Macroeconomic conditions are aligning for EM Debt

Overview

- We highlight six macroeconomic conditions that we believe create a supportive backdrop for EM debt.

- We believe these six conditions currently hold and bode well for EM debt performance in the coming months.

Macroeconomic conditions are aligning for EM Debt

We believe the six macroeconomic conditions highlighted below typically create an attractive entry point for emerging market (EM) debt investments. We believe these conditions currently hold and should create a positive backdrop for EM debt in the coming months. Below we explain these support factors and how they could drive EM performance.

Macroeconomic case for EM debt

Over the past decade, the US economy’s strength and resilience has drawn investors away from EM, resulting in sustained outflows from the asset class. However, this trend has also led to more attractive valuations within the EM asset class, in our view.

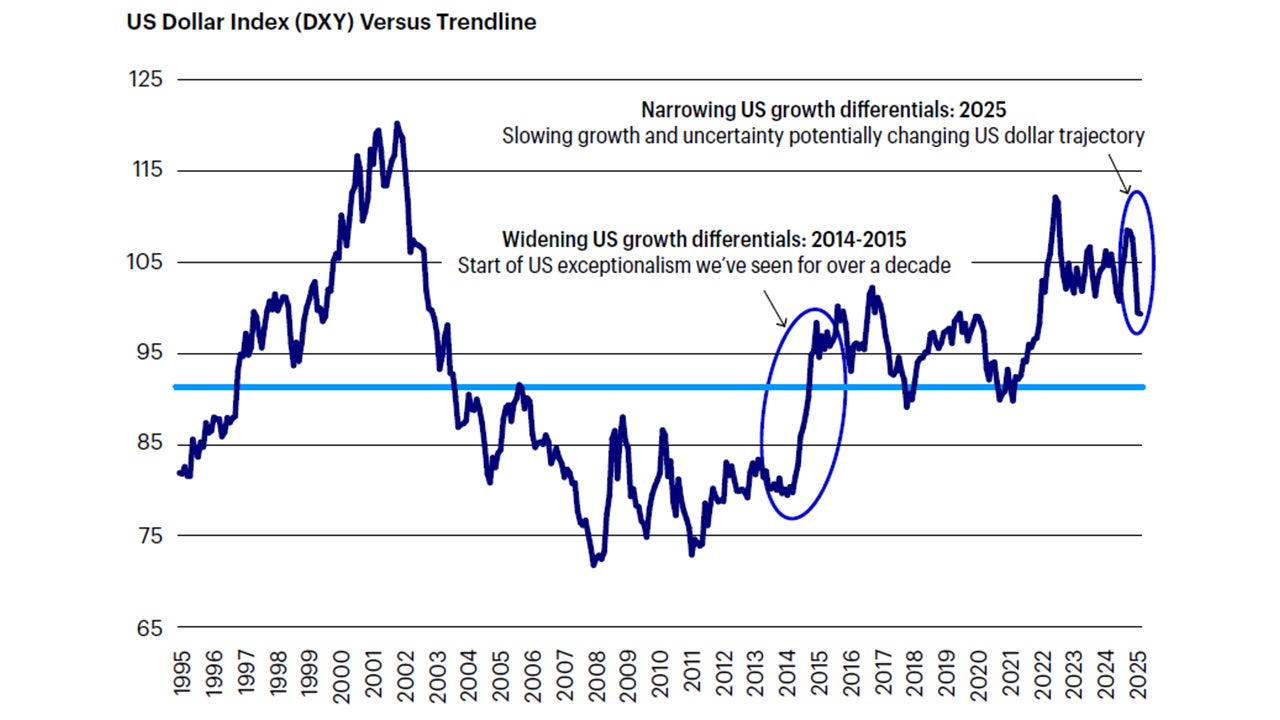

A notable shift in 2025 has been the changing global perception of the US dollar. For over a decade, foreign investors have benefited from holding US assets either unhedged or partially hedged. However, as these investors begin to scale back allocations or repatriate capital, demand for US assets and by extension, the US dollar may decline.

