Monthly fixed income update - February 2024

Asset Class Returns

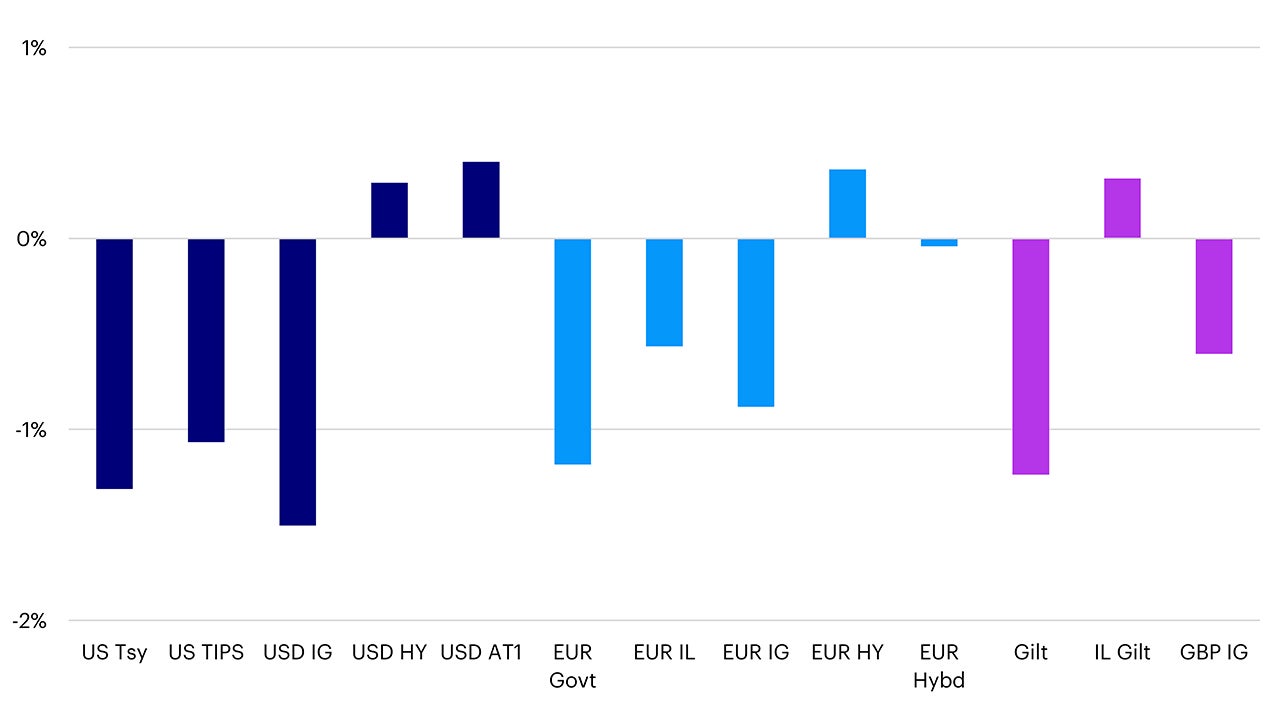

While returns across fixed income were muted in February, there was a divergence in fortunes between higher and lower quality bond markets. Higher quality asset classes such as government bonds and investment grade credit suffered slightly negative returns as yields rose, while lower rated credit markets performed better, supported by their lower duration and higher yield while also benefiting from spread tightening during the month.

In addition to monitoring central bank commentary, markets are increasingly focusing on two key data points each month to determine the timing of the first rate cut from the US Federal Reserve. Both were stronger than had been expected in February. Early in the month, the US employment report showed strong gains in payrolls and strong earnings data, which pushed back expectations for rate cuts and drove government bond yields higher. This was followed mid-month by stronger than expected US inflation data which had a similar effect. However, while risk free rates rose over the month there was a general risk-on tone to markets, with the S&P 500 index hitting a new all-time high, which supported credit spreads over the month. Nevertheless, spread tightening in investment grade space was insufficient to offset the rise in risk free rates and the impact of interest rate risk on total returns.

