Blog 1: Why China

China has been a strong advocate to promote sustainable finance and decarbonization efforts. In this first blog we outline the importance of China’s role in sustainable investing.

We believe that the time has come where ESG investing in China is increasingly a why not moment. As China is one of the largest carbon emitters globally, it has adopted one of the most ambitious climate change plan. As a result, there is potential for fixed income investors to explore thematic opportunities that can offer attractive yield.

Source: Irena, Invesco

Source: Bloomberg, as of March 2022.

Source: Bloomberg, as of March 2022.

Source: Wood Makenzie, data as of 10 August 2021.

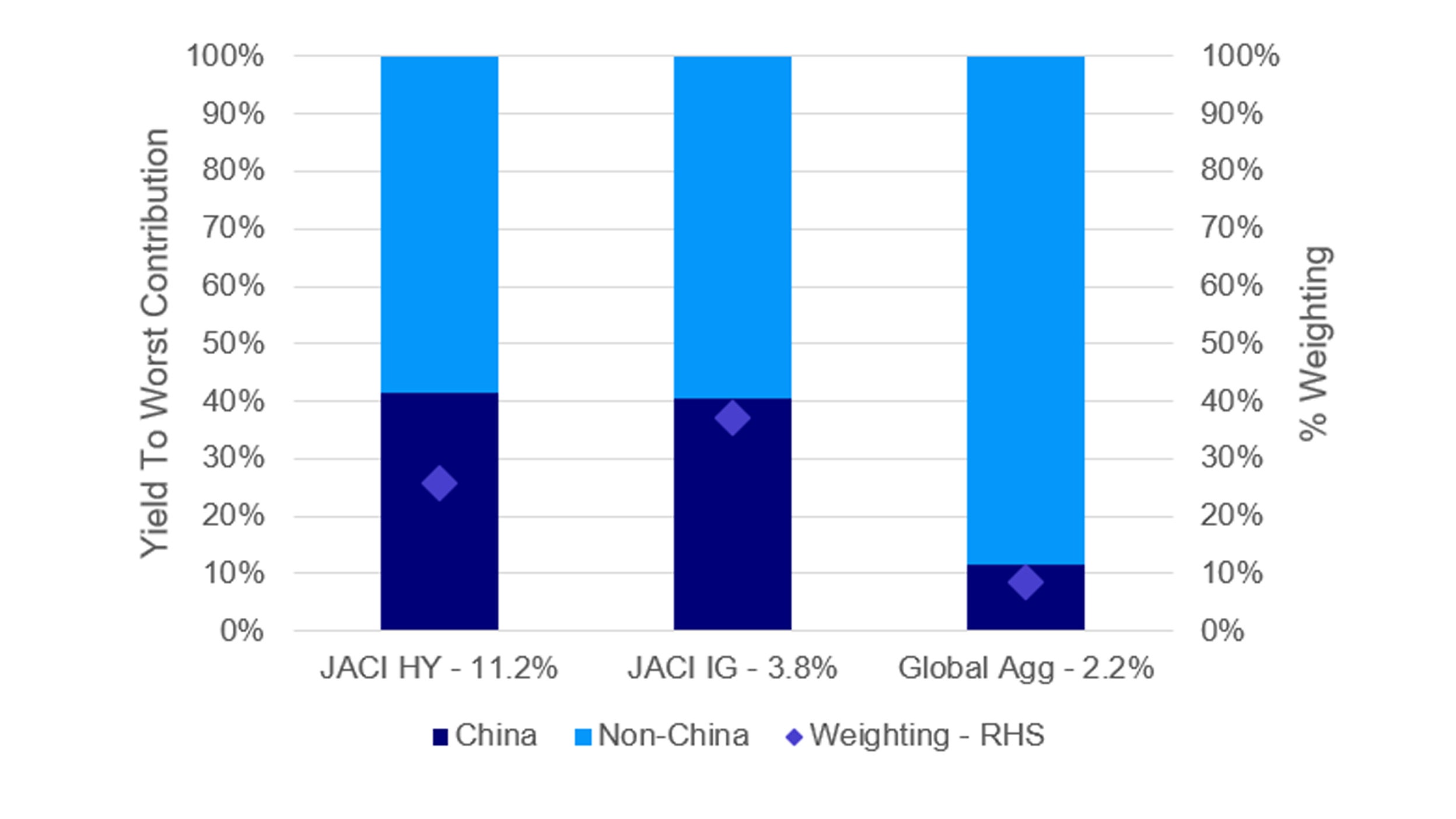

Explore the opportunities to enjoy the China growth story in a sustainable way through investing in China fixed income, which has the potential to provide attractive risk-adjusted returns and diversification benefits.

Source: Aladdin, Invesco, Bloomberg, as of 31 December 2021.

Source: Aladdin, Invesco, Bloomberg, as of 31 December 2021.

China has been a strong advocate to promote sustainable finance and decarbonization efforts. In this first blog we outline the importance of China’s role in sustainable investing.

China’s green taxonomy is quickly aligning with international standards. The second blog in our series compares China's green taxonomy with the European Union's taxonomy for sustainable activities.

The third blog in our series delves into the seven key thematic opportunities we believe currently exist in China around sustainable investing in fixed income.

This is the last of a four-part blog series that seeks to demystify China’s sustainable investing landscape for fixed income. In our first blog we outlined the importance of China’s role in sustainable investing. The second article in the series looked at how China’s taxonomy is aligning with international standards. We articulated the thematic investment opportunities that may exist in China from a fixed Income perspective in the third blog. This fourth piece seeks to familiarize investors with China’s sustainable bond market.

- $24bn AUM in ESG strategies1

- Independent and proprietary ESG research since 2018

- Specialist asset class teams

- Scalable platform for clients solutions

- Responsible and sustainable strategies

- Carbon optimization

- Net zero aligned portfolios

- Multi-sector

- ESG aware mandates since 1989

- Insurance

- Pension funds

- Foundations

- Private investors

Source: Invesco. 1 as of 31 December 2021.

Stay on top of the latest market developments with macro updates and deep dives into specific topics from Invesco’s global team of experts.