While trade policy remains a source of short-term volatility, we believe the greater long-term risk to EMs lies in a potential resurgence of US exceptionalism, though we view this as unlikely in the near term. With growth differentials now favoring EM economies and inflation remaining contained, the backdrop for EM debt appears increasingly favorable for the remainder of the year.

Below, we highlight market conditions that we believe create an attractive entry point for EM debt investments. We believe these conditions currently hold and should lead to a positive backdrop for EM debt in the coming months.

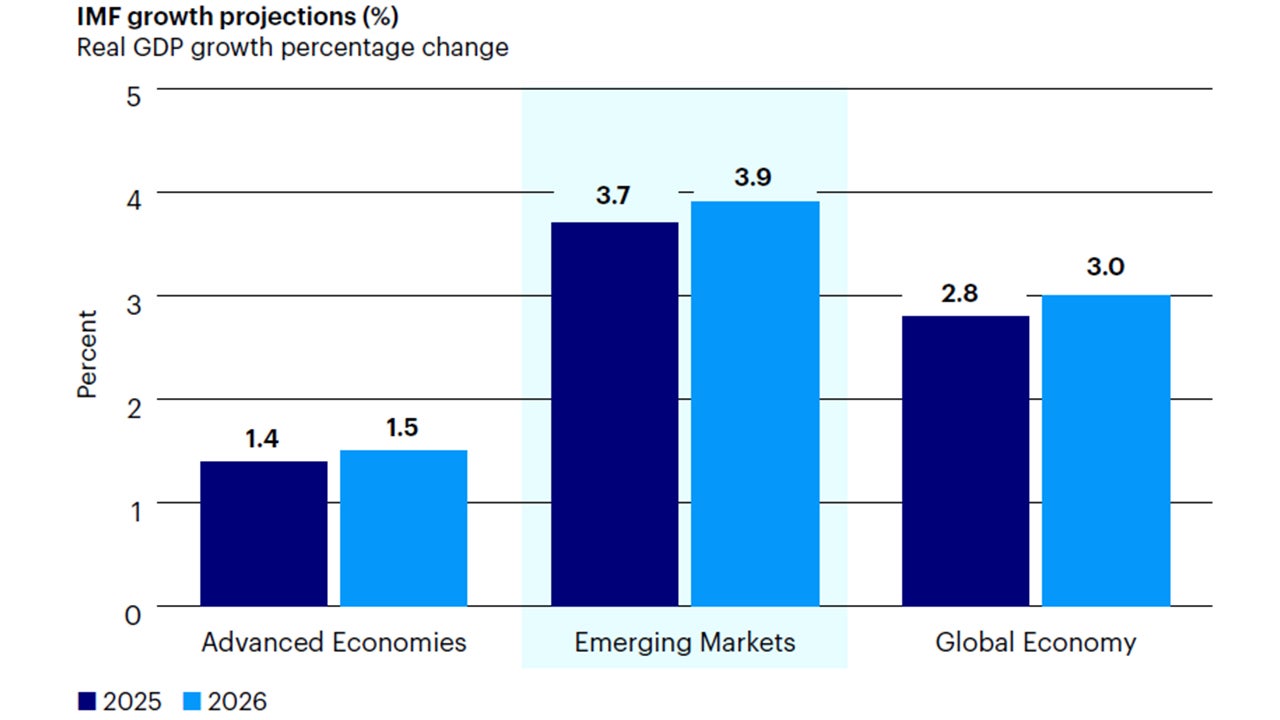

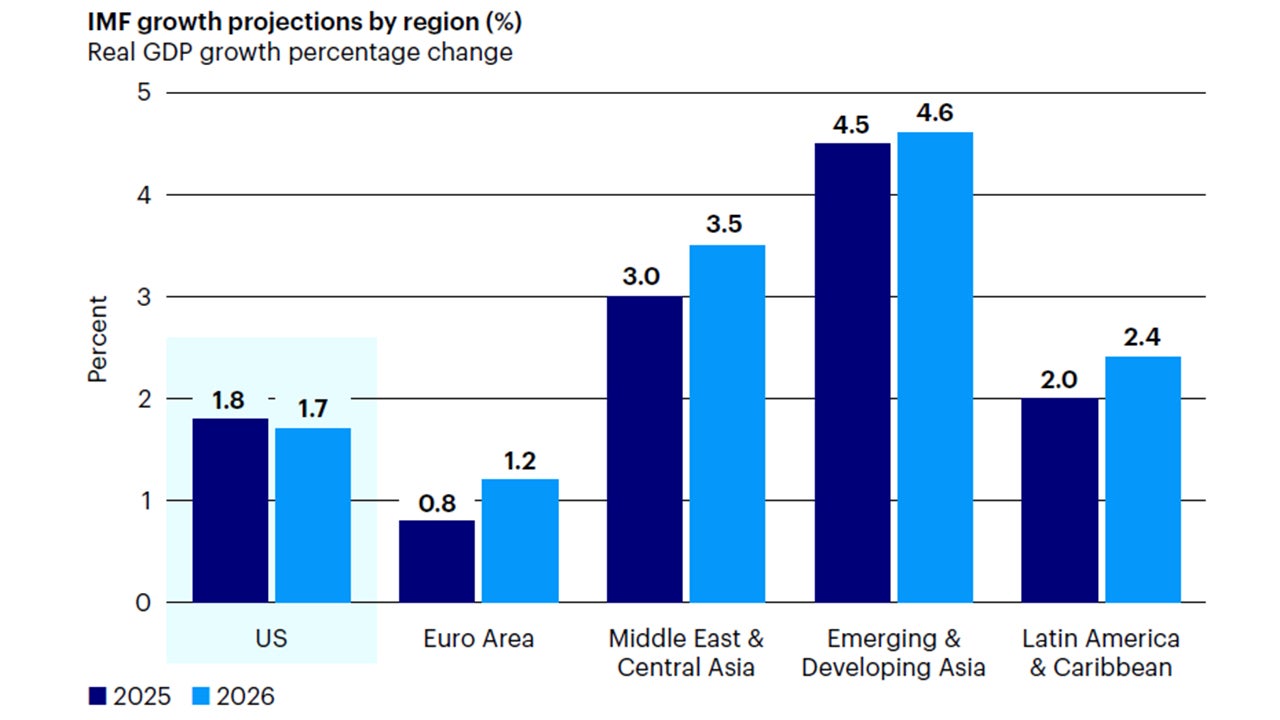

1. EMs leading global growth

The US economy is showing signs of cooling, while many EMs are experiencing improving growth, narrowing the US growth differential. In response to ongoing trade and policy uncertainty, countries abroad are adopting more pro-growth agendas—such as structural reforms and increased domestic spending—helping to drive domestic growth abroad.

Source: IMF, World Economic Outlook. Data as of April 2025. Growth represents real GDP growth annual percentage change.

Source: IMF, World Economic Outlook. Data as of April 2025. Growth represents real GDP growth annual percentage change.

2. Stable to weakening US dollar

Heightened trade and geopolitical uncertainties combined with slowing US economic growth have challenged the narrative of US exceptionalism, and the US dollar has weakened. We believe the US dollar will weaken further as the Federal Reserve (Fed) eases interest rates and various countries enact domestic policies to strengthen their local economies.

Source: Bloomberg L.P. Data as of May 31, 2025.