Source: Bloomberg, Invesco as at 29 Feb 2024

Government and Inflation-Linked Bonds

Government and inflation linked bonds performed poorly in February as a strong employment report from the US, along with US and eurozone inflation data printing above market expectations, further pushed back expectations of the first-rate cuts and drove government bond yields higher.

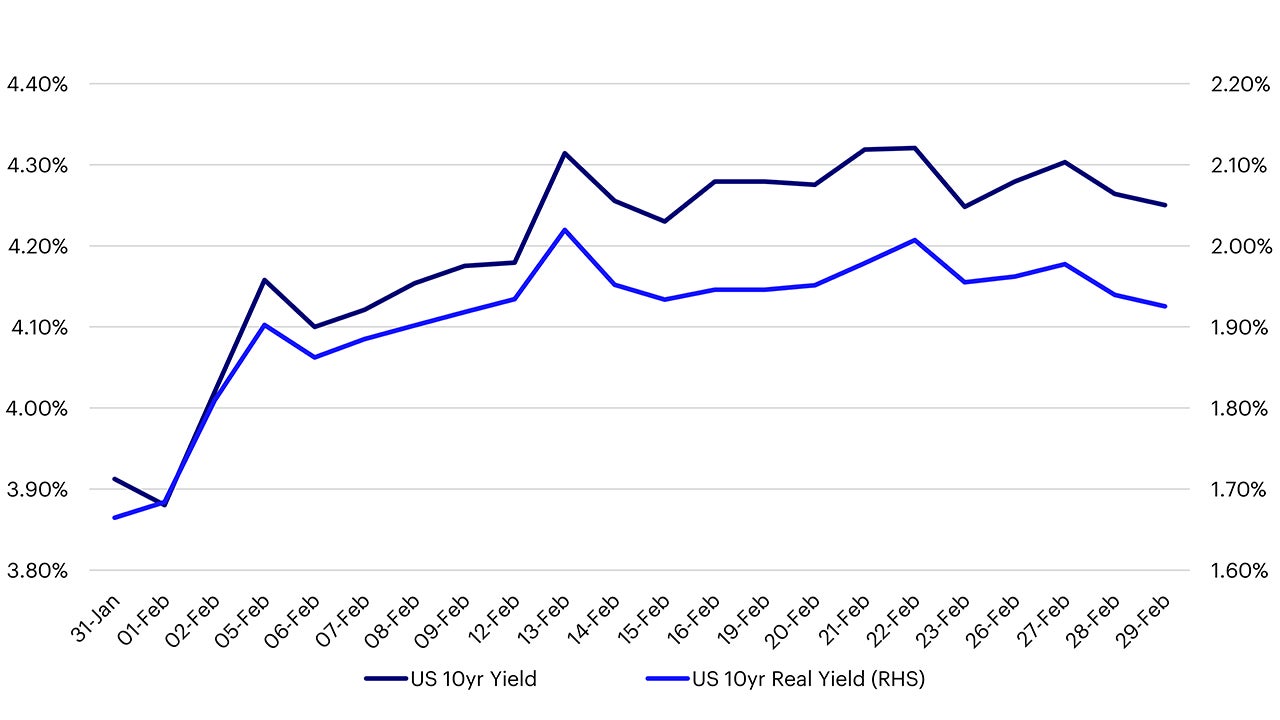

US Rates

US economic data released earlier in the month was broadly surprising to the upside. Business survey data beat market expectations with the price paid component being particularly strong. But it was the strong employment report that was the main catalyst for US Treasury yields to rise early in the month. The headline non-farm payrolls print was the strongest for a year and was much higher than had been anticipated and was accompanied by upward revisions to previous months along with strong hourly earnings data. Mid-month both headline and core CPI1 inflation data exceeded expectations which, along with a broadly hawkish tone to the minutes of the last Federal Reserve meeting, maintained upward pressure on US Treasury yields. Meanwhile, the higher inflation print helped to drive breakeven inflation rates wider with US TIPS2 outperforming their nominal counterparts over the month.

