Monthly fixed income update - July 2024

Key takeaways

Fixed income markets performed well in July as yields fell in response to growing expectations of rate cuts

July was a record month for inflows into EMEA-domiciled ETFs with over $10bn in net new assets

Looking ahead, interest rate risk continues to appear favourable to credit risk at current levels which should encourage investors to move further out the yield curve

Fixed Income Performance

Fixed income markets performed well in July as yields rallied in response to weaker economic data which brought forward expectations of rate cuts. In particular, data from the US indicated that the economy is slowing which, along with inflation data undershooting market expectations, culminated in a more dovish tone from the Federal Reserve at the end of the month.

Source: Bloomberg, Invesco as at 31 Jul 2024

Fixed Income ETF Flows

With $10.7bn NNA, July was the strongest month on record for net inflows into EMEA-domiciled ETFs and takes the year-to-date total to $38.9bn. While the perceived ‘safe-haven’ asset classes of cash management and government bonds remained in favour with investors, demand was strong across the board with inflows seen in both investment grade and high yield credit ETFs, along with emerging market government debt.

Cash management ($1.8bn) was the strongest category for net inflows in July for the second consecutive month, closely followed by US Treasuries ($1.8bn), most of which went into ETFs focused on sub-1-year maturities. EUR and USD investment grade credit ETFs took in $1.7bn and $1.1bn respectively, with EUR Govts ($0.6bn) completing the top five. Categories experiencing outflows were limited with only ETFs focused on Development Bank bonds (-$0.3bn) seeing material selling.

Source: Bloomberg, Invesco, as at 31 Jul 2024

While yields ended the month lower, the outlook for fixed income markets remains positive as weaker economic data is likely to lead to rate cuts in coming months. There were signs of weakness in the US employment report and in both manufacturing and services survey data early in the month. This was followed by headline and core CPI inflation data printing lower than the market had expected in the middle of the month. Although the Federal Reserve held rates at the end of the month, the tone of the statement was more dovish. Acknowledging that inflation was continuing to fall back towards target while the unemployment rate has ticked up in recent months, and that they would need to focus on both to meet their dual mandate in the coming months. The market took this as a signal that the first rate cut is in sight and rallied into month end.

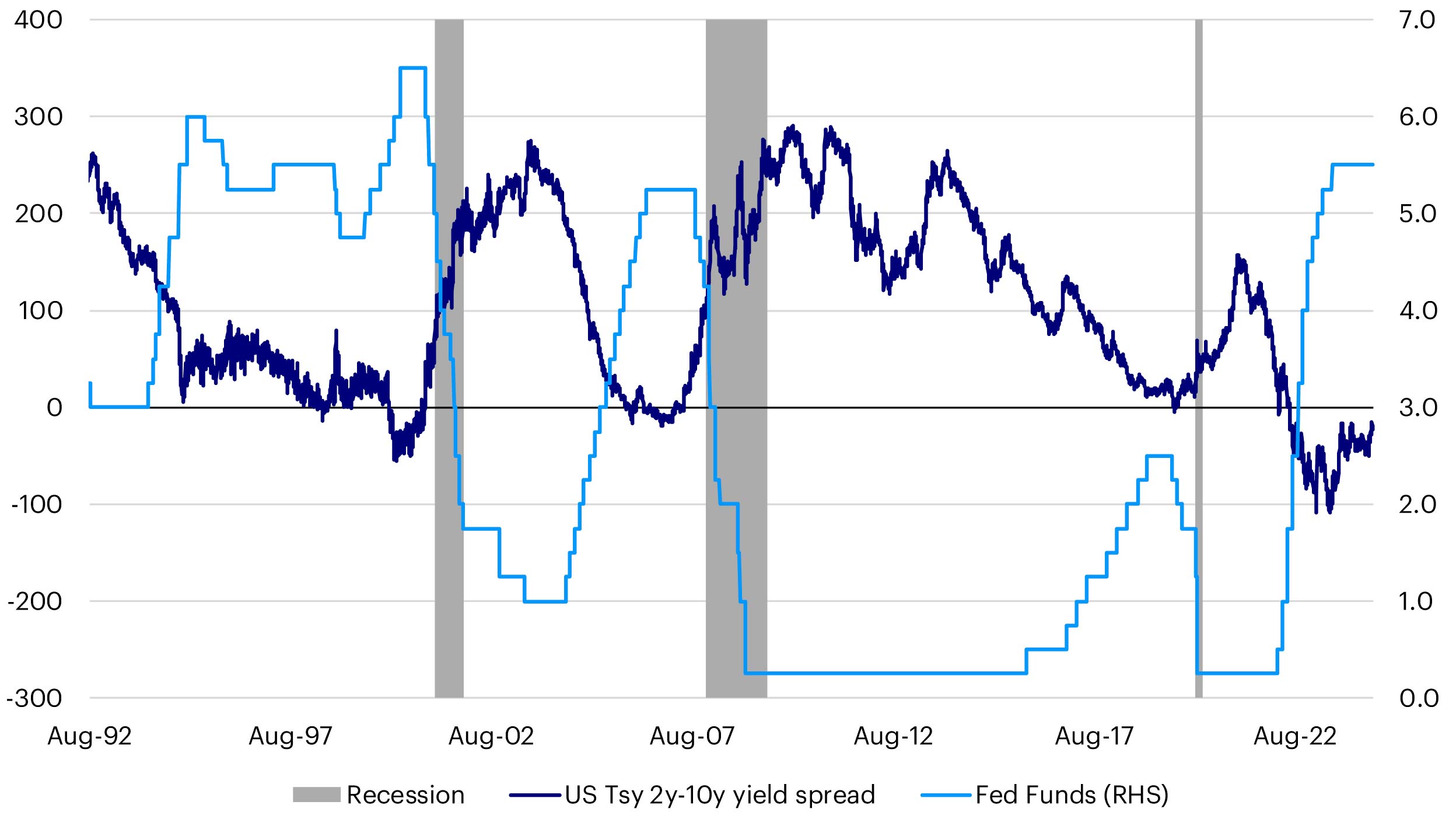

With cash management ETFs having experienced the strongest net inflows in the fixed income space so far this year, increasing certainty over the economic outlook and the likelihood of rate cuts should drive investors further out the curve to lock in current yield levels that are available and to benefit from higher interest rate risk if yields rally further. Credit spreads, however, remain tight which means interest rate risk continues to appear favourable to credit risk at current levels. For investors looking to move out the curve, there will be a more nuanced decision on which maturities are likely to perform best going forward. Yield curves have been steepening (disinverting) over the last year having been deeply inverted in the middle of 2023. As rate cuts get closer, this is likely to continue and, with inflation still above central bank targets, could see curves steepen more aggressively in coming months

Source: Bloomberg, Invesco, as at 31 Jul 2024