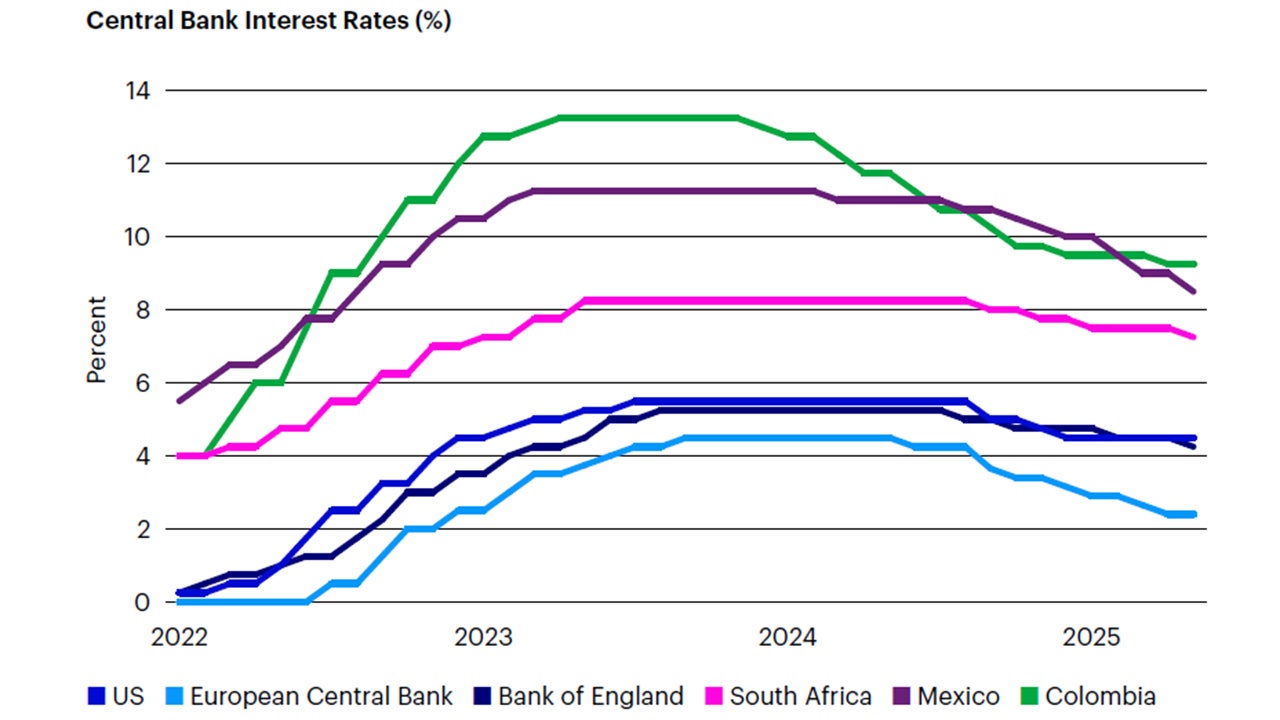

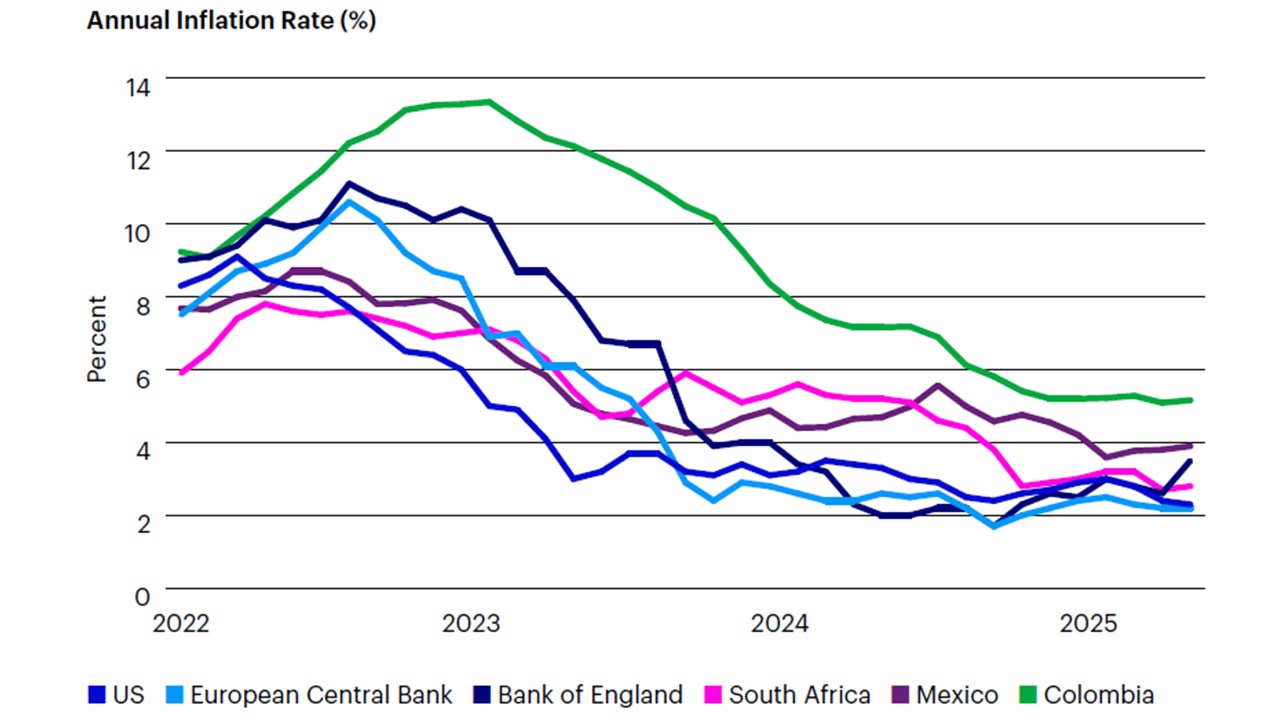

3. Sound policymaking and disinflation

EM central banks were orthodox in hiking interest rates early to control inflation, and rates have generally remained elevated, offering investors attractive yields compared to those in developed markets. While EM central banks are expected to proceed cautiously, the current trend has shifted toward more aggressive monetary easing as the focus has shifted from inflation concerns to growth.