Source: Bloomberg, Invesco as at 29 Feb 2024

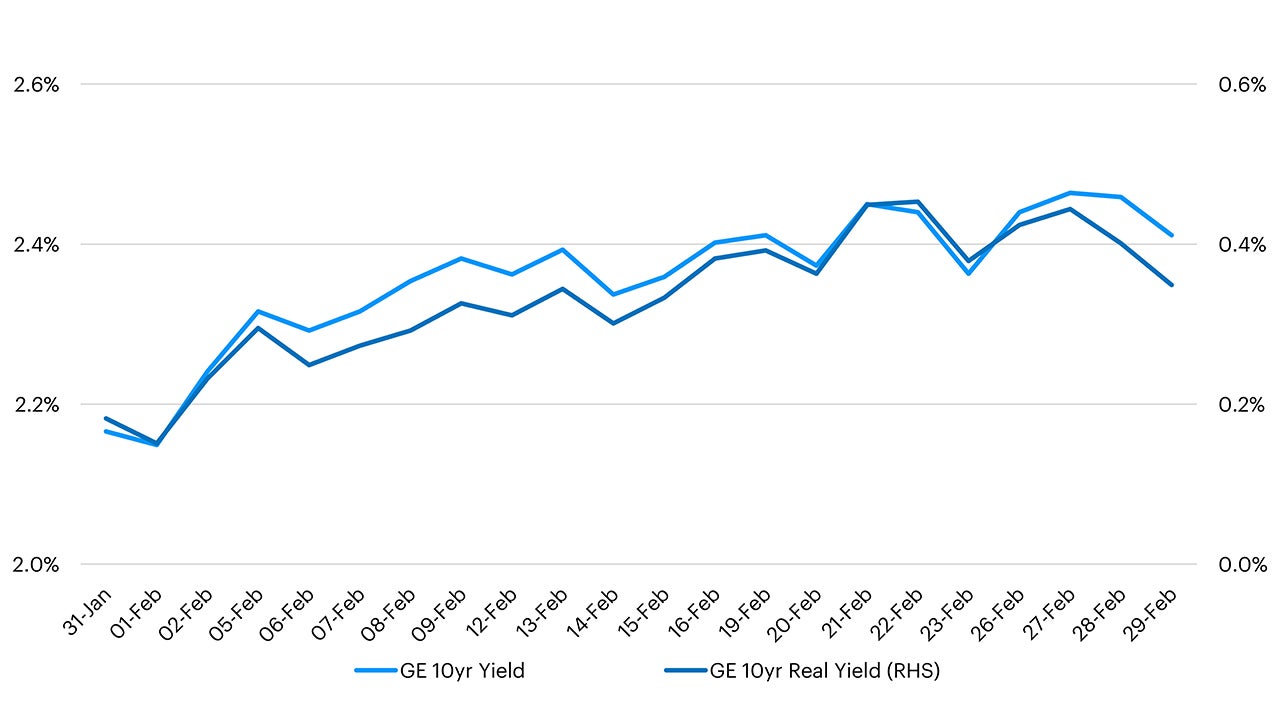

Eurozone Rates

While eurozone government bond yields were led by the US Treasury market, eurozone data also put pressure on bonds with both headline and core CPI1 estimates higher than expected early in the month, followed shortly after by the ECB’s 3-year CPI1 expectation data rising to 2.5%. Like the US, breakeven inflation rates widened slightly over the month with eurozone inflation-linked bonds outperforming conventional government bonds. Meanwhile the positive attitude towards risk helped to drive spreads on peripheral eurozone bonds tighter with Italy and Spain ending the month at the tightest levels to Germany for two years.

