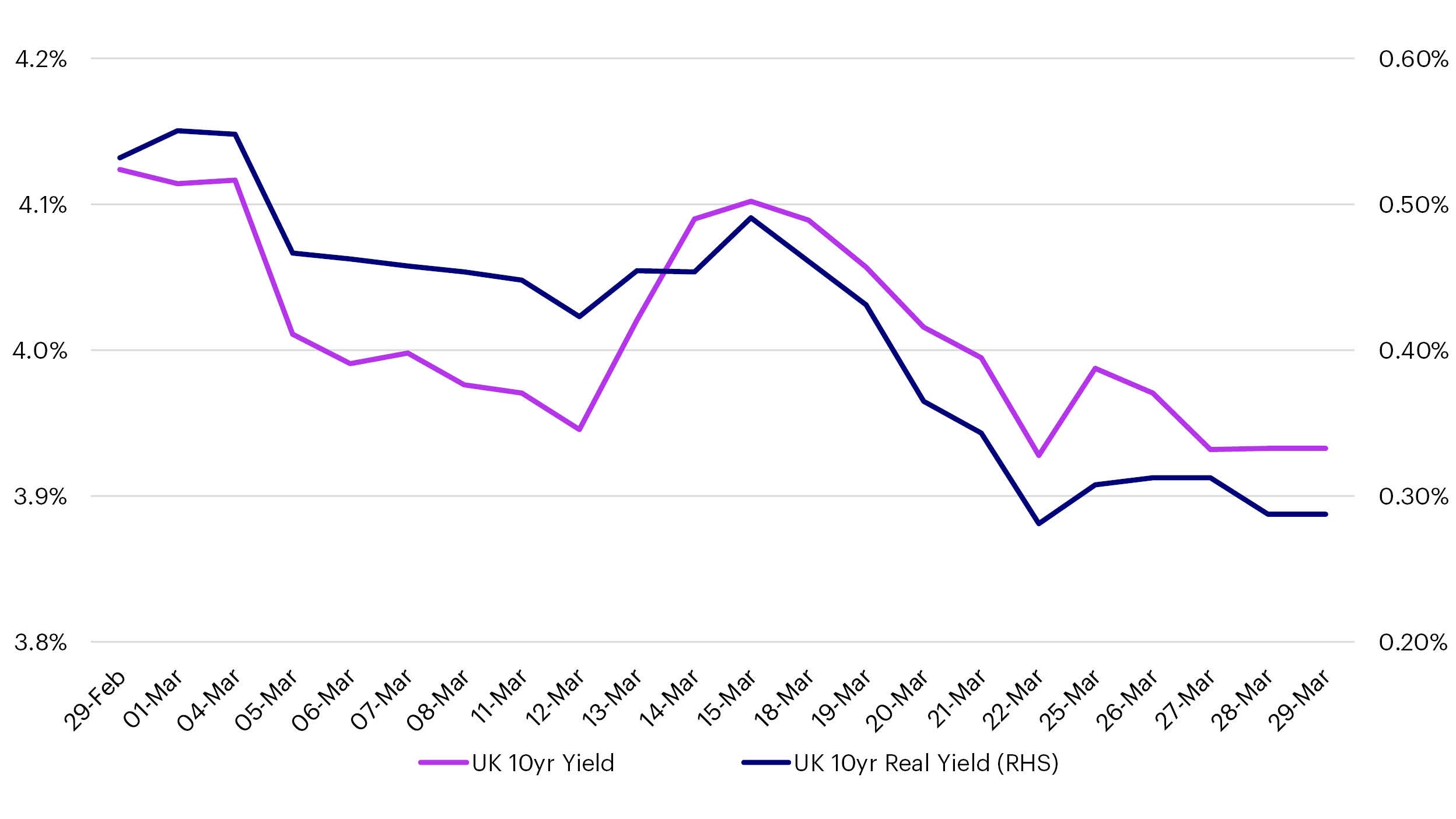

UK Rates

The gilt market performed well in March. Like US Treasuries, gilts rallied early in the month before giving up some of the gains in the middle of the month. However, there were some signs of weakness in the labour market data, along with headline and core inflation data coming out slightly lower than expected. The two hawks on the Bank of England’s rate setting committee changed their vote from a further hike to leaving rates unchanged, allowing the gilt market to rally into month end.

Source: Bloomberg, Invesco as at 29 Mar 2024

...central bank commentary about the timing and extent of rate cuts.