Source: Bloomberg L.P. Data as of May 2025.

Source: Bloomberg L.P. Data as of April 2025.

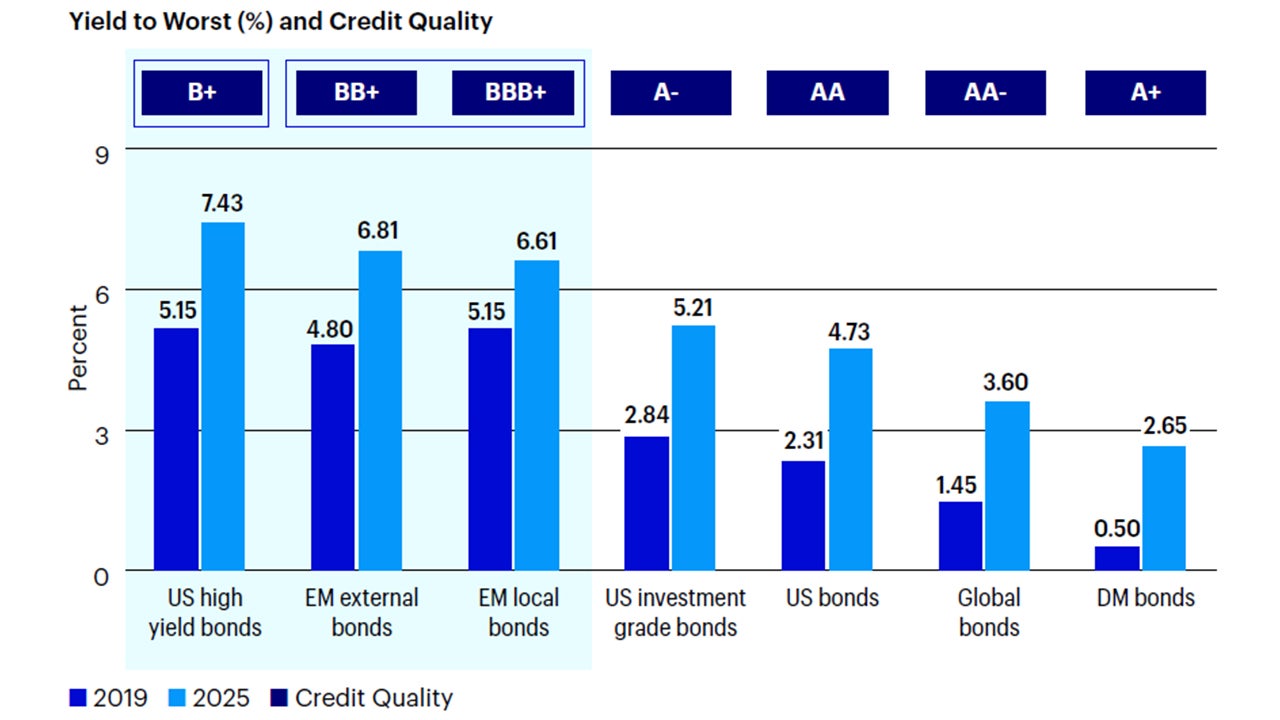

4. Attractive valuations and income levels

Nominal and real interest rates have remained elevated across EMs, offering attractive income potential, in our view. Additionally, we believe current interest rate differentials between developed markets and EM also present potential opportunities for investors.