Source: Bloomberg, Invesco as at 29 Feb 2024

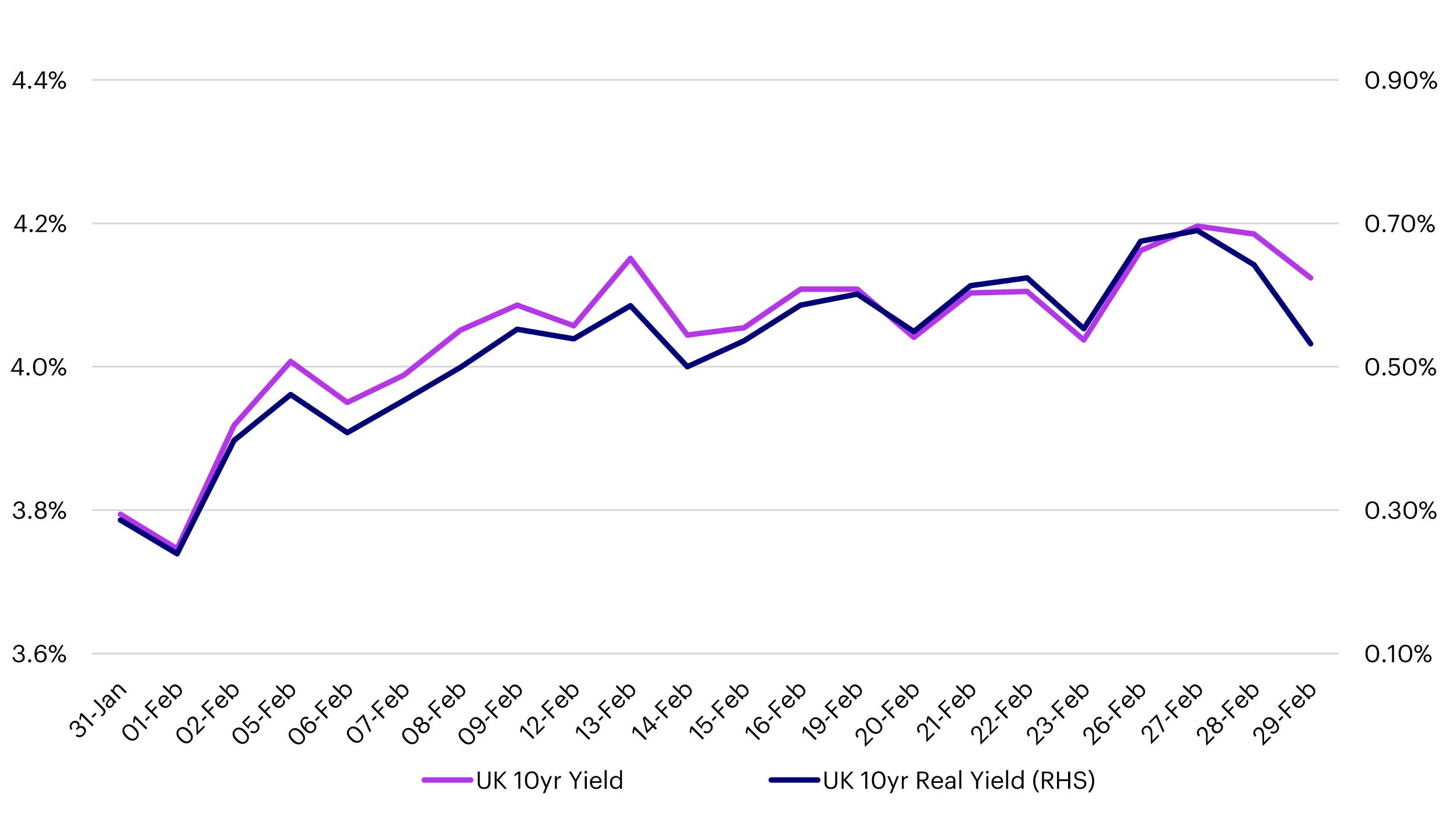

UK Rates

Although UK inflation was better behaved than in the US and eurozone, and GDP3 data showed that the UK had fallen into a recession in the second half of 2023, gilt market performance was primarily driven by international factors. Like the US and eurozone, index-linked gilts outperformed with a strong rally into month end driving performance back into positive territory for the month.