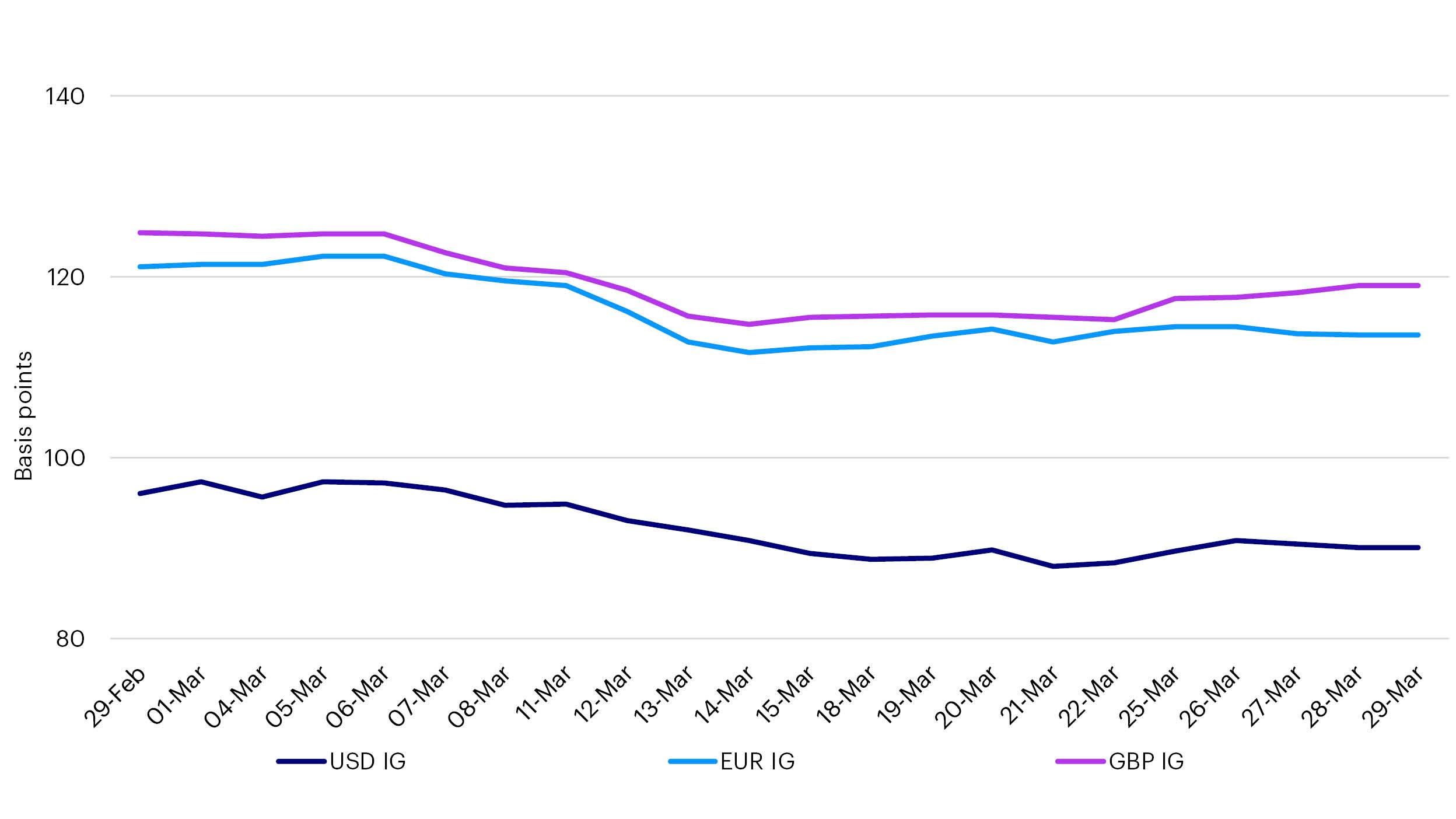

Investment Grade Credit

Investment grade credit spreads continued to tighten in March, ending the month 6-7 basis points tighter than at the end of February, once again benefiting from the risk-on tone which saw equity markets rally with broad indices such as MSCI World hitting new all-time highs during the month. The driver for this positive attitude towards risk appears to have been increasing confidence that the global economy is heading for a soft landing, with central banks preparing to ease rates later in the year to support growth, as inflation falls back towards target.

Source: Bloomberg, Invesco as at 29 Mar 2024

...economic data as spreads could be vulnerable to a hard landing.