Source: Invesco. Data as of May 31, 2025, versus Dec. 31, 2019. US High Yield Bonds represented by Bloomberg US High Yield Index, EM External Bonds by JPM EMBI-GD Index, EM Local Bonds by JPM GBI-EM Index, US Investment Grade by Bloomberg Investment Grade Index, US Bonds by Bloomberg US Aggregate Index, Global Bonds by Bloomberg Global Aggregate Index, Developed Market Bonds by FTSE Non-US WGBI Index. Past performance is not a guarantee of future results. An investor cannot invest directly in an index.

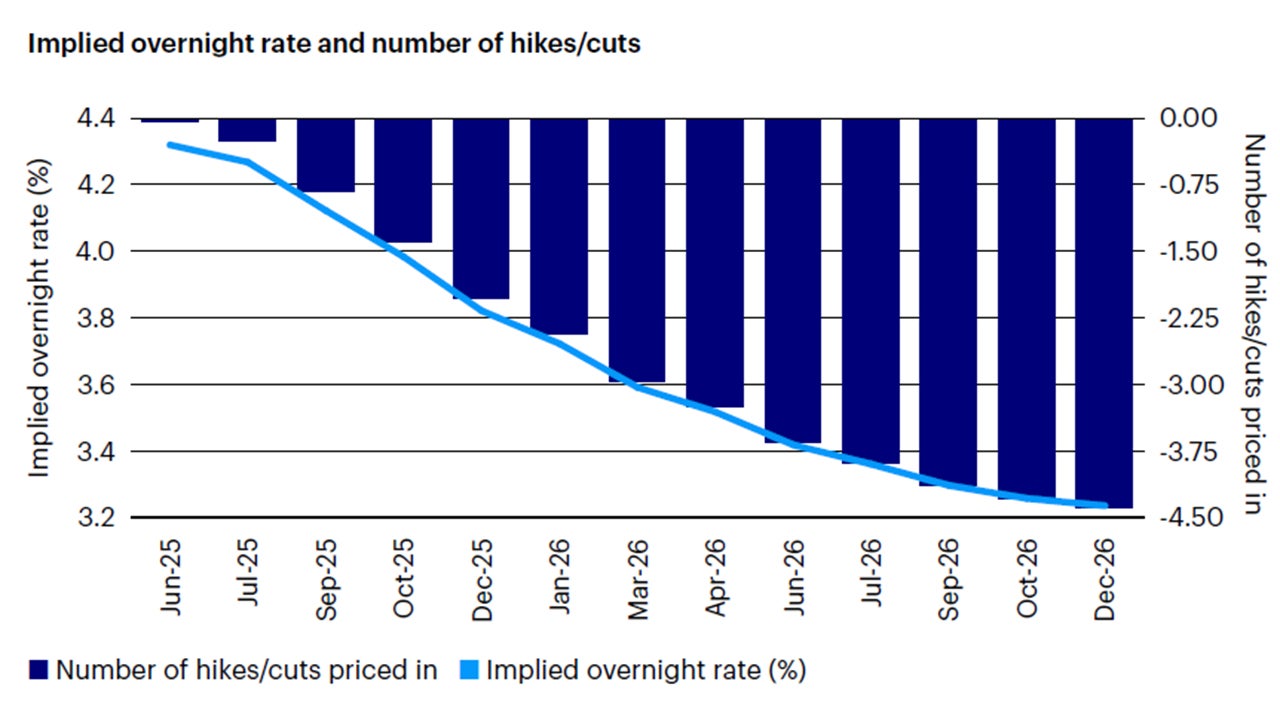

5. More predictable path for US financial conditions

With US inflation slowly stabilizing and growth slowing, the US bond market has priced in multiple Fed rate cuts for the remainder of 2025 and into 2026. Fed rate cuts typically exert downward pressure on the US dollar and upward pressure on international local currencies. Additionally, this dynamic has tended to support EM external balances and led to capital appreciation of external debt.