Source: Bloomberg, Invesco as at 29 Feb 2024

...inflation data which will be key to the timing and extent of rate cuts

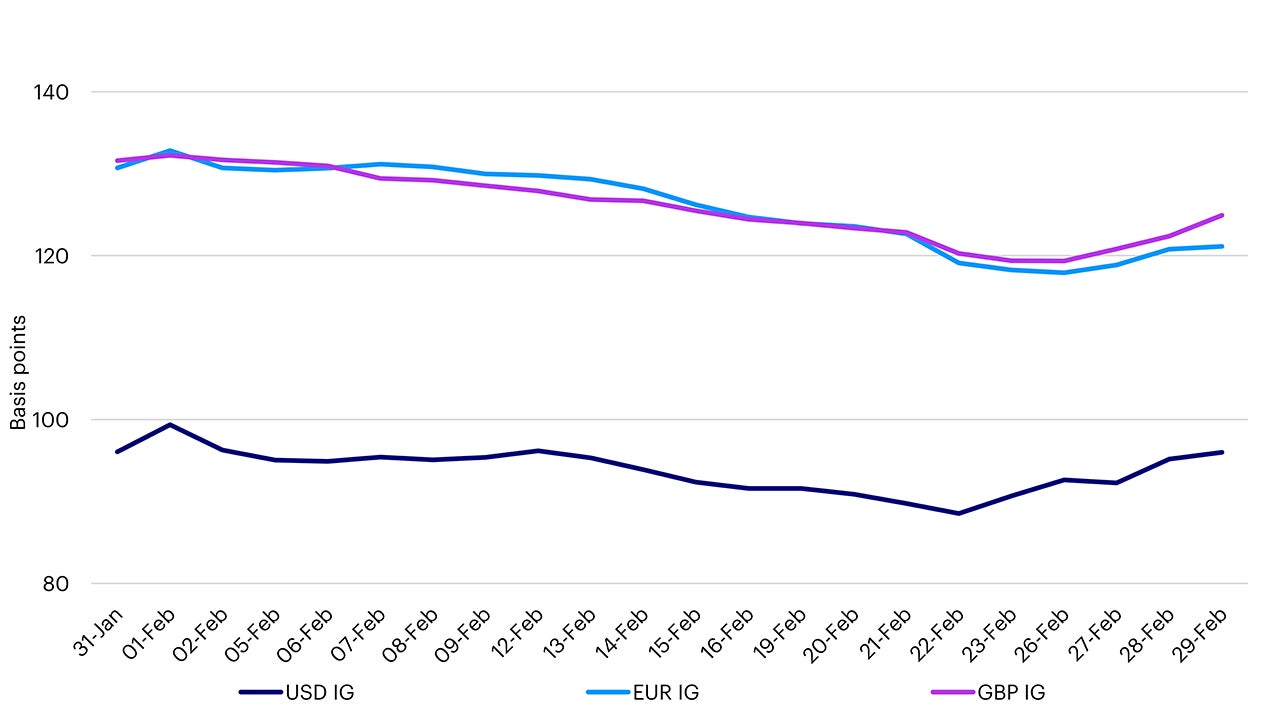

Investment Grade Credit

Investment grade credit tightened for most of the month, benefiting from the risk-on tone which saw the S&P 500 rally to a new all-time high, before giving back some of that spread tightening into month end. Although there are many factors influencing spreads, the tights in US credit coincided with the release of the minutes of the January Federal Reserve meeting with the hawkish tone potentially indicating market concerns that delayed rate cuts could increase the possibility of a recession and cause some weakness in credit markets.