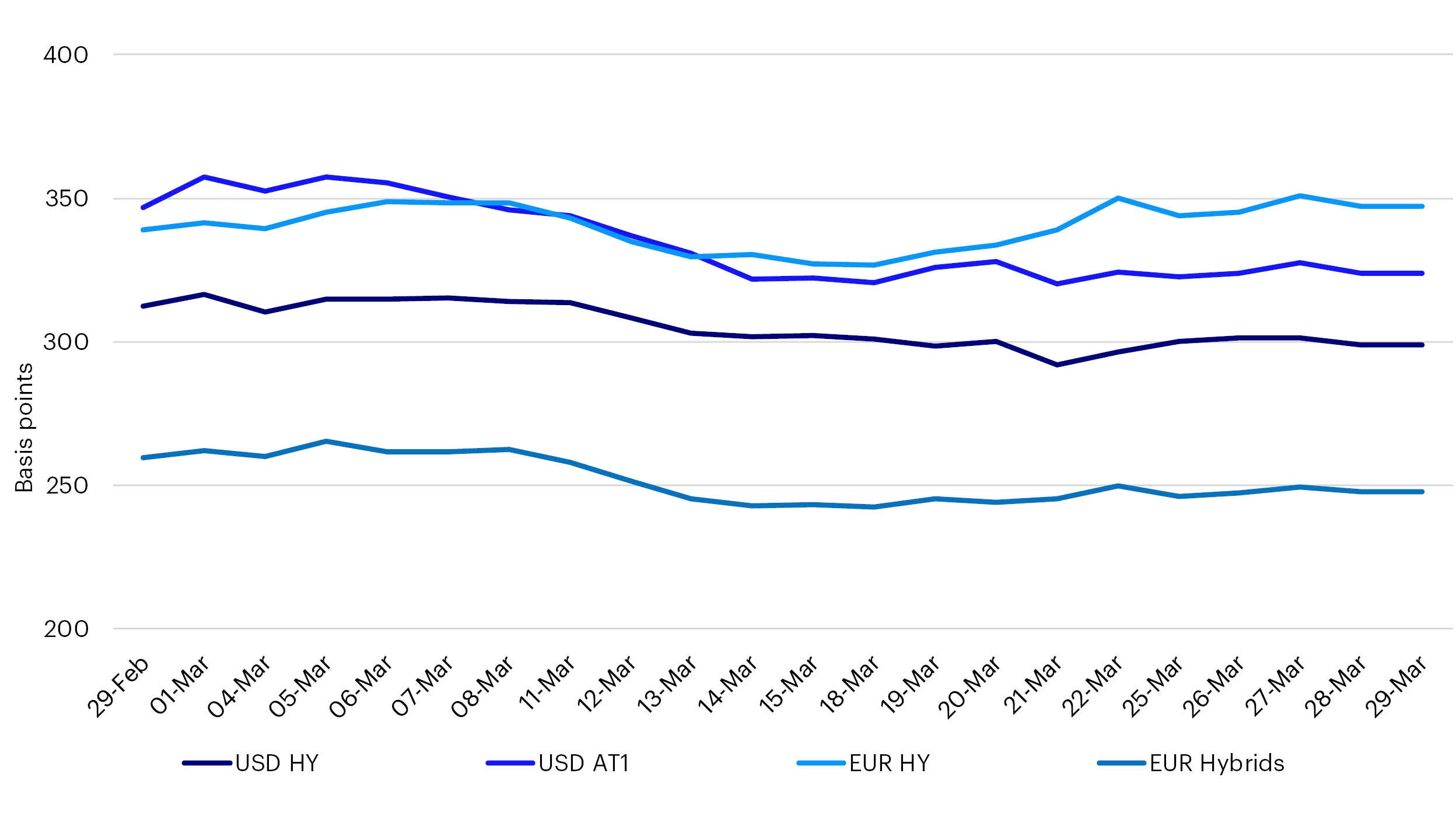

High Yield and Subordinated Credit

Lower rated credit spreads had mixed fortunes in March. In traditional high yield space, USD-denominated spreads tightened by 13 basis points while spreads for EUR widened by 8 basis points, potentially due to rising concerns about ratings and debt restructuring for certain issuers. Meanwhile, subordinated credit continued to perform strongly. Spreads on Euro Corporate Hybrids rallied by 12 basis points and hit the tightest level for over two years during the month. While USD-denominated AT1 spreads tightened by 13 basis points as the market continued its recovery as it passed the one-year anniversary of the Credit Suisse write down.

Source: Bloomberg, Invesco as at 29 Mar 2024

...the outlook for ratings on high yield issuers.