Source: Bloomberg L.P. Data as of May 31, 2025.

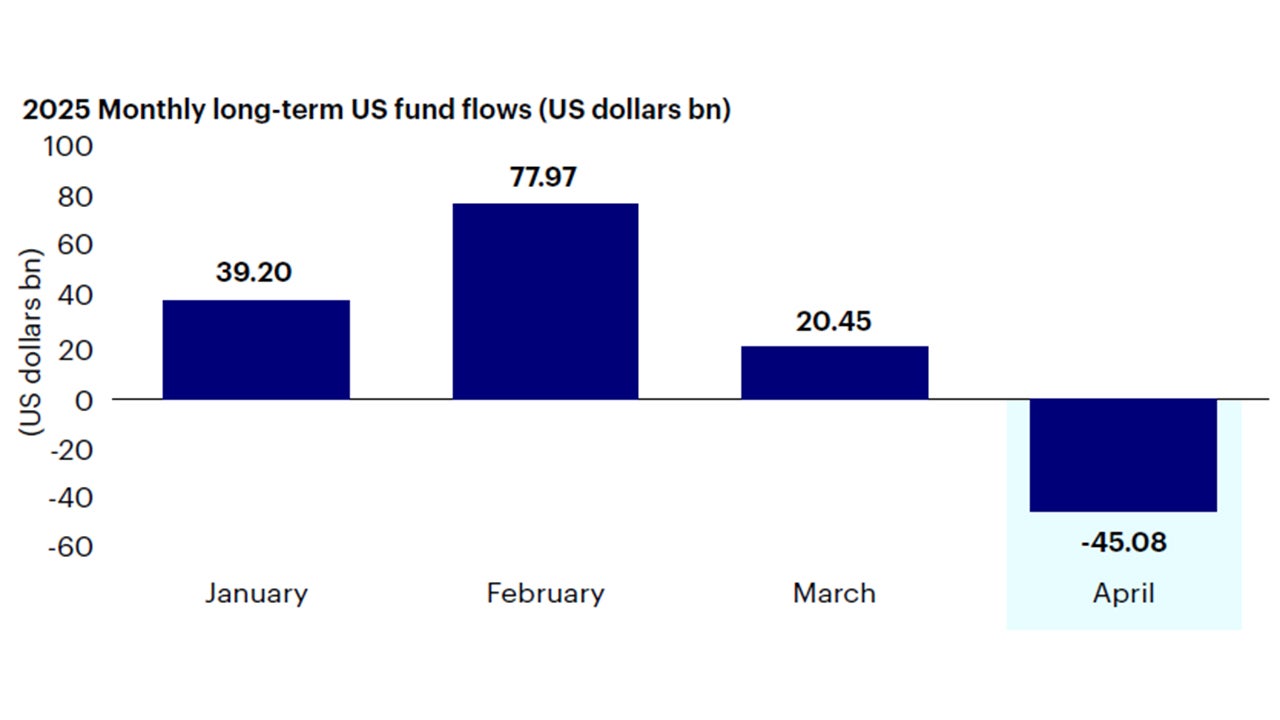

6. Potential rebalancing of capital away from the US

EM assets have been largely ignored over the last decade, as US equities and the US dollar have outperformed, leading to cheap EM valuations, in our view. The global shift in the “American exceptionalism” narrative and the high share of US assets in global portfolios, could prompt a rebalancing of capital away from the US.

Source: Morningstar. US Fund Flows data as of April 30, 2025.