Source: Bloomberg, Invesco as at 29 Feb 2024

...economic data as spreads could be vulnerable to a hard landing

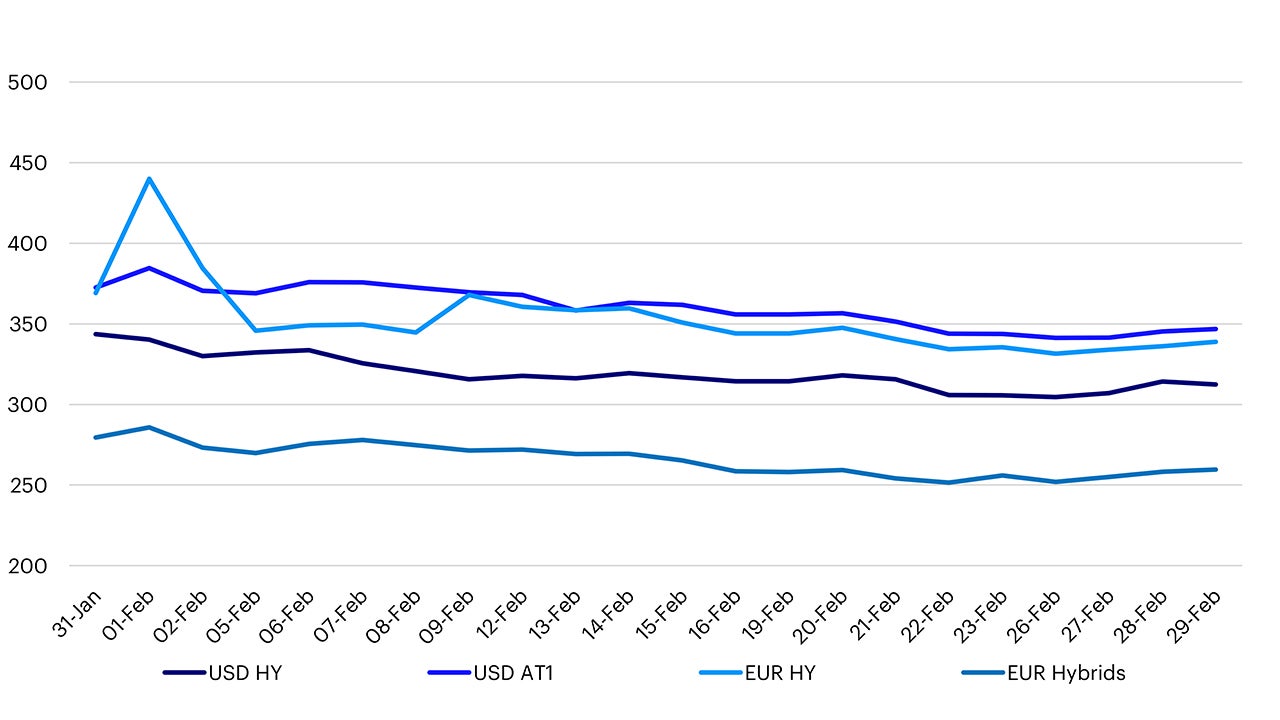

High Yield and Subordinated Credit

Lower rated credit spreads rallied in February, benefiting from the positive attitude towards risk over the month. Traditional high yield markets led the way with spreads on USD- and EUR-denominated indices tightening by 31bp and 30bp respectively. While subordinated debt spread tightening lagged, it was still a strong month with USD AT1 spreads tightening by 26bp and Euro Corporate Hybrid spreads tightening by 20bp. Confidence in the AT1 market continues to return following the events with Credit Suisse almost a year ago with strong demand seen for two new US Dollar issues from ING and UBS, with the latter able to issue new bonds with reset spreads almost 100bp tighter than their issues last November.