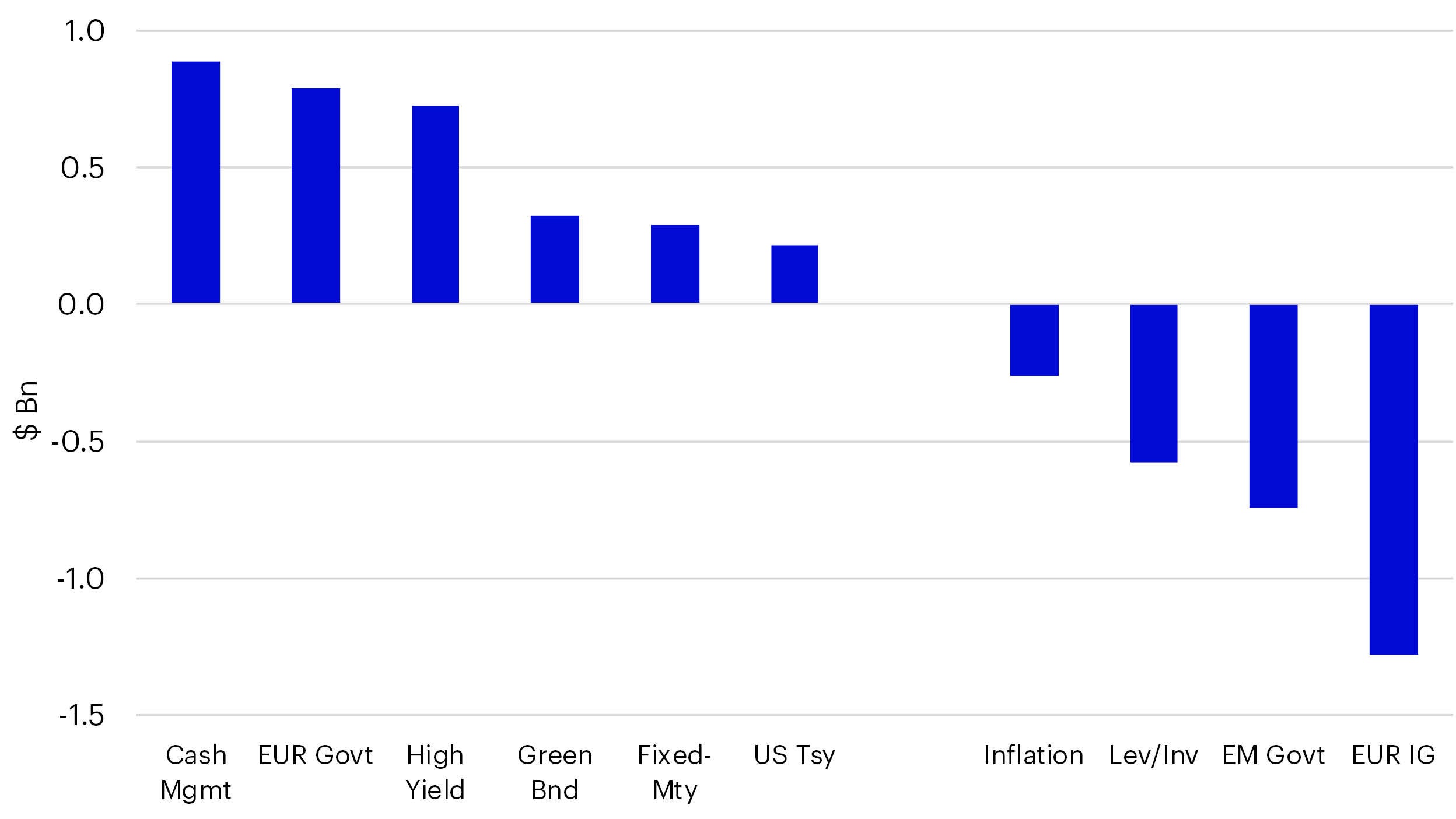

Fixed Income ETF Flows

Inflows into Fixed income ETFs remained subdued in March with NNA of just $1.0bn, taking the total for Q1 to $12.1bn. Flows by fixed income category were mixed, making it difficult to identify a pattern or risk preference. Cash Management ($0.9bn) remained the strongest category for net inflows in March, followed by EUR Government Bonds ($0.8bn), High Yield ($0.7bn), Green Bonds ($0.3bn) and Fixed Maturity ($0.3bn). EUR IG (-$1.3bn) experienced a second consecutive month of heavy selling with EM Government Bonds (-$0.7bn), Leverage/Inverse (-$0.6bn, mainly unwinding 2y-10y steepening exposure in US Treasuries) and Inflation (-$0.3bn) also seeing outflows.

Fixed income markets bounced in March following lacklustre performance in the first two months of the year, as bonds had rallied too hard into the end of 2023 in the hope of early rate cuts. However, with the timing of rate cuts having been pushed back, central banks appear to see market expectations broadly in line with their outlook. Having generally erred towards a more hawkish bias earlier in the year, central banks appeared to have become slightly more dovish in March. This indicates that they would look through near-term noise from economic data and focus on the longer-term outlook. This is likely to prove supportive for fixed income markets, particularly as the first-rate cuts from the major central banks gets closer.

Source: Bloomberg, Invesco, as at 29 Mar 2024