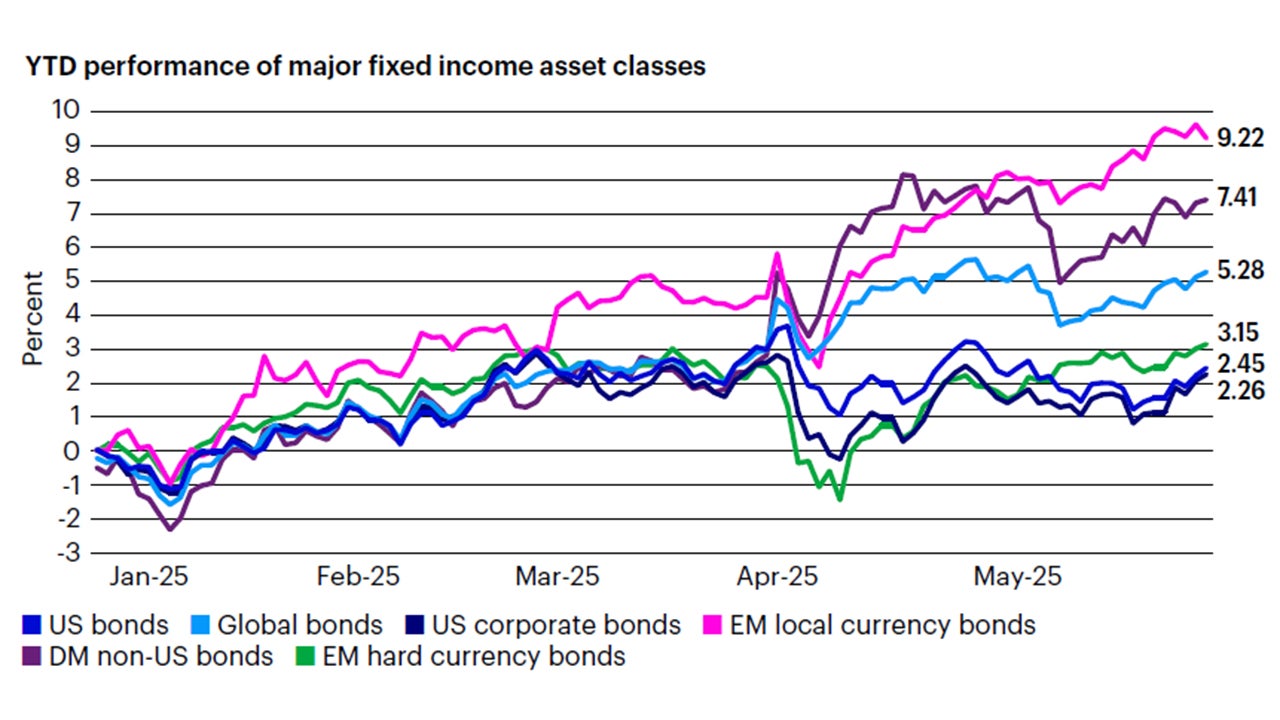

Source: Bloomberg L.P. Performance is cumulative return from Jan. 1, 2025, to May 31, 2025. DM is developed market. Emerging Markets Local Currency Bonds represented by JPM GBI-EM Index, US Bonds by Bloomberg US Aggregate Index, Developed Market Non-US Bonds by FTSE Non-US WGBI Index, Global Bonds by Bloomberg Global Aggregate Index, EM Hard Currency Bonds by JPM EMBI-GD, and US Corporate Bonds by Bloomberg US Corporate Index. Past performance is not a guarantee of future results. An investor cannot invest directly in an index.

Conclusion

Policy uncertainty and slowing US economic growth have challenged the narrative of US exceptionalism, contributing to a softening US dollar and creating a more favorable backdrop for EM debt, in our view. Additionally, ongoing trade and geopolitical uncertainties have prompted countries outside the US to take more proactive steps toward reviving their domestic economies. As a result, we expect non-US growth abroad to exceed US growth, with a wider differential toward the end of the year. With growth differentials narrowing between the US and EMs, a weakening US dollar, and attractive valuations, we believe EM debt assets present a compelling opportunity that we believe investors have under-allocated to for the last decade.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

Non-investment grade bonds, also called high yield bonds or junk bonds, pay higher yields but also carry more risk and a lower credit rating than an investment grade bond.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

The performance of an investment concentrated in issuers of a certain region or country is expected to be closely tied to conditions within that region and to be more volatile than more geographically diversified investments.