Source: Bloomberg, Invesco as at 29 Feb 2024

...the outlook for interest rates as spreads have rallied on expectations of rate cuts

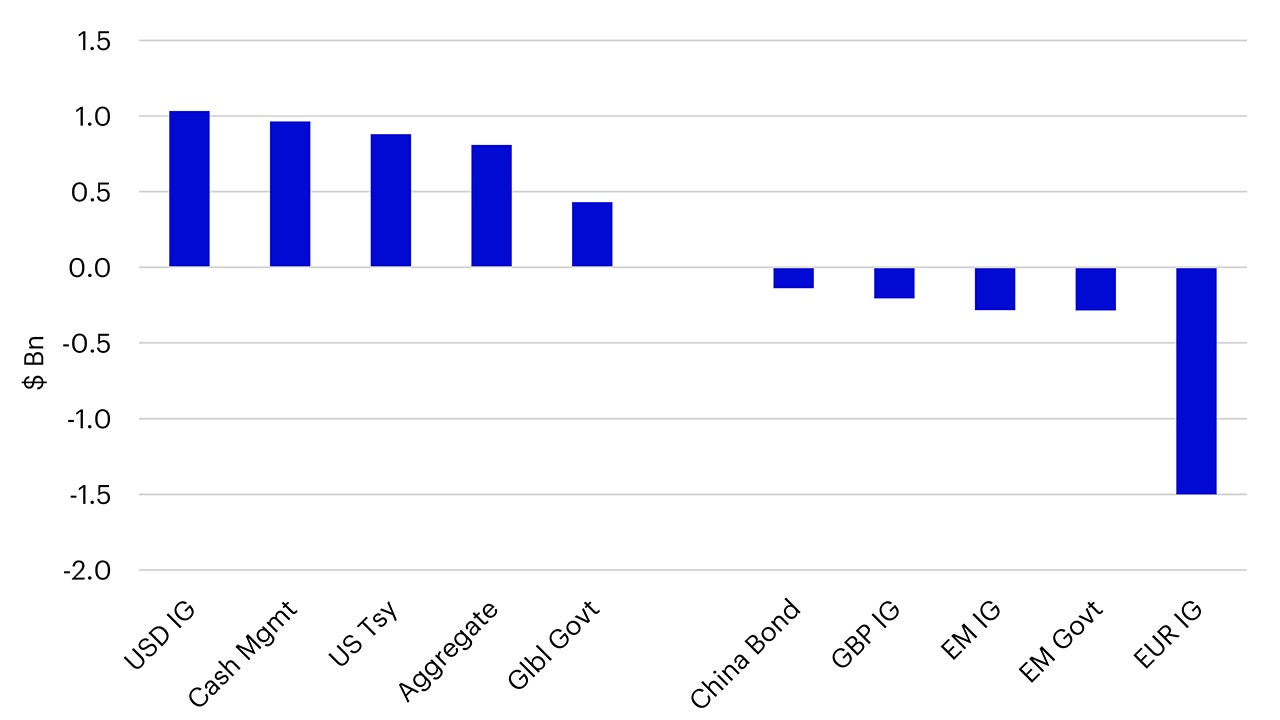

Fixed Income ETF Flows

Inflows into Fixed income ETFs slowed sharply in February with just $2.8bn NNA4 taking the year-to-date total to $10.8bn. USD investment grade credit ($1.0bn) was the strongest category for net inflows over the month. Cash management ($1.0bn), US Treasuries ($0.9bn) and Aggregate ($0.8bn) also experienced high demand. EUR investment grade credit (-$1.5bn) led the outflows in a reversal of fortunes having been the strongest category for inflows in January. Emerging market debt was out of favour with combined outflows of $0.7bn across EM governments (-$0.3bn), EM IG (-$0.3bn) and China Bond (-$0.1bn).

Having stalled in January, fixed income generally suffered in February due to stronger economic data pushing back rate cut expectations and putting upward pressure on bond yields. Additionally, the risk-on tone and strong returns from equities meant that fixed income ETFs flows were relatively subdued over the month. Nevertheless, the backdrop for fixed income remains broadly supportive with interest rates likely to start coming down in the middle of the year. It therefore seems likely that investors will see pull backs, like markets have experienced so far this year, as opportunities to put cash to work in bond markets, increasing duration to lock in yields before central banks start easing policy.

Source: Bloomberg, Invesco as at 29 Feb 2024